Company Overview

Frick India Limited, incorporated in 1962 in collaboration with Frick Company USA, has grown into one of India’s largest equipment manufacturers and turnkey solution providers for industrial refrigeration and air-conditioning. With over 50 years of expertise, the company offers energy-efficient refrigeration systems, exports to 45+ countries, and operates from a 22-acre complex in Faridabad (Haryana). Its portfolio includes compressors, condensers, air handling units, ice-making equipment, blast freezers, chillers, and PUF panels. Additionally, Frick India provides single-source turnkey responsibility for refrigeration and air-conditioning projects and offers advanced solutions like the Frick India Energy Management System (FEMS).

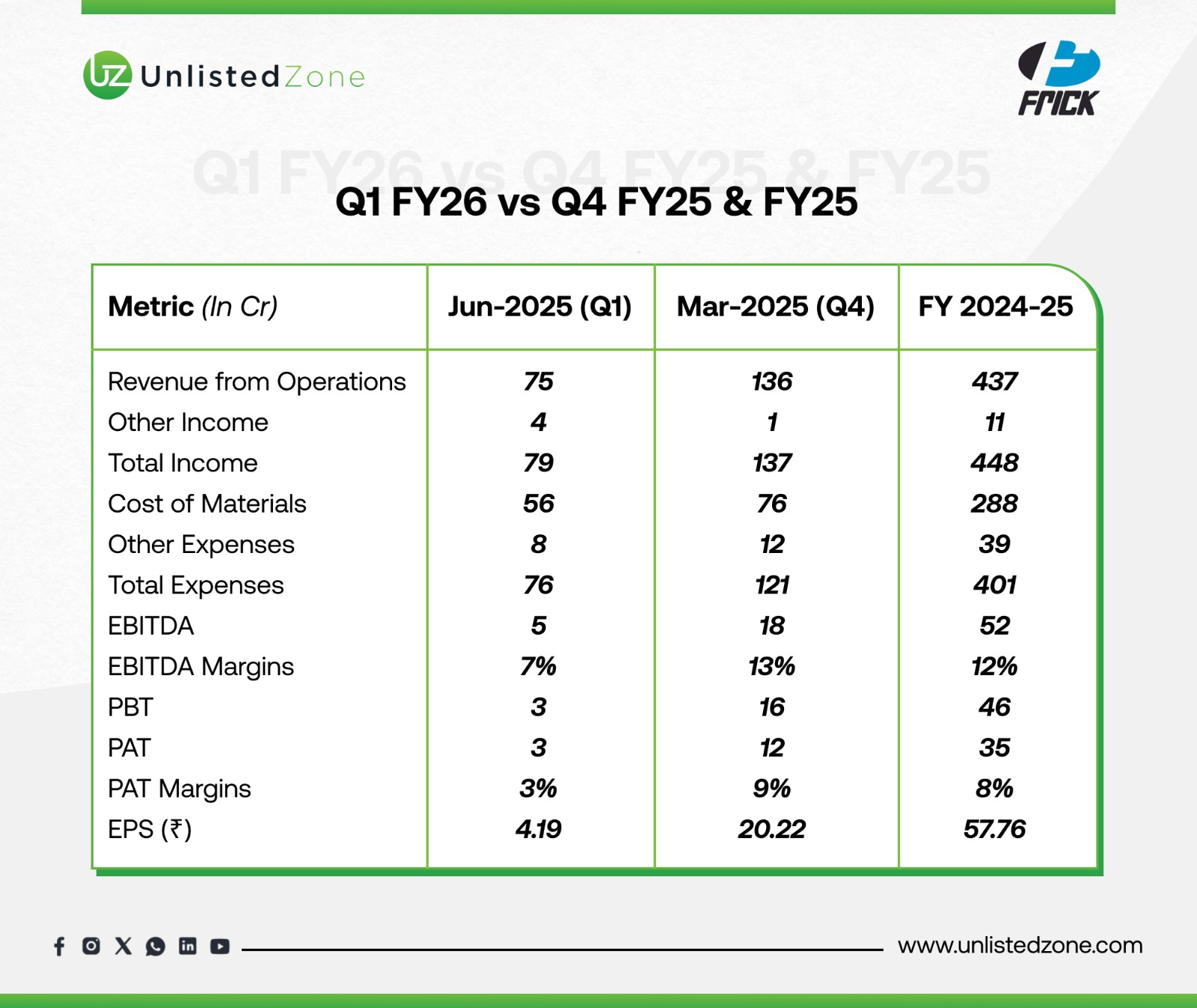

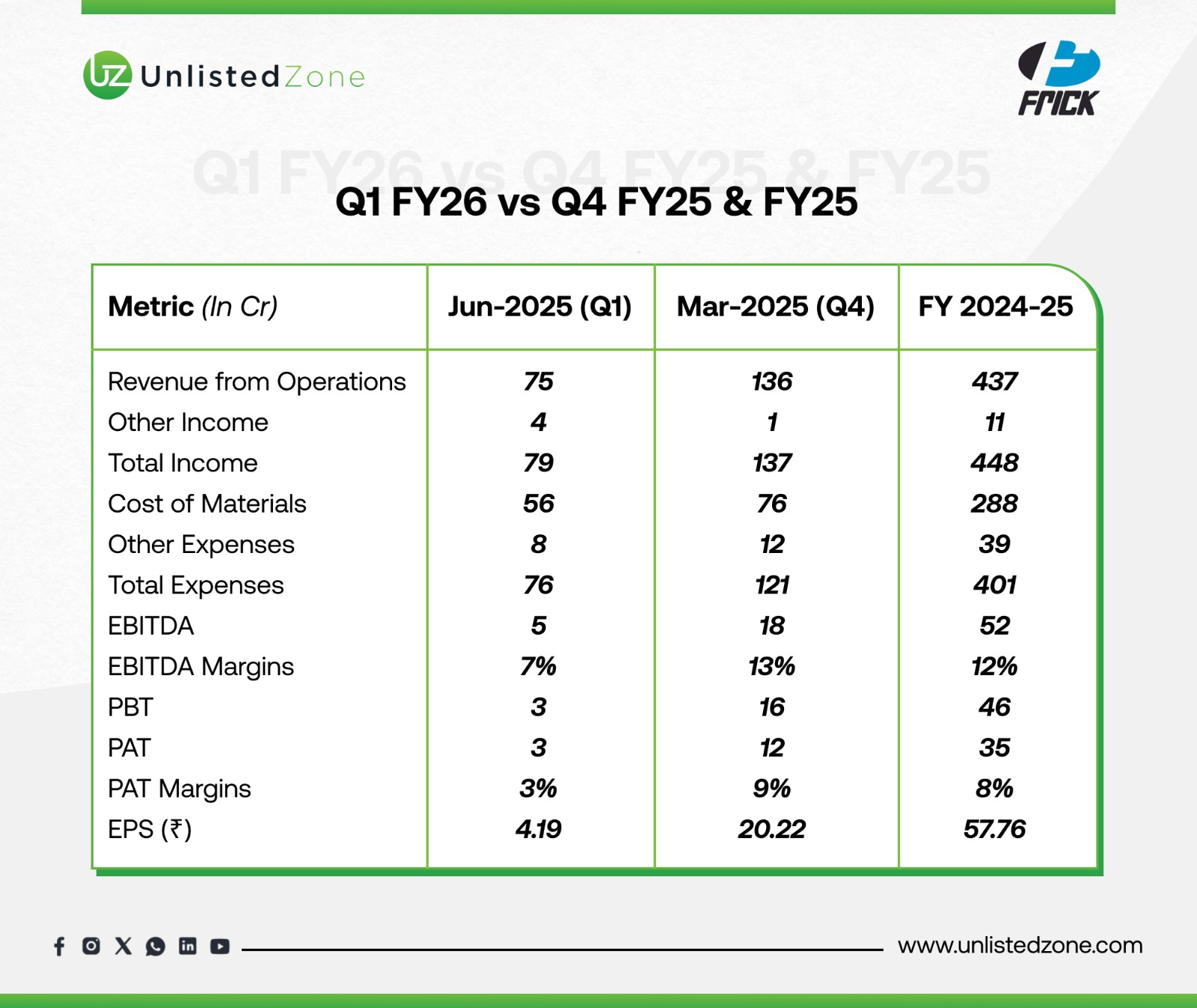

A) Financial Performance – Q1 FY26 vs Q4 FY25 & FY25

B) Quarterly Analysis (Q1 FY26 vs Q4 FY25)

-

Revenue saw a significant decline from ₹136 Cr in Q4 FY25 to ₹75 Cr in Q1 FY26, reflecting seasonality and softer demand in the opening quarter.

-

EBITDA dropped sharply to ₹5 Cr (7% margin) compared to ₹18 Cr (13% margin) in the previous quarter, largely due to lower absorption of fixed costs on reduced revenues.

-

Profitability took a hit with PAT at just ₹3 Cr vs ₹12 Cr in Q4, pushing margins down to 3% from 9%. EPS also fell from ₹20.22 to ₹4.19.

C) Annual Comparison (Q1 FY26 vs FY25 Average)

-

The company posted ₹437 Cr revenue in FY25, with an EBITDA of ₹52 Cr (12% margin) and PAT of ₹35 Cr (8% margin).

-

The Q1 FY26 performance, though weak, represents a softer start but may stabilize in subsequent quarters given the seasonal nature of refrigeration and project-based revenue cycles.

D) Key Takeaways for Investors

-

Seasonal Business Impact – Q1 generally tends to be weaker for capital goods and refrigeration players, with stronger traction expected in upcoming quarters.

-

Profitability Pressure – EBITDA and PAT margins have compressed sharply due to lower volumes, highlighting sensitivity to revenue fluctuations.

-

Exports & Turnkey Projects – With 45+ countries in its portfolio, international orders can be a key driver of growth in FY26.

-

Strong Legacy & Diversification – Despite quarterly volatility, Frick India maintains a strong product portfolio with long-term demand visibility in industrial refrigeration and cold-chain infrastructure.

UnlistedZone View

Frick India’s Q1 FY26 results reflect a weak start with margin compression and declining profitability. However, considering the company’s long-standing industry leadership, strong order book potential, and diversified presence across domestic and international markets, medium-to-long-term prospects remain intact. Investors in unlisted shares should closely monitor the upcoming quarters to see if the company regains profitability momentum and sustains healthy margins as seen in FY25.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.