Introduction

India Exposition Mart Ltd. (IEML), widely known as India Expo Mart, is India’s premier integrated venue for exhibitions, conventions, and trade fairs. Located on the Greater Noida Expressway, it has become a magnet for both national and international exhibitions, including flagship events like the Auto Expo and IHGF Delhi Fair.

Despite its strong operational performance, what truly sets IEML apart is its 58 acres of strategically located prime land. At current market rates, the land parcel alone is valued significantly higher than the company’s market cap—unveiling a classic hidden-value opportunity for long-term investors.

History & Land Footprint

Conceived in 2001 and operational since 2006, India Expo Mart was envisioned as a world-class exhibition facility to support Indian trade and commerce.

-

Total Area: 58 acres (~2.53 million sq.ft).

-

Facilities: 14 exhibition halls, a five-star hotel (ExpoInn), a business convention center, and over 785 permanent showrooms.

-

Among the largest MICE (Meetings, Incentives, Conferences, Exhibitions) destinations in Asia.

Business Model of India Expo Mart

India Expo Mart operates on a multi-revenue MICE model that makes it a resilient and diversified business:

1. Venue Rentals

-

Renting exhibition halls, conference rooms, and outdoor areas for events, expos, and conventions.

-

Flagship events: Auto Expo, Renewable Energy India Expo, IHGF Delhi Fair, etc.

2. Proprietary Events

3. Hospitality Services

-

ExpoInn Suites & Convention: 134-room five-star hotel with banquet facilities and in-house restaurants.

-

Additional benefit from the 1,400 hotel rooms within 5 km and 6,000 rooms within 40 minutes driving distance.

4. Permanent Marts

5. Digital B2B Platform – ExpoBazaar

👉 Diversified business segments ensure consistent cash flows and international visibility.

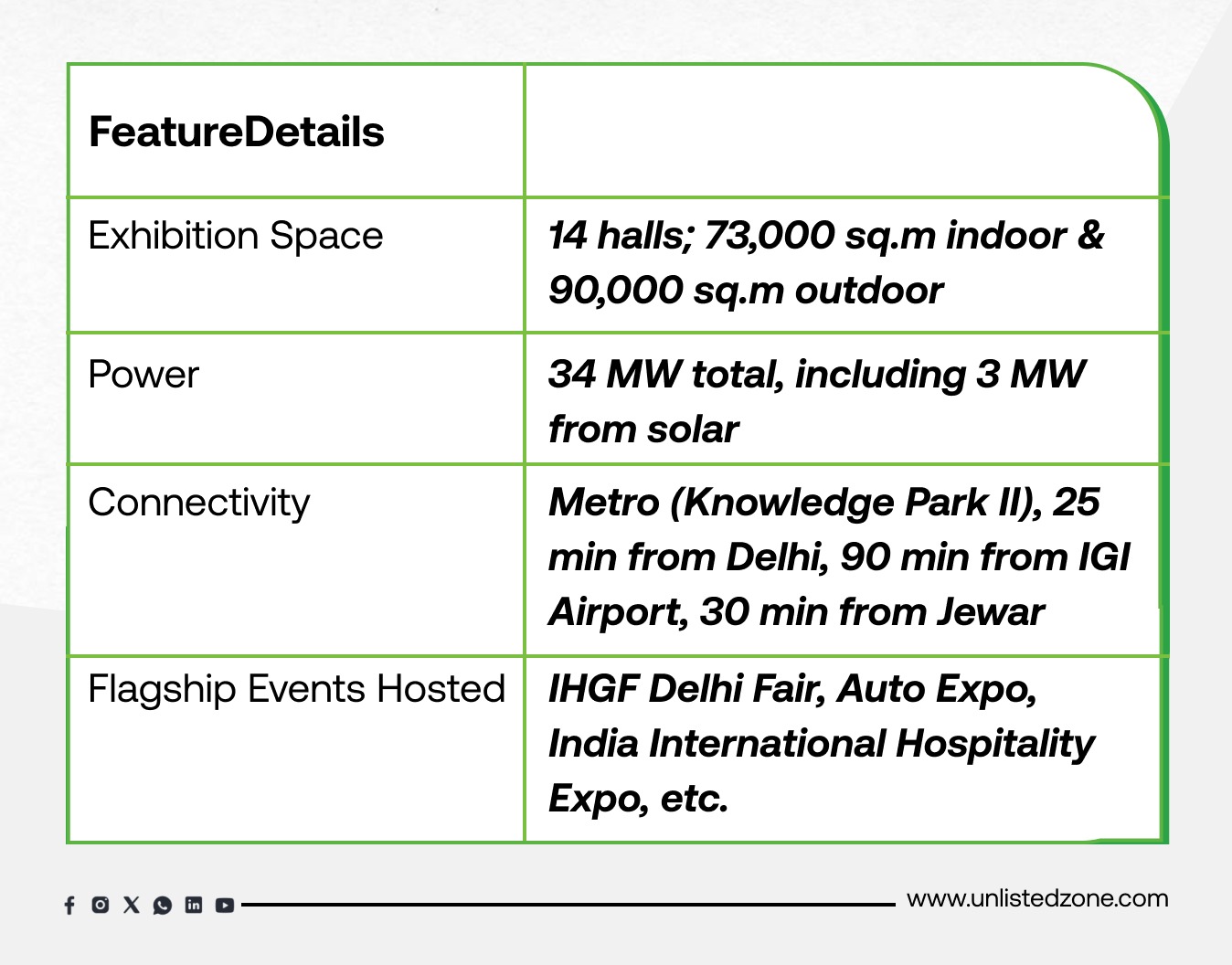

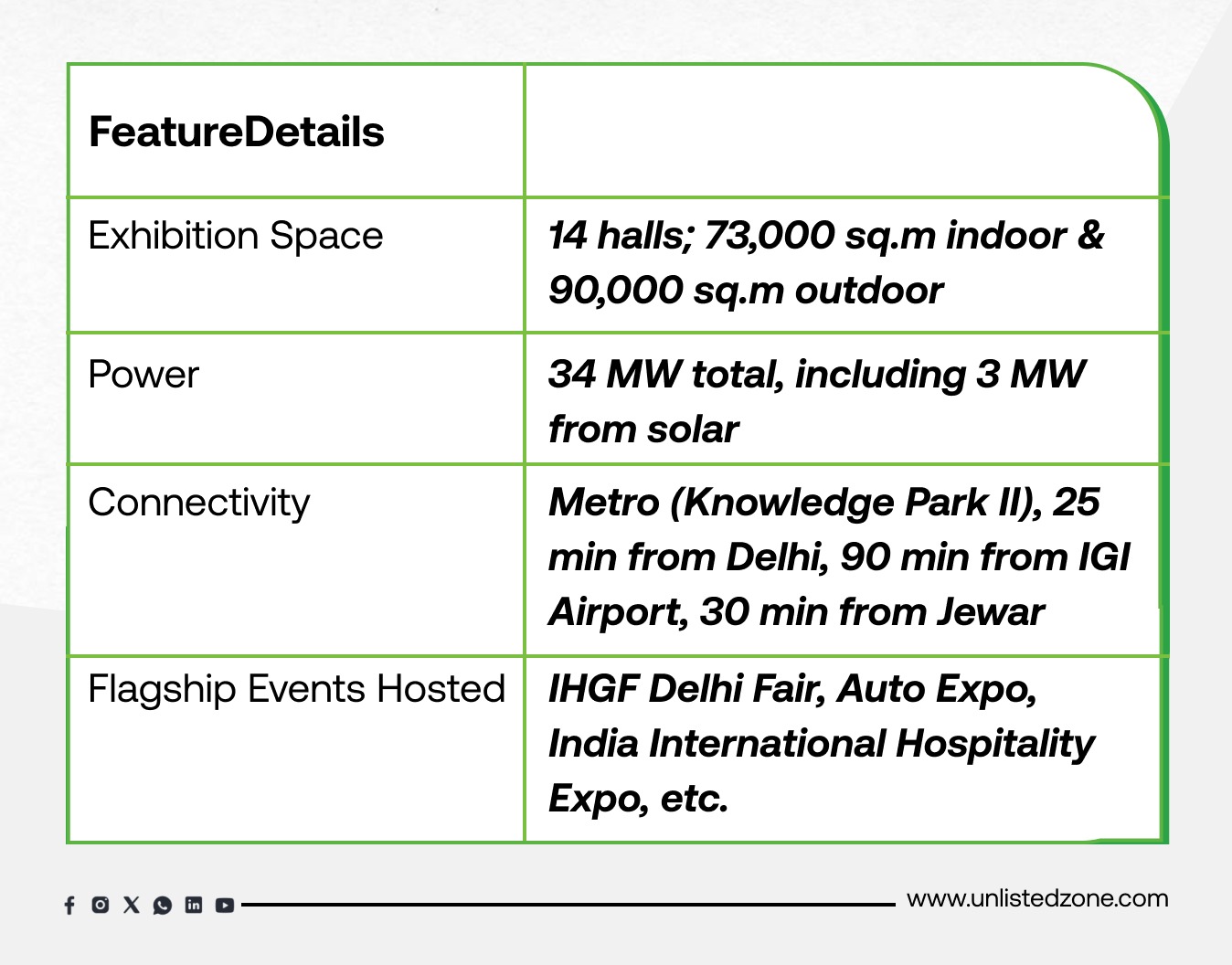

Infrastructure & Features

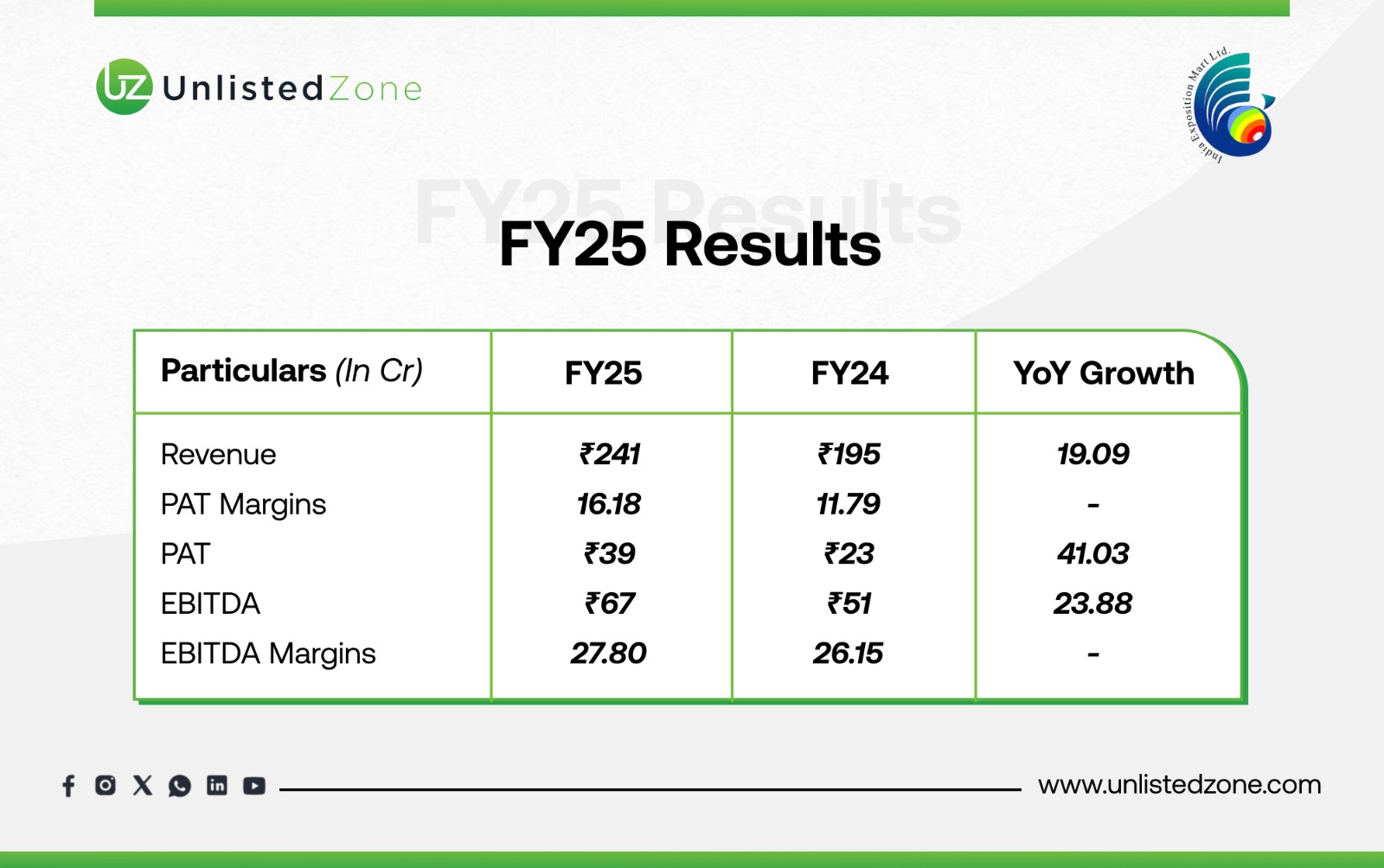

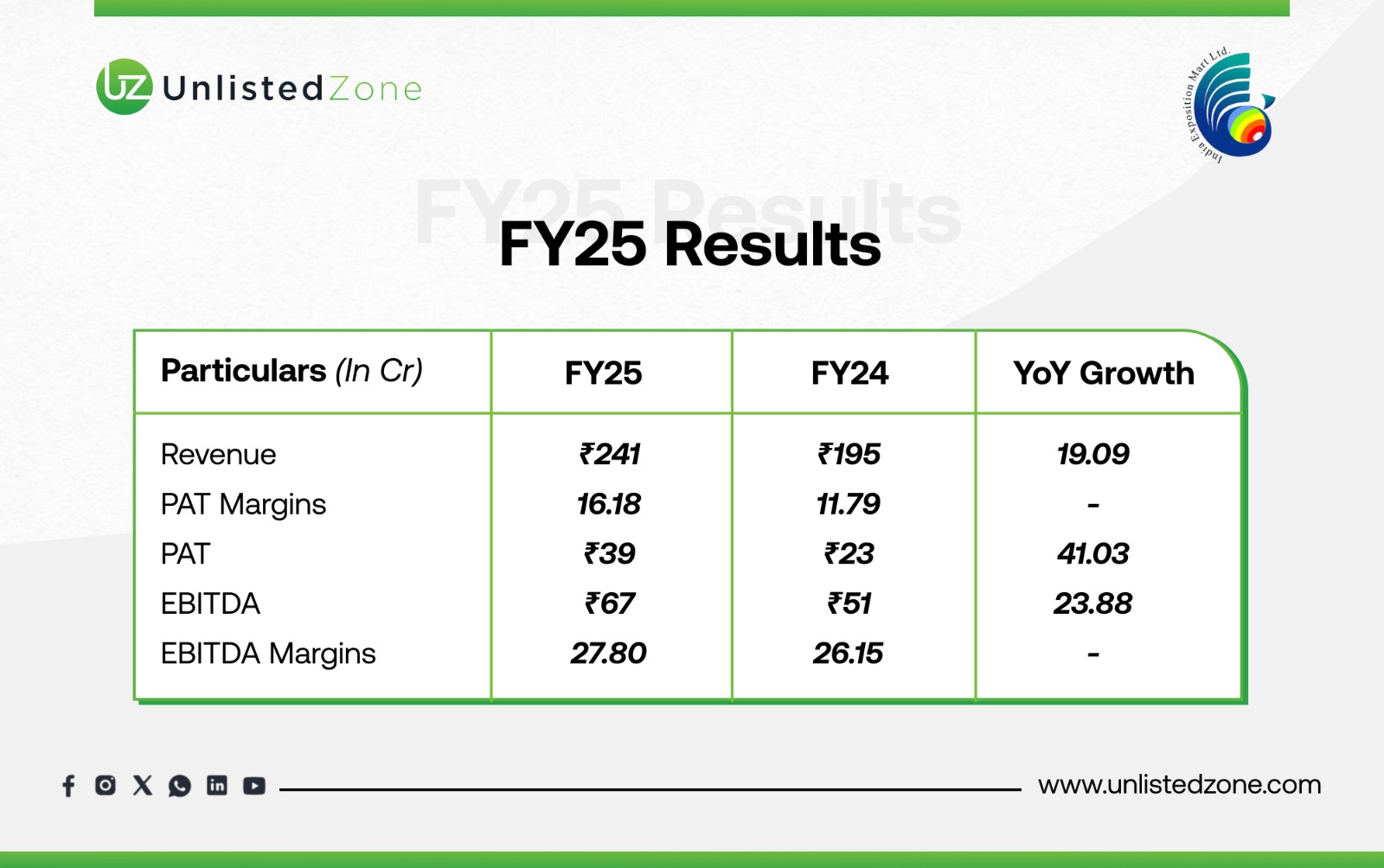

Financial Performance: FY25 vs FY24

These numbers showcase strong operating leverage, profitability, and growth momentum.

Market Cap vs Real Estate Value

Let’s analyze the hidden value that makes India Expo Mart a standout asset:

-

Market Cap: ~₹1,111 crore

-

Land Area: 58 acres = 2.53 million sq.ft (0.25 crore sq.ft)

-

Estimated Land Rate: ₹7,000/sq.ft (Greater Noida Expressway)

💰 Implied Land Value = 0.25 crore sq.ft × ₹7,000 = ₹1,750 crore

Insight:

The market is undervaluing IEML by nearly ₹639 crore, which means investors are buying into the entire business operations—exhibitions, hotel, digital platform—for FREE.

📍 Prime Location Advantage

The real estate's premium comes from unmatched connectivity and infrastructure:

With UP’s infrastructure growth and India’s push for large-scale global trade expos, the demand for MICE infrastructure is poised to grow—and India Expo Mart is already built and operational.

Strategic Insights for Investors

-

Asset-Backed Investing: Investing in IEML is akin to buying undervalued real estate with an operationally cash-generating business.

-

Dividend Potential: Strong EBITDA margins and recurring revenues provide room for future dividends.

-

Digital Play: ExpoBazaar opens new revenue lines from cross-border e-commerce.

-

Jewar Airport Proximity: Could re-rate real estate valuations in the next 3–5 years.

Key Risks to Watch

While the story is compelling, investors should also consider:

-

Event Seasonality: Revenue can be concentrated in peak event quarters.

-

Competition: New MICE players in Delhi-NCR may impact rental rates.

-

Macro Sensitivity: Dependent on government policies and international trade dynamics.

Conclusion

India Expo Mart is a rare blend of operational excellence and undervalued real estate. At a time when the Indian markets are hunting for value amidst overvalued narratives, IEML stands tall with:

-

A 21.6% YoY revenue growth and 47% PAT growth in FY25.

-

A 58-acre land bank in one of NCR’s most promising zones.

-

A stable, diversified, MICE-led business model with digital upside.

-

A market cap lower than its real estate value, creating a margin of safety.

For long-term investors seeking growth with downside protection, India Expo Mart offers a compelling case of Value Hidden in Plain Sight.