About the Company

Indofil Industries Limited, part of the K.K. Modi Group, traces its roots back to 1962 when it was established as a subsidiary of Rohm & Haas Co., USA, initially named Indofil Chemicals Limited. The first EBDC plant was commissioned in Thane in 1965. It became independent in 1982 under Mr. K.K. Modi as Modipon Ltd. and was reincorporated as Indofil Industries Limited in 1993. Headquartered in Mumbai, it is a research-led, fully integrated chemical company specializing in agrochemicals and specialty chemicals. With a mission to deliver innovative and sustainable solutions for crop care and industrial sectors, Indofil has grown into a diversified entity with a global presence in 120+ countries.

Business Model & Divisions of Indofil Industries Unlisted Shares

Indofil’s business model revolves around the "Crop Care Concept", identifying crop needs and delivering tailored solutions. Its operations focus on R&D-driven innovation with a mix of agrochemicals and specialty chemicals.

Divisions:

-

Agrochemical Division: Offers insecticides, herbicides, fungicides, and plant nutrition solutions in India and abroad.

-

Xoritas Private Limited (Subsidiary): Specializes in bio-stimulants, micronutrients, and plant growth regulators.

-

Indofil Innovative Solutions (IIS): Provides solutions for plastics, paints, coatings, leather, textiles, and construction.

The company operates 3 manufacturing units, with a total production volume of 3,41,733 KL, supported by 14 subsidiaries (including step-down).

Industry Positioning of Indofil Industries Unlisted Shares

Indofil is a leading player in the Indian agrochemical market, particularly strong in fungicides like Mancozeb, with a robust global export network. Competing with peers like UPL and PI Industries, Indofil has positioned itself through:

-

Sustainability: 18% renewable energy, 100% water recycling, zero liquid discharge.

-

Innovation: 1 R&D office, 8 new launches, 6 patents filed, 2 patents granted.

-

Recognition: Export Excellence Award (Runner-Up, Large Scale) at ICSCE 2025 Dubai.

The global agrochemical industry is projected to grow at an 8.6% CAGR, which offers a strong tailwind for the company.

Key Highlights of the Year FY2024-2025

-

8 new products launched, 6 patents filed, and 2 patents granted.

-

18% volume growth with improved profitability despite marginal revenue growth.

-

Sustainability achievements: LCA study for Mancozeb, LTIFR of 0.

-

Expansion of international presence in emerging markets.

-

Recognition at ICSCE Dubai for export excellence.

Financial Performance of Indofil Industries Unlisted Shares

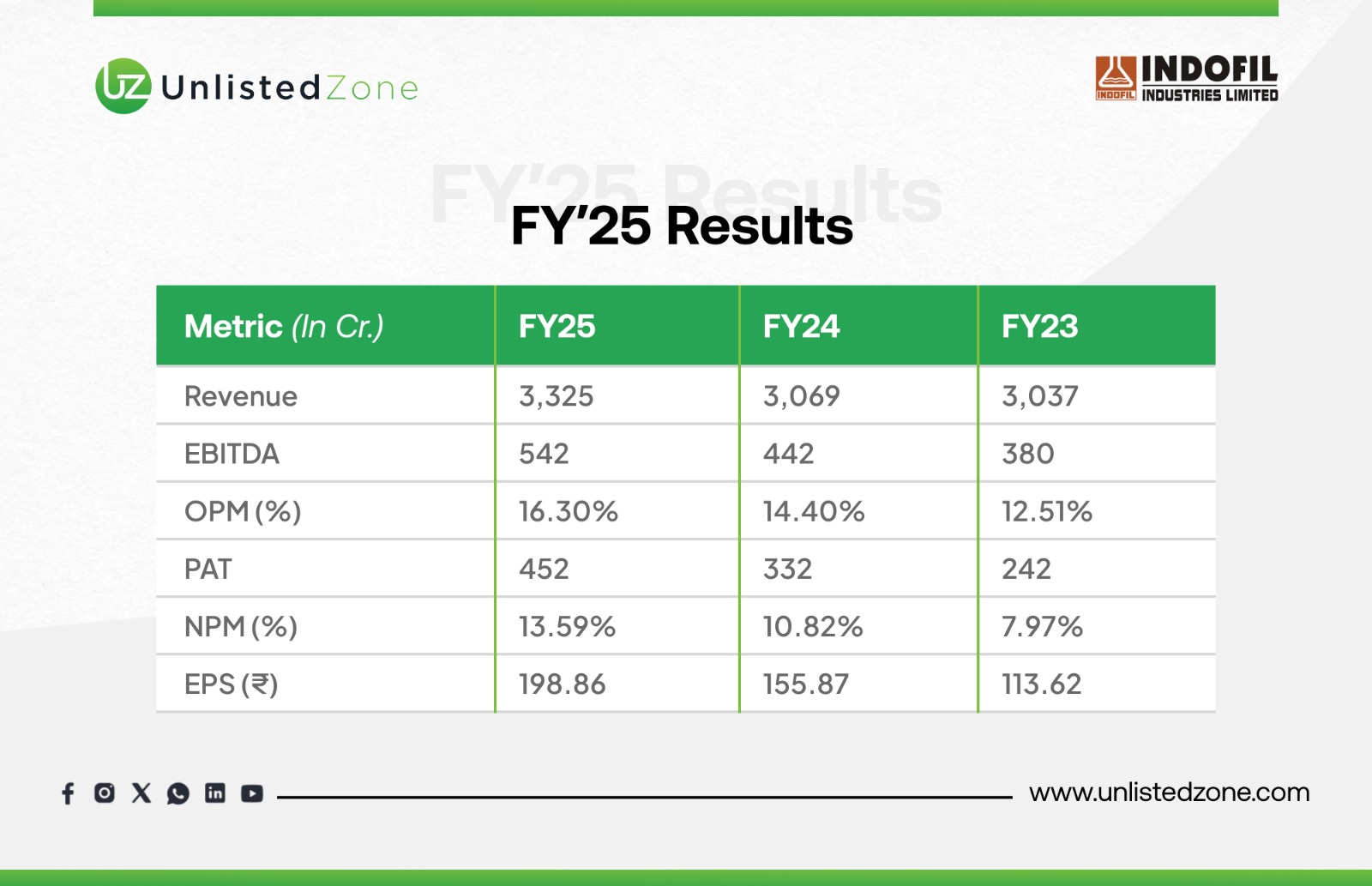

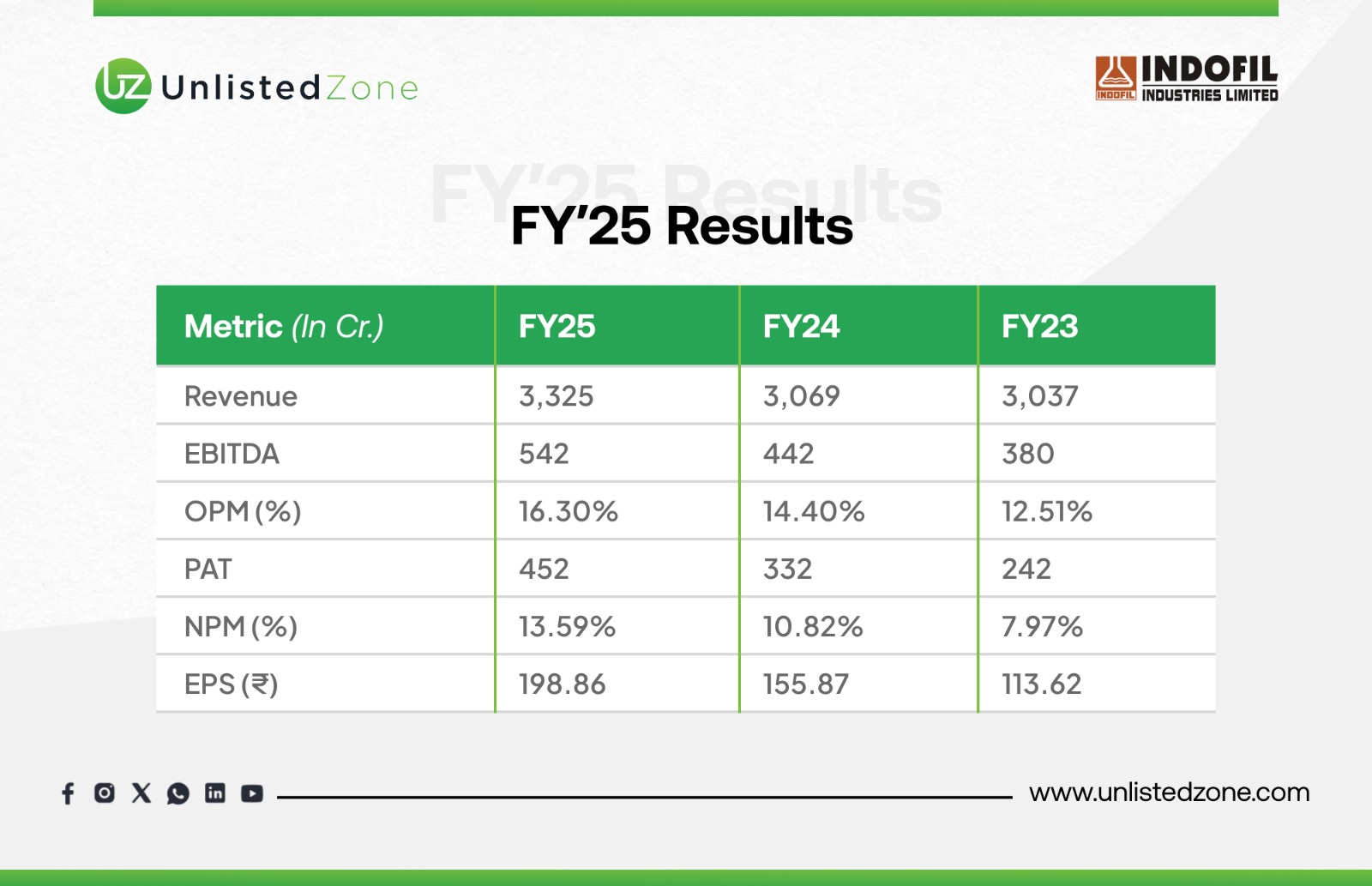

Profit & Loss Statement (₹ in Crore)

The Profit & Loss statement reveals a company that has dramatically improved its efficiency and profitability over the last three years.

-

Top-Line Stability, Bottom-Line Explosion: While revenue grew a healthy 9.5% from FY23 to FY25 (₹3,037 Cr to ₹3,325 Cr), the bottom-line growth is astounding. Profit After Tax (PAT) nearly doubled, surging by 86.8% from ₹242 Cr in FY23 to ₹452 Cr in FY25.

-

Massive Margin Expansion:

-

Gross Profit Margin: Jumped from 36.68% (FY23) to 44.12% (FY25). This suggests much better control over the cost of raw materials, a favorable product mix (selling more high-margin products).

-

EBITDA Margin: Improved from 12.51% to 16.30%, showing enhanced operational efficiency.

-

PAT Margin: More than doubled from 7.97% to 13.59%. This means for every ₹100 of revenue, the company kept ₹13.59 as profit in FY25, compared to just ₹7.97 two years prior.

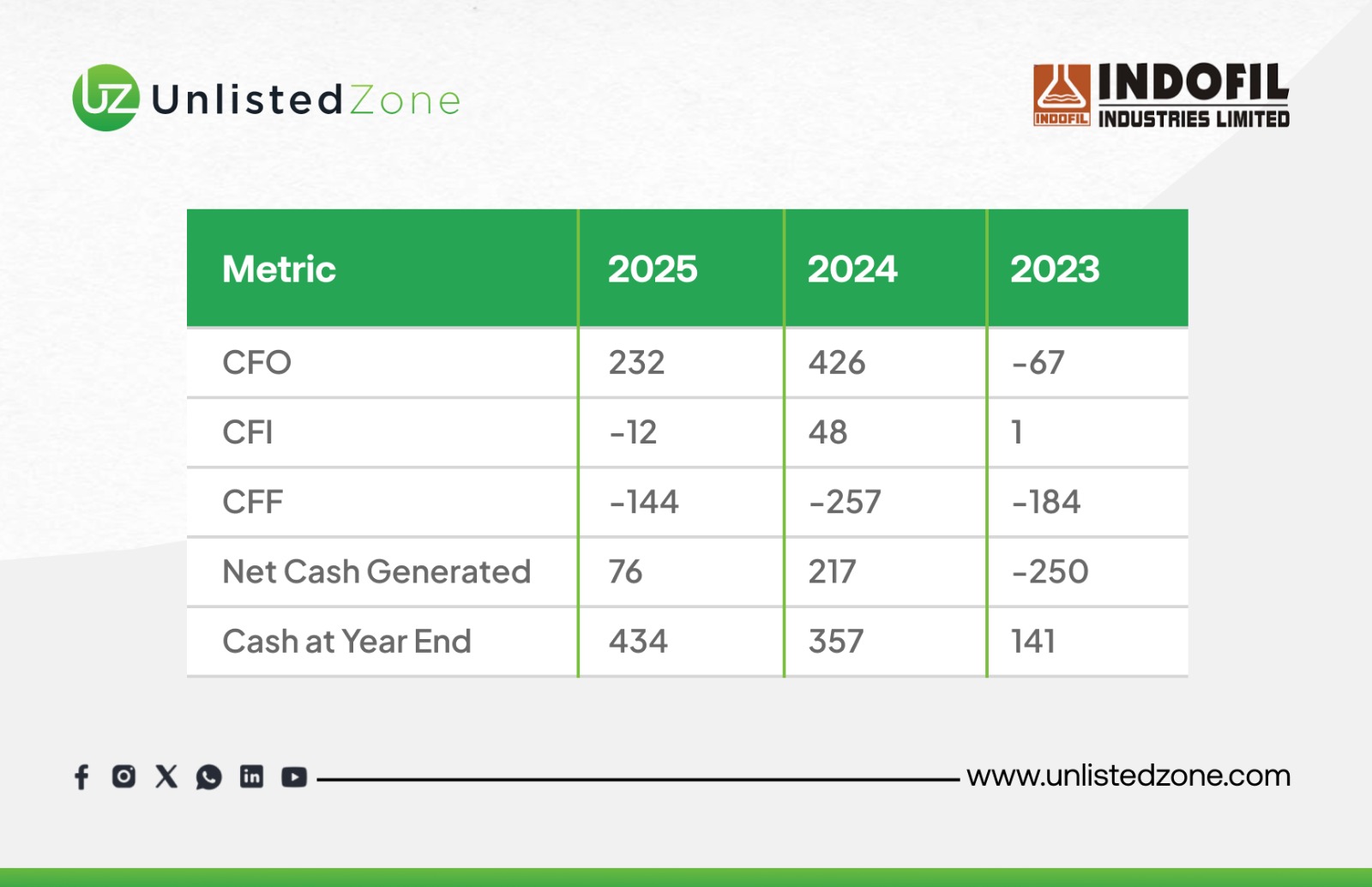

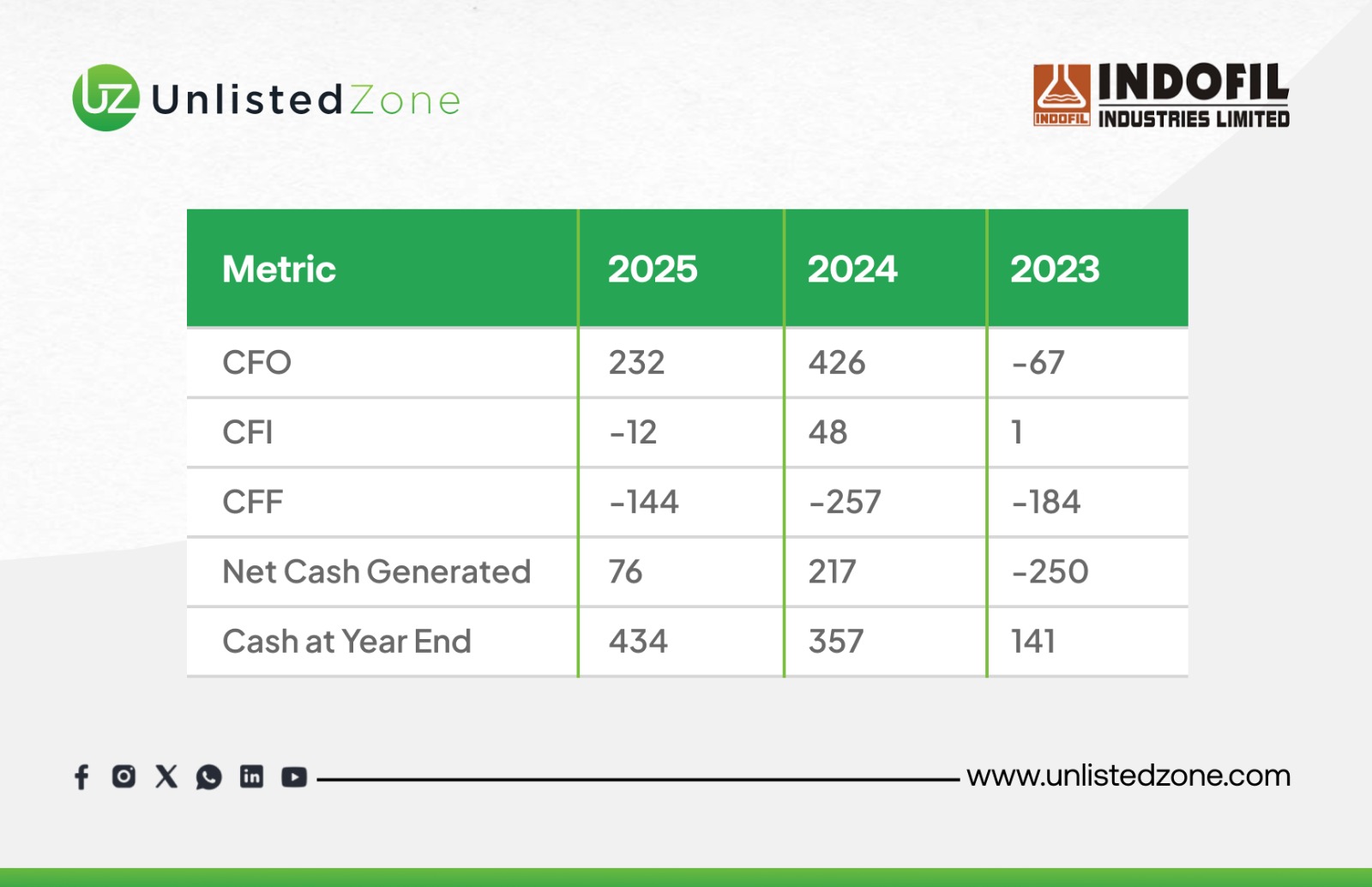

Cash Flow Statement (₹ in Crore)

The Cash Flow Statement confirms the quality of the impressive earnings.

-

Strong Operational Cash Generation: After a dip in FY23, Cash Flow from Operations (CFO) rebounded powerfully to ₹426 Cr in FY24. Although it decreased to ₹232 Cr in FY25, this is still strong and positive. The difference between PAT (₹452 Cr) and CFO (₹232 Cr) in FY25 is primarily due to a significant increase in working capital

-

Prudent Investing and Financing: The company has been consistently investing in PPE (Capital Expenditure) to maintain and grow operations.

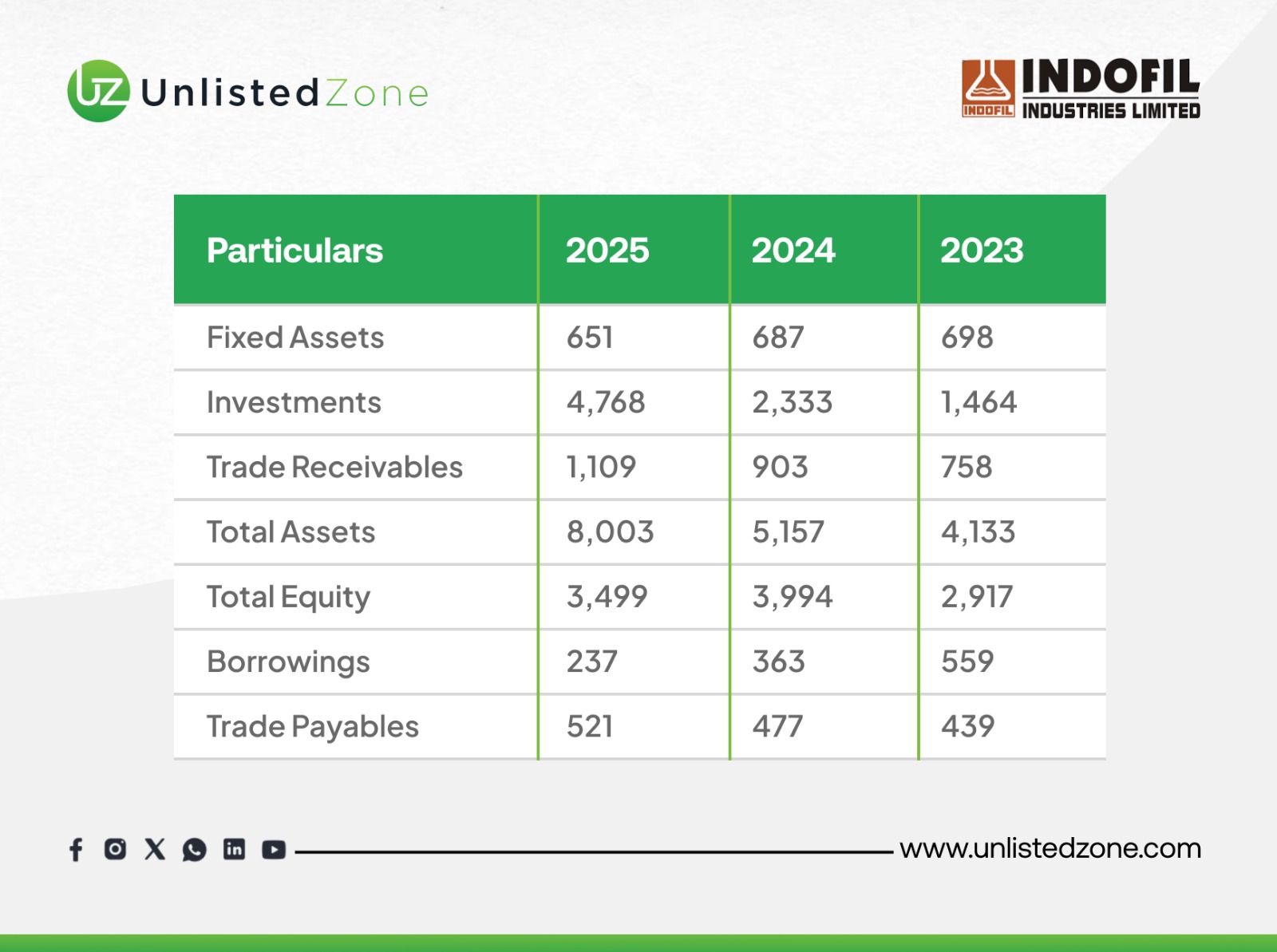

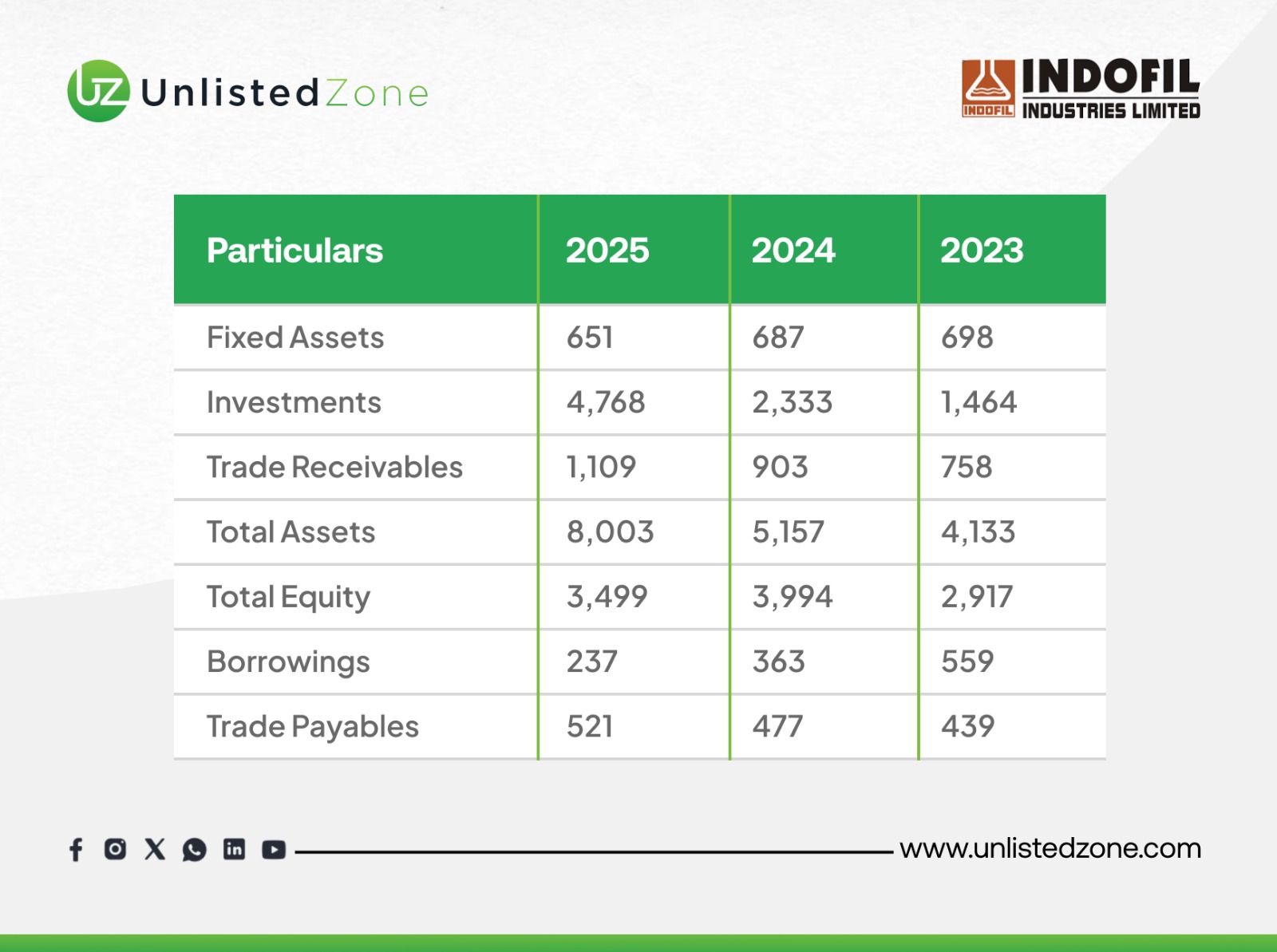

Balance Sheet (₹ in Crore)

Total assets grew 55.2% YoY to ₹8,003 Cr in 2025, driven by investments surging to ₹4,768 Cr (from ₹2,333 Cr).

Liabilities increased similarly, with equity at ₹3,498.73 Cr (down slightly due to reserves adjustment).

Debt reduced to ₹237 Cr, yielding a low Debt/Equity ratio of 0.07.

Net worth (equity) improved overall, with reserves at ₹3,476 Cr.

Liquidity is strong, with cash at ₹434 Cr end-2025 and trade receivables up 22.8% to ₹1,109 Cr, supported by positive CFO.

Segment-Wise Analysis of Indofil Industries Unlisted Shares

-

Agrochemicals (~89%): Dominated by fungicides (esp. Mancozeb), insecticides, herbicides, and plant nutrition. Strong export orientation has supported volume growth.

-

Specialty Chemicals (~11%): Serves industrial clients in plastics, coatings, textiles, and leather. This division enhances diversification and reduces reliance on agro segment.

-

Regional Performance: Solid growth in India, coupled with a robust presence in 120+ countries. Emerging markets remain a key focus for expansion.

Management Discussion & Analysis on Indofil Industries Unlisted Shares

-

Market Outlook: Rising global food demand and a growing agrochemical industry (CAGR 8.6%) position Indofil well for future growth.

-

Risks: Dependence on rainfall, raw material price fluctuations, intense competition, and global trade disruptions are key challenges.

-

Strategic Roadmap: Indofil aims to expand product registrations, strengthen R&D, and invest in capacity upgrades. Sustainability and efficiency remain core priorities.

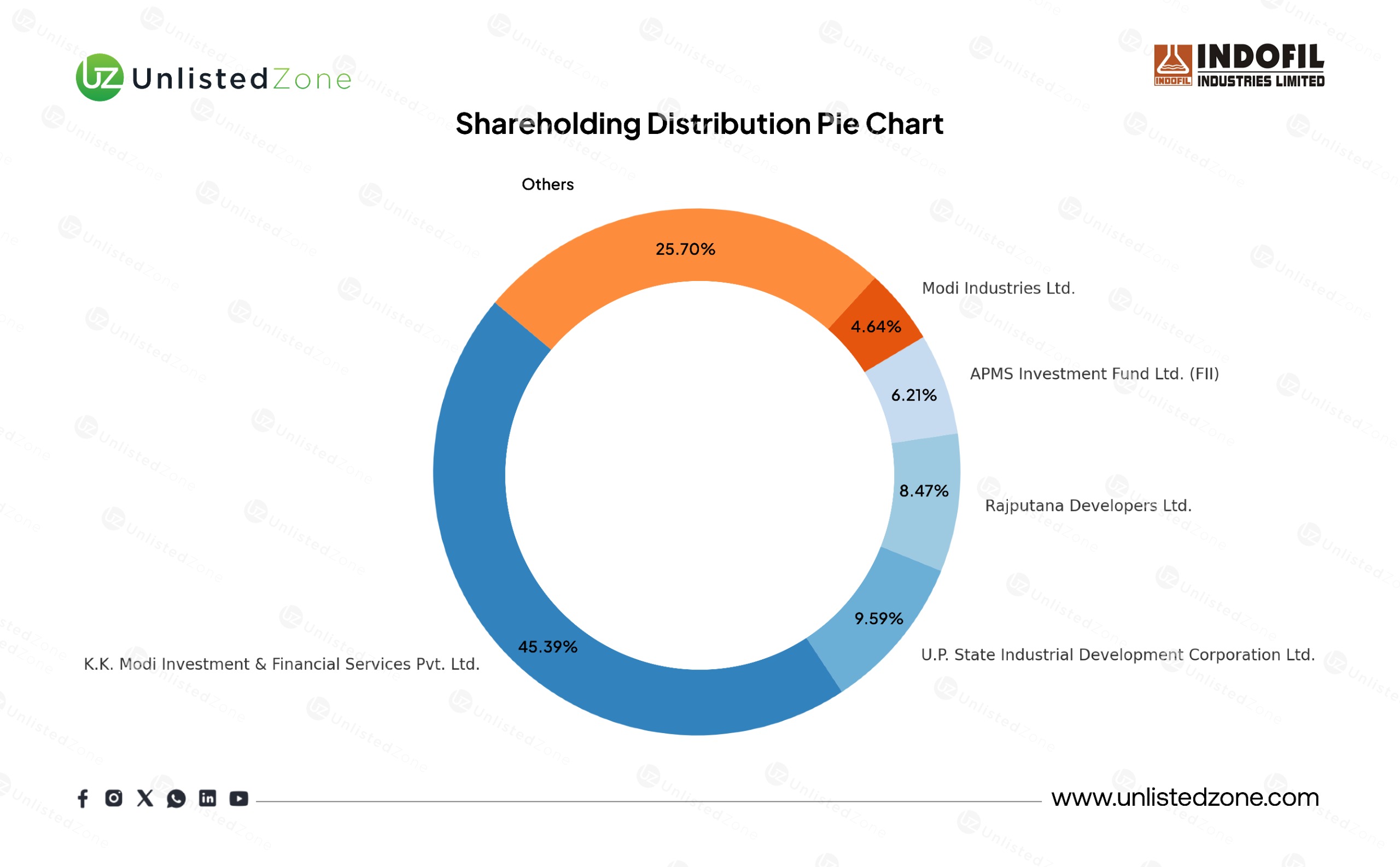

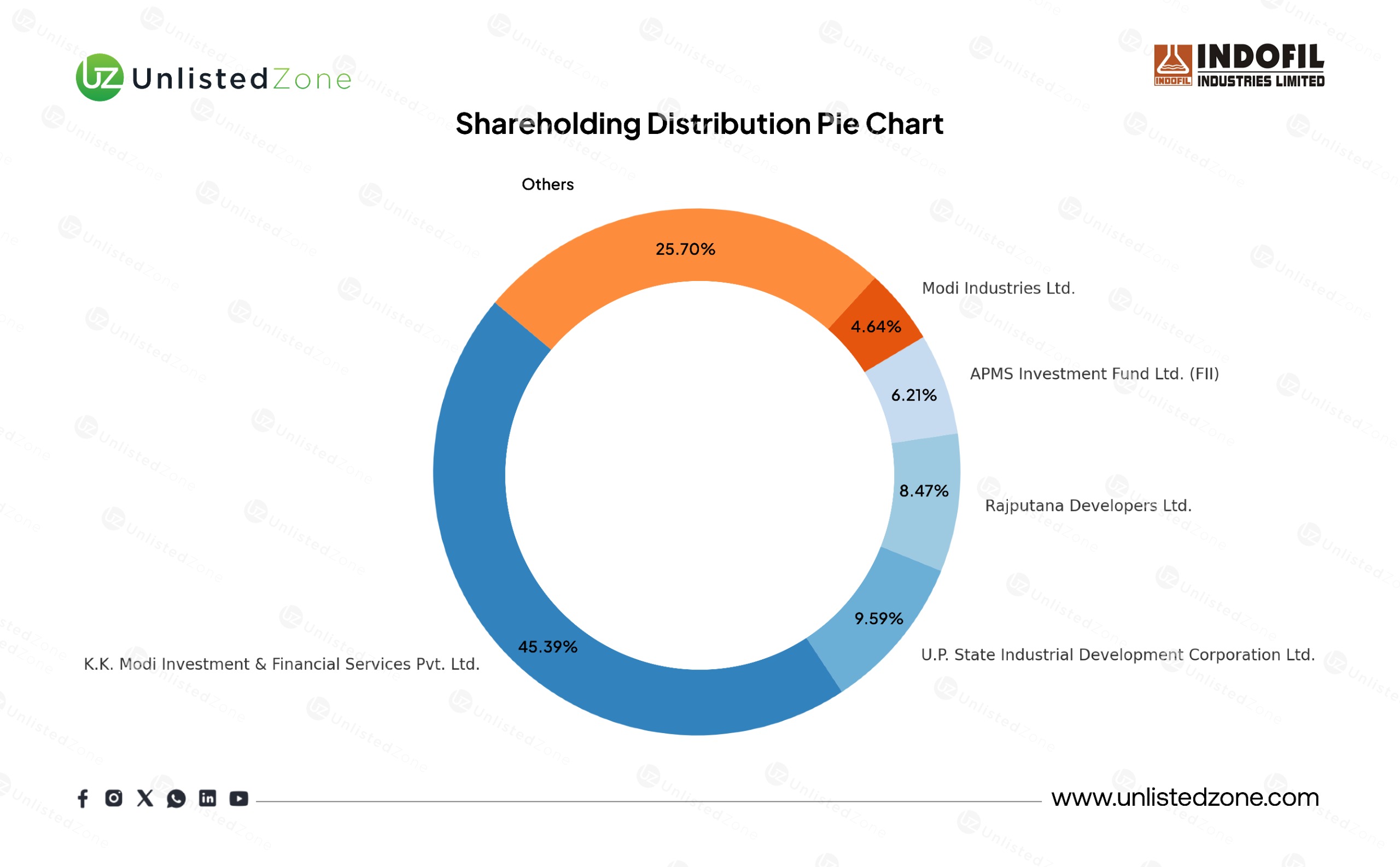

Shareholding Pattern of Indofil Industries Unlisted Shares

Discussion: The promoter group maintains strong control with 45.39% stake, while institutional presence through FII adds credibility. The diversified shareholding provides stability, but high promoter stake also ensures long-term commitment.

Valuation Insights of Indofil Industries Unlisted Shares

Discussion: Indofil trades at attractive valuation multiples, especially considering its large holdings in Godfrey Phillips India Ltd. (worth ~₹5,867 Cr). This makes the core agro and specialty chemicals business effectively undervalued. Its low leverage, high ROE, and consistent cash flows further strengthen its investment appeal.

Future Outlook

-

Growth Opportunities: Product portfolio expansion, increased global penetration, and capacity upgrades.

-

Tailwinds: Rising food demand, favorable industry growth rate, sustainability focus.

-

Headwinds: Trade disruptions, rainfall volatility, and raw material dependency.

Discussion: Indofil’s future lies in leveraging its R&D pipeline, scaling exports, and unlocking hidden asset value. While risks persist, its strong fundamentals and low debt provide resilience against cyclical downturns.

UnlistedZone View on Indofil Industries Unlisted Shares

Indofil is an undervalued gem in the unlisted market. Its Godfrey Phillips stake exceeds its own market cap, making its core business nearly free for investors. This hidden value, combined with robust agrochemical fundamentals, makes Indofil a rare opportunity.

Investment Thesis: Strong market positioning, undervaluation, sustainable business practices.

Risks: Liquidity constraints in unlisted markets, agro cyclicality, and external economic shocks.

Suitability: Best for HNIs and long-term investors seeking undervalued, asset-rich companies.

Conclusion: Indofil Industries combines innovation, sustainability, and hidden value creation. With solid financials, global presence, and undervaluation, it stands out as a compelling long-term bet in the unlisted market.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.