India’s electric vehicle (EV) sector is witnessing a major development with Maruti Suzuki’s launch of its first Battery Electric Vehicle (BEV), the E-Vitara, along with the inauguration of the TDS lithium-ion battery plant. This move is set to reshape the EV landscape and poses indirect competition to companies already active in the battery ecosystem, such as GFCL EV (Gujarat Fluorochemicals Limited EV Products). For investors tracking the GFCL EV Unlisted Share, understanding these developments is critical to assessing future opportunities.

Maruti Suzuki’s EV Push

-

Launch of E-Vitara

-

Maruti Suzuki has rolled out its first fully electric SUV, the E-Vitara.

-

The company plans to export the model to over 100 countries, making it a global EV offering from India.

-

Battery Manufacturing – TDS Lithium-ion Plant

-

Alongside the vehicle launch, Prime Minister Narendra Modi inaugurated the TDS Lithium-ion Battery Plant.

-

TDS is a joint venture between Toshiba, Denso, and Suzuki.

-

The plant will manufacture lithium-ion battery cells and electrodes, ensuring supply chain security for Maruti’s EVs.

This marks Maruti Suzuki’s shift from a late entrant in EVs to a serious player with both domestic and international ambitions.

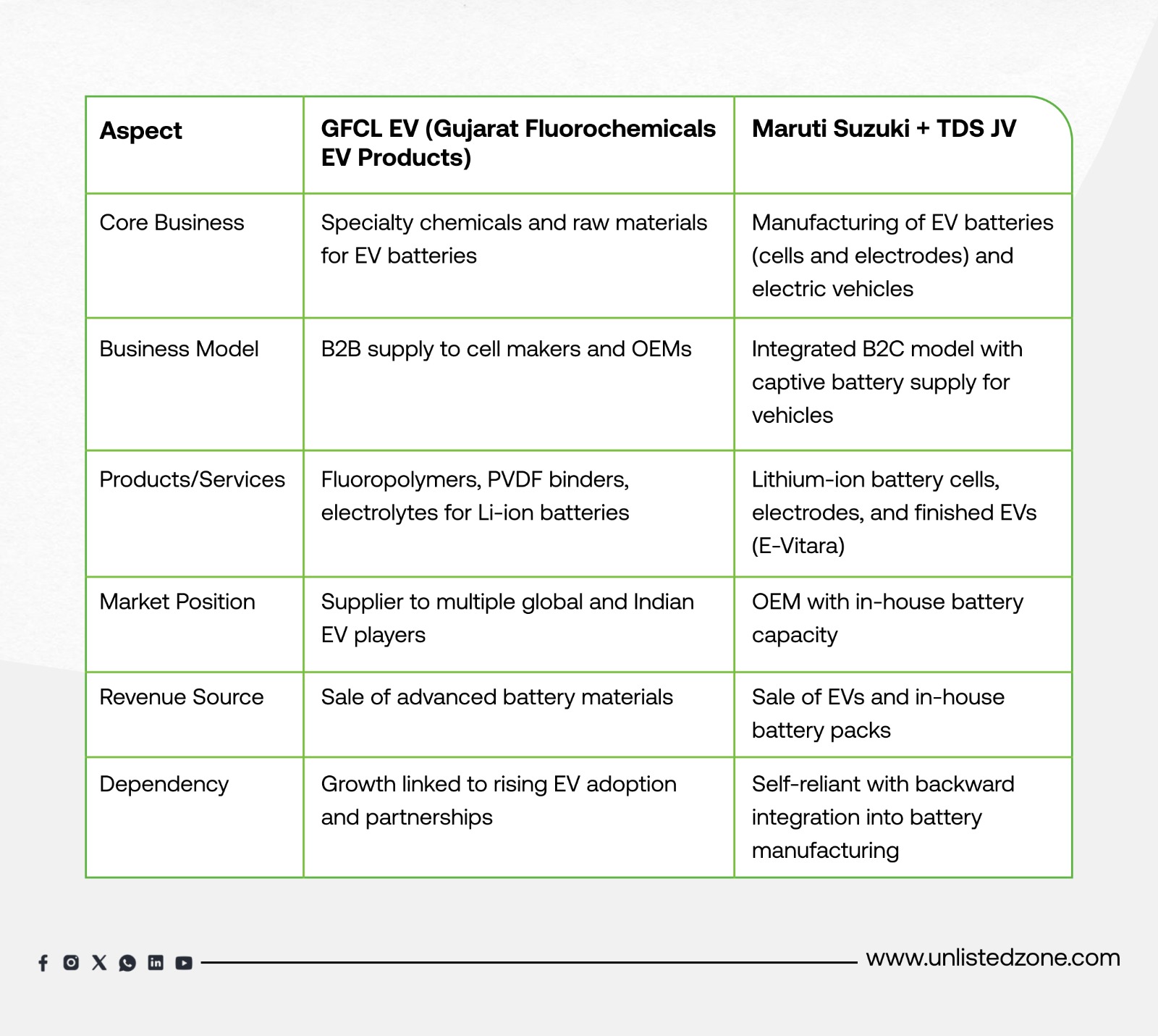

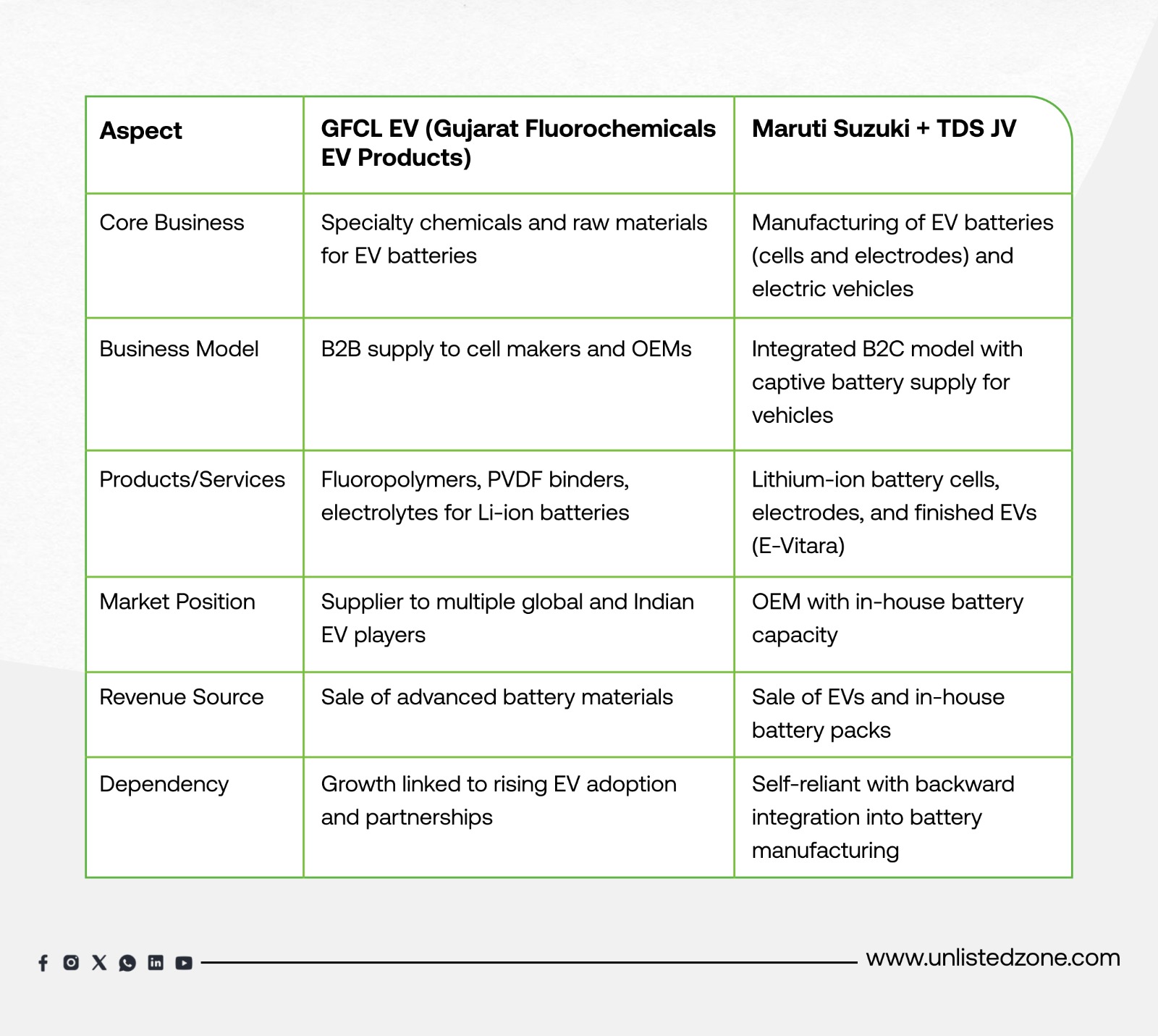

GFCL EV vs Maruti Suzuki (TDS JV): Business Model Comparison

Impact on GFCL EV Unlisted Share

-

Positive Side:

-

Rising EV adoption in India benefits GFCL EV, as more automakers and battery plants will require advanced materials.

-

Even Maruti’s TDS plant may indirectly rely on suppliers like GFCL EV for certain raw materials.

-

Risk Side:

-

As OEMs like Maruti Suzuki move into backward integration, dependence on third-party suppliers could reduce over time.

-

This may limit the long-term growth potential for external material suppliers if major players become self-reliant.

For investors, the GFCL EV Unlisted Share remains a proxy to India’s EV battery material growth story. However, the emergence of integrated players like Maruti Suzuki adds a new dimension to the competitive landscape.

Conclusion

Maruti Suzuki’s E-Vitara launch and the TDS lithium-ion battery plant mark a bold step in India’s EV transition. While GFCL EV Unlisted Share represents an opportunity in the materials supply chain, Maruti’s entry highlights the trend of automakers securing their own battery supply. For investors, this means GFCL EV’s long-term success will depend on maintaining technological leadership and securing contracts across the expanding EV ecosystem.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.