Company Overview & Strengths

Anugraha Valve Castings Limited (AVCL) is a Coimbatore-based steel foundry and manufacturing company, often referred to as part of South India’s “steel hub.” It specializes in producing steel castings for the valve and pump industries, using materials such as stainless steel, alloy steel, nickel-based alloy, duplex, and super duplex steel. The company operates through 4 foundries and 2 machine shops. Its promoter brings over 20 years of experience, and the business has been manufacturing and exporting since 1993. AVCL holds quality certifications including ISO 9001:2015, ISO 14001:2015, and OHSAS 18001:2007.

A) Business Model of Anugraha Valve Unlisted Shares

-

B2B Manufacturing & Export: Sells precision steel castings directly to other industrial businesses, with ~90% revenue from exports.

-

Niche Specialist: Focuses on high-quality castings for valves and pumps using specialized steels (Duplex, Stainless, etc.).

-

Value-Added Services: Provides castings in both raw and fully machined conditions.

-

Integrated Operations: Runs its own wind and solar power plants to reduce energy costs and generate extra income.

-

Relationship-Based: Relies on long-term, stable relationships with a core client base in Europe and North America.

B) Key Verticals / Segments of Anugraha Valve Unlisted Shares

1. Core Manufacturing Vertical:

-

Valve Industry Castings (for oil & gas, chemicals)

-

Pump Industry Castings (for water treatment, irrigation)

-

General Engineering Components

2. Support Vertical:

C) Key Highlights of the Year (FY 2024-25) of Anugraha Valve Unlisted Shares

-

Export Dominance: Approximately 90% of revenue is derived from exports, with a stable customer base in Germany, Italy, and France.

-

Customer Diversification: Successfully added new clients from the US, Canada, and Russia, indicating global demand growth.

-

Production Scale: The company exports over 6,000 Metric Tons of steel castings annually, with an export value exceeding $36 million.

-

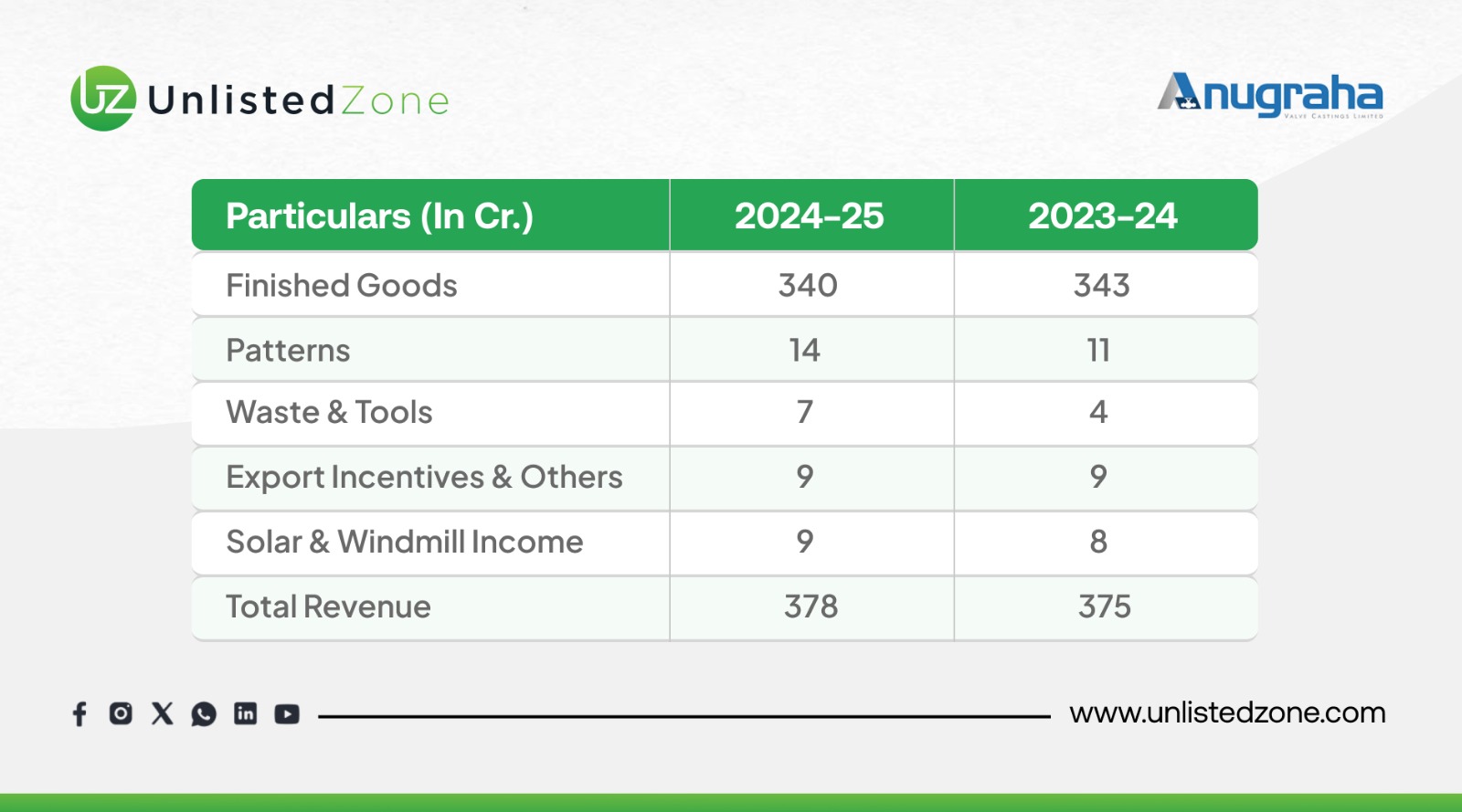

Turnover: Stable but flat growth, rising slightly to ₹ 385.75 Crores from ₹ 380.67 Crores (a minor increase of ≈0.32%).

-

Profit Dip : Profit After Tax (PAT) also fell to ₹ 19.37 Crores. The primary cause was an increase in operating costs, including raw materials and consumables.

-

Dividend: A dividend of ₹ 2.00 per equity share (a 20% payout) was recommended, with a total cash outflow of ₹ 70.53 Lakhs.

-

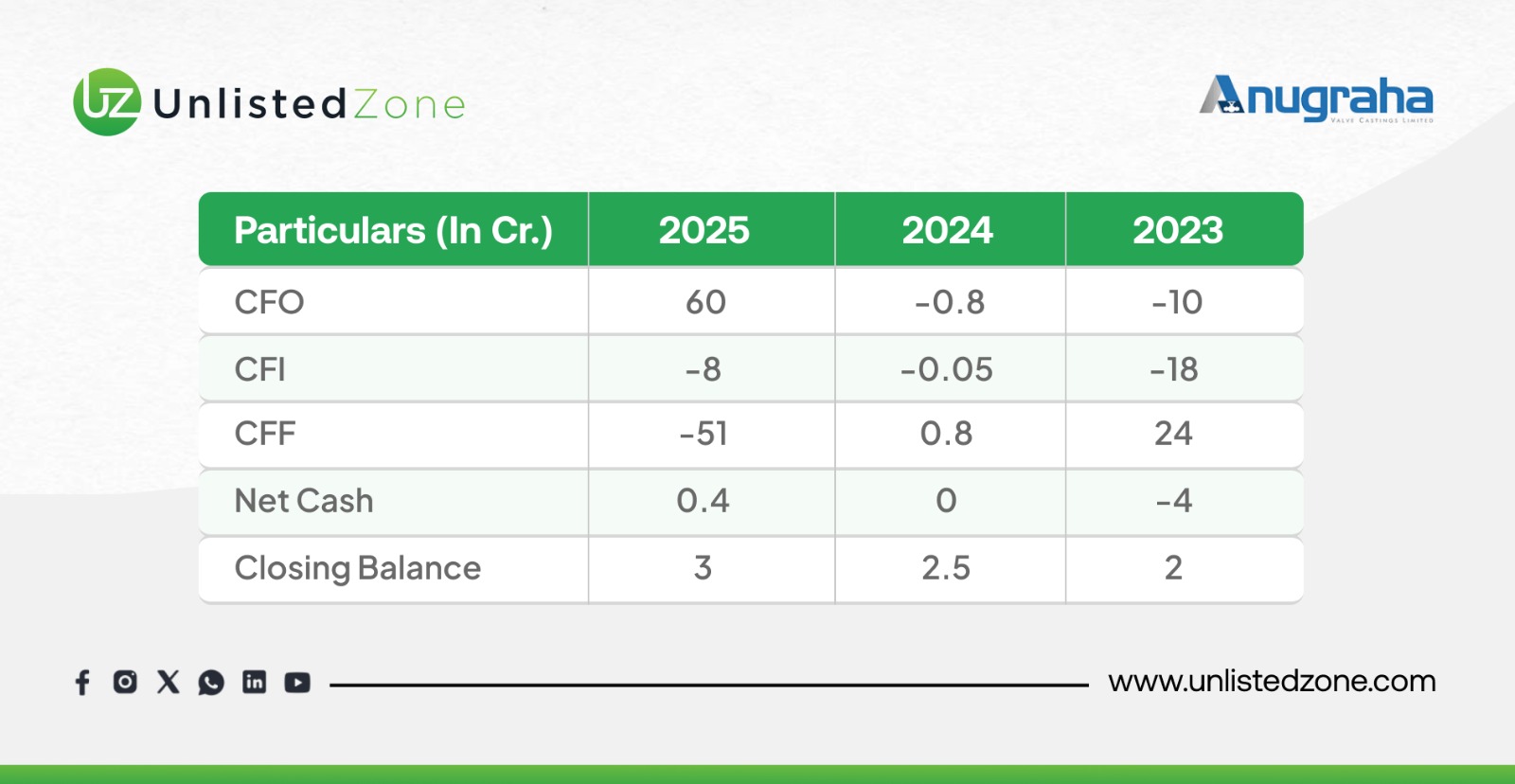

Cash Position: The company maintained a Cash and Bank Balance of ₹ 2.96 Crores as of March 31, 2025.

D) Financial Performance Snapshot of Anugraha Valve Unlisted Shares

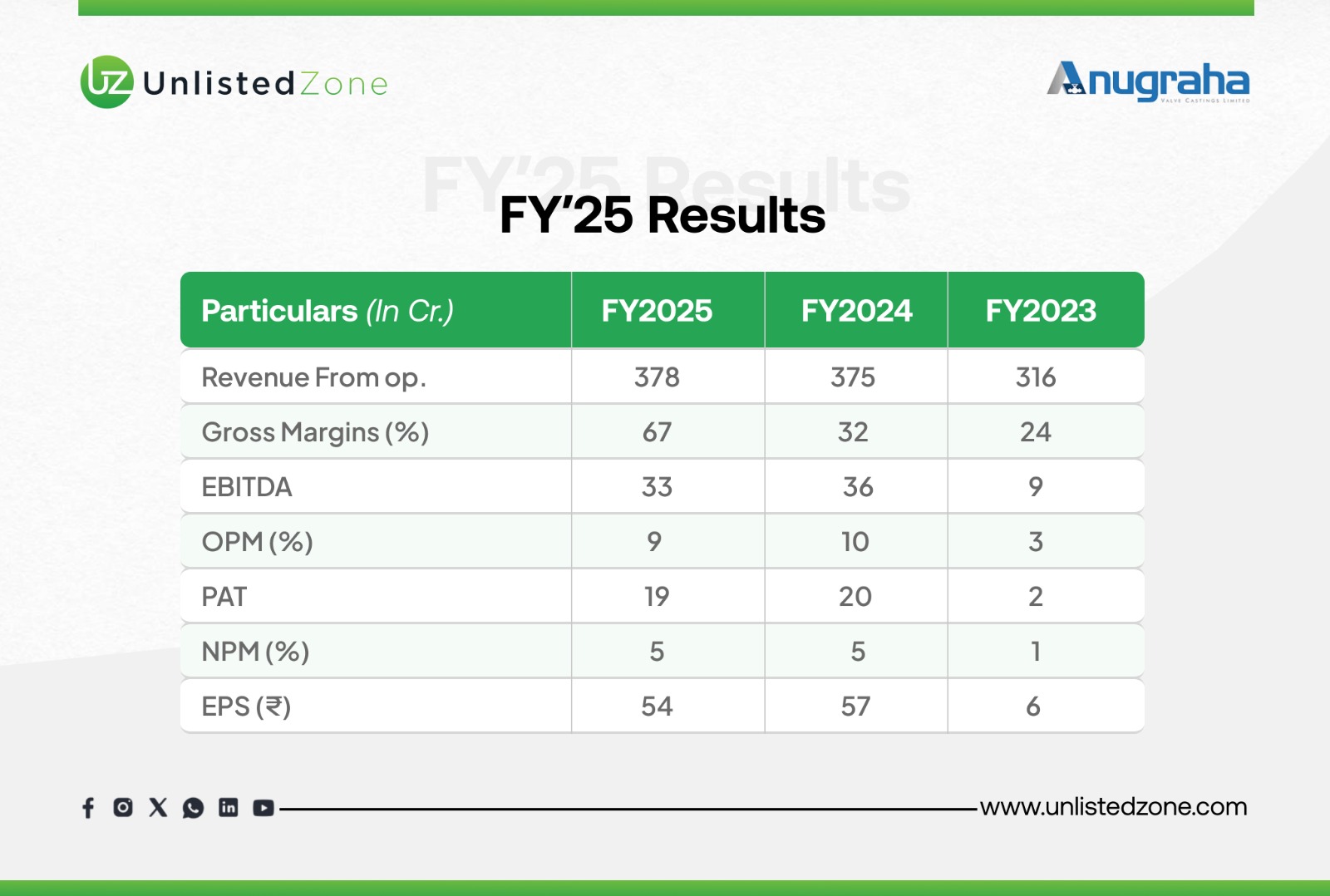

Profit & Loss Statement (₹ Cr )

-

Top-Line Growth: The company recorded significant overall revenue growth from 316 Cr in FY23 to 378 Cr in FY25. However, this growth was front-loaded, with the major jump occurring between FY23 and FY24 (316 Cr to 375 Cr), and revenue becoming nearly flat in FY25 (375 Cr to 378 Cr).

-

Profitability Transformation: This was the most striking aspect. Net Profit (PAT) and Earnings Per Share (EPS) saw a massive transformation. PAT surged from 2 Cr in FY23 to 20 Cr in FY24, before slightly easing to 19 Cr in FY25. Similarly, EPS jumped from ₹6 to ₹57, settling at ₹54.

-

Operational Efficiency: The Operating Profit Margin (OPM) improved substantially from a low of 3% in FY23 to a solid 10% in FY24, and was successfully sustained at a high level of 9% in FY25. This indicates a strong, structural improvement in operational leverage over the three years.

-

Margin Pressure: While operating efficiency improved, the company faced a persistent challenge in raw material costs, as evidenced by the sharp drop in Gross Margins from FY23 to FY24 (and continued minor erosion in FY25). This cost pressure is what prevented PAT from growing in FY25, despite the stable revenue.

Key Takeaway: Revenue remained steady (380 Cr), but margins fluctuated due to raw material costs. Profitability is stable with PAT of ₹19 Cr in FY25.

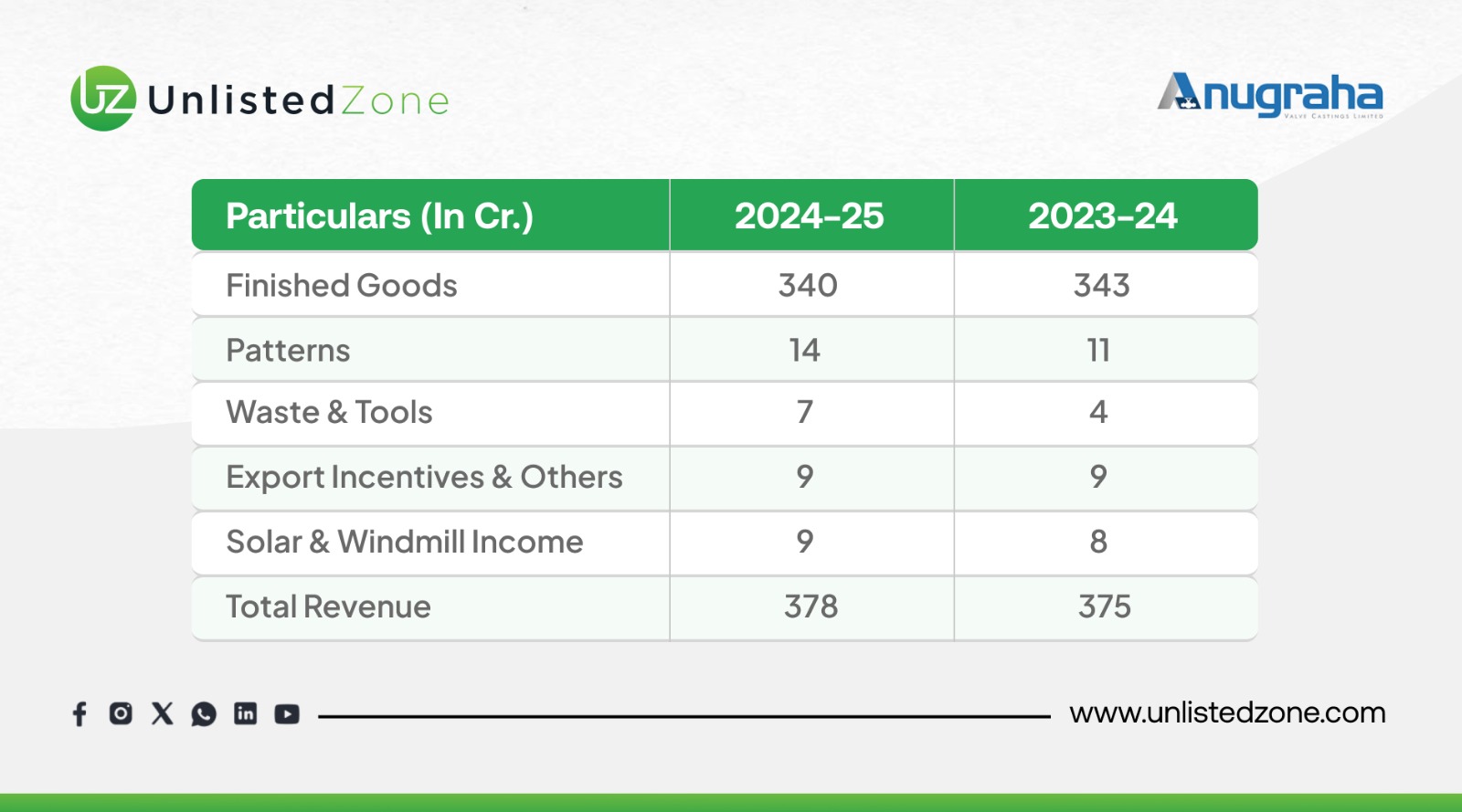

Revenue from Operations (₹Cr)

Renewable Energy Operations (in ₹ cr)

A. Wind Turbine Generator

B. Solar Plant ( IN Lakhs)

Balance Sheet (₹ Cr)

The period shows a strong focus on asset efficiency and debt reduction in the final year (FY2025).

-

Total Assets Trend: Grew significantly in FY2024 (346 Cr→ 372 Cr ), then contracted sharply in FY2025 (372Cr → 339Cr).

-

Debt Reduction (Major Highlight): Borrowings were drastically reduced in FY2025, dropping from ₹ 85 Cr to ₹ 38 Cr, significantly deleveraging the company.

-

Equity Strengthening: Total Equity and Reserves showed consistent, healthy growth every year (Reserves: 207 Cr → 246 Cr), indicating strong profit retention.

-

Inventory Efficiency: The company sharply reduced Inventory in FY2025 (91 Cr → 61 Cr), suggesting a focus on improving inventory management and liquidity.

-

Fixed Assets: The core asset base remained stable (147 Cr→ 144 Cr) after initial growth in FY2024.

-

Receivables: Remained high and steady at ₹ 106 Cr in the last two years, following a jump in FY2024.

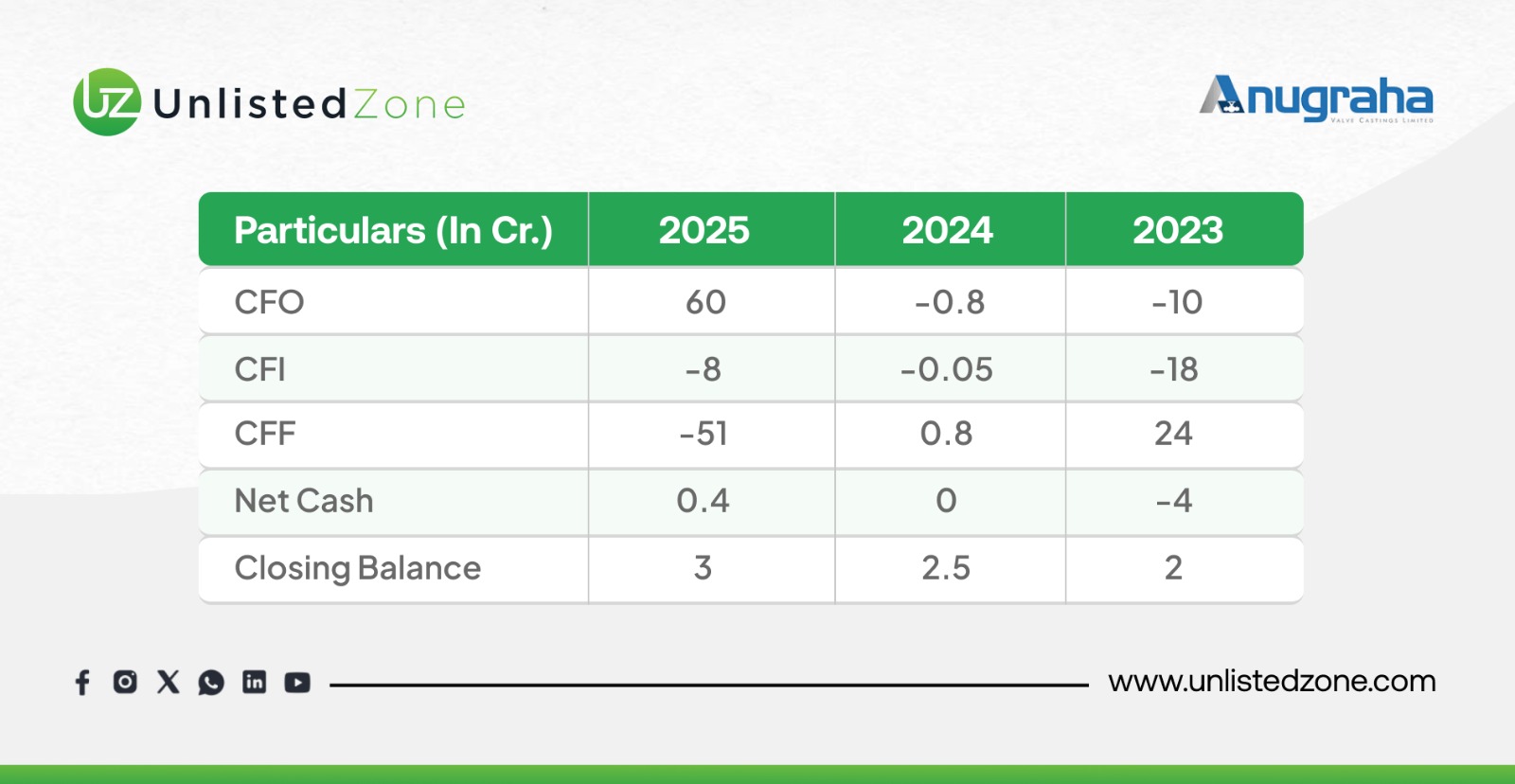

Cash Flow (₹ Cr)

Cash Flow Performance Analysis (FY2022–FY2025)

-

Operational Cash Flow (CFO) Turnaround: CFO shifted dramatically from being a cash burner (-11 Cr in FY22) to a state of near-zero cash generation (FY23/FY24) to generating massive cash (59.8 Cr) in FY2025.

-

Aggressive Deleveraging: Cash Flow from Financing (CFF) shows a sharp reversal, moving from years of taking on debt (inflows of 28.5 Cr to 5.19Cr ) to a massive net outflow of -51.24 Crin FY2025, driven almost entirely by the -47 Cr in Borrowing paydown.

-

Investing (CFI): Investment outflows were significant in FY2022/2023 but have moderated to a consistent, lower level (around -8 Cr) in the last two years.

E) Key Ratios (FY25 vs. FY24) of Anugraha Valve Unlisted Shares

-

Current Ratio: 2.30 (vs. 1.78) → +29.5% improvement in liquidity.

-

Debt-Equity Ratio: 0.15 (vs. 0.37) → -59% leverage reduction.

-

ROE: 8% (vs. 9%) → slight dip.

-

Inventory Turnover: 1.66 (vs. 1.32) → +25% efficiency gain.

-

Trade Receivables Turnover: 3.57 (vs. 3.89) → slight decline.

-

Net Profit Ratio: 5% (unchanged).

-

ROCE: 10% (unchanged).

F) Management Discussion & Analysis (MD&A)

-

Outlook: Management expects better prospects in FY2025-26 due to a significant increase in the inflow of orders.

-

Challenges: The primary challenge remains the instability in the cost of raw materials and consumables.

-

Strategy: Focus on judicious working capital management, operational efficiency, and continuous quality improvement.

G) Valuation Insights (Unlisted Market)

The company is trading in the unlisted market at a discount to its book value, indicating a potential value opportunity.

Valuation Parameter Value

Current Unlisted Share Price: ₹ 650 per share

Market Capitalization (₹ Crores): ₹ 229.23 Cr

P/E Ratio : 12.06

P/B Ratio: 0.88

Return on Equity (ROE) : 7.61%

Book Value Per Share (₹) : 735.91

Peer Comparison Insight: The P/B ratio of 0.88 suggests the market is valuing the company below its book value, which could be attractive compared to listed peers in the engineering and capital goods space that often trade at higher multiples.

H) Future Outlook

Growth Opportunities: Expansion into new geographies (US, Canada, Russia) and a strong order book provide clear growth visibility.

Industry Tailwinds: Global demand for industrial valves and pumps in the energy and chemical sectors remains stable.

Headwinds: Volatility in raw material (steel) prices and high working capital requirements due

I) Conclusion & Outlook (FY26)

AVCL has showcased resilient performance despite margin pressures from raw material costs. Key positives include:

-

Strong export base (~90% revenue from Europe & North America).

-

Stable turnover with steady profits.

-

Improved liquidity and reduced debt burden.

-

Renewable energy contribution through wind and solar operations.

The risks remain high working capital needs and customer concentration. However, with increased order inflow for FY26 and strong operational controls, AVCL is positioned for stable growth. The dividend declaration further underscores management’s confidence in cash flows and financial stability

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.