About Maharashtra Knowledge Corporation Limited (MKCL)

Established in 2001, Maharashtra Knowledge Corporation Limited (MKCL) is a pioneering public-private partnership (PPP) initiative led by the Government of Maharashtra. Its core mission is to foster a knowledge-driven society by delivering accessible IT literacy, digital skills training, eLearning solutions, and eGovernance services. MKCL expands its reach through joint ventures with other Indian state governments and international subsidiaries, while its courses are distributed via a widespread network of Authorized Learning Centers (ALCs).

A) Business Model & Operations

MKCL operates primarily in the digital education and governance space, with a focus on affordability and scalability. Key aspects include:

-

Flagship Programs:

➤ MS-CIT (Maharashtra State Certificate in Information Technology): A widely recognised IT literacy course.

➤ KLiC (Krishi and Lokavidya Certification): Vocational skill development programs.

-

Service Diversification:

➤ eGovernance solutions for government bodies.

➤ Digital transformation projects for educational institutions.

-

Revenue Streams:

➤ Course fees from learners.

➤ Project-based revenue from government/digital initiatives.

B) Industry Positioning & Impact

MKCL is a cornerstone of Maharashtra’s digital literacy movement, having trained millions of learners across the state. Its government-backed foundation, extensive network of learning centers, and focus on affordable education have solidified its role as a key player in India’s ed-tech and governance landscape. The company continues to leverage its partnerships and technological capabilities to drive sustainable social impact and expansion.

C) MKCL Unlisted Share Key Highlights of the Year (FY 2024-25)

-

Revenue Growth: Revenue from operations grew to ₹27,605.83 Lakhs, marking a +17.71% YoY increase.

-

EBITDA Growth: EBITDA stood at ₹9,209.13 Lakhs, reflecting +5.47% YoY growth.

-

Learner Base Expansion: MS-CIT attracted 7,98,647 learners, while KLiC courses added 1,11,232 learners in FY25.

-

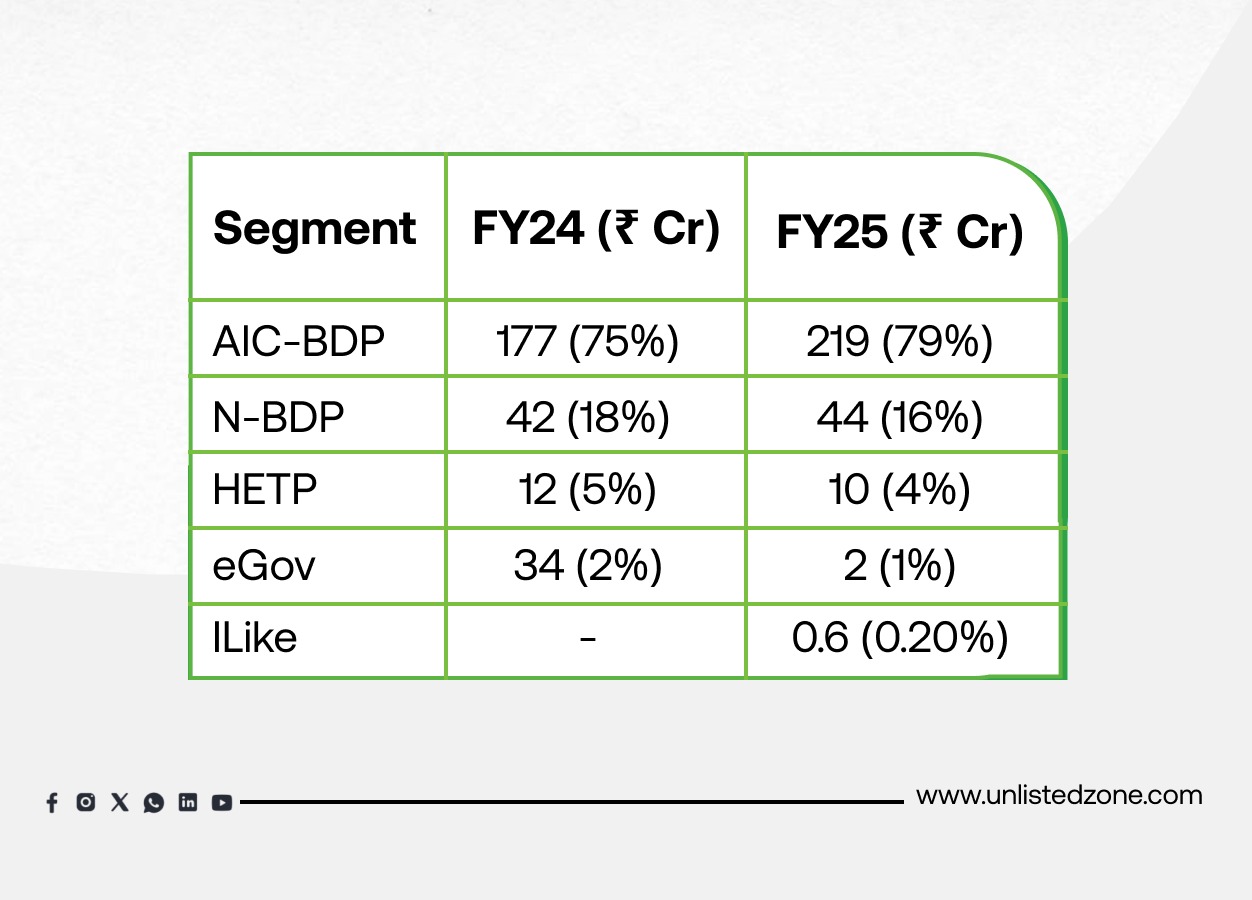

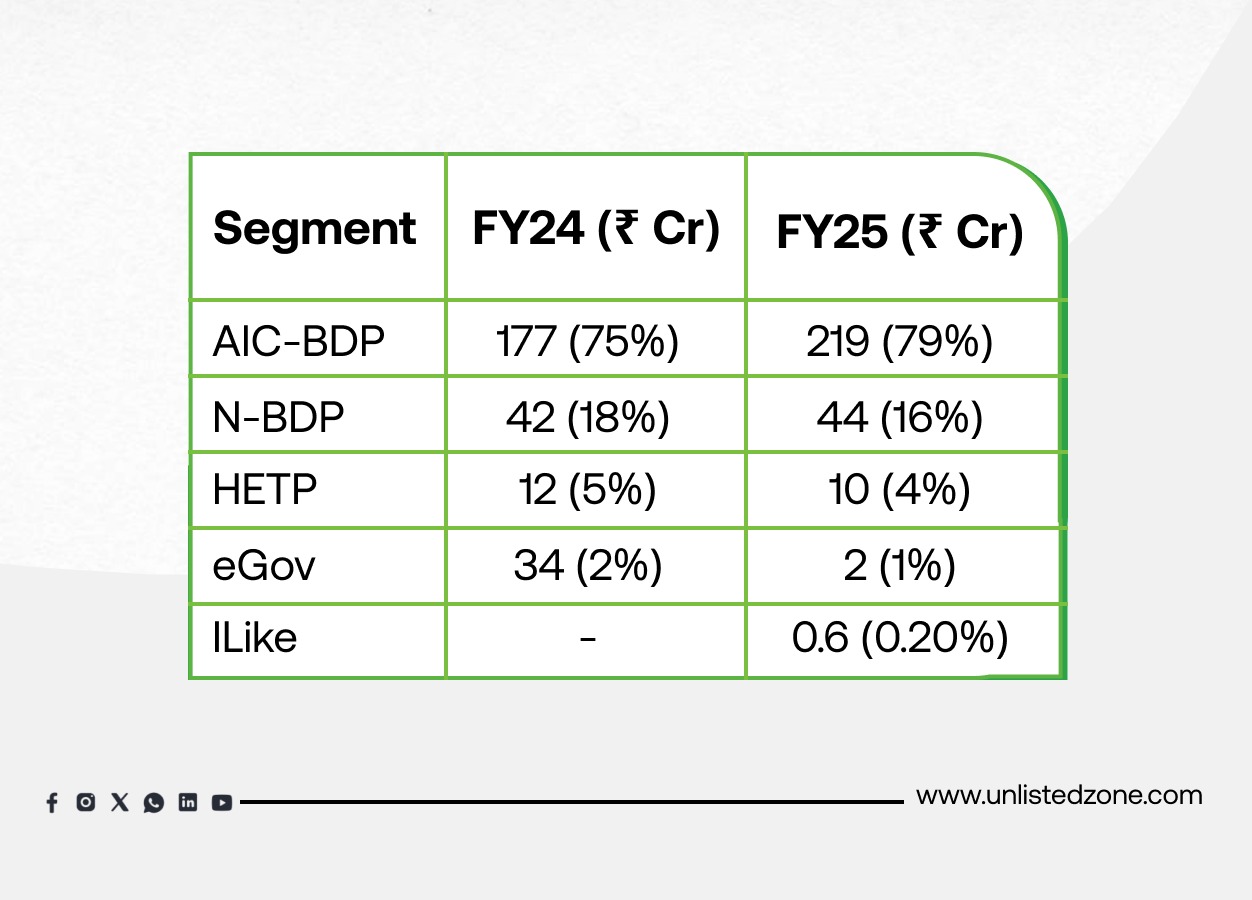

Segmental Shift: Greater contribution from AIC-BDP segment, accounting for 79% of revenues.

-

Operational Cash Flow: Gross cash generated from operations was ₹2,463.87 Lakhs.

D) Financial Performance of MKCL Unlisted Share

Revenue & Profitability

Revenue & Profitability: Mixed Results

-

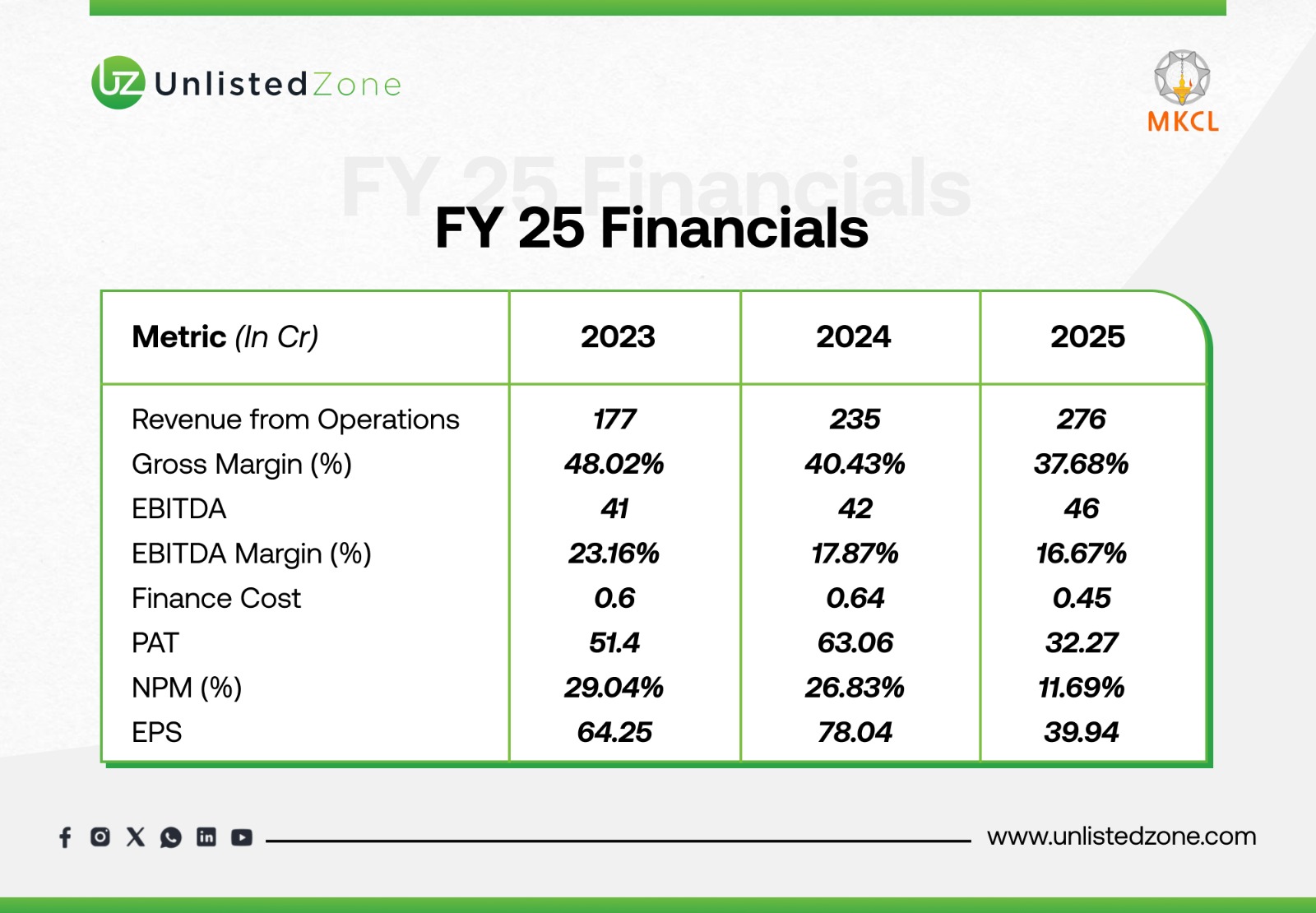

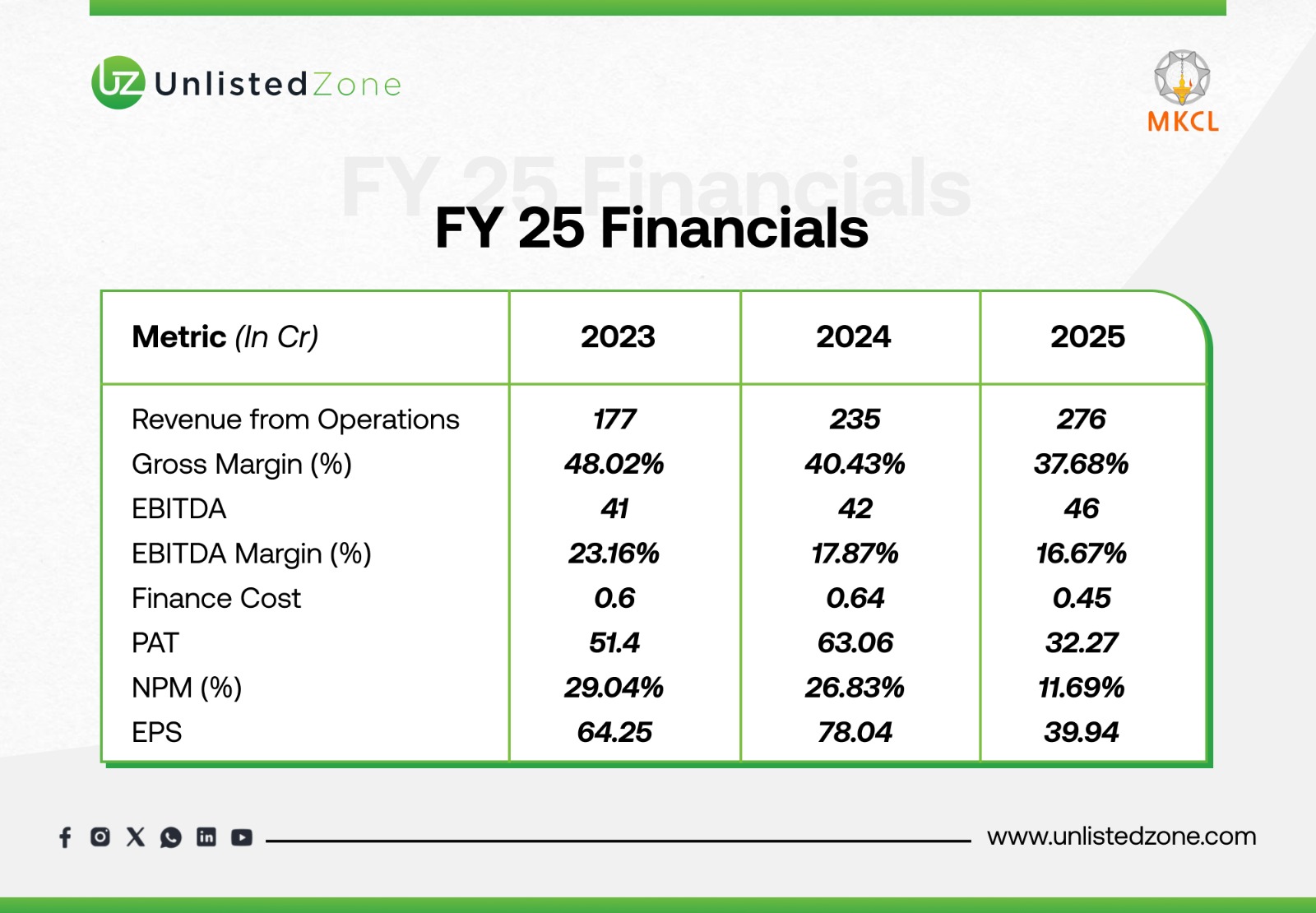

Strong Revenue Growth: Revenue from operations showed consistent improvement, rising from ₹177 Cr in FY23 to ₹276 Cr in FY25, reflecting healthy top-line expansion.

-

Declining Profitability: Despite revenue growth, margins contracted significantly:

-

Gross Margin fell from 48.02% (FY23) to 37.68% (FY25)

-

EBITDA Margin declined from 23.16% (FY23) to 16.67% (FY25)

-

Net Profit Margin (NPM) dropped sharply to 11.69% in FY25 (from 29.04% in FY23)

-

PAT Volatility: Profit After Tax (PAT) peaked in FY24 (₹63.06 Cr) but nearly halved in FY25 (₹32.27 Cr), indicating potential cost inflation, one-time expenses, or competitive pressures.

Cash Flow Analysis

Cash Flow & Liquidity: Concerns Emerge

-

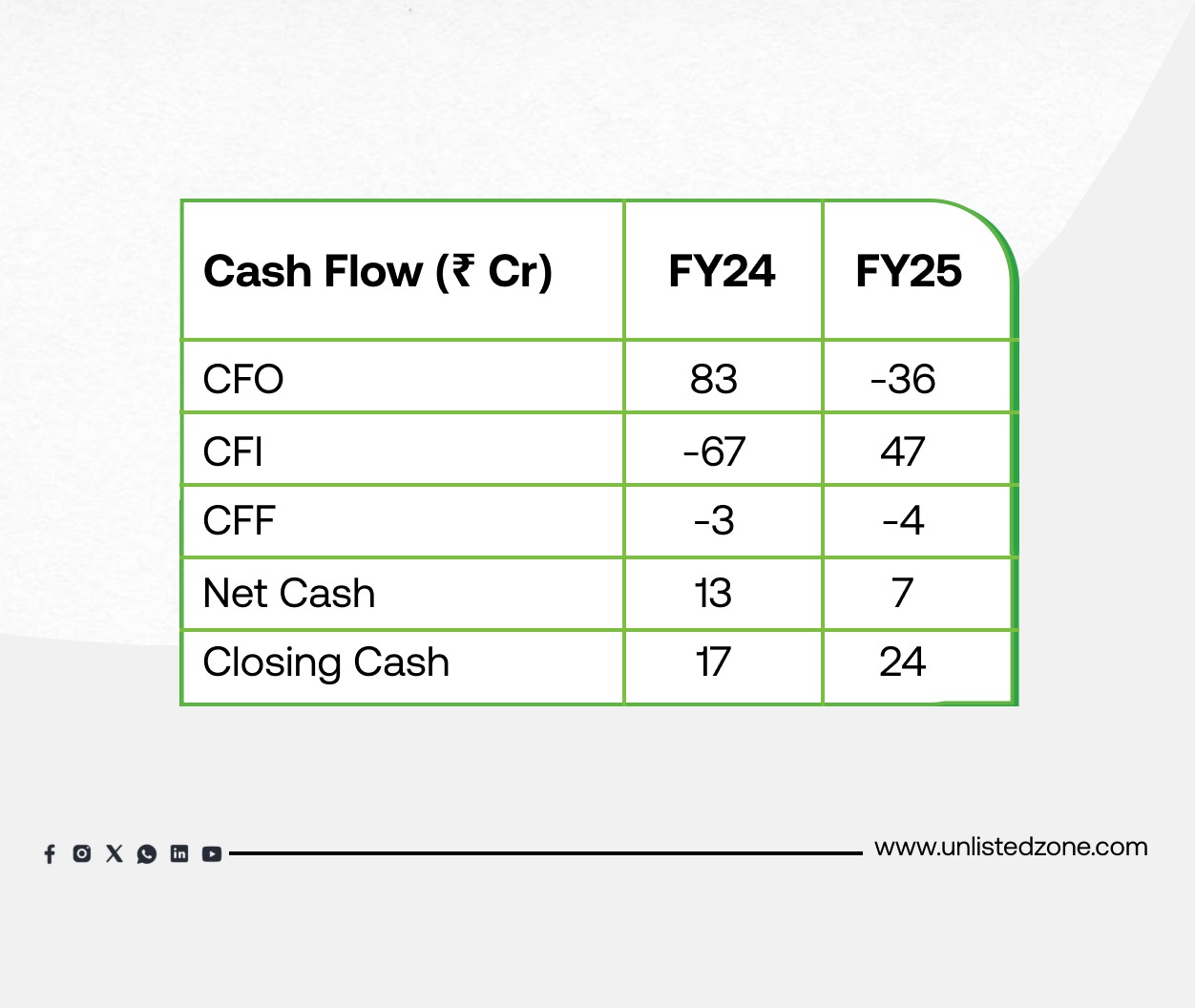

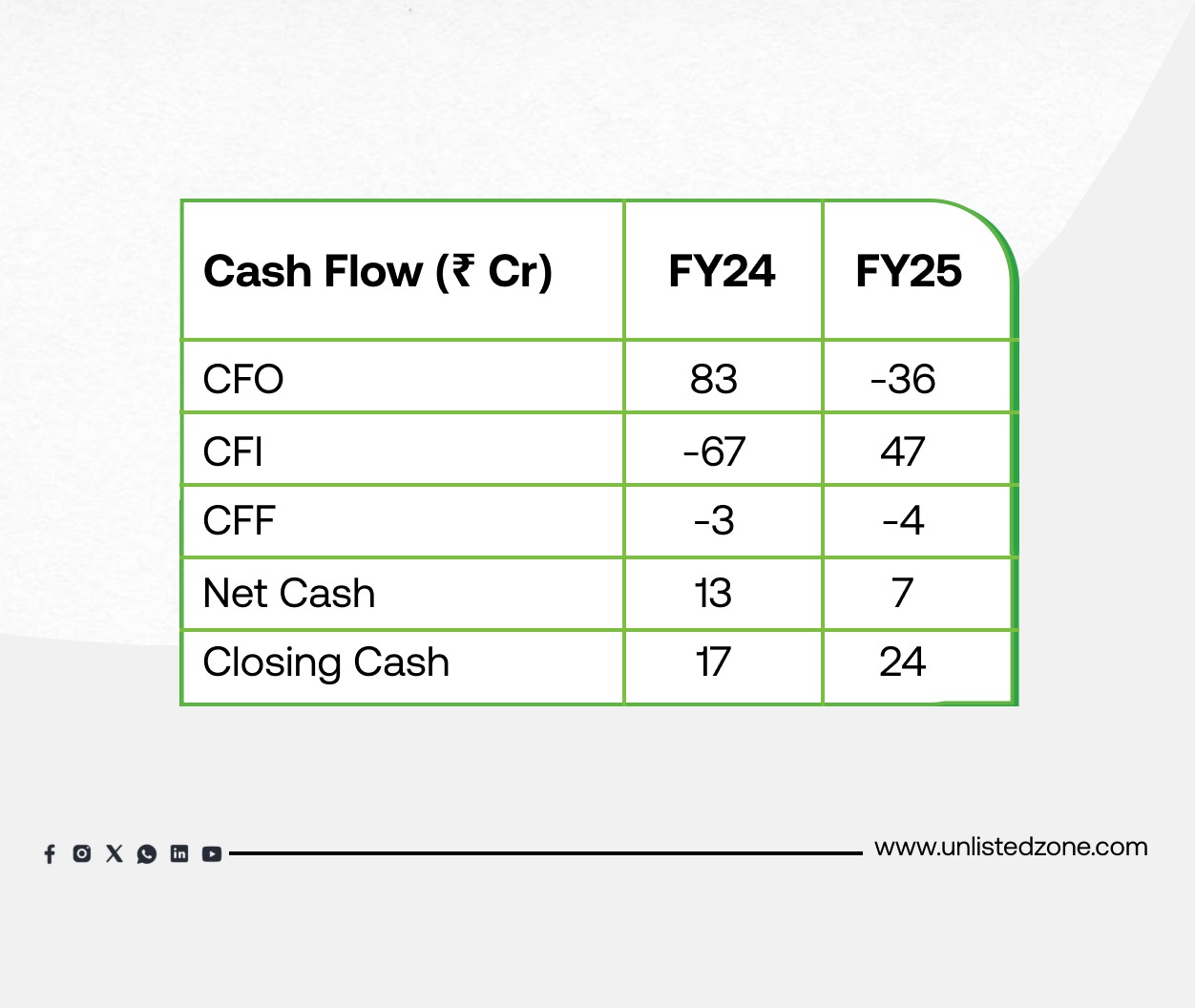

Operating Cash Flow (CFO) turned negative in FY25 (–₹36 Cr) after a strong FY24 (₹83 Cr), suggesting working capital challenges (e.g., rising receivables or inventory).

-

Investing Cash Flow (CFI) shifted from outflow (–₹67 Cr in FY24) to inflow (₹47 Cr in FY25), likely due to asset sales or divestments.

-

Closing Cash remained adequate at ₹24 Cr in FY25, but the volatility in CFO requires monitoring.

EPS & Book Value

Balance Sheet Strength

-

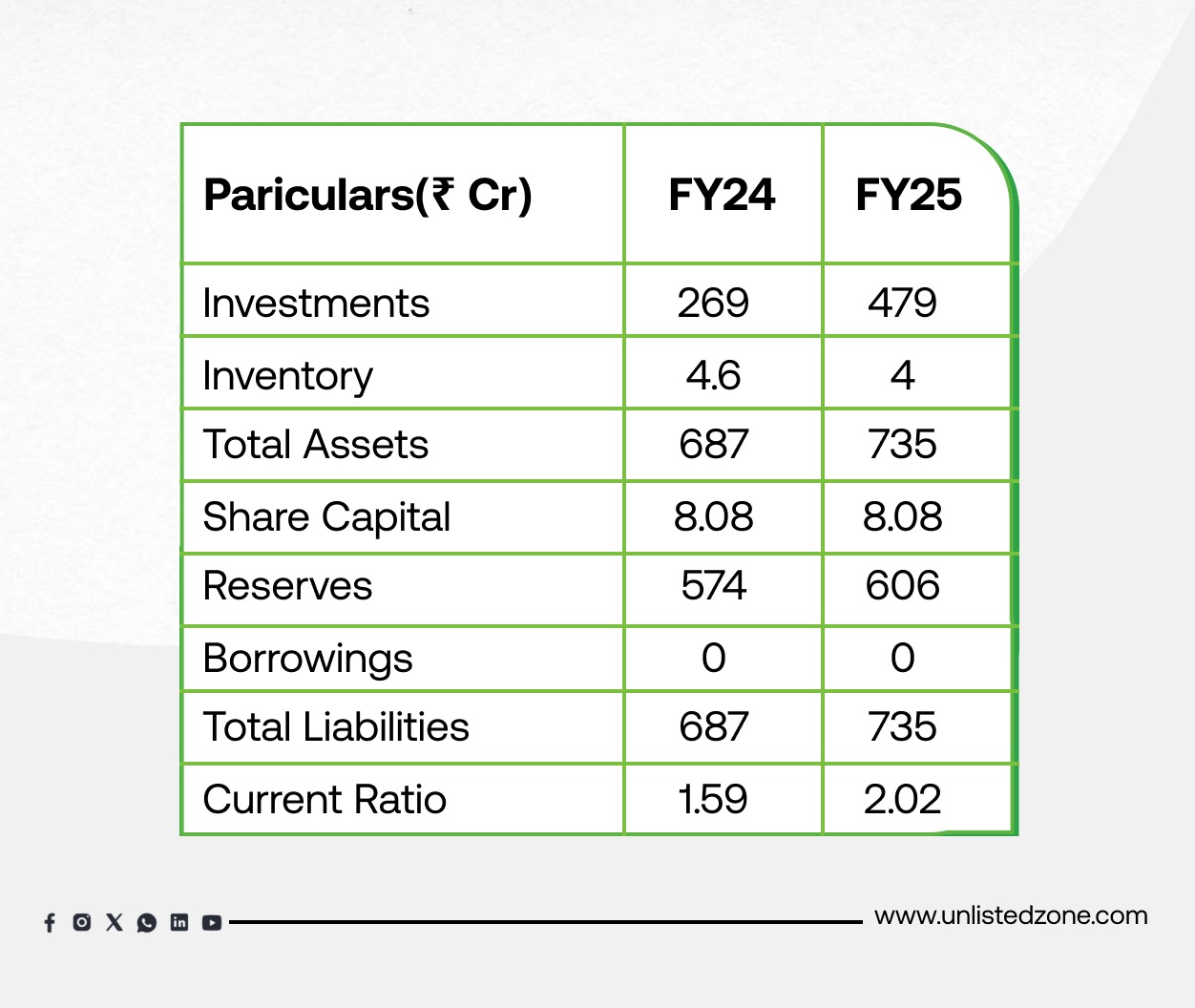

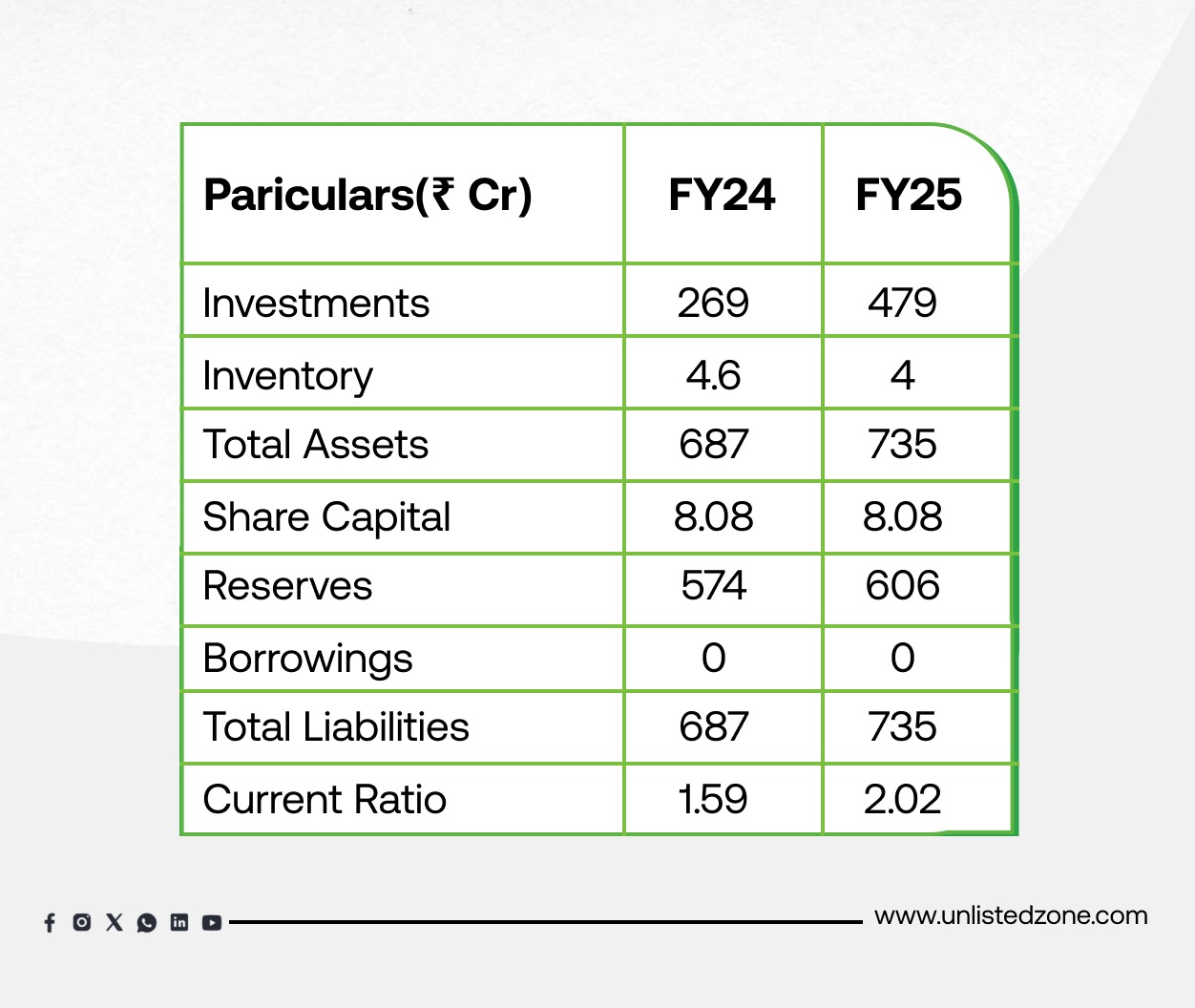

Zero Debt: The company maintains a debt-free balance sheet with strong reserves (₹606 Cr in FY25).

-

High Liquidity: Current ratio improved to 2.02 (FY25), indicating strong short-term financial health.

-

Lower ROE: Return on Equity (ROE) stood at 5.21%, which is relatively modest given the high book value (₹772.36 per share), suggesting suboptimal utilization of equity.

E) Segment-Wise Analysis of MKCL Unlisted Share

Revenue Contribution

Segment-Wise Performance: Overdependence on Core Segment

-

AIC-BDP Dominance: Contributed 75–79% of revenue, highlighting reliance on flagship programs. Growth here is driving overall revenue but may concentrate risk.

-

Other Segments Stagnant: N-BDP, HETP, and eGov saw minimal growth or decline, indicating limited diversification success.

F) Management Discussion & Analysis (MD&A)

-

Market Outlook: Growing demand for digital education and vocational skill training in India provides a strong tailwind.

-

Risks: Heavy dependence on AIC-BDP segment; declining share of eGov projects; working capital volatility.

-

Strategic Roadmap: Expansion of KLiC courses, entry into newer states, and diversification of product offerings (ILike initiative).

G) Shareholding Pattern MKCL Unlisted Share

-

State Government: 37.13%

-

Universities: 33.91%

-

Indian Residents: 22.19%

-

Others: 6.77%

H) Valuation Insights (Unlisted Market) of MKCL Unlisted Share

I) Future Outlook of MKCL Unlisted Share

-

Opportunities:

-

Increasing demand for IT literacy and vocational skills.

-

Potential to expand learner base across India.

-

New initiatives like ILike can diversify revenue streams.

-

Challenges:

-

Over-reliance on government support.

-

Declining eGov contribution.

-

Stagnant profitability growth despite revenue expansion.

UnlistedZone View

MKCL is a stable, debt-free, and cash-rich company with a strong legacy in IT education and governance solutions. However, its profit growth remains modest, and working capital fluctuations pose a risk. At a P/B of 0.58, the stock trades at a discount to its book value, making it attractive for value investors.

MKCL is a Maharashtra-based public-private partnership with significant government and university shareholding. There is no confirmation of an upcoming IPO, and such entities often remain unlisted to fulfill their social objectives rather than pursue public markets. Typically, companies with this structure do not launch an IPO.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.