1. Company Overview

Established in 1958, TRL Krosaki has grown from a single-product, single-location company to India’s leading refractories manufacturer, with pan-India manufacturing and service facilities. Backed by Krosaki Harima Corporation (Japan) – a global technology leader in refractories – TRL Krosaki offers world-class products and solutions across multiple industries.

Capacity:

-

Manufacturing capacity of 4 lakh MT per annum at Belpahar (one of the most modern refractory facilities globally).

-

Full-spectrum refractory production under one roof.

-

Continuous modernization ensures advanced, efficient, and sustainable production.

2. Product Portfolio

A. Core Refractory Products

-

Silica Refractories – Widely used in iron & steel plants.

-

High Alumina Refractories – Essential in cement and nonferrous industries.

-

Basic Refractories – Crucial for steel converters, ladles, and blast furnaces.

-

Dolomite Products – Widely applied in steelmaking, especially converters.

B. Specialty Products

-

Flow Control Products (Slide Gates, Nozzles, Stoppers) – Control molten metal flow in steel ladles.

-

AG Refractories – High-performance niche products used in advanced steelmaking.

-

Taphole Clay Refractories – Used in blast furnaces to control hot metal flow.

-

Monolithic Refractories, PCPF, RH Snorkel – Support steelmaking efficiency, reduce CO₂ emissions, and improve process reliability.

3. Industry Applications

TRL Krosaki serves multiple core industries:

-

Iron & Steel Industry – Primary end-user (blast furnaces, converters, ladles, flow control).

-

Cement Industry – High alumina refractories for rotary kilns and lining.

-

Non-Ferrous Metals – Copper, aluminum, and zinc smelting.

-

Glass Industry – Silica refractories for glass furnaces.

-

Other Heavy Industries – Power, petrochemicals, etc.

4. Technological Edge & Achievements

These achievements underscore durability, efficiency, and customer trust in TRL Krosaki’s products.

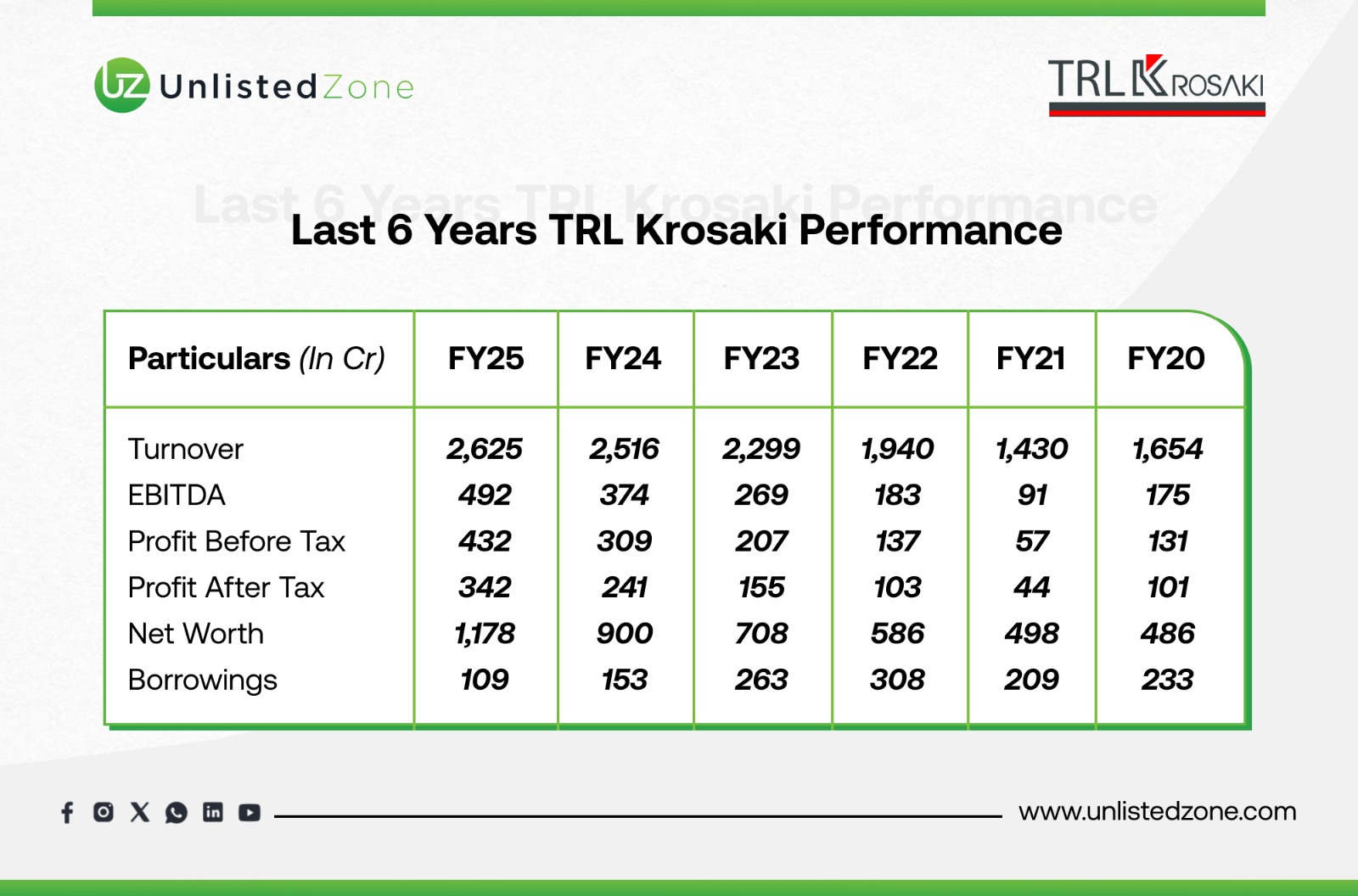

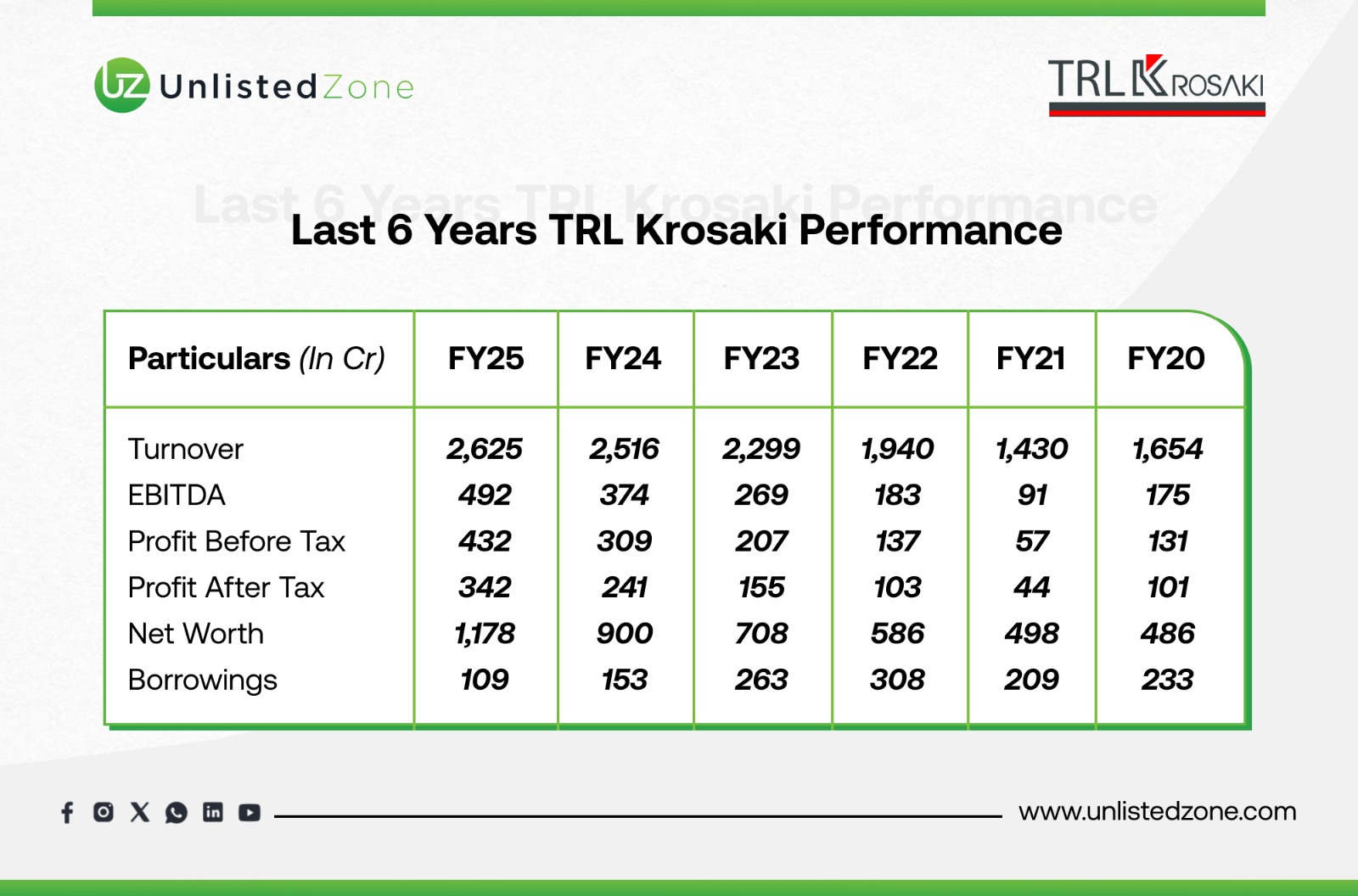

5. Last 6 Years TRL Krosaki Performance (₹ in Crores)

Key Highlights FY25:

-

Turnover: ₹2,624.6 Cr (+4.3% YoY).

-

PAT: ₹342.2 Cr (+41.9% YoY).

-

Net Worth: ₹1,178 Cr.

-

Debt: Reduced significantly to ₹108.8 Cr (vs ₹263 Cr in FY23).

-

Dividend: 330% (₹33/share).

6. Valuation

-

Market Cap: ~₹4,000 Cr.

-

PAT (FY25): ₹342.2 Cr.

-

P/E Multiple: ~12x.

At 12x P/E, TRL Krosaki trades at a reasonable valuation compared to peers in the industrials/materials segment, especially considering:

-

Leadership in refractories.

-

Strong client base (JSW, Tata Steel, global majors).

-

High dividend payout history.

7. Investment Thesis

Bull Case:

-

India’s steel output is projected to grow strongly (targeting 300 MT by 2030).

-

Cement & nonferrous capacity expansions will increase refractory demand.

-

TRL Krosaki’s global technology tie-up (Krosaki Harima) ensures product leadership.

-

Healthy balance sheet, improving return ratios, and strong dividend history.

Risks:

-

Heavy reliance on iron & steel industry (~70% demand).

-

Raw material price volatility (bauxite, magnesite, etc.).

-

Global competition from RHI Magnesita, Vesuvius, etc.

8. Conclusion

TRL Krosaki is India’s leading refractories company, supplying to core industries like steel, cement, nonferrous metals, and glass. Its specialty products (Flow Control, RH Snorkel, Monolithics, Taphole Clay) provide technological superiority and customer stickiness.

With ₹2,624 Cr revenue, ₹342 Cr PAT, and a dividend of ₹33/share in FY25, the company has shown strong financial performance. At a market cap of ₹4,000 Cr (P/E ~12x), valuations remain attractive given industry growth, strong dividend payout, and leadership positioning.

UnlistedZone View: TRL Krosaki represents a steady compounder play on India’s steel and cement growth story, with robust fundamentals, global technology backing, and improving return metrics.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.