Tata Capital, the financial services arm of the Tata Group, has consistently positioned itself as one of India’s leading diversified financial services companies. With offerings spanning retail, corporate, and infrastructure financing, as well as wealth management and advisory solutions, Tata Capital plays a pivotal role in India’s growing credit ecosystem. Its focus on customer-centric financial products, strong risk management, and backing of the Tata brand has enabled it to scale across market cycles.

Q1 FY26 Performance Highlights

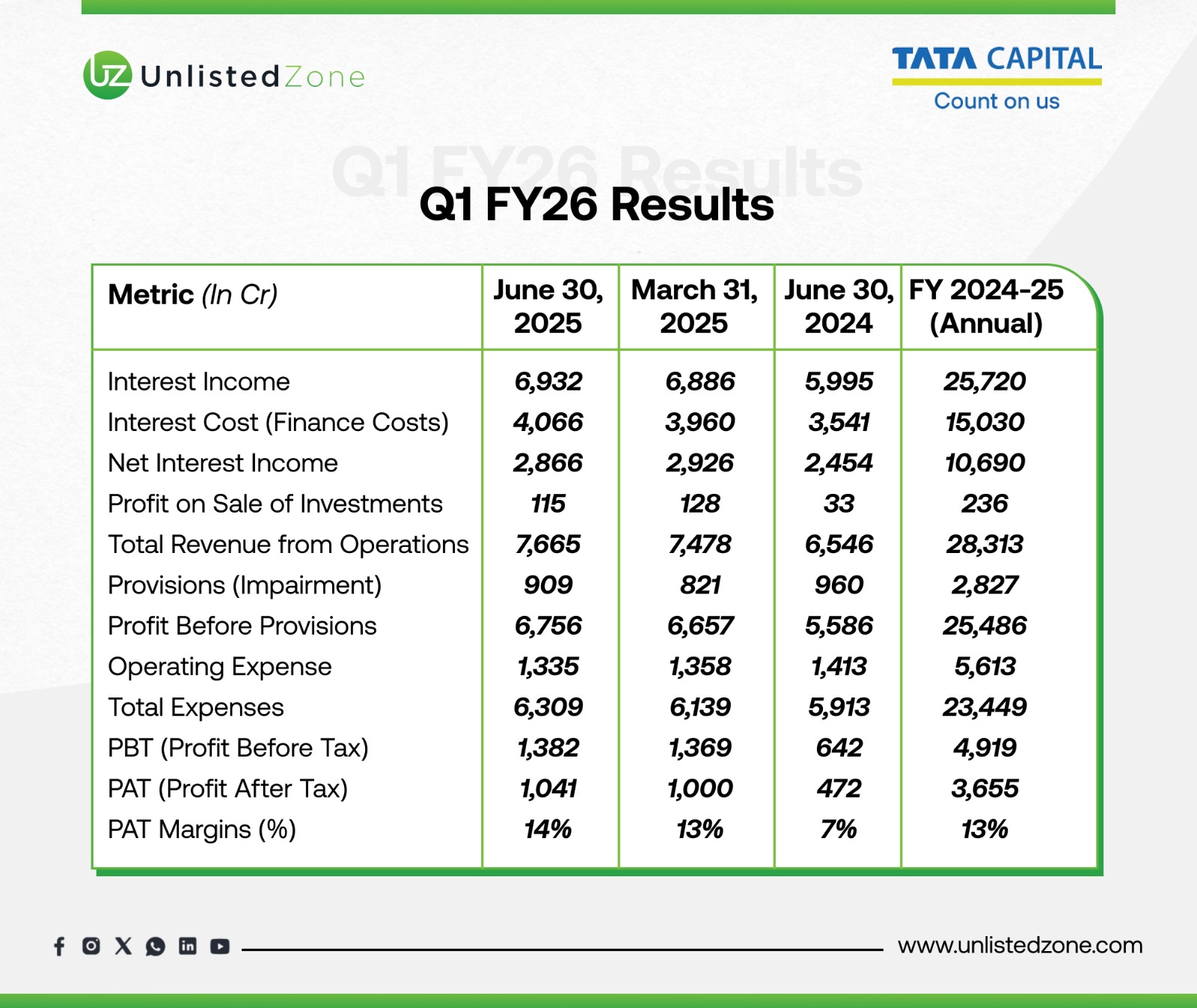

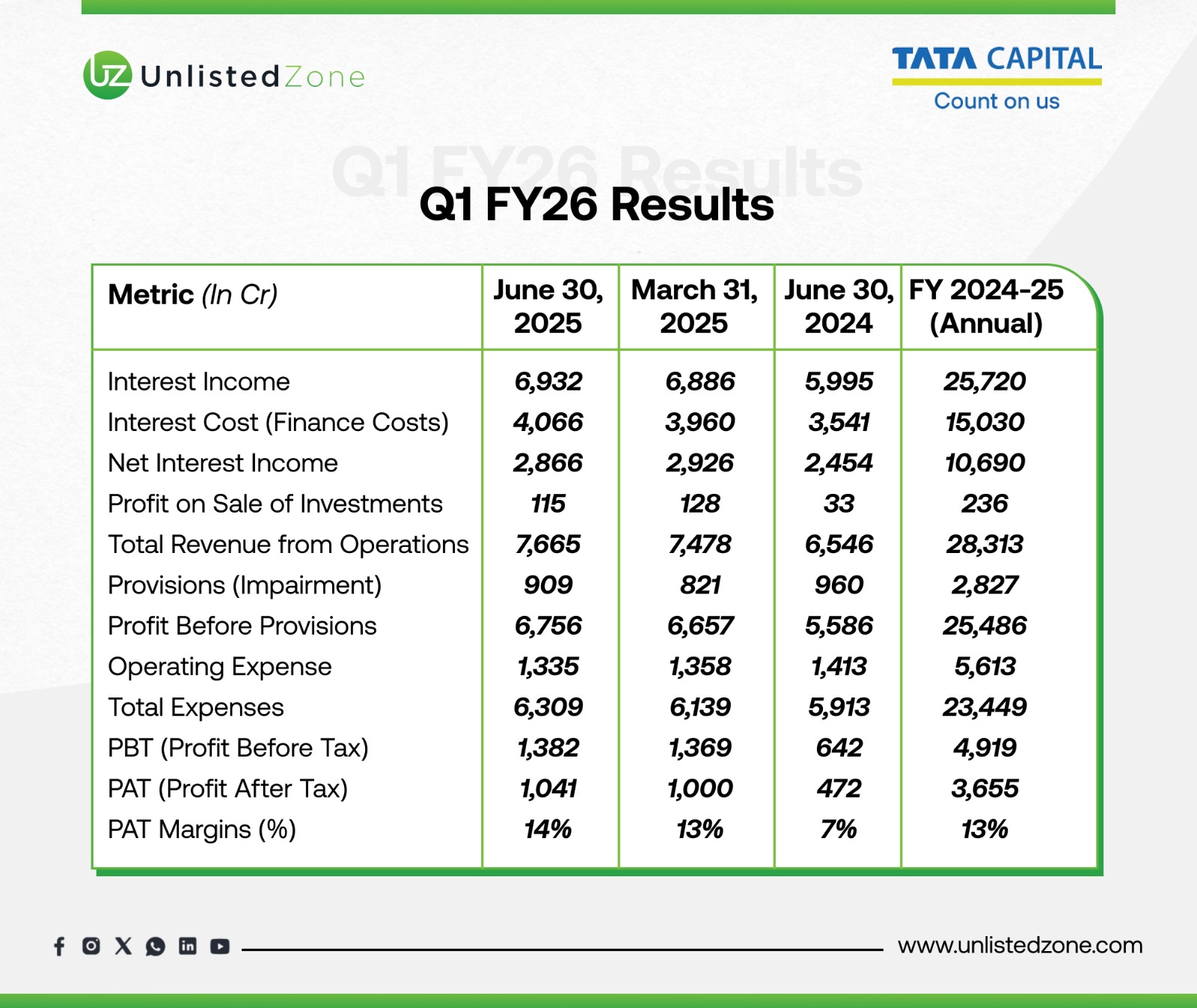

Tata Capital has delivered a robust performance in the first quarter of FY26, reflecting steady loan growth, efficient cost management, and strong profitability. Below is a snapshot of the company’s financials:

Key Takeaways for Investors

-

Revenue Momentum: Revenue from operations stood at ₹7,665 crore in Q1 FY26, up from ₹6,546 crore in Q1 FY25 – an impressive 17% YoY growth.

-

Profitability Surge: PAT came in at ₹1,041 crore, more than doubling YoY from ₹472 crore in Q1 FY25. PAT margins expanded significantly from 7% last year to 14% this quarter.

-

Stable Net Interest Income (NII): NII was at ₹2,866 crore compared to ₹2,454 crore in Q1 FY25, reflecting healthy loan book growth and interest spreads, though slightly lower than the previous quarter due to interest cost pressure.

-

Provisions Under Control: Provisions stood at ₹909 crore, lower than last year’s ₹960 crore, showing improved asset quality and effective credit monitoring.

-

Operational Efficiency: Operating expenses remained well-managed at ₹1,335 crore, down from ₹1,413 crore in Q1 FY25, highlighting cost discipline.

Investor View

Tata Capital has delivered a strong start to FY26 with solid revenue growth, margin expansion, and improved asset quality. The company’s ability to scale profitably while maintaining risk discipline is encouraging for long-term investors. With India’s credit demand on the rise and Tata Capital’s diversified financial services platform, the outlook remains promising.

For investors in the unlisted space, Tata Capital continues to stand out as a high-quality play within the NBFC sector, backed by the trust and governance of the Tata brand.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.