About the Company

GFCL EV Products Limited is a wholly-owned subsidiary of Gujarat Fluorochemicals Limited (GFL), incorporated on June 11, 2021. The company was established to capitalize on the global energy transition by becoming a critical supplier of advanced battery materials for Electric Vehicles (EVs) and Energy Storage Systems (ESS).

Its business model revolves around backward integration, aiming to reduce dependence on China and ensuring supply chain resilience. GFCL EV Products targets over 50% of the lithium-ion battery value chain, positioning itself as a key enabler of India’s EV ecosystem while also catering to international markets.

Key Differentiator: Strong backward integration, producing critical inputs like Hydrofluoric Acid (HF) and Lithium Fluoride in-house. This ensures supply chain control, product consistency, and compliance with regulations like the US IRA.

-

End Applications: Electric Vehicles (EVs), Energy Storage Systems (ESS), and advanced electronics (3C).

-

Name of subsidiaries which are yet to commence operations: GFCL EV Products Americas LLC, GFCL EV (SFZ) LLC, GFCL EV Products GmbH and GFCL EV Products Pte. Ltd.

Product Portfolio

-

LiPF6 Salt

-

Electrolyte Formulations

-

PVDF and PTFE Binders (for wet and dry battery chemistries)

-

LFP Cathode Active Material (LFP-CAM)

-

Fluorinated Rubber Solutions

Existing R&D Portfolio

-

Cathode Active Material (CAM): Lithium Iron Phosphate (LFP).

-

Electrolytes: Salts, additives, and advanced formulations.

-

Binders: PVDF and PTFE.

-

Product Development: Battery-chemistry agnostic approach to serve multiple technologies.

Target Markets & Customers

The company is focusing on India, USA, and the European Union (EU), with an emphasis on securing long-term supply contracts with leading EV OEMs and global battery manufacturers.

Market Demand Drivers

-

Rising global EV penetration driven by decarbonization mandates.

-

Accelerating build-out of grid-scale energy storage.

-

Supply chain diversification beyond China (China+1 strategy).

-

Policy frameworks incentivizing local manufacturing.

-

Growing demand for higher material purity and automotive-grade specifications.

Operational Highlights for FY2024-25

-

Commissioning: Successfully commissioned and stabilized high-purity plants for LiPF6 salt, electrolyte, PVDF, and PTFE, meeting auto-grade specifications.

-

Validation: Products sampled with major global cell OEMs (outside China). Secured full-cell validation with a leading electrolyte player.

-

Contracts: Signed long-term contracts for LiPF6 and binders with global customers. Early agreements for LFP-CAM are under discussion.

Key Highlights of FY2025

-

Commercial Scale-Up: Revenue from operations jumped from just ₹36.82 Lakhs in FY24 to ₹944.30 Lakhs in FY25, signaling the start of commercial sales.

-

Geographic Expansion: India contributed ~98% of sales, with first entries into USA and Europe markets.

-

Strengthened Balance Sheet: Equity base expanded significantly due to fresh share issuances, eliminating long-term debt.

-

Capex Drive: Huge investments in plant & equipment (₹44,383 Lakhs) and capital work-in-progress (₹57,683 Lakhs) to scale manufacturing capacity.

-

Liquidity Boost: Cash reserves increased from ₹30.63 Lakhs to ₹530.38 Lakhs, despite heavy cash burn.

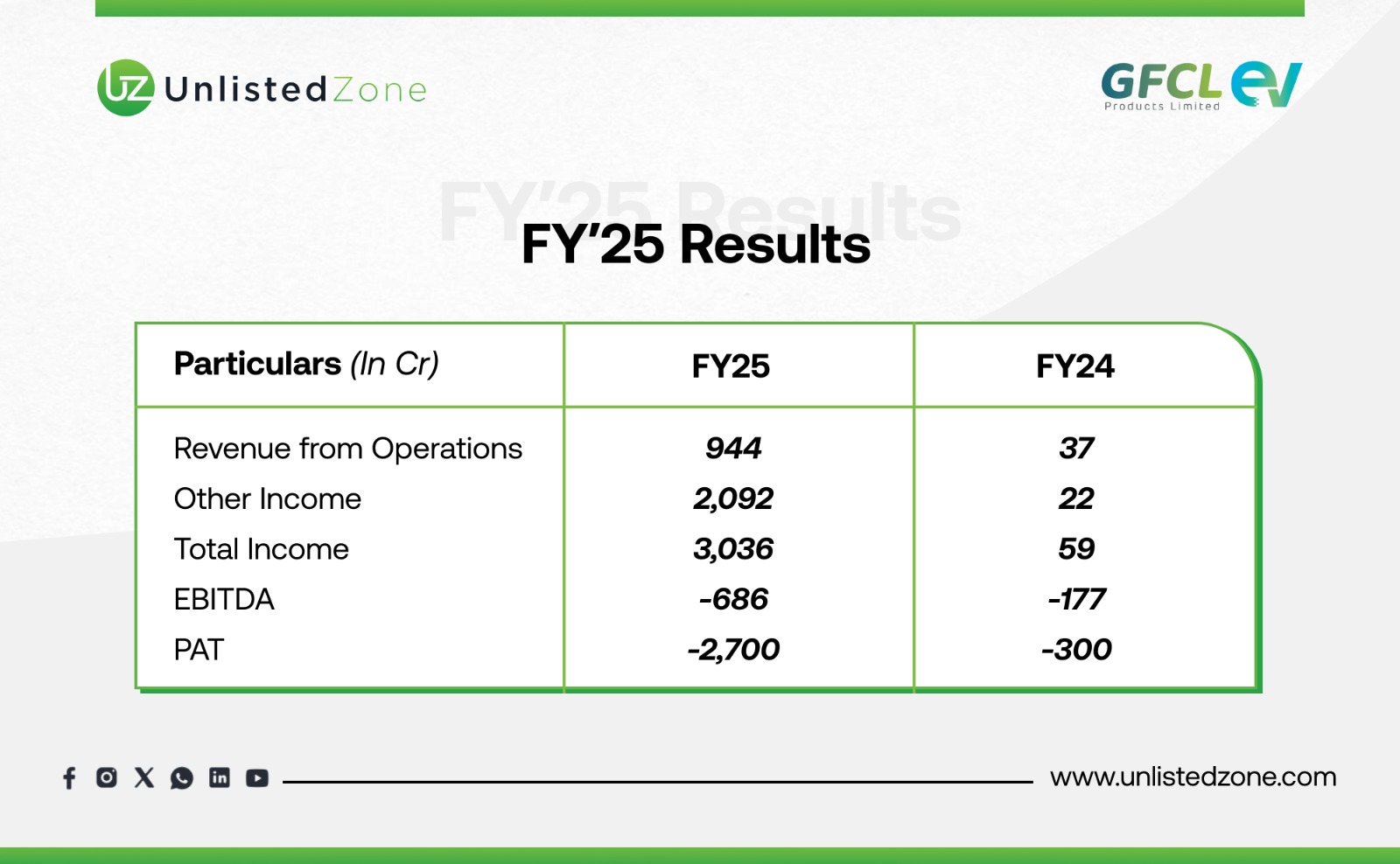

Financial Performance (in ₹ Lakhs)

GFCL EV Products has entered the commercial revenue phase with a 25x increase in sales, showing strong traction in its core battery chemicals business. However, the company’s expenses ballooned due to raw material costs, depreciation, and operational ramp-up, leading to an expanded loss of ₹2,701 Lakhs. Interestingly, Other Income (₹2,092 Lakhs) contributed a significant portion of total income, highlighting the role of treasury operations and grants in cushioning operational losses. This is typical for early-stage, capex-heavy businesses.

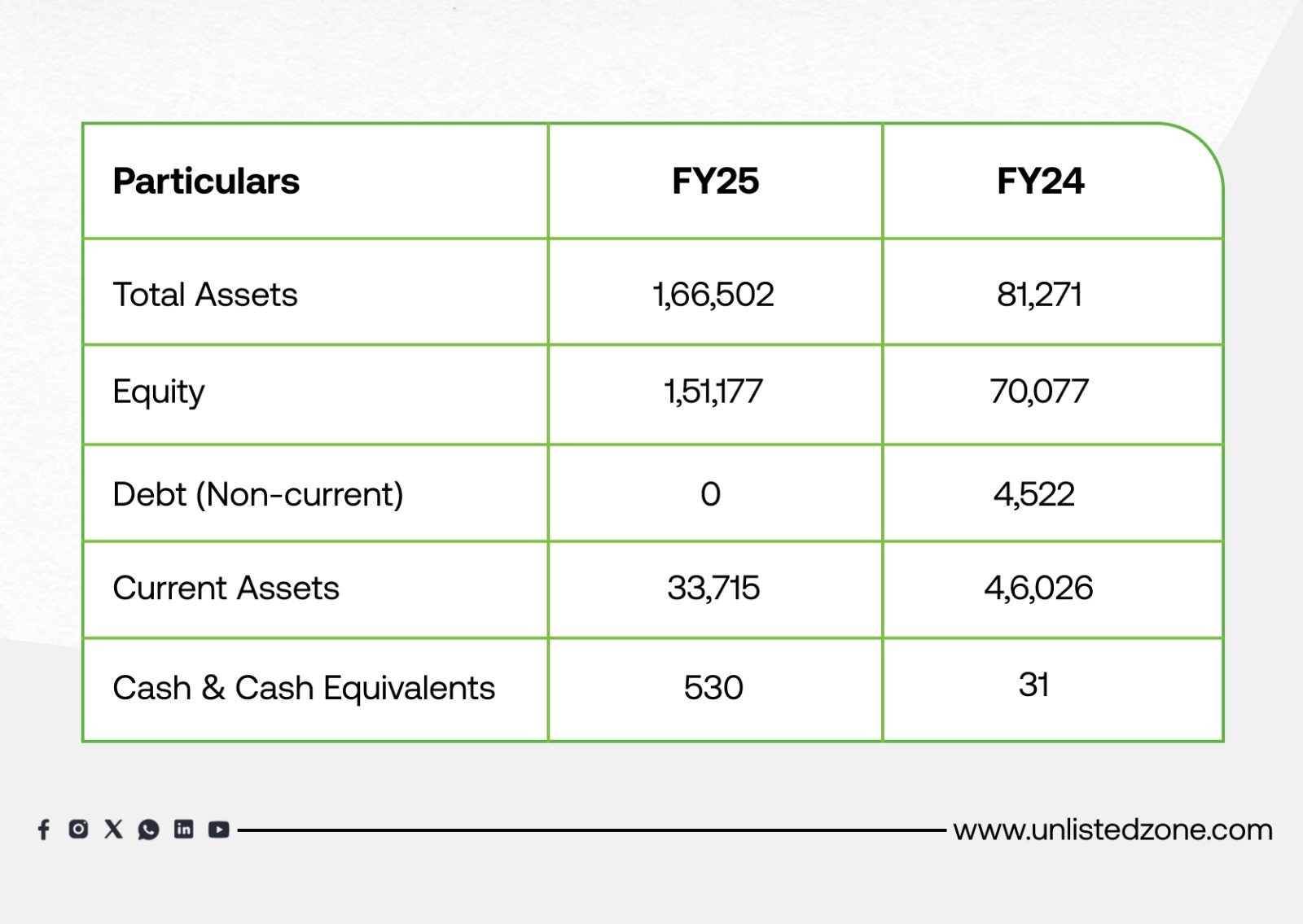

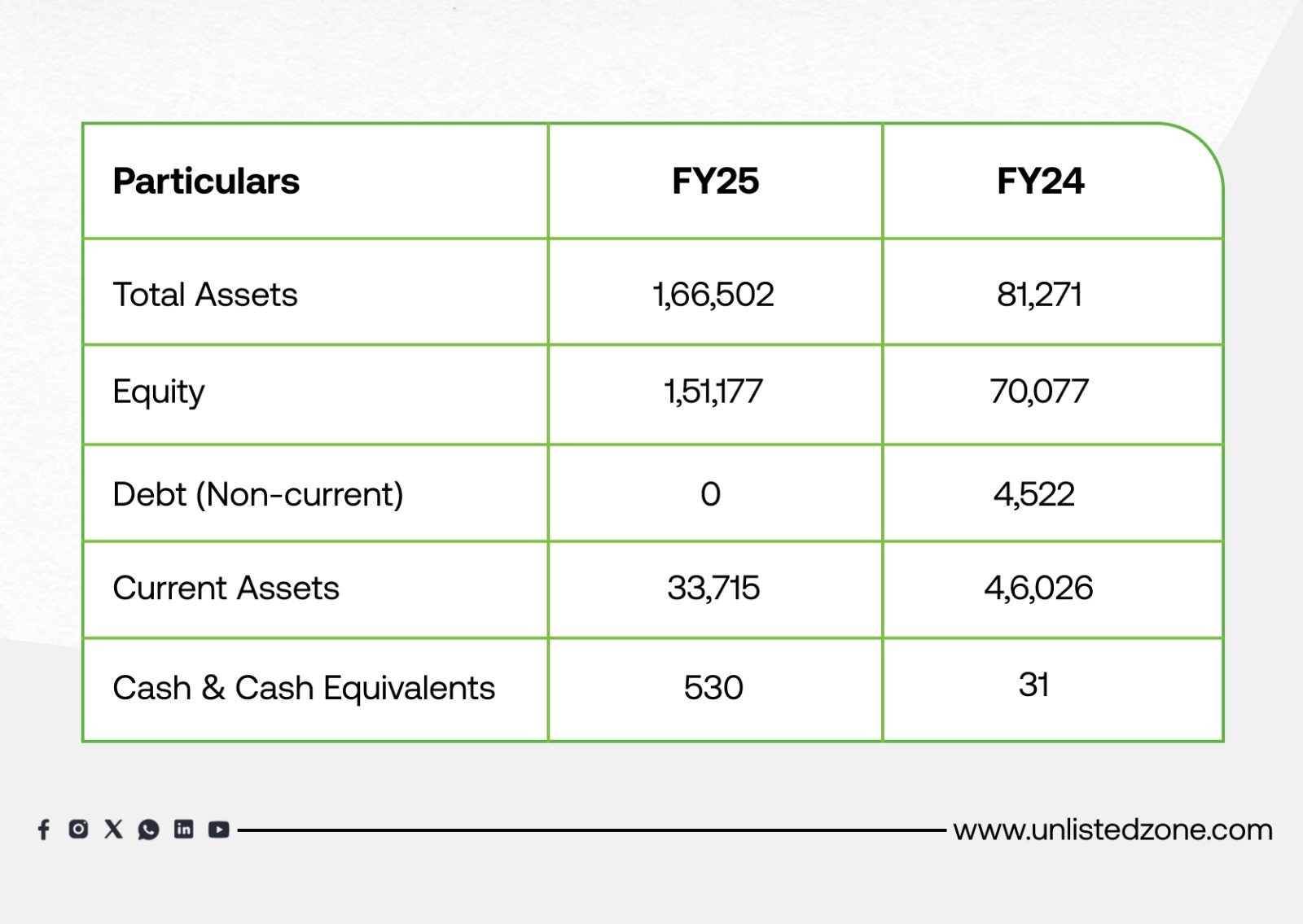

Balance Sheet Strength (in ₹ Lakhs)

The company’s asset base more than doubled due to massive ongoing projects under capital work-in-progress. Importantly, the company has eliminated all long-term debt, replacing it with equity funding. This shift reduces financial risk and interest burden. Current assets, especially inventories and receivables, shot up due to scaling operations. The cash balance improved 17x, showcasing strong liquidity from fundraising. Overall, the balance sheet reflects a growth-stage company aggressively expanding without over-leverage.

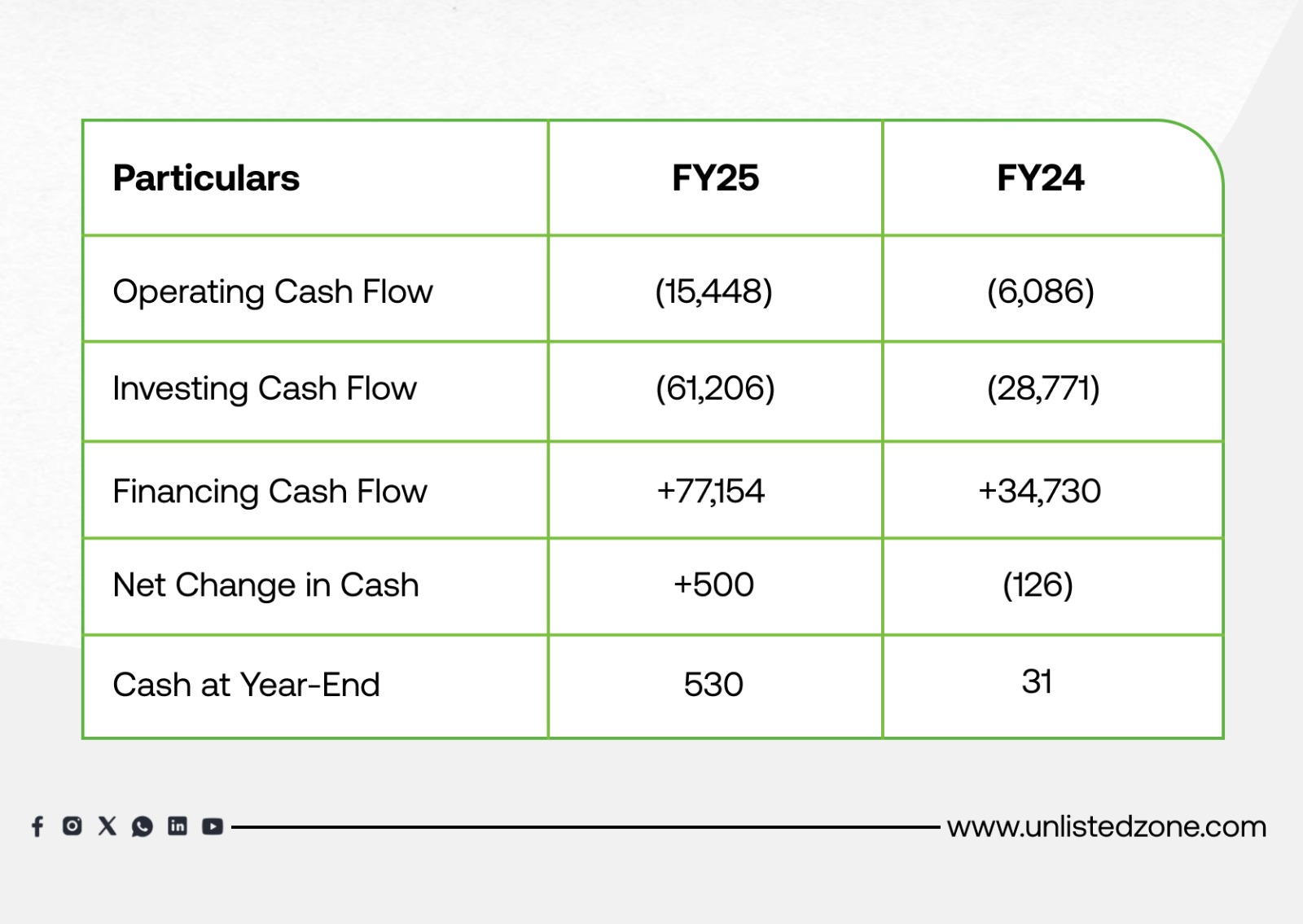

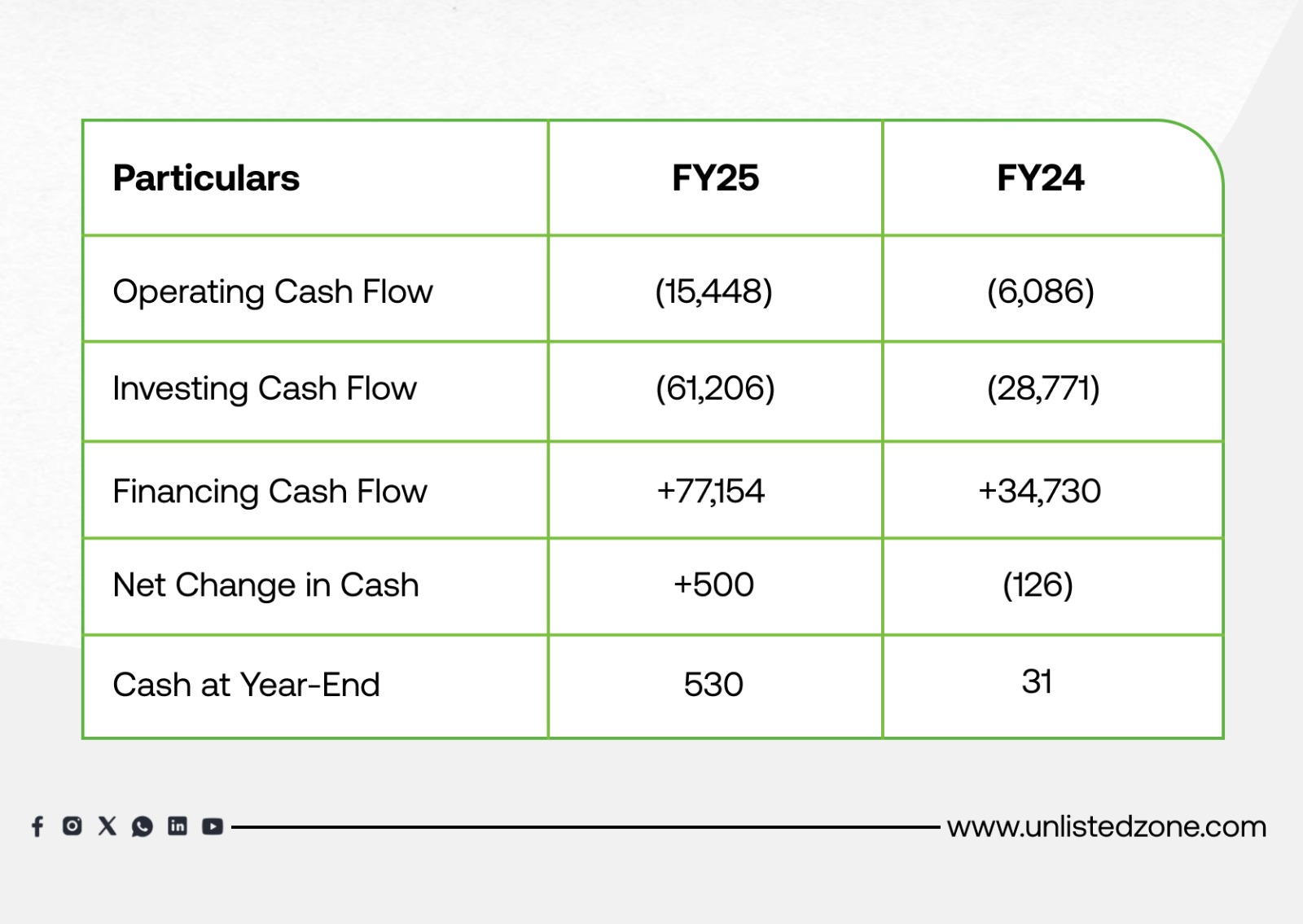

Cash Flow Analysis (in ₹ Lakhs)

The core operations are still cash negative (₹15,448 Lakhs burn), a reflection of the scale-up phase where costs precede revenues. The biggest outflow is Capex (₹44,383 Lakhs), which matches the balance sheet’s surge in assets. Interestingly, the company is also actively managing short-term investments, with large buy-sell transactions reflecting treasury discipline. On the funding side, GFCL EV Products raised ₹83,793 Lakhs through equity shares and warrants. Thanks to this fundraising, despite massive outflows, the company ended FY25 with higher cash reserves than FY24. This underscores investor confidence in its growth journey.

Segment/Division-Wise Analysis

-

Product Contribution: Revenue came almost entirely from Battery Chemicals (Lithium Hexafluorophosphate, PVDF binders, etc.), confirming this as the company’s first monetized segment.

-

Geography Contribution (FY25):

-

India: ₹925.21 Lakhs (dominant market).

-

USA: ₹7.93 Lakhs (first exports).

-

Europe: ₹10.71 Lakhs (initial traction).

-

Rest of World: ₹0.45 Lakhs (decline from FY24).

The company’s revenue is still India-dominated (~98%), but the entry into USA and Europe marks the beginning of its global footprint. This validates its strategy of becoming a global supplier while securing early Indian EV ecosystem clients.

Management Discussion & Analysis (MD&A)

-

Director Appointment: Ms. Vanita Bhargava (DIN: 07156852) was appointed as an Independent Director for a 5-year term from November 1, 2024, to October 31, 2029.

-

Retirement by Rotation: Mr. Sanjay Bhan is liable to retire and is eligible for re-appointment at the upcoming AGM.

-

Key Managerial Personnel (KMP) as of March 31, 2025:

-

Mr. Vivek Jain - Managing Director

-

Mr. Manoj Agrawal - Chief Financial Officer

-

Mr. Bhavin Desai - Company Secretary

-

Outlook: Strong demand visibility in EV and ESS markets, supported by India’s push for clean mobility.

-

Risks: Heavy reliance on equity fundraising, continued losses, and execution risks in scaling capex.

-

Strategy: Secure long-term supply contracts, expand in global markets, and focus on cost efficiency via backward integration.

Outlook for FY2025-26

-

Focus: Poised for commercial ramp-up with customer approvals in place.

-

Competitive Edge: First-mover advantage outside China and ability to serve both EV and ESS sectors.

-

Key Markets: Priority on the US and India, followed by Europe.

-

Market Trends: Expects domestic Indian demand to accelerate due to renewable energy policies. Global trade tensions are seen as an opportunity to position itself as a trusted, compliant alternative.

Financial & Corporate Governance

-

Dividend: No dividend was recommended for the financial year.

-

Unclaimed Dividend: No transfer to the Investor Education and Protection Fund was required.

-

Reserves: No amount was transferred to the General Reserve.

Shareholding Pattern

-

Promoter Holding: 100% (Gujarat Fluorochemicals Limited).

-

No external FIIs/DIIs/PE yet, as it remains a wholly-owned subsidiary.

Future Outlook

-

Growth Opportunities: Rapid EV adoption in India, USA, and EU; localization of battery supply chains; potential government incentives.

-

Headwinds: High upfront cash burn, global competition, and technological shifts in battery chemistry.

UnlistedZone View

GFCL EV Products Limited is in a classic startup-like growth phase: rapid revenue growth, heavy cash burn, equity-funded expansion, and large-scale capex.

✅ Positives: Strong parent support (GFL), equity-funded expansion (no long-term debt), first signs of revenue scale-up, global customer focus.

⚠️ Risks: Persistent losses, high dependence on fundraising, execution delays in capacity ramp-up.

Our View:

For Information Visits : UnlistedZone

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.