Electrosteel Steels Ltd (ESL), now part of Vedanta Ltd through its subsidiary Vedanta Star, operates a 2.51 MTPA greenfield integrated steel plant at Siyaljori, Bokaro, Jharkhand. Despite Vedanta’s acquisition through NCLT in 2018, the company continues to face profitability challenges, although FY2025 shows some signs of operational improvement compared to earlier years.

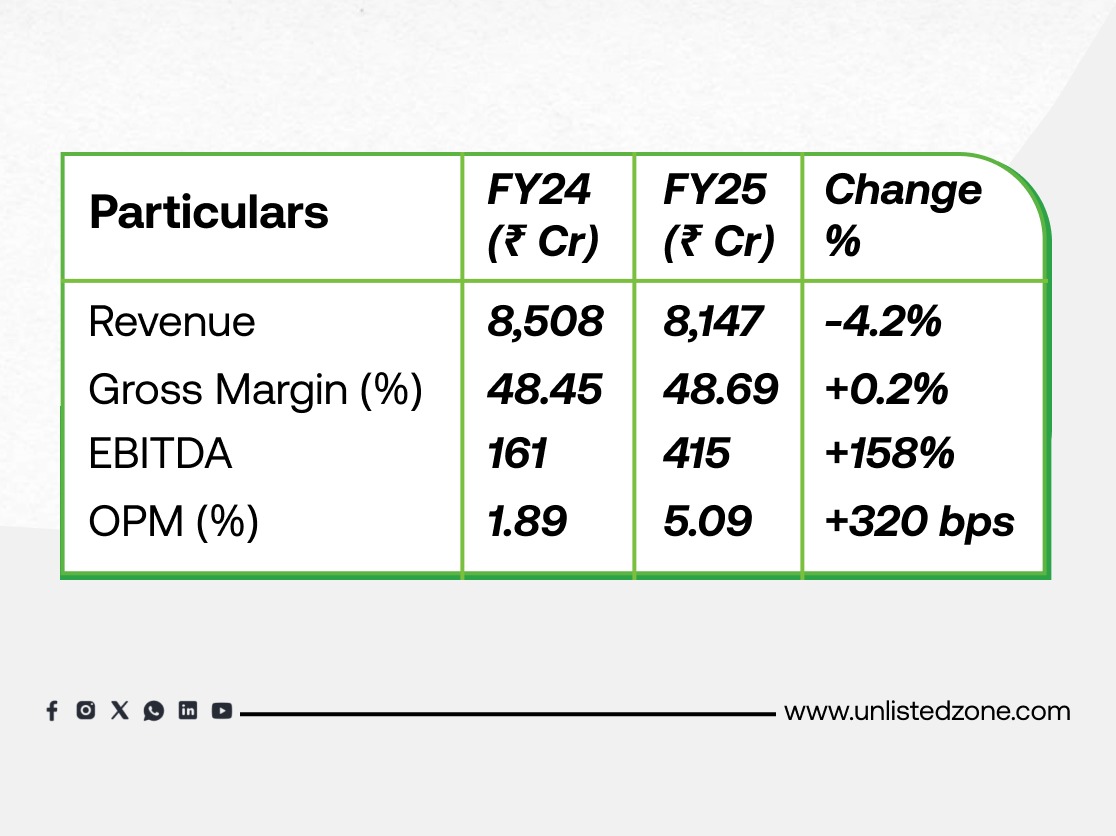

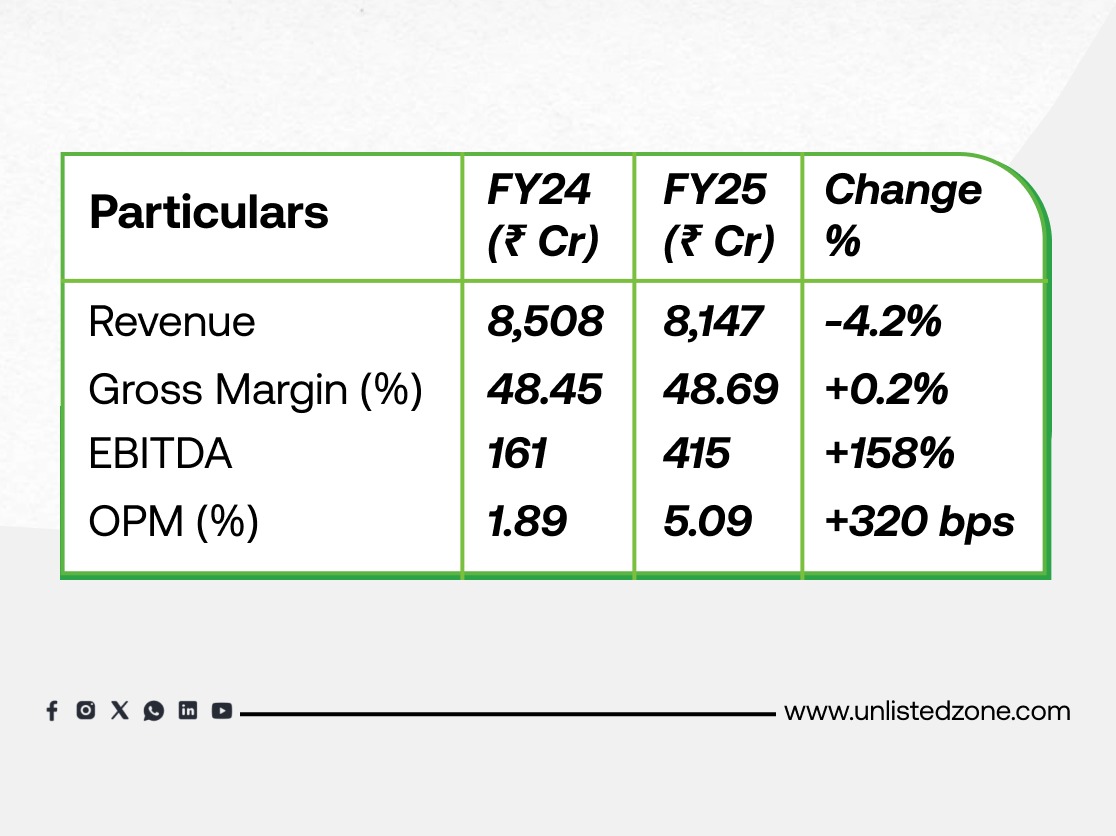

Revenue and Operating Performance

-

Revenue dipped marginally, but profitability improved due to lower raw material costs.

-

EBITDA more than doubled, showing better operating efficiency.

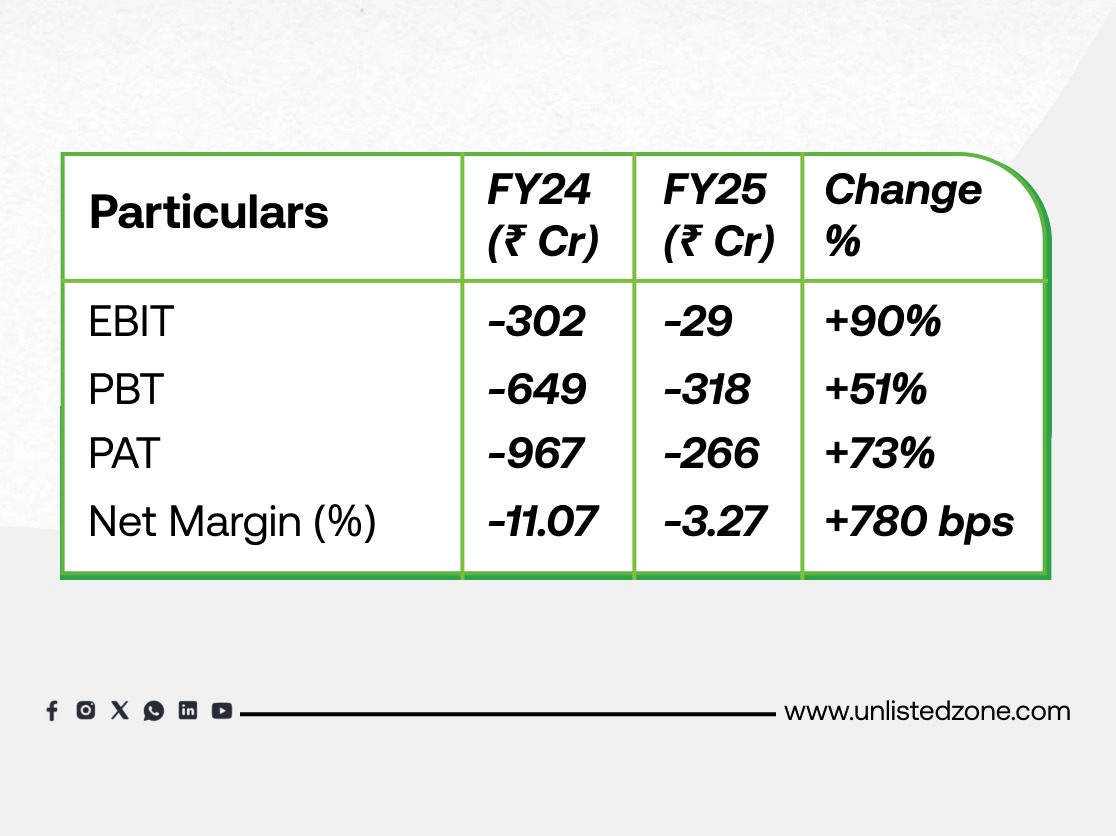

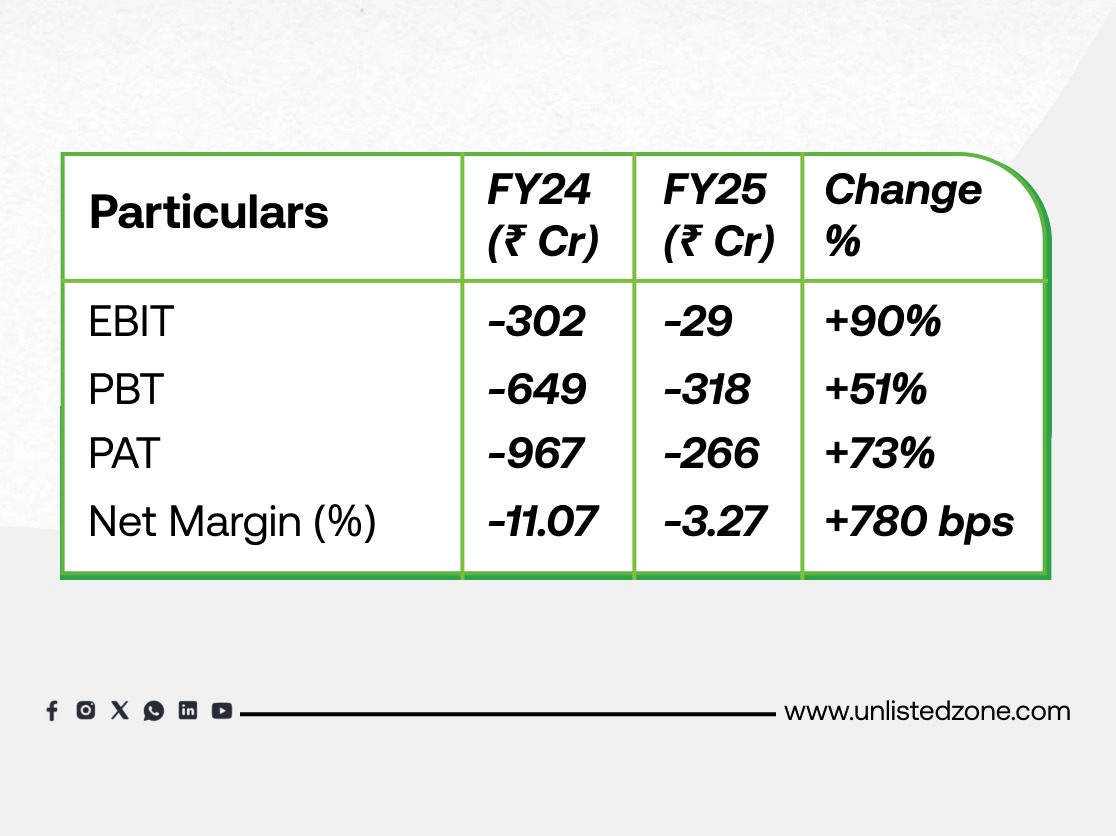

Profitability Pressures

-

Net loss reduced significantly, from ₹967 crore in FY24 to ₹266 crore in FY25.

-

EBIT loss narrowed, reflecting improving cost control, though still negative.

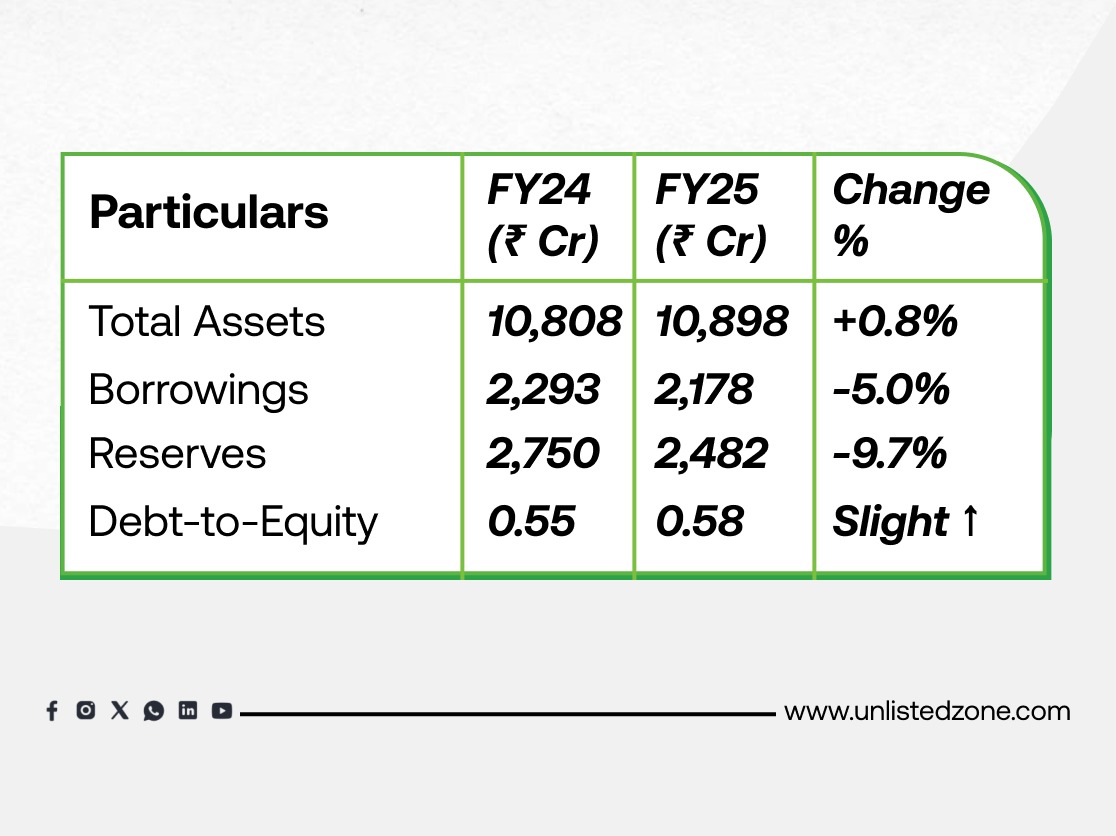

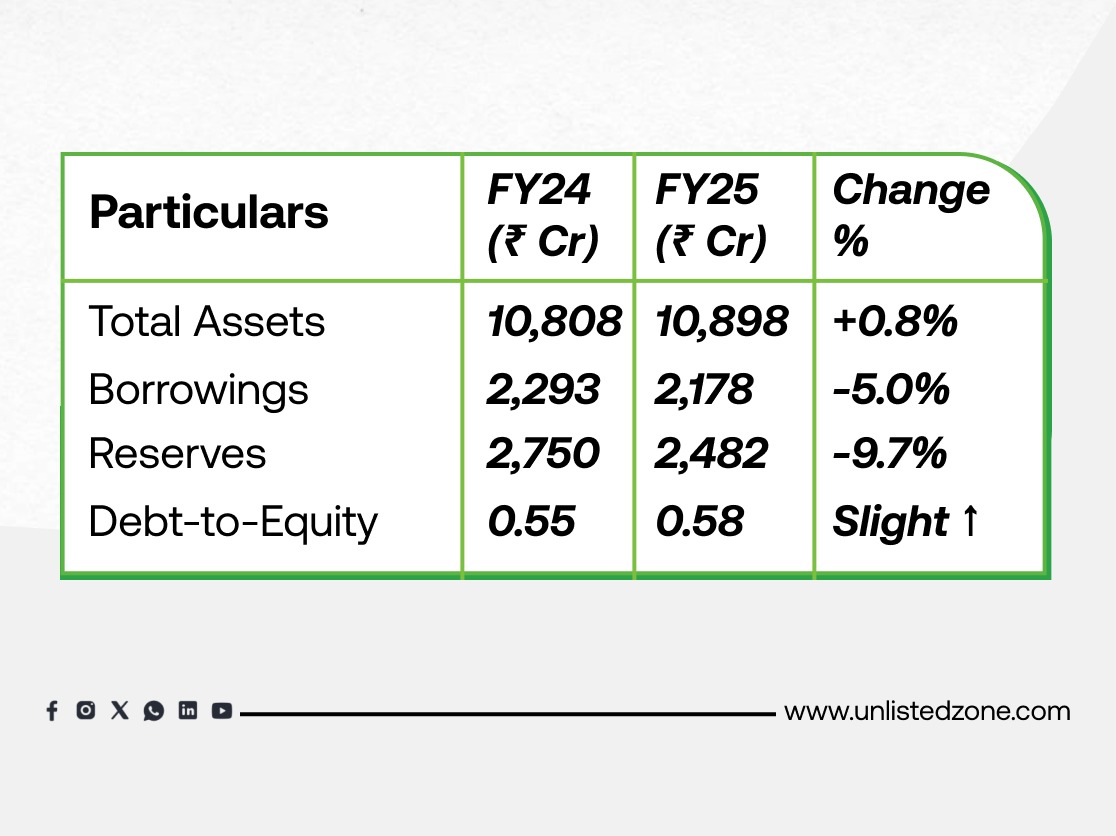

Balance Sheet & Leverage

-

Borrowings reduced marginally, but reserves declined due to losses.

-

Debt-to-equity ratio remains at moderate levels.

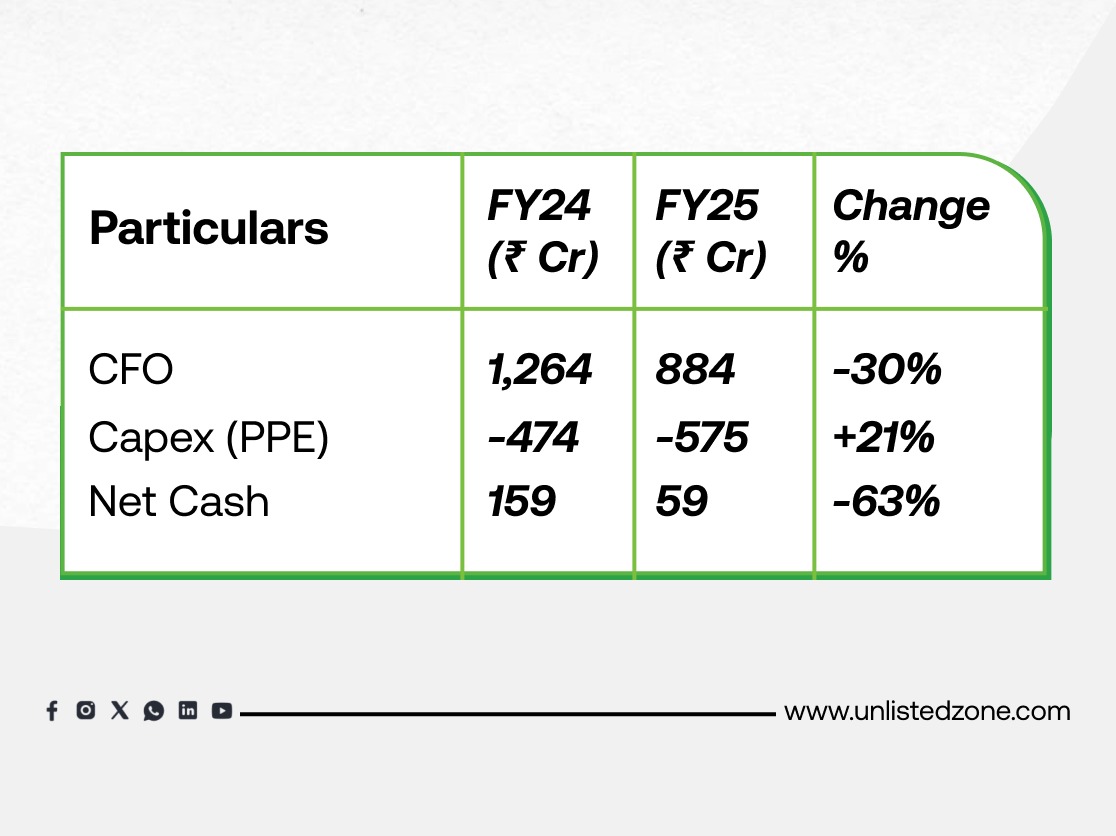

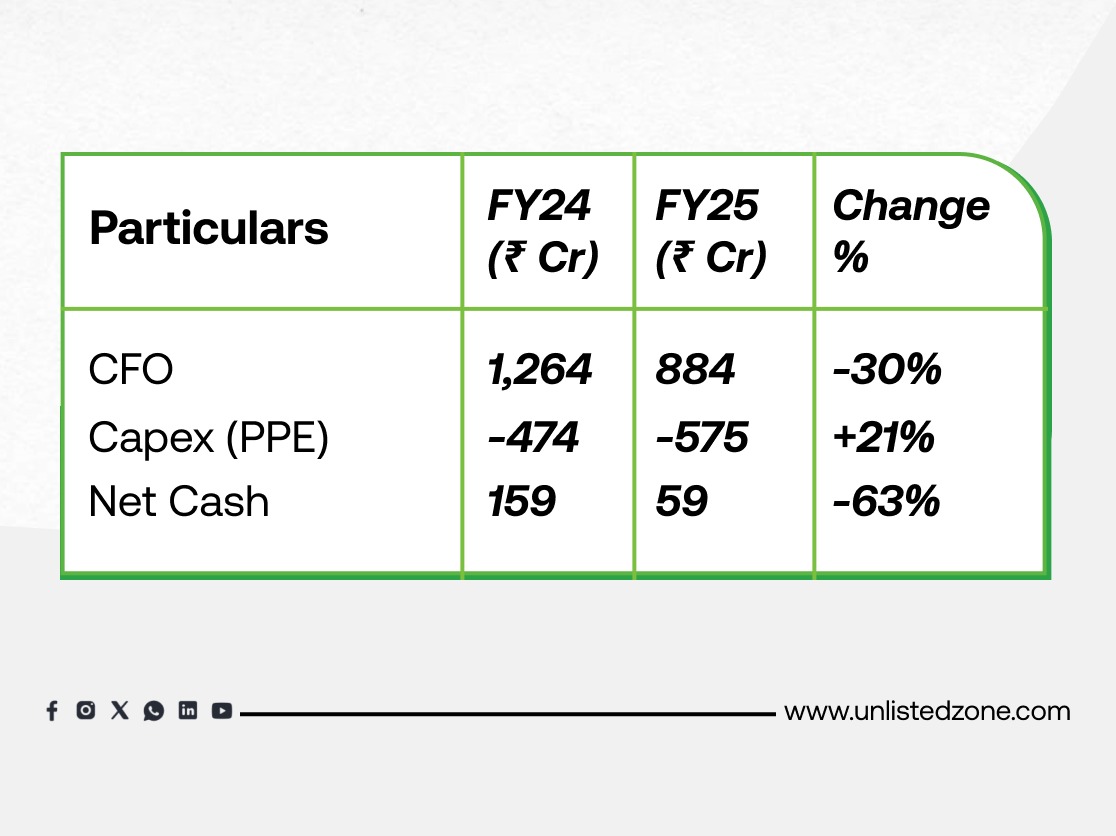

Cash Flows

-

Cash flow from operations dropped, impacted by lower earnings.

-

Higher capex spend and weaker cash generation led to a sharp fall in closing balance.

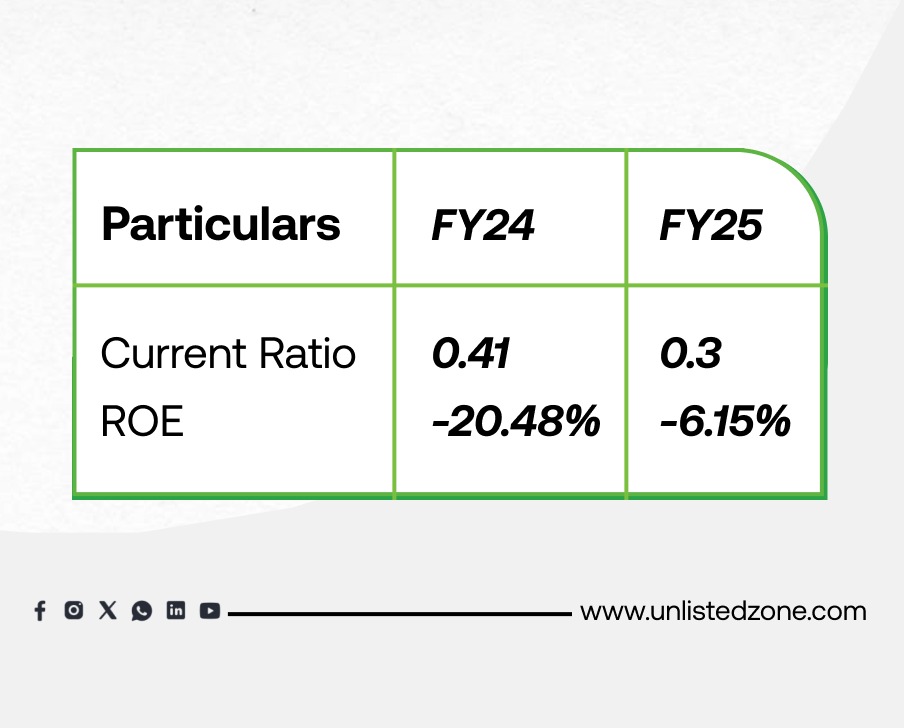

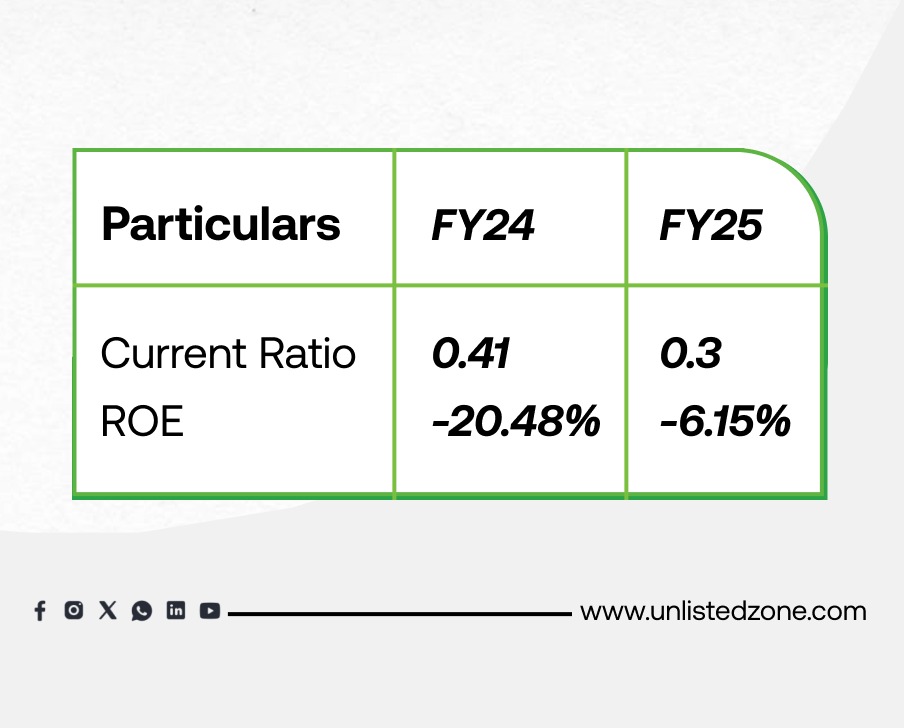

Key Ratios

-

Liquidity remains stressed with a very weak current ratio.

-

ROE improved but is still negative, signaling continued shareholder value erosion.

Conclusion

Electrosteel Steels continues to face operational and financial pressures, though FY2025 indicates early signs of stabilization with stronger EBITDA and reduced losses. However, persistent negative profitability, liquidity constraints, and weak return metrics underline significant risks. Any value unlocking depends heavily on Vedanta’s restructuring capabilities and an upturn in steel market dynamics.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.