Versuni India Home Solutions Ltd. (Unlisted Shares) – Products, IPO Plans, Financials & Valuation

Introduction

Versuni India Home Solutions Limited (formerly Philips Domestic Appliances India Ltd.) is a leading consumer appliance company with a strong presence in India and across global markets. With household names like Philips and Preethi, the company has become a trusted partner in millions of kitchens and homes.

As the company gears up for its Initial Public Offering (IPO), Versuni’s unlisted shares are increasingly attracting investor attention. In this article, we cover its business model, product portfolio, financial performance, IPO plans, and valuation outlook.

Business Model

Versuni follows a house-of-brands strategy in the consumer appliance segment, built around innovation, sustainability, and customer-centric design.

Brand Portfolio

-

Philips: Kitchen electronics, coffee machines, air purifiers, and garment care appliances.

-

Preethi: A leading Indian kitchen brand for 40+ years, offering mixer grinders, gas stoves, cookers, and coffee makers.

Sustainability Initiatives

-

100% clean energy usage.

-

Zero landfill discharge.

-

Recycling of plastic, paper, wood, and metal.

-

Strong focus on reducing CO₂ emissions.

Right to Repair

Versuni empowers consumers by providing genuine spare parts, tools, and repair guides, ensuring a longer lifecycle of products.

Product Innovation

-

Philips Airfryers (NAF240, HD9285, OAC220)

-

Philips Garment Steamers (STE1000 Series)

-

Philips Air Purifiers (AC2990, AC3212, AC3221, AC4231)

-

Preethi Zodiac Mixer Grinder – India’s highest-selling mixer grinder

Strategic Growth Drivers

-

Expansion across categories and geographies.

-

Optimized capacity utilization to improve margins.

-

Focus on premiumization of product portfolio.

Products Portfolio

Versuni’s portfolio spans across home and kitchen categories:

-

Kitchen Electronics: Mixer grinders, gas stoves, coffee makers, cookers.

-

Airfryers: Flagship Philips range, a bestseller in urban households.

-

Garment Care: Irons and steamers designed for modern lifestyles.

-

Air Purifiers: High-performance solutions to tackle urban pollution.

-

Home Care: Smart appliances for simplifying household tasks.

Segment-Wise Analysis (FY24 vs FY25)

Revenue from External Customers

Assets

Capital Expenditure (Capex)

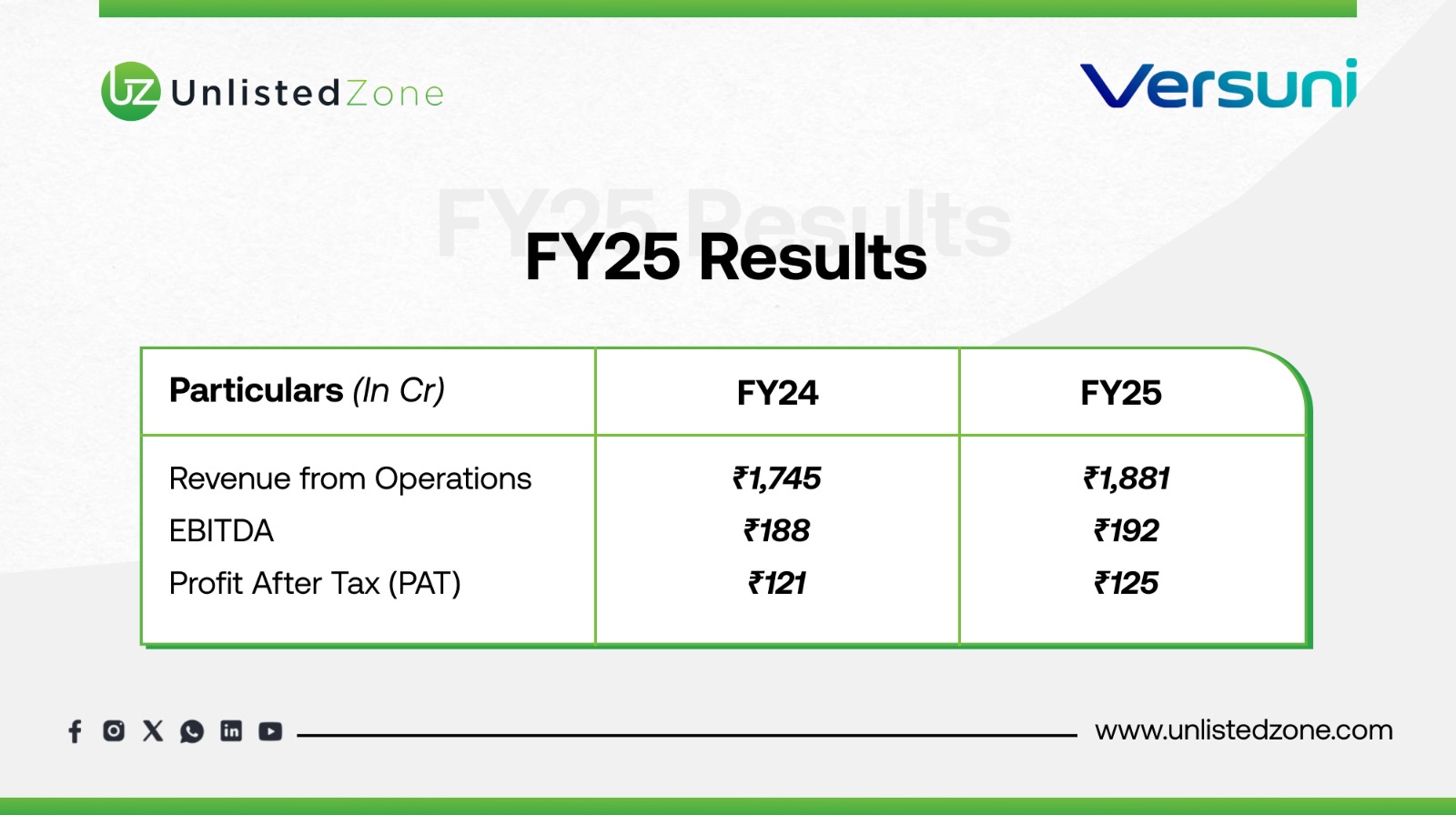

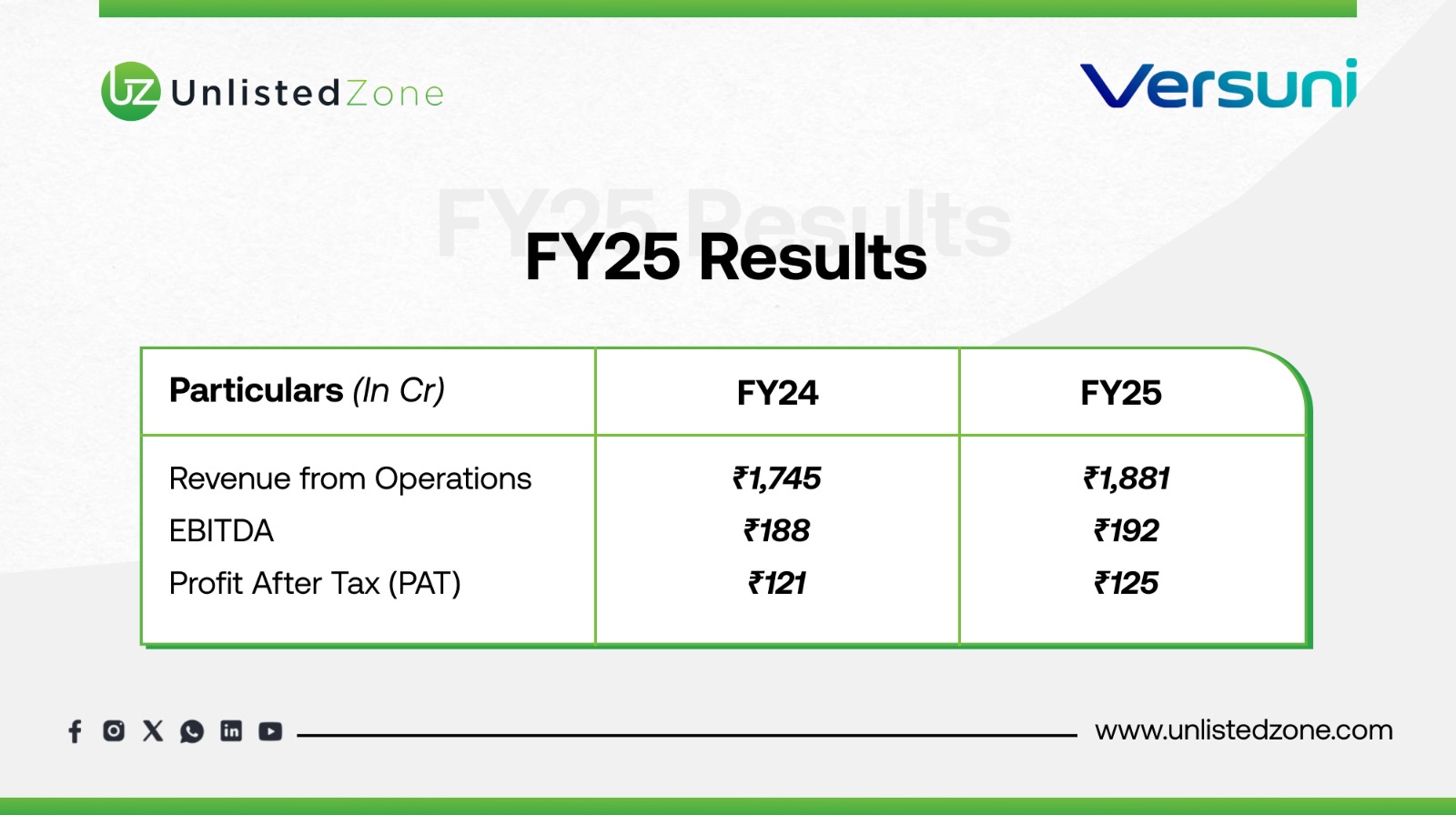

Financial Performance (FY24 & FY25)

Key Insights

-

Revenue Growth: 8% YoY in FY25, defying concerns of flat performance.

-

Profitability: PAT improved to ₹125 Cr, showing consistency.

-

Margins: EBITDA margin sustained at ~10%.

Shareholding & Equity Structure

IPO Plans

-

On August 6, 2024, Versuni’s board approved its IPO proposal.

-

The IPO will include:

-

The Draft Red Herring Prospectus (DRHP) is expected to be filed soon. Listing will depend on market conditions and SEBI approval.

Why Investors Are Eyeing Versuni’s Unlisted Shares

-

Iconic Brands: Philips & Preethi command household trust.

-

Sustainability Edge: 100% clean energy, ESG-focused operations.

-

Steady Growth: ₹1,881 Cr revenue with strong profitability.

-

IPO Trigger: Likely listing will unlock higher valuations.

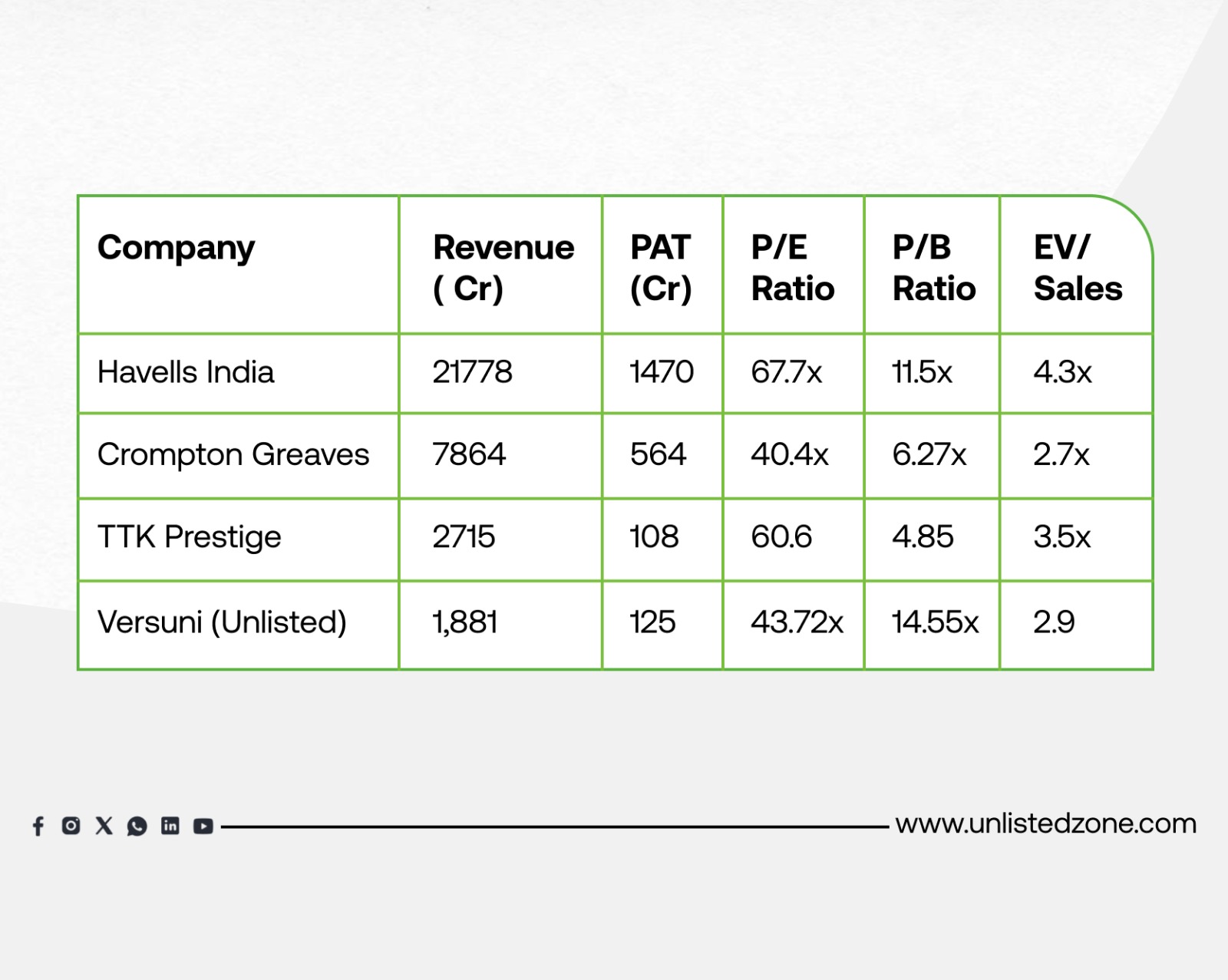

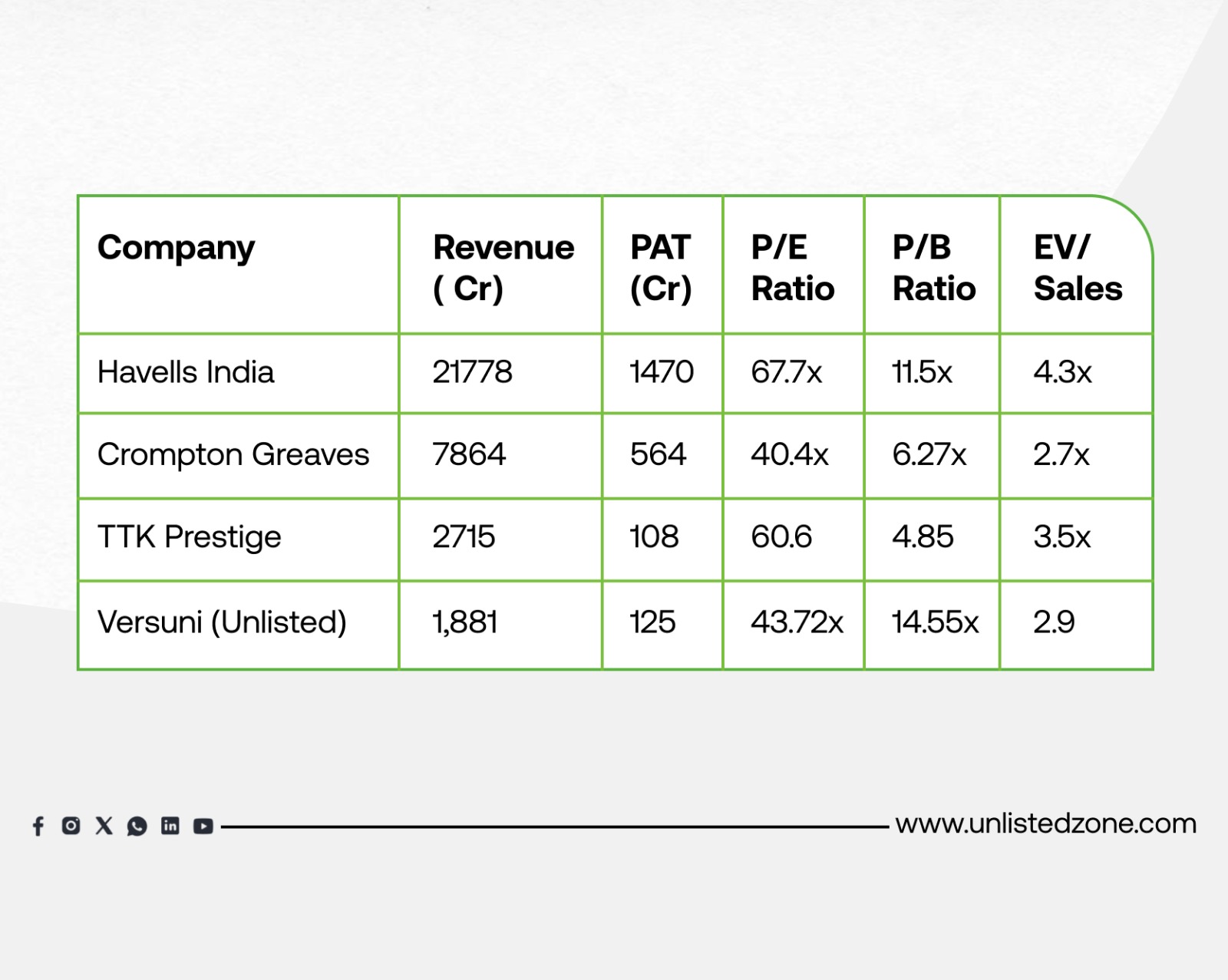

Peer Comparison Group:

Discussion on Peer Comparison

Versuni is currently trading at a discount compared to its listed peers. While Havells, Crompton, and TTK Prestige command P/E multiples ranging between 40–68x, Versuni is valued at ~43.72x on FY25 earnings. This gap suggests significant upside potential upon listing. Its strong brand equity (Philips and Preethi), consistent margins (~10% EBITDA), and ESG initiatives make it competitive in the premium appliance space. Moreover, with a diversified portfolio and expanding asset base, Versuni is well-positioned to narrow the valuation gap post-IPO.

Conclusion

With revenue of ₹1,881 Cr and PAT of ₹125 Cr in FY25, the company is well-placed for an IPO. For investors, its unlisted shares provide an early opportunity to participate in India’s growing consumer appliance story before the valuation re-rating at listing. The attractive valuation gap compared to peers makes Versuni’s unlisted shares an appealing pre-IPO investment opportunity.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.