A) About the Company

Brief History & Overview: Founded in 2001, Transline Technologies Ltd. has evolved into a prominent technology services firm. It specializes in end-to-end solutions across electronics manufacturing (ESDM) and IT, with a strong focus on security, surveillance, and biometric identification systems.

Business Model: The company operates through two primary segments:

-

-

Solutions (80% of sales): This is their "making stuff" division. Design, manufacturing, and integration of electronics systems for automotive, industrial, and telecom sectors. This includes surveillance (IP cameras, scanners) and biometric systems (fingerprint, iris, face recognition).

-

Services (20% of sales): This is their "support and software" division. Provides IT infrastructure, cloud computing solutions, digitization, Annual Maintenance Contracts (AMC), and custom software for HR management and transport ERP.

Industry Positioning: A niche player in the high-growth Electronic System Design & Manufacturing (ESDM) and security solutions space in India, leveraging technologies like IoT and cloud computing.

B) Key Highlights of the Year Transline Unlisted Shares

-

Explosive Financial Growth: Achieved a remarkable 64.3% year-on-year revenue growth.

-

Equity Fundraising: Raised significant capital through three private placement rounds, issuing 1,724,624 equity shares at ₹270 per share.

-

Capital Restructuring: Executed a 5-for-1 stock split, sub-dividing shares of ₹10 face value into ₹2 to enhance liquidity.

-

Board Strengthening: Appointed four new Independent Directors to bolster corporate governance.

-

DRHP Filing: Took a concrete step towards an IPO by filing a Draft Red Herring Prospectus (DRHP) with SEBI for an Offer for Sale (OFS) on August 7, 2025.

-

Strategic Subsidiary Experiment: Briefly acquired and subsequently divested a stake in Computer Knowledge Corporation Private Limited.

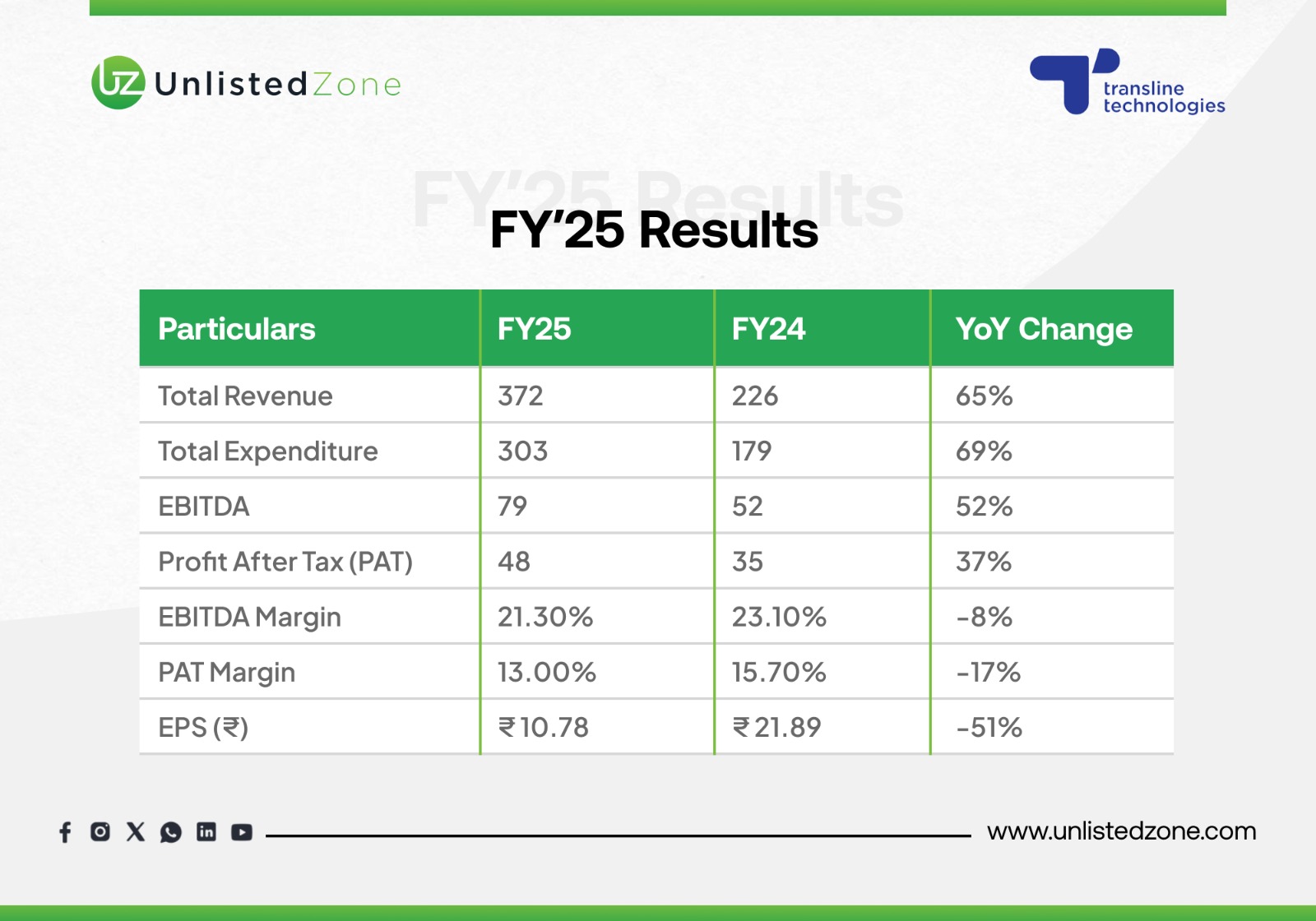

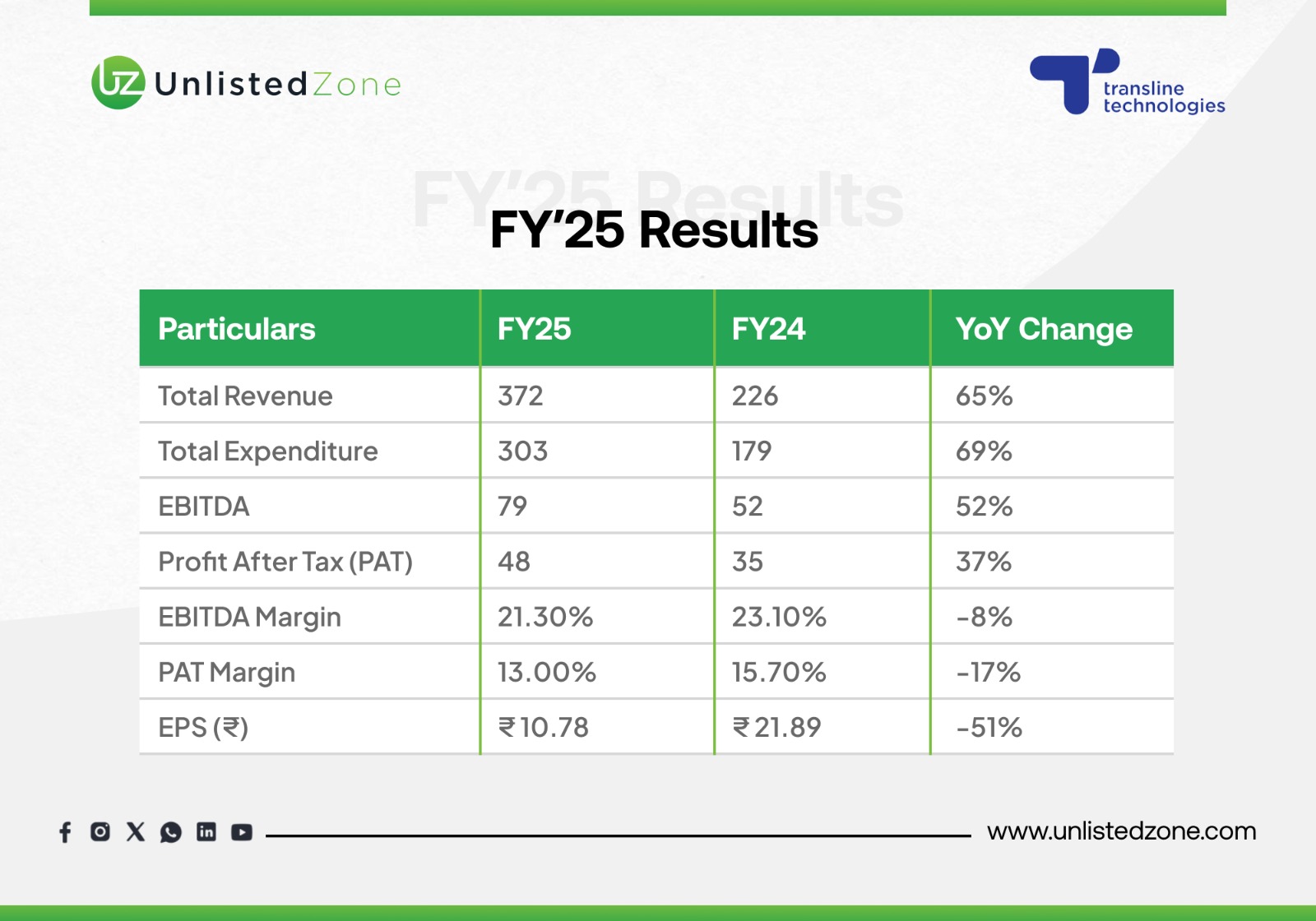

C) Financial Performance of Transline Unlisted Shares

(Values in ₹ Cr)

*Note: EPS calculation post stock-split. FY24 EPS restated for comparison: PAT / (No. of Shares post-split).*

-

Massive Sales Growth: Revenue jumped by 64%. This is the biggest story, showing their products and services are in high demand.

-

Profit Growth: Despite spending more, profit still grew well (36%).

-

Raised Money & Split Shares:

-

The company created new shares to raise money from investors for future growth.

-

They split their shares (1 old share became 5 new ones), a common step before an IPO.

D) Cash Flow Analysis of Transline Unlisted Shares

-

Operating Cash Flow (CFO): Negative (₹ -8.1 Cr), primarily due to a significant increase in working capital requirements (₹ -14.4 Cr change) to fuel growth, evident in the rise in trade receivables and inventory.

-

Investing Cash Flow (CFI): Negative (₹ -0.5 Cr), due to the purchase of Property, Plant & Equipment (PPE).

-

Financing Cash Flow (CFF): Positive (₹ 8.4 Cr), driven by proceeds from borrowings (₹ 4.5 Cr) and equity issuance (₹ 4.6 Cr). The company relied on external financing to fund its growth and working capital needs.

E) Balance Sheet Strength of Transline Unlisted Shares

(Values in ₹ Crore)

Key Takeaways from the Balance Sheet:

-

Massive Growth: The company's total size (assets) grew by over 80% in one year. This is very aggressive expansion.

-

Cash Used for Growth: The large increases in Inventory (+233%) and Other Assets (+260%) show that a lot of cash was spent to prepare for future sales. This explains why the company had negative cash flow from operations.

-

How was it funded? This growth was paid for by:

-

Taking on more debt (Borrowings up 110%).

-

Raising money from new investors (Share Capital increased).

-

Using profit from the year (added to Reserves).

-

Delaying payments to suppliers (Trade Payables up 51%).

-

Still Healthy: Despite the increased debt, the Debt-to-Equity Ratio (0.48) is still at a comfortable and manageable level. The company is not over-leveraged.

Key Ratios:

-

Debt-Equity Ratio: 0.48 (Mar'25) vs. 0.49 (Mar'24). Debt increased but was matched by a larger rise in equity, keeping leverage stable.

-

Current Ratio: 1.80 times, indicating a comfortable short-term liquidity position.

-

Return on Equity (RoE): 36.86% (down from 62.36% in FY24), still exceptional but normalized due to a larger equity base.

-

Return on Capital Employed (RoCE): 53.37% (down from 76.62%), indicating highly efficient use of capital despite the decrease.

F) Segment-Wise Analysis of Transline Unlisted Shares

(Values in Crore)

Breaks down OF the total sales into the company's two main business areas.

-

Solutions (₹298 Cr, 80% of Revenue):

-

This is the products division (e.g., making biometric devices, scanners).

-

It is the main engine of growth, seeing the fastest sales increase.

-

Services (₹73 Cr, 20% of Revenue):

-

This is the software and support division (e.g., IT maintenance, cloud services).

-

While smaller, this segment is often more profitable over time as it creates recurring revenue.

G) Management Discussion & Analysis (MD&A) on Transline Unlisted Shares

-

Market Outlook: Management is highly optimistic, focusing on growth in revenue, strategic marketing, and brand building in the expanding ESDM and digital solutions market.

-

Risks and Challenges: Key challenges include managing rapid growth, working capital requirements, and rising finance costs.

-

Strategic Roadmap: The strategy involves:

-

Aggressive expansion funded through equity.

-

Strengthening governance for a public listing.

-

Preparing for an IPO to provide liquidity and unlock value.

-

Conserving cash (no dividend) to fund future operations.

H) Shareholding Pattern of Transline Unlisted Shares

I). Valuation Insights (Unlisted Market) of Transline Unlisted Shares

Current Share Price: ₹165 per equity share.

Market Capitalization: ₹1,460 Crores.

Valuation Multiples:

P/E Ratio: 30.39x .

P/B Ratio: 7.73x

Debt to Equity: 0.48.

Return on Equity (ROE): 26.83%.

Book Value: ₹21.35 per share.

J) Future Outlook of Transline Unlisted Shares

-

Growth Opportunities: The company is perfectly positioned to benefit from the Indian government's PLI schemes for electronics manufacturing and the increasing demand for security and digital solutions.

-

Management Guidance: Implicit guidance is extremely positive, evidenced by the DRHP filing and massive revenue growth targets.

-

Industry Tailwinds: "China Plus One," digital India initiatives, and increased tech adoption are major tailwinds.

-

Headwinds: Intense competition, supply chain disruptions, and the ability to manage working capital efficiently amidst growth are key headwinds.

K) UnlistedZone View

-

Investment Thesis: Transline presents a compelling story of a high-growth, profitable company in a sunrise sector. Its capital-raising strategy, preparation for an IPO, and exceptional RoCE make it an attractive pre-IPO investment opportunity for investors seeking to get in before the public listing.

-

Risks:

-

Pre-IPO Risk: The IPO is not guaranteed and is subject to SEBI and market conditions.

-

Liquidity Risk: Unlisted shares are inherently illiquid.

-

Execution Risk: The ability to sustain this hyper-growth rate is critical and challenging.

-

Valuation Risk: At a P/E of 30.39x, much of the near-term growth may already be priced in.

Conclusion

Transline Technologies shows strong growth with a 64% revenue surge and robust profitability. Its high valuation reflects IPO expectations. While the balance sheet is healthy, negative cash flow from rapid expansion is a key watchpoint. A compelling yet high-risk pre-IPO opportunity for sophisticated investors.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations.