Imagine a future where farmers can hedge their crops against unpredictable weather or earn real money from eco-friendly practices.

Sounds futuristic? Not anymore.

In a recent Bloomberg TV interview, Dr. Arun Raste, Managing Director of the National Commodity & Derivatives Exchange (NCDEX), unveiled a bold blueprint that could transform India’s agri-economy.

From weather derivatives to carbon credit trading and entry into equity derivatives, NCDEX is positioning itself as a multi-asset powerhouse, bridging agriculture, finance, and sustainability.

For UnlistedZone investors, this vision represents not just innovation — but the birth of India’s next agri-fintech revolution.

1) Weather Derivatives: Turning Climate Risk into Opportunity

a) What Are Weather Derivatives?

Weather derivatives are financial instruments that help hedge against adverse weather conditions such as erratic rainfall, drought, heatwaves, or cold spells.

Unlike traditional crop insurance, which pays out after verifying actual crop damage, weather derivatives are parametric — meaning payouts are linked directly to measurable weather data (like rainfall or temperature) reported by the India Meteorological Department (IMD).

If weather conditions deviate from the agreed benchmark, the payout is automatic — no inspection, no delay.

b) How It Works — A Simple Example ?

Let’s say a cotton farmer in Vidarbha fears below-average rainfall this season.

-

Contract Type: Rainfall Derivative (1 July – 31 August)

-

Strike Level: 600 mm of rain

-

Actual Rainfall Recorded: 420 mm (by IMD)

-

Deviation: 180 mm below threshold

-

Payout Formula: ₹100 per mm deviation

The farmer automatically receives ₹18,000 per hectare — without filing a claim.

Similarly, an ice-cream manufacturer in Delhi can hedge against an unusually cold summer using temperature derivatives, which pay out when average temperature falls below a specified level.

In short — farmers, food processors, and agri businesses can all manage climate volatility using weather-linked contracts.

c) Why It Matters for India ?

India’s agriculture still depends on the monsoon for nearly 60% of its cropped area.

A single bad season impacts not only farmers but also food prices, inflation, and supply chains.

Weather derivatives provide:

-

Income Stability: Farmers can secure predictable returns even in adverse weather.

-

Credit Confidence: Banks and NBFCs can lend more confidently when risks are hedged.

-

Policy Support: Governments can use these contracts to complement crop insurance schemes.

Globally, weather derivatives have been used for years by companies trading on the Chicago Mercantile Exchange (CME). India’s entry into this space marks a major leap toward climate-resilient finance.

2) Carbon Credit Trading: Monetizing Sustainability

a) What Are Carbon Credits?

A carbon credit is a tradable certificate representing one tonne of CO₂ (or equivalent greenhouse gas) prevented or removed from the atmosphere.

Farmers or companies that adopt eco-friendly practices — such as renewable-powered irrigation, low-tillage farming, tree planting, or organic cultivation — can generate carbon credits.

These credits can be sold to industries that emit greenhouse gases and want to offset their carbon footprint.

b) How It Works — The Agricultural Way

Suppose a farmer in Madhya Pradesh replaces diesel irrigation pumps with solar-powered ones.

By reducing emissions, his project generates carbon credits that can be verified and registered on approved carbon registries.

-

1 Credit = 1 Tonne of CO₂ avoided

-

Market Price (Indicative): ₹400–₹800 per credit (varies globally)

-

Credits can be traded on upcoming NCDEX carbon platforms or sold to corporations seeking offsets.

This means sustainable farming practices can now generate additional income, not just yield.

c) Why Carbon Trading Matters ?

India’s Net Zero 2070 commitment requires massive investments in emission reduction across sectors — including agriculture, which contributes around 18% of national greenhouse gas emissions.

Through carbon credit trading:

-

Farmers earn more by adopting sustainable methods.

-

Companies achieve compliance with ESG and decarbonization goals.

-

India builds a domestic carbon market, reducing dependency on foreign registries.

This is where NCDEX steps in — to create transparent, standardized, and regulated carbon exchanges, allowing both farmers and corporations to participate in the green economy.

3) Entering Equity Derivatives: The Big Leap

NCDEX is now set to expand beyond commodities into equity derivatives, armed with ₹770 crore in fresh funding and SEBI’s approval.

Dr. Raste noted that capturing even 1% market share in this segment could turn NCDEX profitable — transforming it from a niche agri-exchange into a multi-asset financial platform.

This evolution parallels the global trajectory of exchanges like the CME Group, which started with grains and grew into a diversified powerhouse covering commodities, currencies, and equities.

4) Myth-Busting: Derivatives Aren’t Gambling

Dr. Raste was clear in his message — derivatives are not speculative tools, but risk management instruments.

“Market volatility comes from weather and policy shocks, not from futures trading,” he said.

NCDEX is running nationwide awareness campaigns to educate farmers, cooperatives, and agri startups about using derivatives for:

-

Locking in future prices.

-

Reducing price uncertainty.

-

Building predictable revenue models.

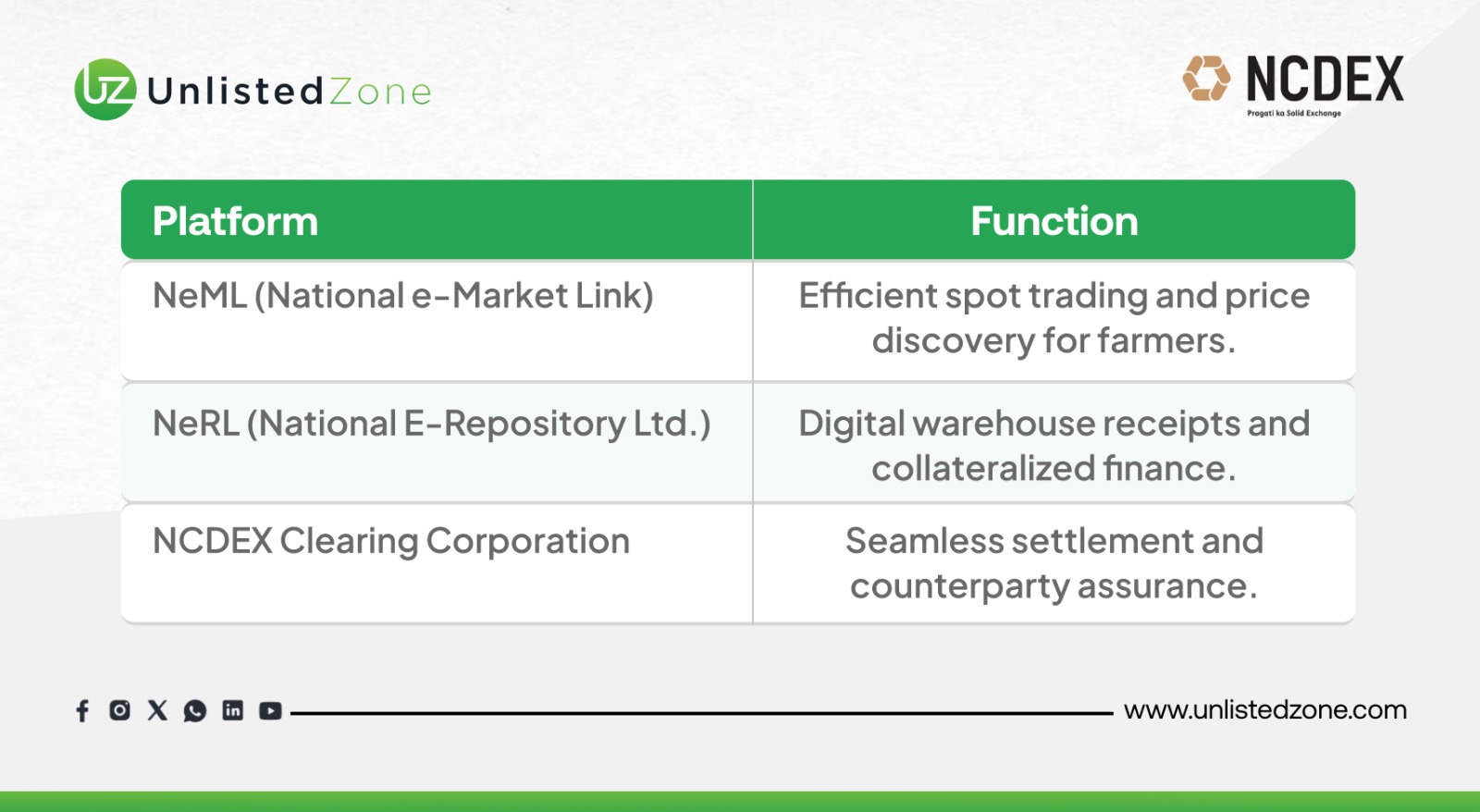

5) Building a Full-Stack Agri Ecosystem

NCDEX’s strength lies in its integrated infrastructure, combining technology and transparency:

This ecosystem enables a digital farm-to-market journey, aligning with the government’s Digital Agriculture Mission.

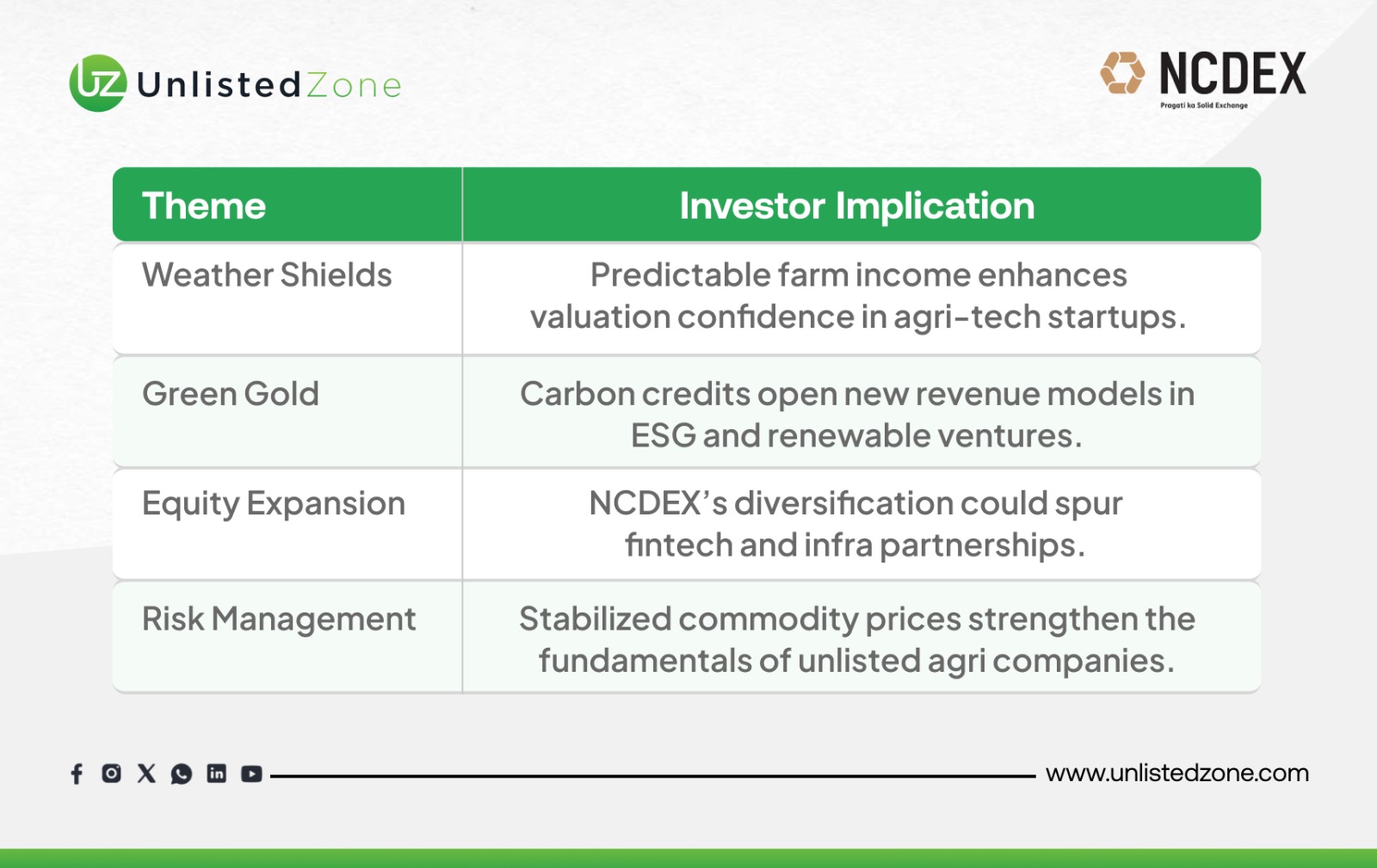

6) Why This Matters for UnlistedZone Investors?

7) Challenges Ahead

While the vision is promising, execution will depend on:

-

Regulatory clarity on carbon credit ownership.

-

Data integrity in IMD weather reporting.

-

Farmer adoption and liquidity in derivative markets.

However, NCDEX’s innovation-first approach and public–private collaborations give it a strong foundation to overcome these barriers.

8) The Bottom Line

As Dr. Arun Raste aptly concluded:

“It’s about resilient farms, not just products.”

With weather derivatives, carbon credit trading, and multi-asset diversification, NCDEX is redefining how India’s farmers, financiers, and investors engage with risk and sustainability.

For UnlistedZone readers and investors, this could be the beginning of a new agri-fintech era — where data, derivatives, and digital platforms cultivate not just crops, but capital.