Digantara’s $50M defence-first space bet

Indian space startup Digantara just raised $50 million in a Series B round. But instead of chasing commercial space customers, it’s doubling down on defence and missile tracking. That decision...

India’s quick‑commerce star may be preparing for its biggest delivery yet — an IPO.

Zepto is reportedly planning to file draft papers for a $500 million IPO in India as early as next week, according to people familiar with the matter. The filing is expected to happen via the confidential pre‑filing route, a mechanism that allows companies to submit documents privately before making them public.

In simple terms: Zepto wants to test investor appetite without putting everything out in the open just yet.

The proposed IPO is expected to have two parts.

First, a fresh issue of shares, which means Zepto will raise new capital for itself. This money is expected to be used mainly for expansion, especially as the company continues to invest heavily in dark stores, logistics, and delivery infrastructure.

Second, a secondary share sale, where some existing investors may sell part of their stake. This doesn’t bring money into the company, but it does allow early backers to partially cash out.

That said, discussions are still ongoing, and the final size and timing of the IPO could change.

Zepto is said to be working with a strong line‑up of investment banks, including Axis Bank, Motilal Oswal Investment Advisors, and the Indian units of Morgan Stanley, HSBC, and Goldman Sachs.

So far, Zepto and most of the banks have declined to comment, which isn’t unusual for deals at this stage.

India’s quick‑commerce sector is in hyper‑growth mode.

Consumers increasingly want groceries and household essentials delivered in minutes, not hours. To meet this demand, startups are racing to build dense networks of warehouses and delivery fleets. Global investors like SoftBank and Temasek have already poured billions of dollars into this experiment, making India the most closely watched quick‑commerce market in the world.

An IPO from Zepto would be a major signal that the sector believes it’s ready for public scrutiny.

Zepto operates in an intensely competitive landscape. It goes head‑to‑head with Amazon’s India unit and local heavyweights such as Swiggy Instamart, Zomato’s Blinkit, and Tata Group’s BigBasket.

Despite the competition, Zepto has managed to stay in focus. In October, it raised $450 million, valuing the company at around $7 billion — a lofty number for a business still prioritizing growth over profits.

But the financials reveal what that growth has cost.

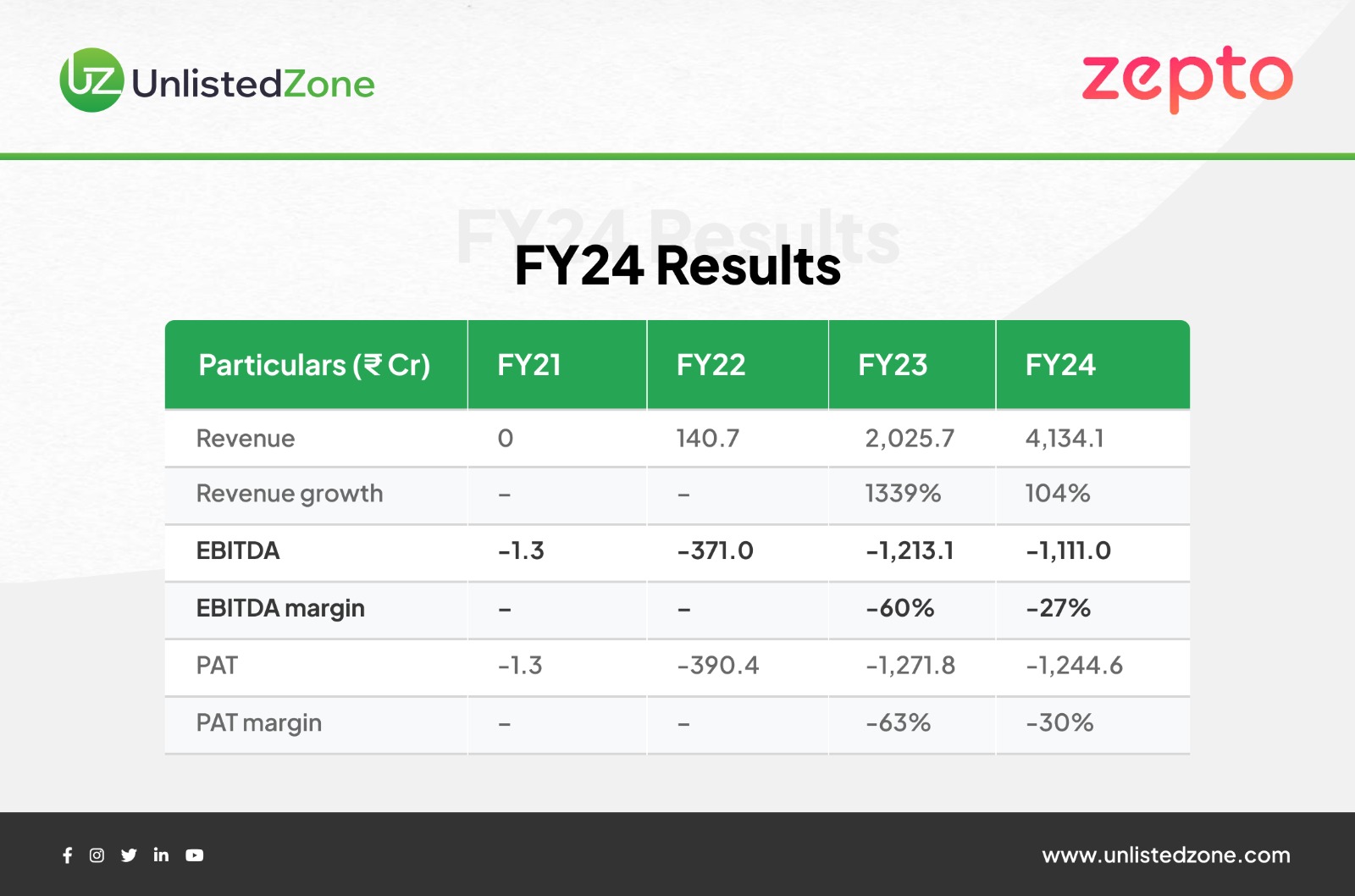

Zepto’s revenue trajectory shows explosive growth, but profitability remains distant.

Financial performance snapshot

What this tells us:

• Revenues have scaled at break‑neck speed, especially post‑FY22. • Losses peaked in FY23 and have started narrowing, but remain substantial. • Improving margins suggest operating leverage, though profitability is still far off.

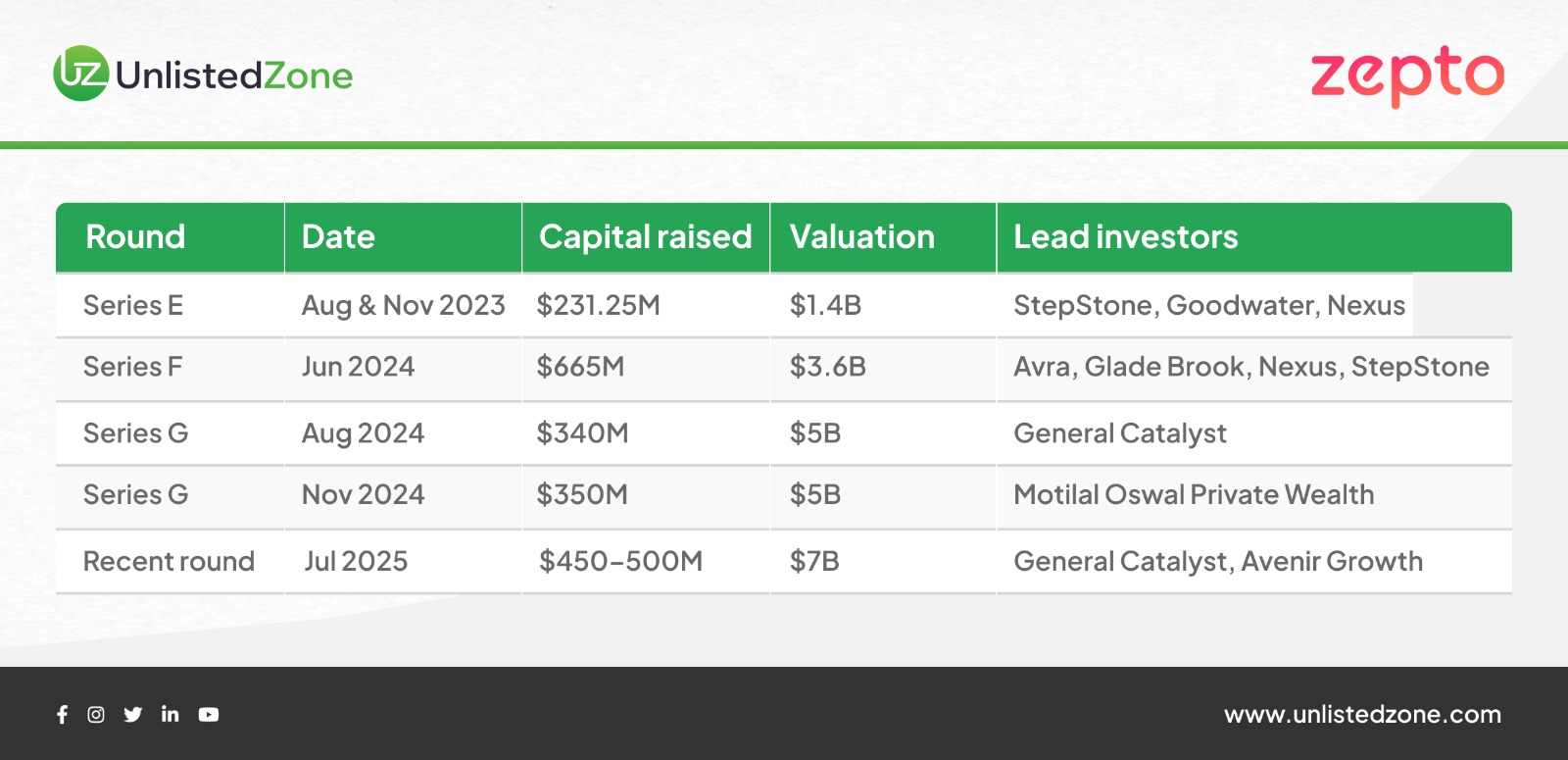

Zepto’s growth has been fuelled by a rapid series of large funding rounds.

Funding history at a glance

The takeaway:

• Valuation jumped 5× in under two years. • Late‑stage investors are doubling down despite ongoing losses. • The IPO is the natural next step for liquidity and capital recycling.

If Zepto’s IPO plans move ahead, it could become one of the most important consumer‑tech listings in India in recent years.

But public markets will ask tougher questions than private investors ever did:

Can 10‑minute deliveries scale without endless cash burn? Can speed turn into sustainable profits?

Zepto’s answer may soon be tested — live, on Dalal Street.