Introduction

HDB Financial Services, a leading NBFC backed by HDFC Bank, is set to launch its much-anticipated IPO. The issue opens on June 25, 2025, and aims to raise ₹12,500 crore through a combination of fresh issue and offer for sale. Here's a comprehensive breakdown for investors tracking India’s evolving NBFC landscape.

A) IPO Snapshot

Key Dates:

-

Anchor Investor Allocation: June 24, 2025

-

IPO Open: June 25, 2025 (Wednesday)

-

IPO Close: June 27, 2025 (Friday)

-

Allotment Finalization: June 30, 2025

-

Refunds/Share Credit: July 1, 2025

-

Listing on BSE/NSE: Tentatively July 2, 2025

Price Band & Structure:

-

Price Band: ₹700–740 per share

-

Lot Size: 20 shares and multiples thereof

-

Fresh Issue: ₹2,500 crore

-

Offer for Sale (OFS): ₹10,000 crore (by HDFC Bank)

-

Face Value: ₹10 per share

-

Total Issue Size: ₹12,500 crore

Grey Market Premium (GMP):

B) Reservation Structure

-

Qualified Institutional Buyers (QIBs): Up to 50%

-

Non-Institutional Investors (NII/HNIs): At least 15%

-

Retail Individual Investors: At least 35%

-

Employee Quota: ₹200 crore

-

HDFC Bank Shareholder Quota: ₹1,250 crore

C) Company Overview

-

Promoter: HDFC Bank (94.3% pre-IPO stake)

-

Classification: NBFC-UL (Upper Layer, per RBI)

-

Focus Segments:

-

Enterprise Lending

-

Consumer Finance

-

Asset Finance

-

Distribution: Omni-channel, PAN-India presence

D) Financial Performance

Growth CAGR (FY23–FY25):

-

AUM: 23.71%

-

Profit After Tax: 5.38%

E) Peer Valuation Comparison (P/B Ratios)

| Company |

P/B Ratio |

| Bajaj Finance |

5.79x |

| Cholamandalam Finance |

5.46x |

| Sundaram Finance |

4.09x |

| L&T Finance |

1.84x |

| Mahindra Finance |

1.4x |

| Shriram Finance |

2.15x |

F) Valuation Check: Price-to-Book (P/B) Ratio

-

Book Value per Share (FY25): ₹199.46

-

IPO Price (Upper Band): ₹740

-

P/B Ratio = 740 / 199.46 = 3.72x

- Mcap = ~INR 60k Cr

Compared to other high-quality NBFCs, this valuation is at the lower end of the peer range but still reasonable given HDB’s growth and asset quality.

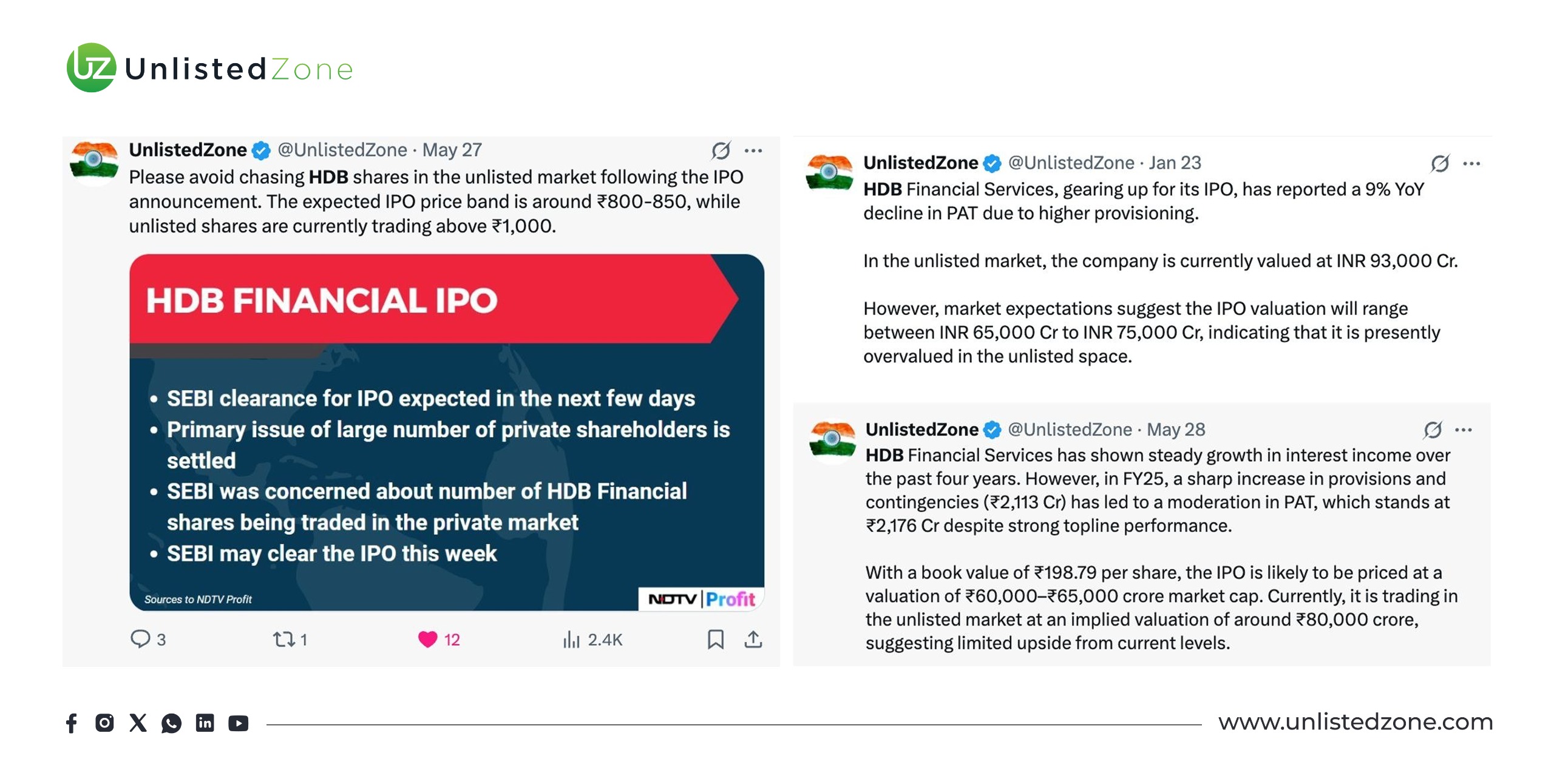

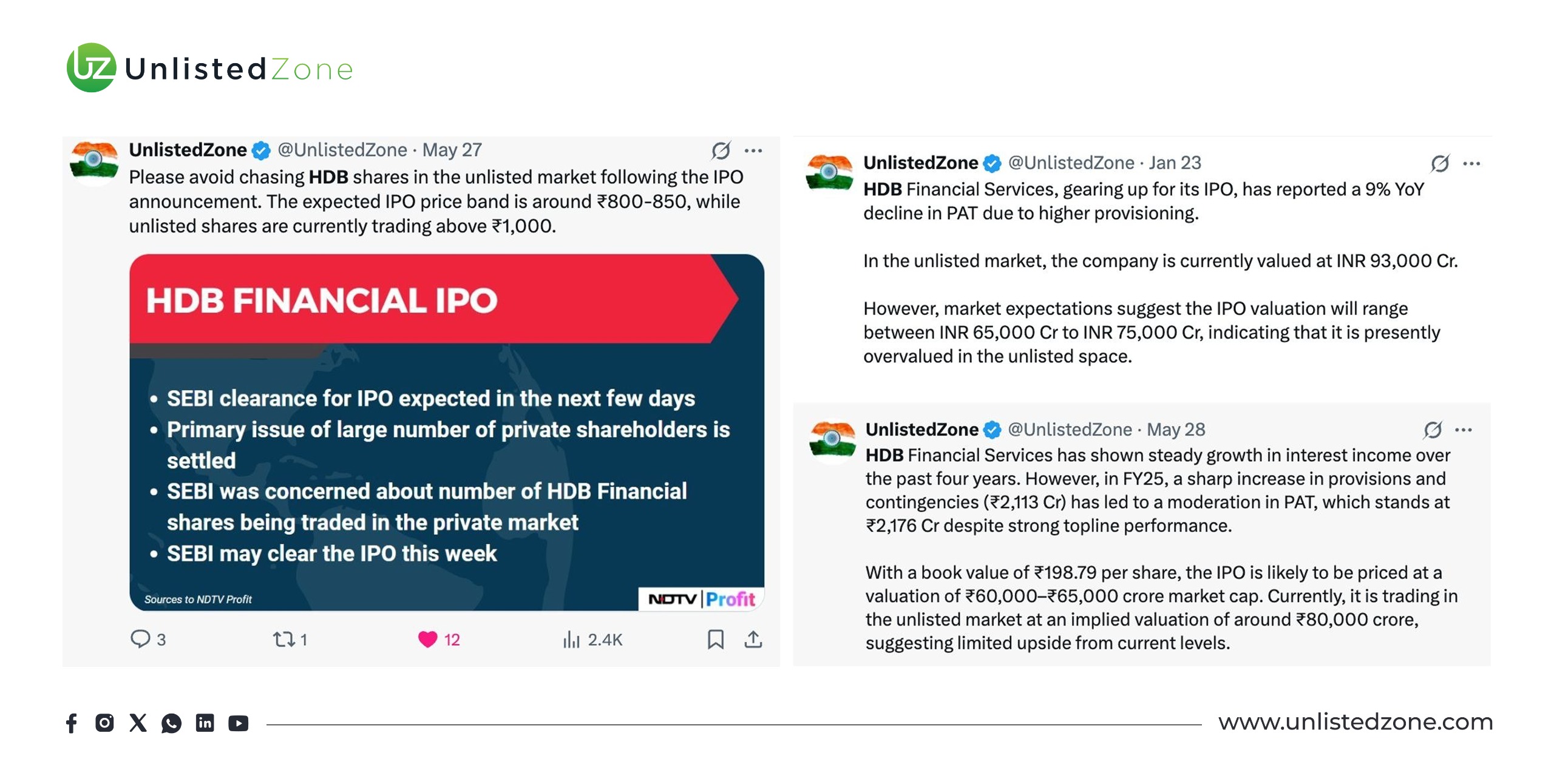

📢 Investor Caution from UnlistedZone

“We Said It Before — Don’t Chase Hype Without Valuation”

UnlistedZone has consistently cautioned investors over the past year that HDB Financial Services' unlisted share price was trading at unjustified valuations, often at implied P/B multiples of 5 to 7 , far above industry norms.

Recently, In the unlisted market, HDB shares were being quoted at ₹1,000–₹1,300 — levels that represented a 5x–6x P/B. Our analysis showed these valuations were not supported by fundamentals and carried significant downside risk.

👉 Our Message Then: Wait for IPO clarity and avoid inflated secondary market prices.

👉 Lesson Now: The IPO price of ₹740 implies a P/B of 3.72x — clearly showing that those who bought at higher unlisted prices are already facing notional losses.

This is a powerful reminder that valuation discipline is more important than market momentum. Chasing FOMO in the unlisted market, without benchmarking, often results in poor entry points.

Stay updated with more IPO insights and Unlisted market trends only on UnlistedZone.