If you're an existing shareholder of Cheelizza Pizza India Limited, you’ve just been handed something interesting — a fresh rights issue served with a topping of expansion plans, discounted pricing, and a taste of opportunity.

Let’s decode it clearly, just like a simple pizza order: no confusion, no extra fluff.

A) What Is a Rights Issue? (Quick Refresher)

A rights issue is when a company offers existing shareholders the chance to buy more shares at a discounted price, before offering them to outsiders.

It’s the company’s way of saying:

“You believed in us early — want more shares before everyone else?”

For Cheelizza, this route raises funds without giving up too much control, keeping ownership within the current shareholder circle.

B) Cheelizza’s Journey So Far

Founded in 2013 with a single outlet in Kandivali (Mumbai), Cheelizza now operates 16 stores across Maharashtra and Gujarat. The company has scaled from:

-

Monthly revenue: ~₹30 lakh (early days)

-

Vision: 100+ stores within two years

-

Goal: Build a global Indian vegetarian food brand

With a niche position in India’s veg-only quick service restaurant (QSR) space, Cheelizza is betting on rising demand for regional tastes and vegetarian comfort food.

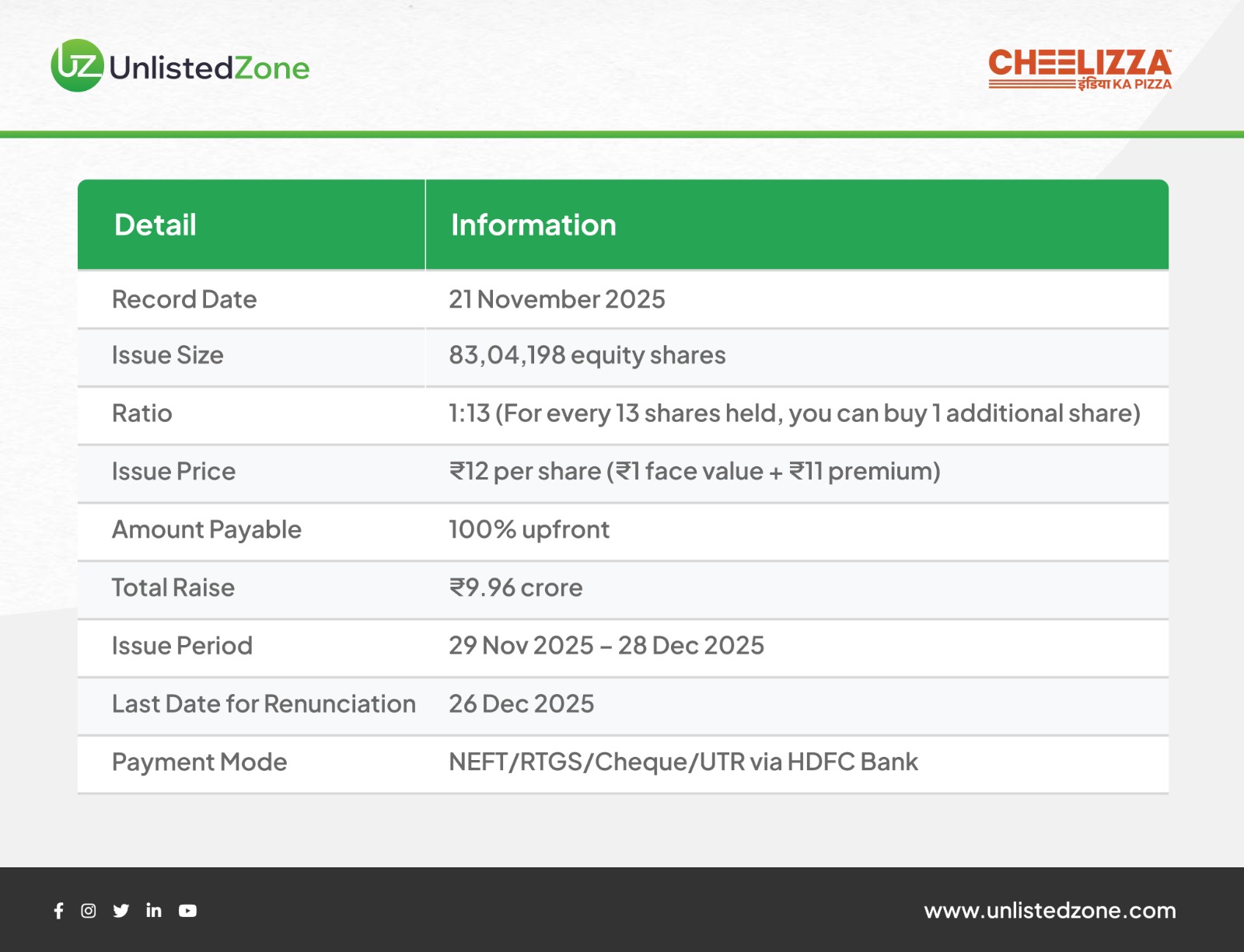

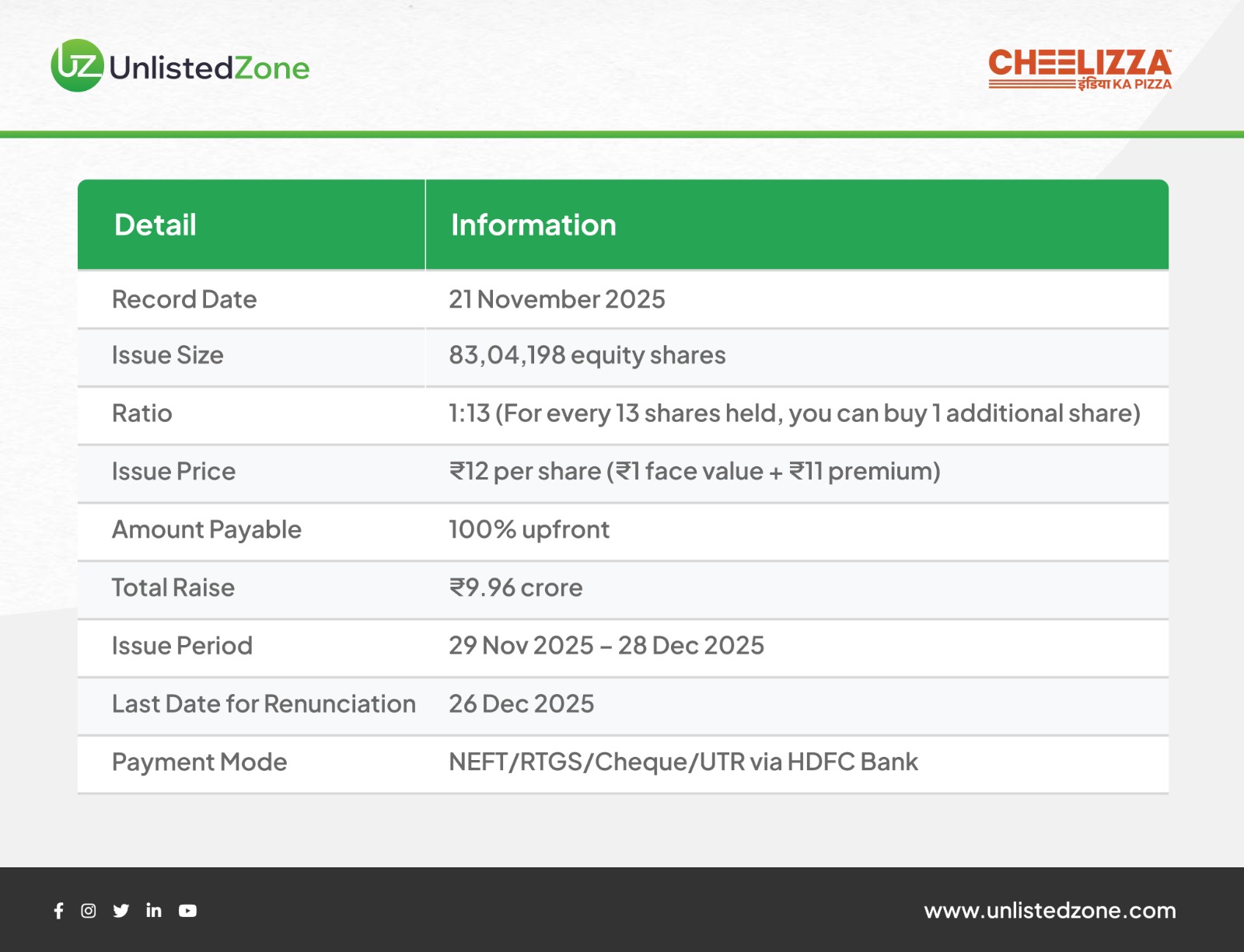

C) The Rights Issue — Key Terms

Shareholders can also renounce their rights — meaning they can sell their entitlement instead of subscribing.

D) Where Will The Money Go?

The net proceeds are earmarked for:

-

Working capital

-

Setting up new outlets

-

General corporate use

Simply put, the capital will fund aggressive expansion — the company wants to scale fast before competitors close the gap.

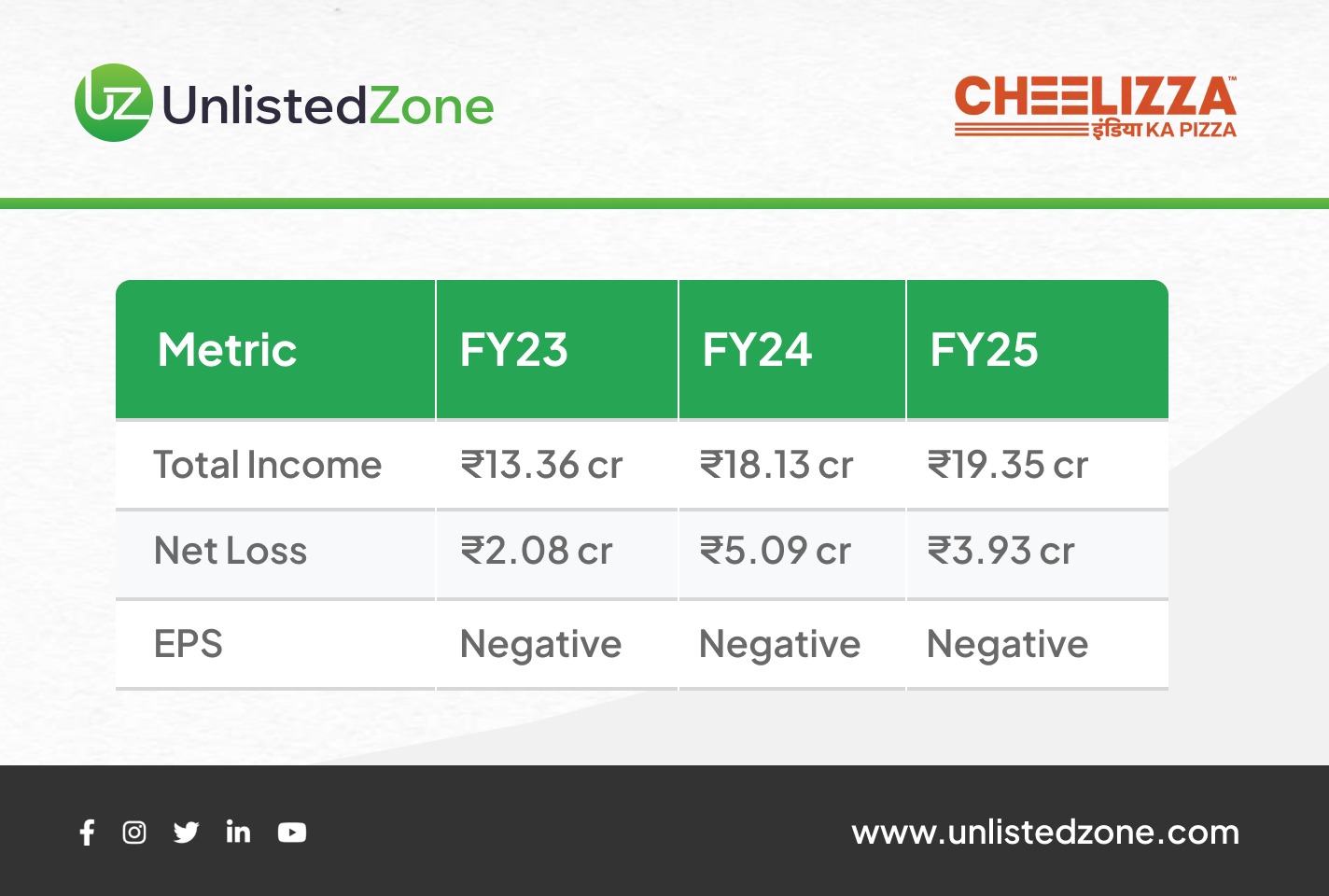

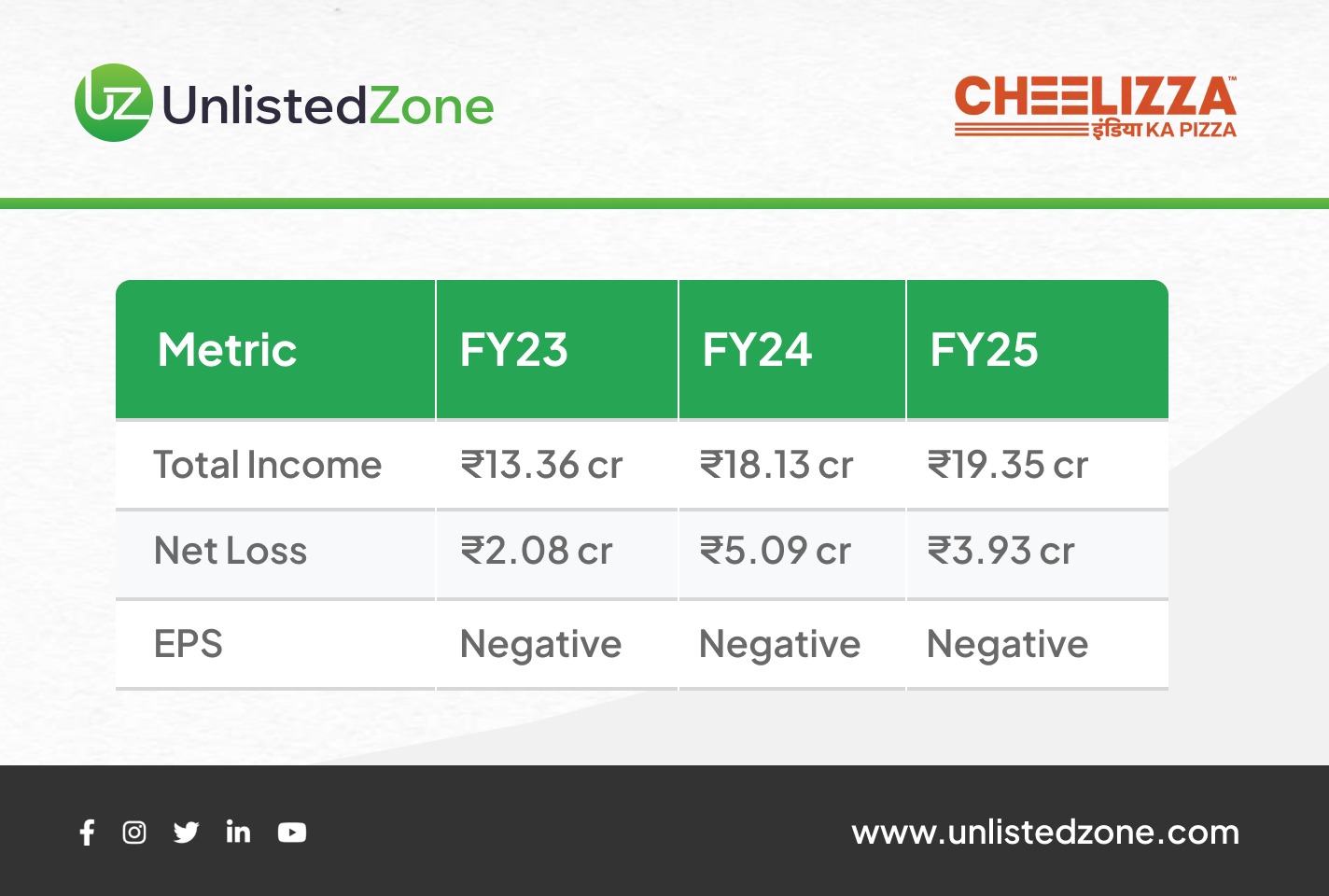

E) Financial Snapshot

Revenue growth shows momentum, but the bottom line remains in the red — a common pattern in early-stage QSR scaling.

Losses are driven by:

-

Store expansion costs

-

High rentals

-

Marketing and branding

-

Supply chain setup

In fast-scaling retail and F&B businesses, profitability generally comes after operational scale crosses a threshold — similar to brands like Wow! Momo, Biryani Blues, and Burger Singh in their early years.

F) Should Shareholders Subscribe?

As a shareholder, you have four options:

-

Subscribe fully

-

Subscribe partially

-

Renounce your rights entitlement

-

Apply for additional shares (if available)

A rights issue at a discount can help:

However, risks remain — losses continue, and execution in the QSR sector is capital-intensive and competitive.

G) Industry Context

India’s QSR market is expanding rapidly, with vegetarian offerings becoming a strong differentiator. With global chains largely non-vegetarian in positioning, Cheelizza is building a veg-only niche — a potentially scalable customer segment in India and abroad.

Bottom Line

Cheelizza isn’t just serving pizzas — it’s trying to build a scalable, vegetarian-first QSR ecosystem. The rights issue signals confidence, growth ambitions, and shareholder-first capital raising.

For current shareholders, this issue represents:

A chance to buy more equity at a lower price — if you believe the story is still early.

The clock is ticking — the offer closes on 28 December 2025.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.