A) Introduction

Sterlite Power Transmission Ltd. (SPTL) is a key player in the power transmission and infrastructure sector, both in India and internationally. As FY24 concludes, Sterlite Power stands at a pivotal moment in its journey, marked by significant restructuring, a promising performance in its Global Products & Services (GPS) business, and challenges in its Infra business, particularly in Brazil. This detailed analysis delves into SPTL's performance across its business units, the impact of its demerger, and the company's future outlook.

B) Key Highlights

-

Demerger and Restructuring:

- Approval by NCLT: SPTL's demerger has been approved by the National Company Law Tribunal (NCLT), leading to the formation of two distinct entities:

- SGL-5 (Infra Co): This new entity will focus on SPTL's India-based infrastructure business, operating on a "Build & Hold-till-maturity" model. It will manage existing transmission projects and actively participate in upcoming bids.

- Demerged SPTL (GPS Co): This entity will house the Global Products & Services (GPS) and Convergence businesses, concentrating on manufacturing, EPC services, and optical fibre solutions.

- Shareholder Benefits: All SPTL shareholders will receive one share of SGL-5 for every SPTL share held as of the record date, aligning their interests with both the Infra and GPS businesses.

-

Record Order Book:

- Impressive Backlog: SPTL closed FY24 with a total order book of ₹12,151 crore, driven by significant wins in the GPS segment, particularly in conductors and cables. This strong backlog sets the stage for future revenue generation.

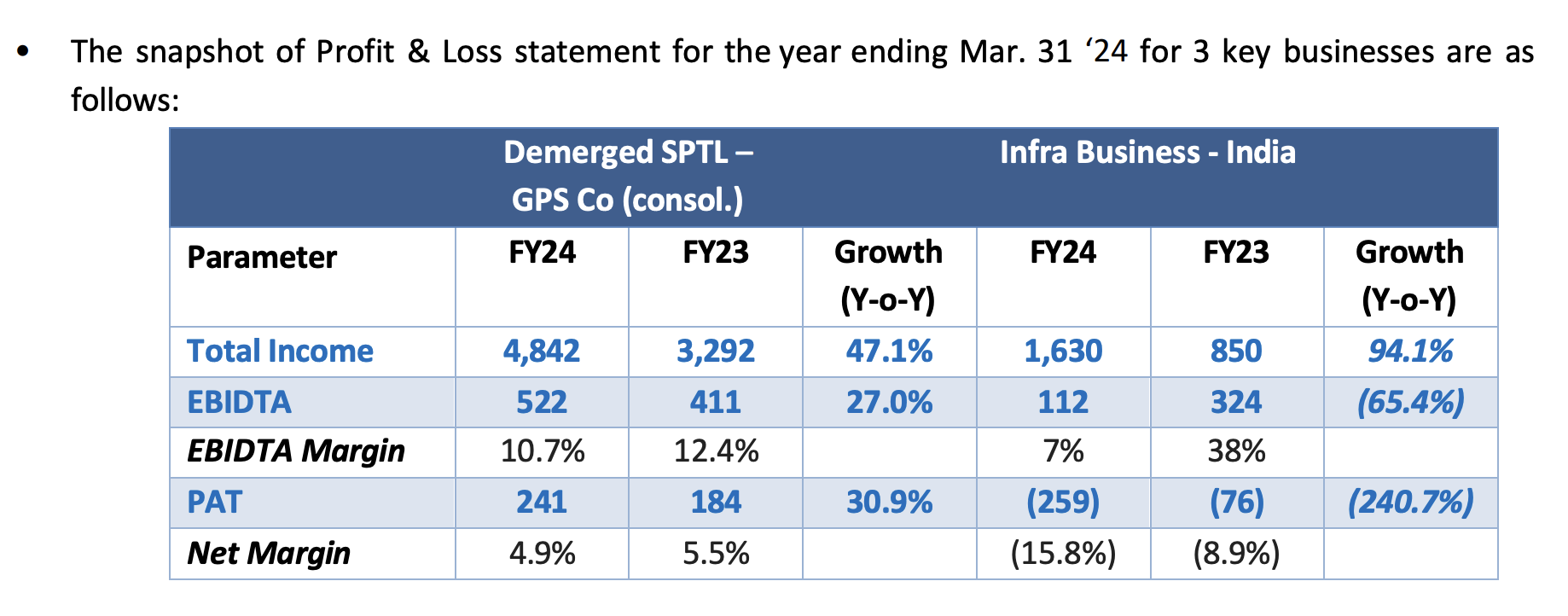

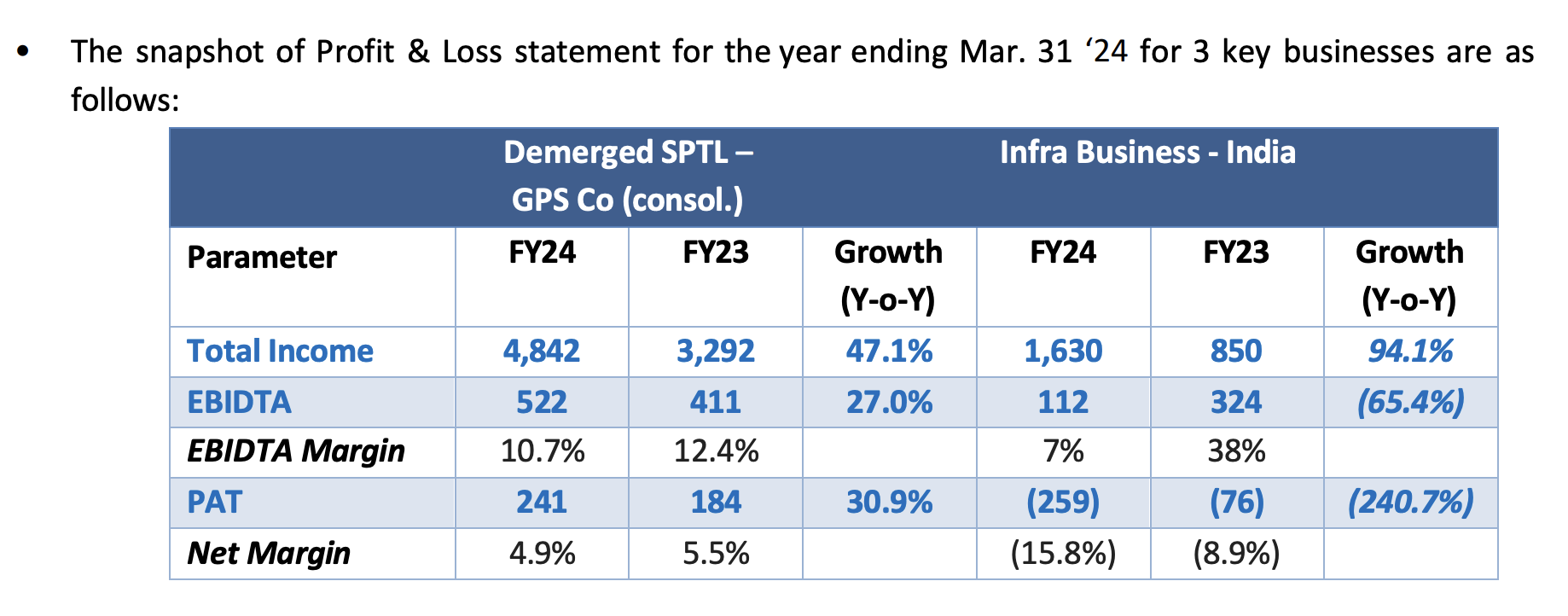

C) Financial Performance (FY24) of Sterlite Power Unlisted Share

-

Total Income:

- Substantial Growth: SPTL reported a 47.1% increase in total income, reaching ₹4,842 crore. However, it's important to note that this growth includes the Convergence business, which was not consolidated in previous years, making direct year-on-year comparisons challenging.

-

Profitability Concerns:

- Infra Business Struggles: Despite the growth in income, profitability in the Infra business, particularly in India and Brazil, declined compared to FY23. Factors contributing to this decline include higher costs of goods sold (COGS), deferred revenue recognition, and increased finance costs.

-

Balance Sheet Metrics:

- Net Worth Decline: SPTL's net worth decreased to ₹1,333 crore in FY24, primarily due to a consolidated net loss and a reduction in hedge reserves.

- Rising Borrowings: Borrowings increased significantly to ₹6,739 crore, mainly due to debt incurred by the Brazilian Infra business.

D) Business Unit Performance

-

Global Products & Services (GPS):

- Exceptional Growth: The GPS division emerged as a strong performer, achieving its highest-ever sales volume and in total income, reaching ₹4842 crore.

- Strong Margins and Returns: The GPS business maintained an impressive EBITDA margin of 10.7%, with a Return on Capital Employed (ROCE) of 43% and Return on Equity (ROE) of 66%.

- Positive Outlook: The company anticipates continued growth in the Indian conductor and cable markets. SPTL is investing ₹450 crore to increase conductor capacity and enter the solar and Extra High Voltage (EHV) cable segments, targeting a 30% revenue growth and 62% PAT growth by FY26.

-

Infra Business - India:

- Mixed Performance: While revenue increased in FY24, the profitability of the Indian Infra business saw a significant decline, with a negative PAT of ₹259 crore.

- Challenges: The profitability drop is attributed to higher COGS due to project delays, deferred revenue booking, and delayed realization of Change in Law (CIL) claims amounting to ₹516 crore.

- Future Prospects: Despite these challenges, SPTL remains optimistic about the long-term potential of the Indian transmission sector. The formation of the SGL-32 joint venture (JV) with GIC reflects their commitment to leveraging upcoming opportunities in the Tariff-Based Competitive Bidding (TBCB) segment.

-

Infra Business - Brazil:

- Underperformance: The Brazilian division faced significant hurdles in FY24, reporting lower revenue, a decline in EBITDA, and a substantial PAT loss of ₹370 crore.

- Reasons for Decline: Slower execution of network projects and significantly higher finance costs (50% higher than FY23) were major factors impacting performance.

- Strategic Review: SPTL is currently undertaking a strategic review of its Brazilian operations to determine the best course of action moving forward.

-

Convergence Business:

- Steady Growth: Although specific financial details were not disclosed, the Convergence business continued its positive trajectory, generating a consistent free cash flow run rate of ₹100-125 crore annually. This trend is expected to continue over the next three years, underscoring its stable contribution to the overall business.

E) Future Outlook

-

Demerger Impact:

- Unlocking Value: The demerger is expected to unlock significant value for shareholders by providing greater transparency and enabling investors to assess the distinct businesses separately.

- Focused Strategy: The restructuring will allow SPTL to sharpen its focus on individual business units, enhancing operational efficiency and strategic direction.

-

Growth Opportunities:

- GPS Division and Infra Growth: SPTL, particularly the GPS division and the newly formed SGL-5, are well-positioned to capitalize on the growing demand in the Indian power transmission and infrastructure sectors.

- Market Prospects: The booming power sector in India, driven by increasing electricity demand and government initiatives, presents a fertile ground for SPTL's growth over the next 4-5 years.

-

Challenges and Risks:

- Addressing Infra and Brazilian Challenges: The company needs to tackle the challenges faced by its Indian Infra and Brazilian businesses to improve profitability and ensure long-term sustainability.

- Macroeconomic and Regulatory Risks: Macroeconomic factors and potential regulatory changes could pose risks to SPTL's future performance, requiring proactive management and strategic planning.

- Valuation of GPS Business:

- Revenue (FY24): ₹4,840 crore

- PAT (FY24): ₹241 crore

- PAT Margin: 5%

- Comparable Company: APAR Industries

- APAR's P/E: 50x

- APAR's Market Cap: ₹41,000 crore

- APAR's Revenue (FY24): ₹16,000 crore

- APAR's PAT (FY24): ₹825 crore

- APAR's PAT Margin: 5%

Estimated Valuation for Sterlite Power's GPS Business:

2. Valuation of Infra Business:

- GIC Investment: $1 billion (~₹8,000 crore)

- This valuation is based on the recent investment by GIC, which gives us a clear market-based valuation of the Infra business.

3. Combined Valuation:

Adding the conservative valuations of the GPS and Infra businesses:

Combined Valuation=₹7,230 crore(GPS Business)+₹8,000 crore(Infra Business)=₹15,230 crore

4. Upside Valuation:

Given the booming power sector in India and the growth prospects over the next 4-5 years, the actual valuation at the time of the IPO could be higher. If market sentiment is strong and growth expectations are high, a higher P/E multiple or additional value from future orders and profitability improvements could push the combined valuation beyond ₹16,000 crore.

Conclusion:

The conservative valuation for Sterlite Power, combining the GPS business and Infra business, stands at approximately ₹15,230 crore based on FY24 financials. However, considering the sector's growth potential and the strategic importance of both business units, the valuation at IPO time could be higher, potentially crossing ₹16,000 crore. This valuation reflects both the current financials and the future potential in a booming sector.