Introduction

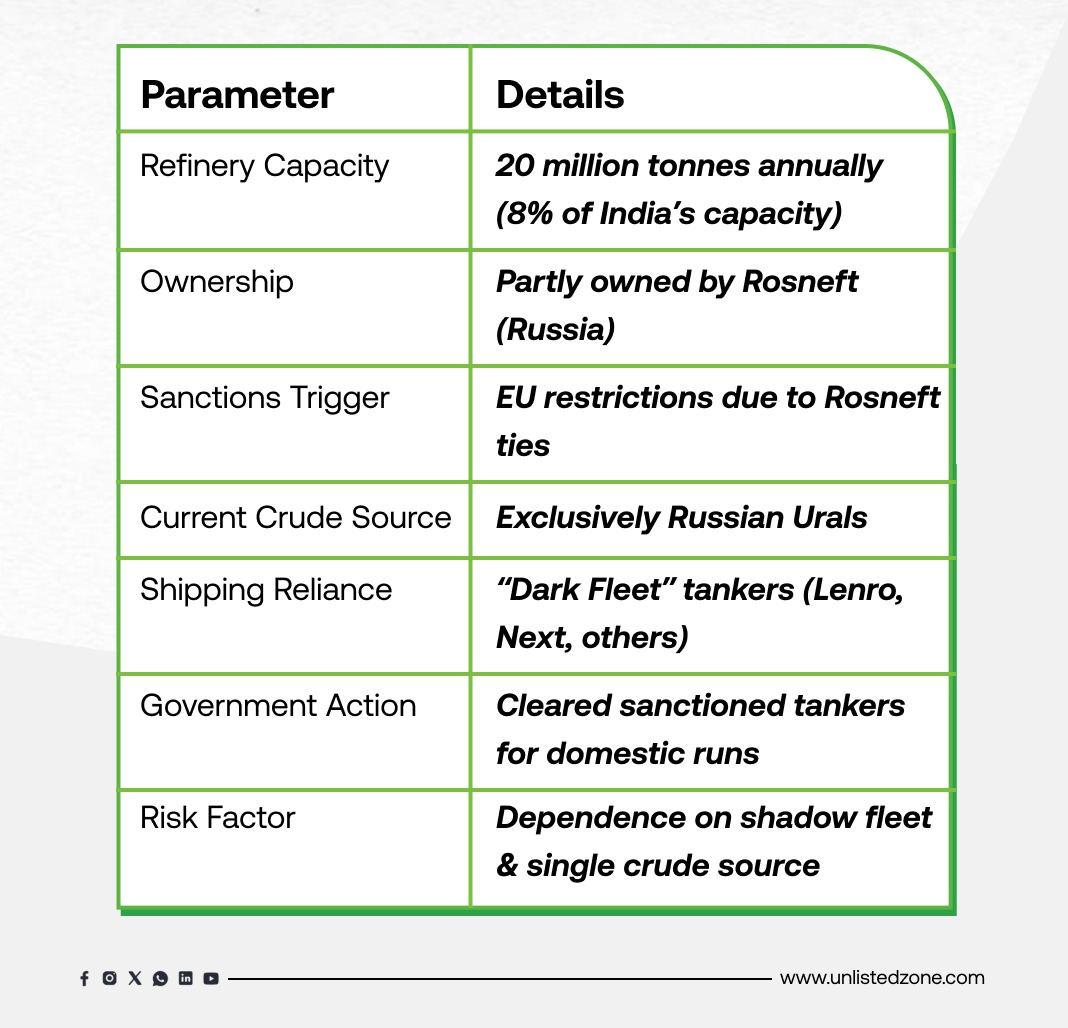

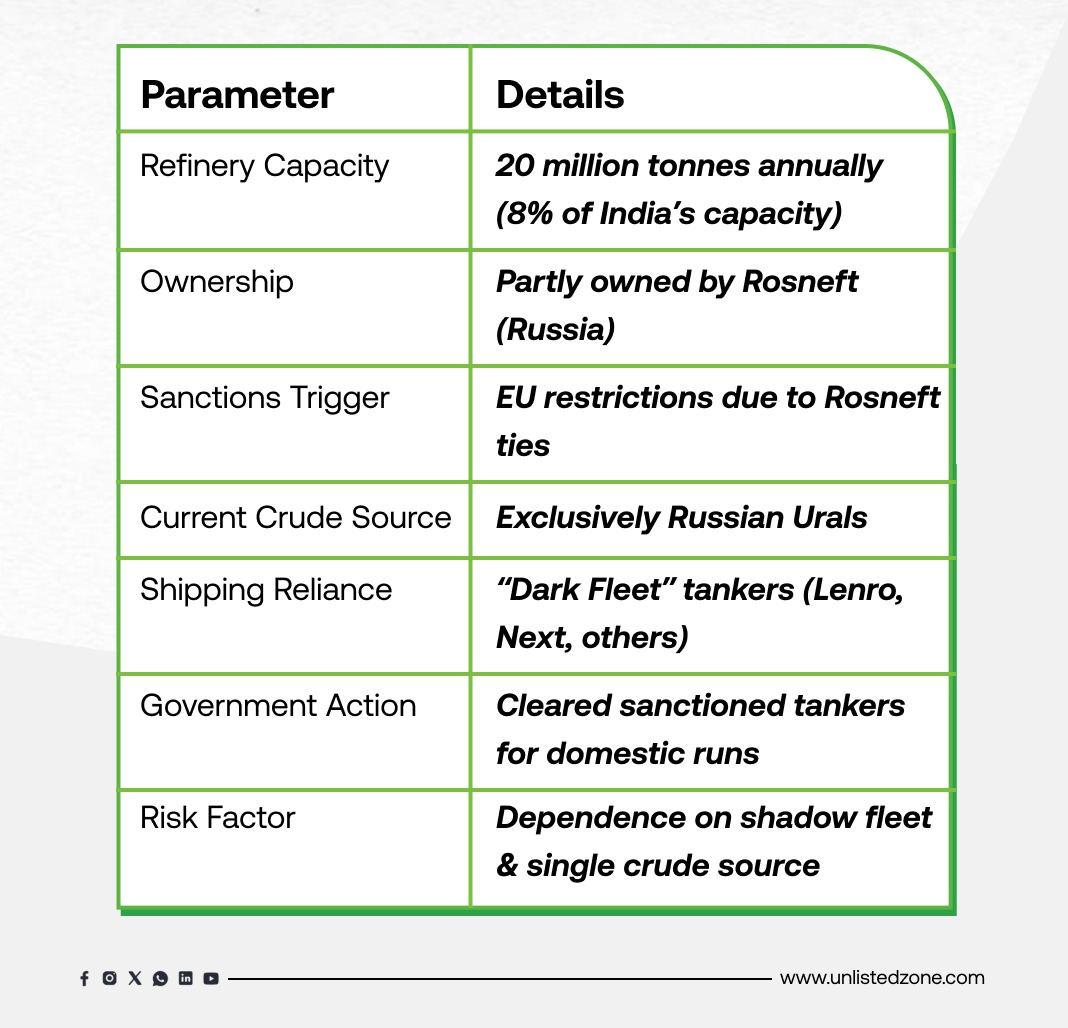

Nayara Energy, one of India’s largest private refiners and partly owned by Russia’s Rosneft, is facing a critical test of survival. One month after being hit by European Union (EU) sanctions, the company is struggling to operate normally and has been forced to rely on a shadow network of vessels — often referred to as the “dark fleet.”

With its refinery at Vadinar accounting for nearly 8% of India’s total refining capacity, the developments around Nayara are not just a corporate issue but a matter of national energy security.

A) Impact of EU Sanctions

The EU sanctions, aimed at curbing Moscow’s oil revenues, have directly affected Nayara due to its Rosneft shareholding.

-

Trade Isolation: Long-standing trade partners and shipping companies have distanced themselves from Nayara.

-

Refinery Slowdown: Reduced access to logistics has forced Nayara to cut refinery run rates.

-

Supply Concentration: Since late July, Nayara has been sourcing only Russian Urals crude, significantly narrowing its supply chain.

B) The “Dark Fleet” Strategy

To keep crude flowing and refined products moving, Nayara has turned to less conventional shipping methods.

-

Sanctioned Tankers: Vessels such as the EU-blacklisted Lenro and Next are now transporting crude oil and finished products for the company.

-

Coastal Runs Approved: The Lenro, despite being on the EU sanctions list, has already made at least three domestic voyages after approval from New Delhi.

-

Operational Risks: These vessels often operate with switched-off tracking systems and obscure ownership structures, raising transparency and compliance concerns.

C) Government Response

The Indian government has stepped in to ensure domestic fuel security is not jeopardized.

-

Official Clearance: At least one sanctioned vessel, the Lenro, has been cleared for domestic operations to help Nayara move cargoes.

-

Energy First Approach: This approval highlights India’s stance that national energy security outweighs compliance with international sanctions.

D) Russia’s Assurance

Moscow has pledged continued support to Nayara:

-

A Russian trade official in New Delhi assured that crude supplies to Nayara will not face disruption.

-

He emphasized the existence of “special mechanisms” designed to bypass transaction restrictions and tariffs.

-

This ensures that India’s imports of Russian oil are expected to remain at current levels.

E) Key Snapshot: Nayara Energy Situation

Investor Takeaways

For UnlistedZone readers and market watchers, the Nayara Energy situation underscores several critical themes:

-

Sanctions Create Grey Markets: Companies adapt by moving into opaque, high-risk trading channels like the dark fleet.

-

National Interest Over Alliances: India’s clearance of sanctioned vessels signals a clear priority on energy security over Western sanctions compliance.

-

High Operational Risk: Heavy reliance on a single crude source (Urals) and sanctioned logistics channels leaves Nayara vulnerable.

-

Market Sensitivity: Any prolonged disruption at Nayara could cause short-term volatility in India’s fuel supply and refining margins.

Conclusion

Nayara Energy’s troubles highlight the growing intersection of geopolitics and energy markets. With EU sanctions cutting off traditional trade partners, the company has been forced into the shadows, relying on sanctioned tankers and Russian crude to survive.

India’s willingness to support Nayara despite international pressure underlines a clear priority: domestic energy stability comes first.

For investors, this case serves as a reminder that global sanctions often reshape, rather than halt, trade flows — creating new risks, shadow networks, and market realignments.

Stay connected with UnlistedZone for more insights into how global developments impact India’s unlisted market ecosystem.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.