Furlenco’s Second Innings: Profitability, Fresh Funding, and an IPO on the Horizon

For more than a decade, Furlenco has played in a tricky corner of the consumer economy—renting furniture to customers who don’t want to commit to ownership. The model sounded perfect for India’s urban millennial workforce: flexible, asset-light living with monthly plans instead of heavy upfront purchases.

But that dream came at a cost. The company spent years burning cash, scaling fast, and relying heavily on debt—notably during Covid—when demand stalled and capital tightened.

This week, the story took a sharp turn.

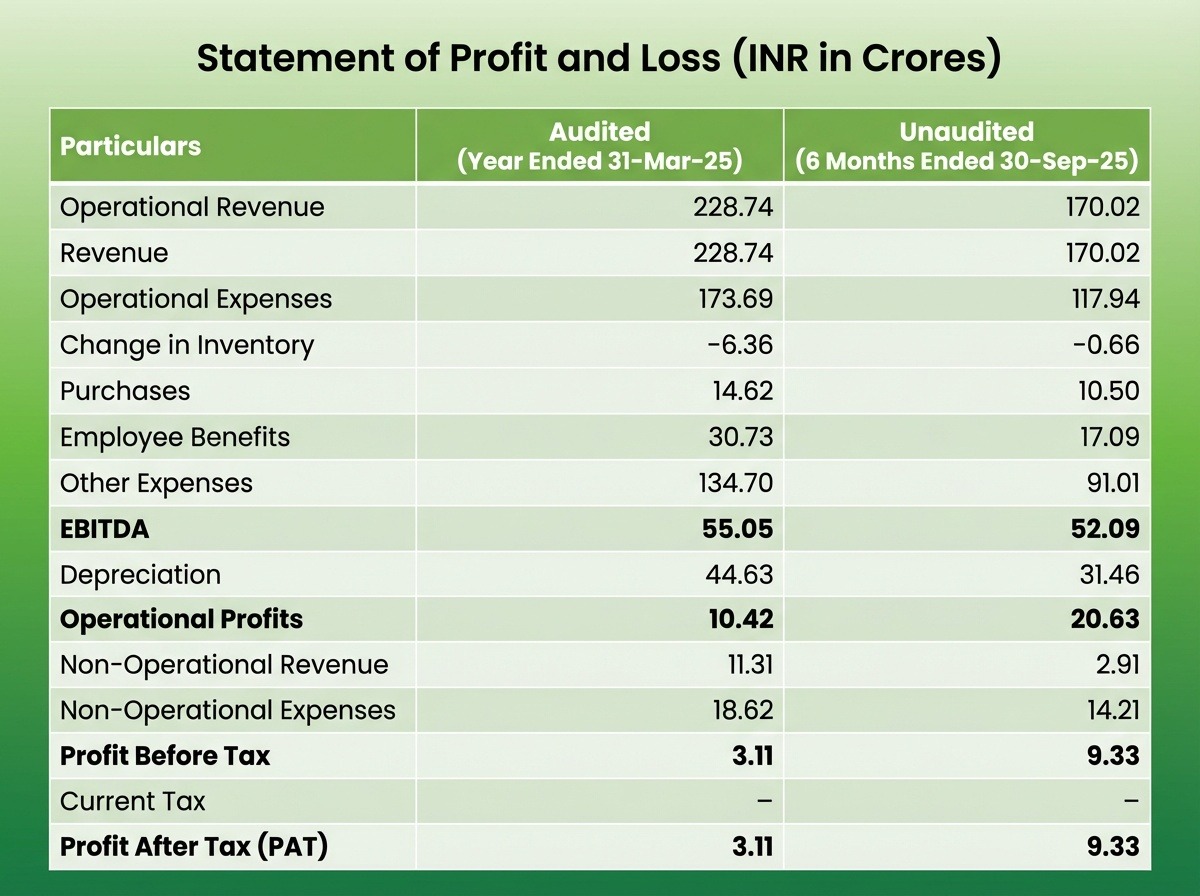

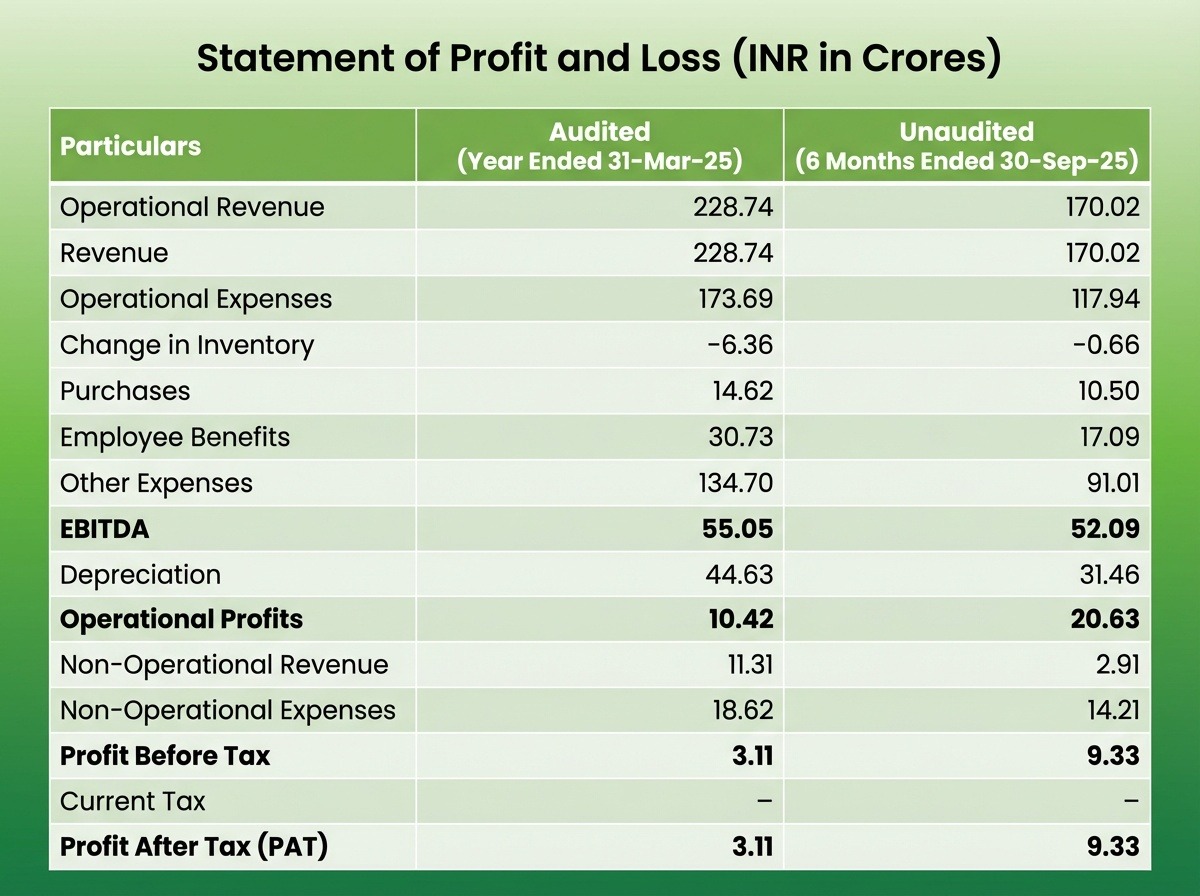

Furlenco has raised ₹90 Cr, led by its major backer Sheela Foam, with participation from Whiteoak and veteran investor Madhu Kela. More importantly, the startup posted its first-ever profit—₹3.1 Cr in FY25, versus a steep ₹130.2 Cr net loss in FY24.

Furlenco has raised funds in this latest round at a price of ₹149.03 per share, valuing the company at approximately ₹1,048 crore.

So what changed?

The Business That Took Time to Grow Up

Founded in 2012 in Bengaluru, Furlenco began as a pure-play rental platform targeting mobile professionals who preferred convenience over ownership.

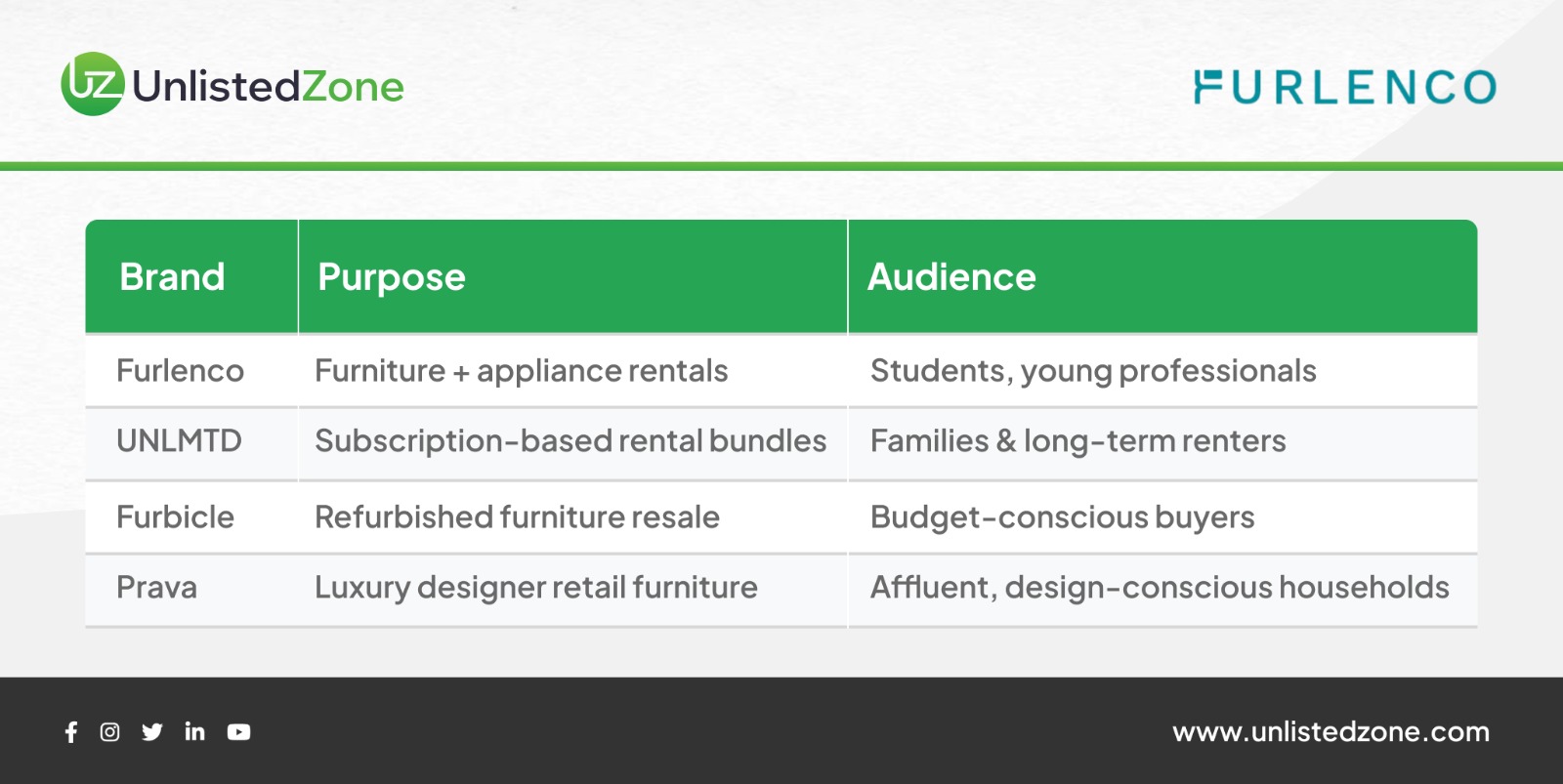

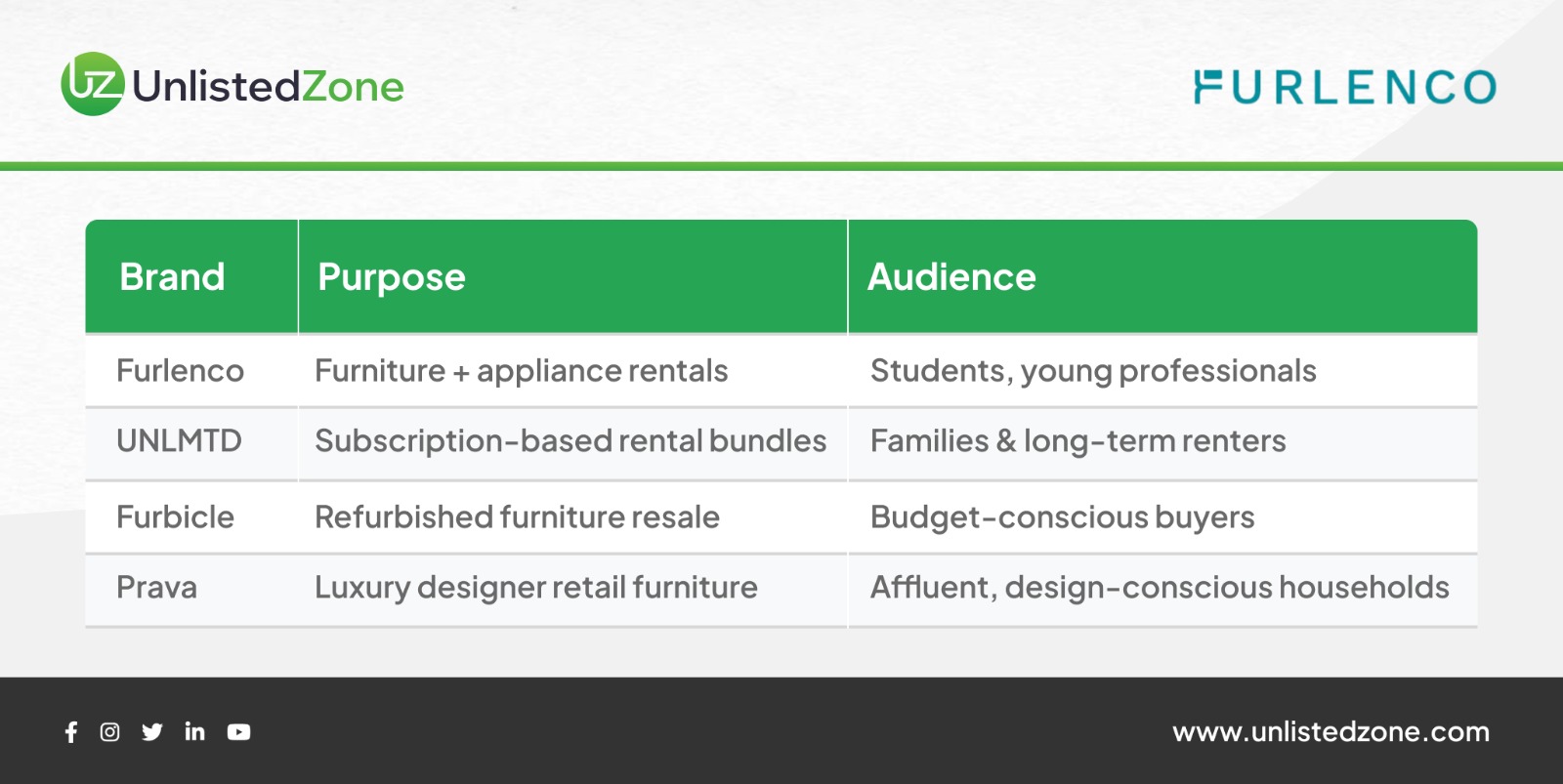

Over time, the model evolved into something broader:

The strategy was simple: own the full lifecycle of a furniture asset—rent it, refurbish it, resell it, and even buy it back.

This allowed the company to build multiple revenue streams beyond monthly rentals.

A Covid Reality Check

The pandemic was a breaking point.

Reduced mobility, high inventory ownership, and dependence on debt pushed the company to the edge. Founder Ajith Mohan Karimpana later called debt funding:

"My life’s worst decision."

The turnaround began in 2023 when Sheela Foam (owner of Sleepwell) acquired a 35% stake for ₹300 Cr, valuing House of Kieraya (HKL) at ~₹1,000 Cr.

That strategic partnership changed Furlenco’s financial discipline.

The Financial Flip

Furlenco’s numbers now tell a different story.

Two big levers drove the turnaround:

Today, Furlenco earns:

What's Next?

Furlenco is now planning:

Growth drivers include:

Competition and Moat

Furlenco operates in a space with players like Rentomojo and Rentickle, but its full-cycle asset strategy—rent → refurbish → resell → upgrade—gives it a structural efficiency advantage.

If it scales efficiently, the rental model may finally prove financially viable at national scale.

The Bottom Line

After a decade of pivots, debt, and operational complexity, Furlenco has finally cracked the economics. The latest fundraise isn’t just capital—it’s validation.

The company now believes it has a realistic runway to becoming IPO-ready within the next two years.

Whether public markets agree is a question for later.

For now, Furlenco’s comeback marks something rare in India’s startup landscape:

A business that didn’t quit—just evolved.