A) Company Overview & Business Model

Berar Finance Limited is a Non-Banking Financial Company (NBFC) categorized under the Middle Layer as per RBI’s Scale-Based Regulation. Its core business revolves around asset financing, with a primary focus on two-wheeler loans. The company’s target market lies in the semi-urban and rural areas of Central & Western India. Berar Finance began its journey as a personal loan provider in Maharashtra and has since evolved into a deposit-taking NBFC.

Operational & Business Data

-

Disbursement Growth: Disbursements increased by 22.67% in FY 2024-25.

-

Customer Base: Serves a growing base of approximately 2.94 lakh (294,000) customers.

-

Branch Network (as of March 31, 2025):

-

Total Branches: 134 branches + 1 Head Office.

-

State-wise Distribution: Maharashtra (41), Madhya Pradesh (24), Chhattisgarh (24), Telangana (17), Gujarat (8), Karnataka (7), Odisha (13).

-

Recent Expansion (Post-March 31, 2025): Opened 27 new branches, taking the total count to 162 branches. Expansion focused on Andhra Pradesh (9), Odisha (8), Jharkhand (3), Chhattisgarh (3), Gujarat (2), Maharashtra (1), Telangana (1).

Business Operations & Market Position

-

Products: Two-wheeler loans (mainstay), Vehicle refinance, Used car loans, Personal loans, MSME loans, LAP

-

Customer Base: 2.55+ lakh customers

-

Branches: 115+ (expanding to 162 in 2025)

-

Geography: Central & Western India, rural/semi-urban focus

-

Milestones:

-

Shifted from franchise → direct branch model

-

Raised equity from institutional investors

-

FY24 disbursements: ₹957 Cr

-

AUM (2025): ₹1,383 Cr

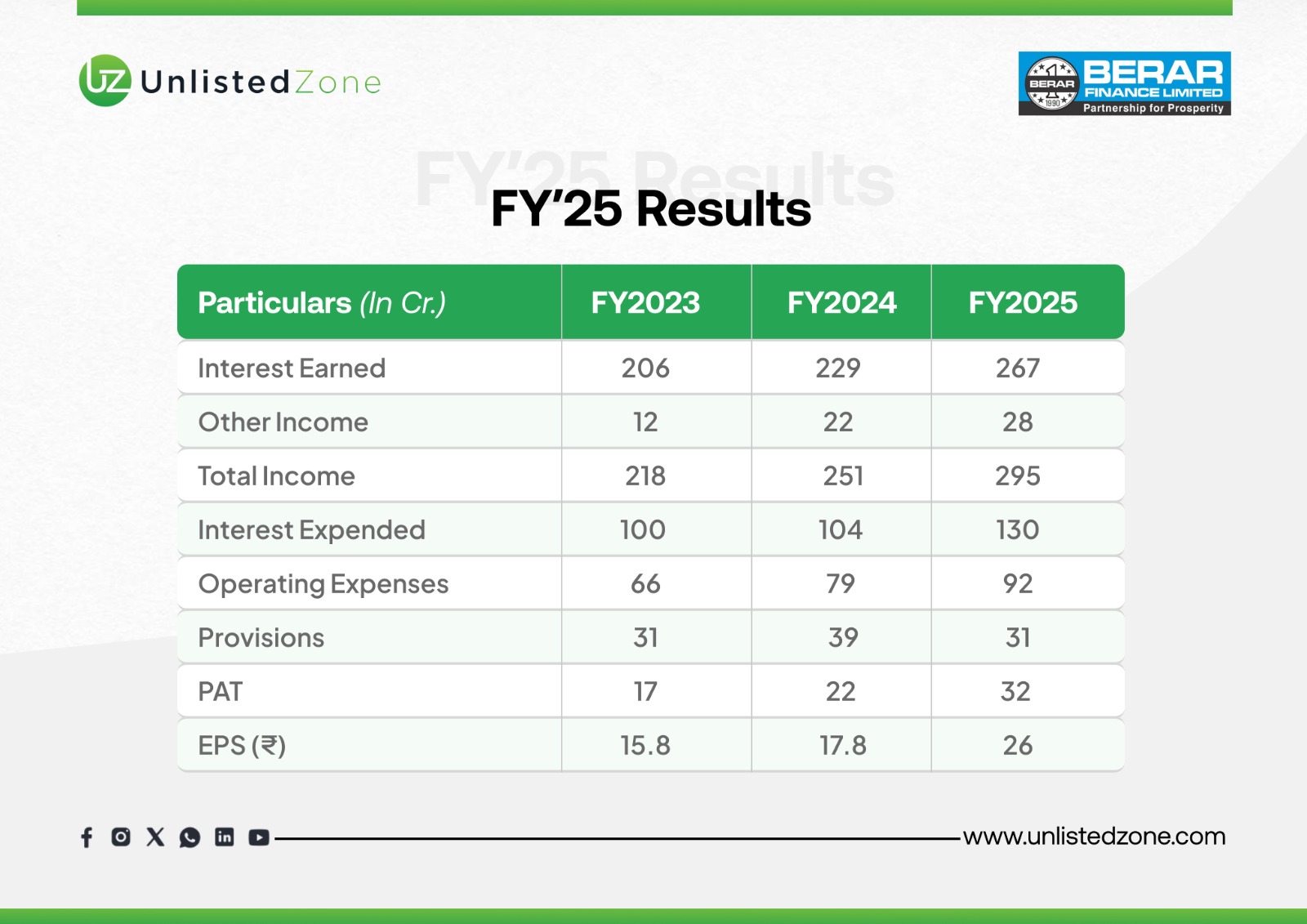

B) Financial Performance Analysis (2022–2025)

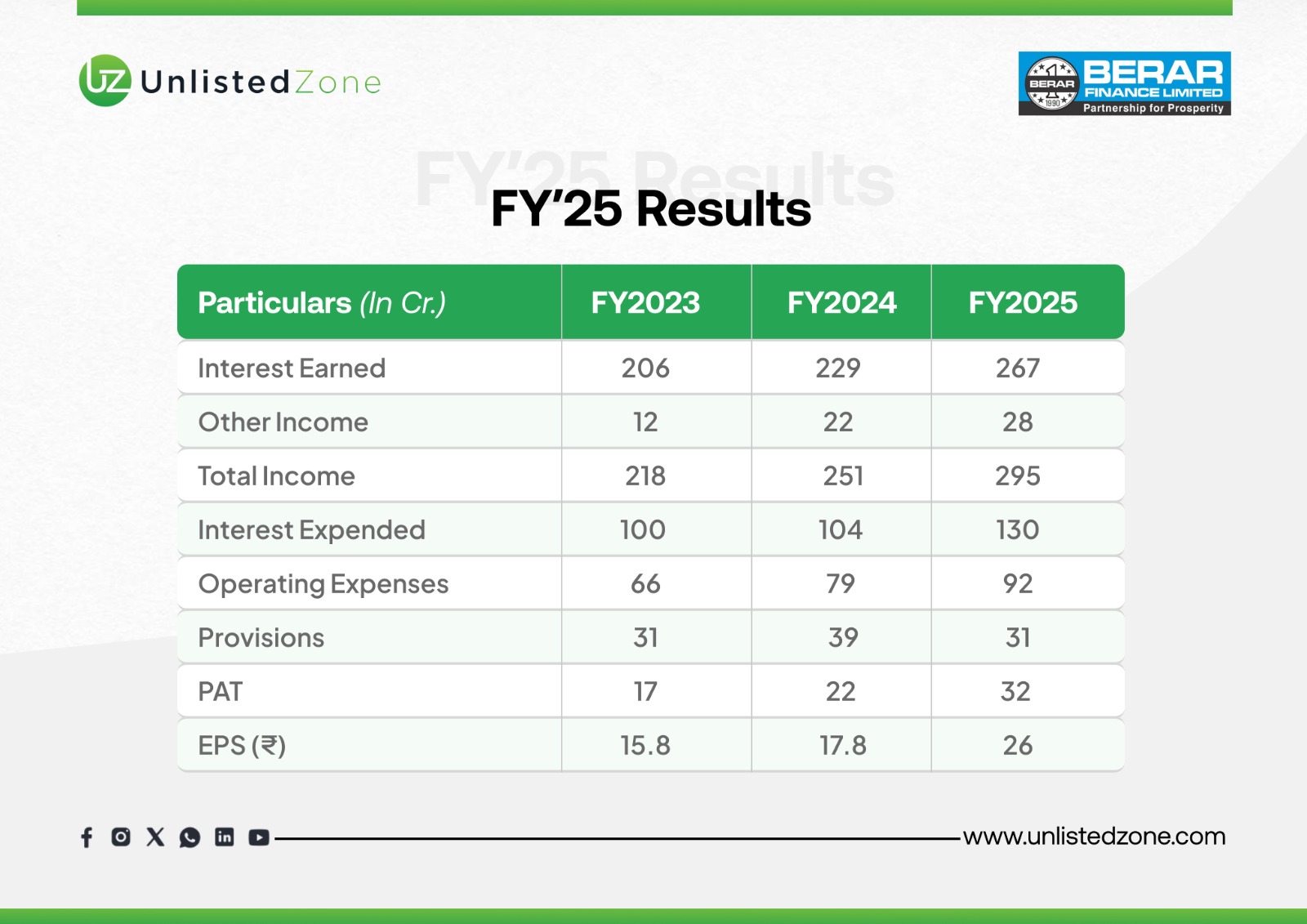

Profit & Loss Statement (₹ Cr)

Key Profitability Insights:

-

PAT Margin improved from 8.2% (2023) to 11.9% (2025)

-

Interest Spread consistently 40–42%

-

Cost-to-Income ratio improved from 33.5% → 31.2%

Segment/Division-Wise Analysis

C) Balance Sheet Analysis (2022–2025)

D) Key Financial Ratios & Metrics

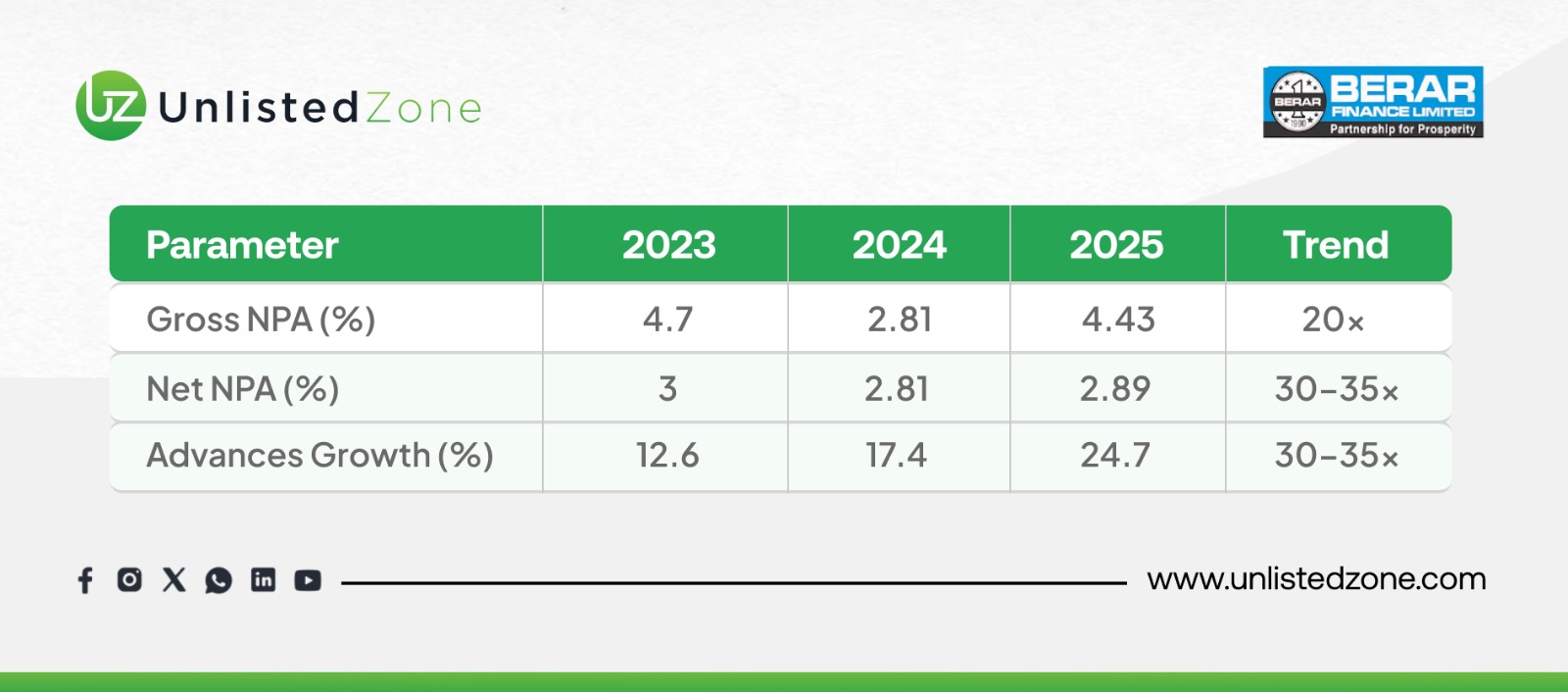

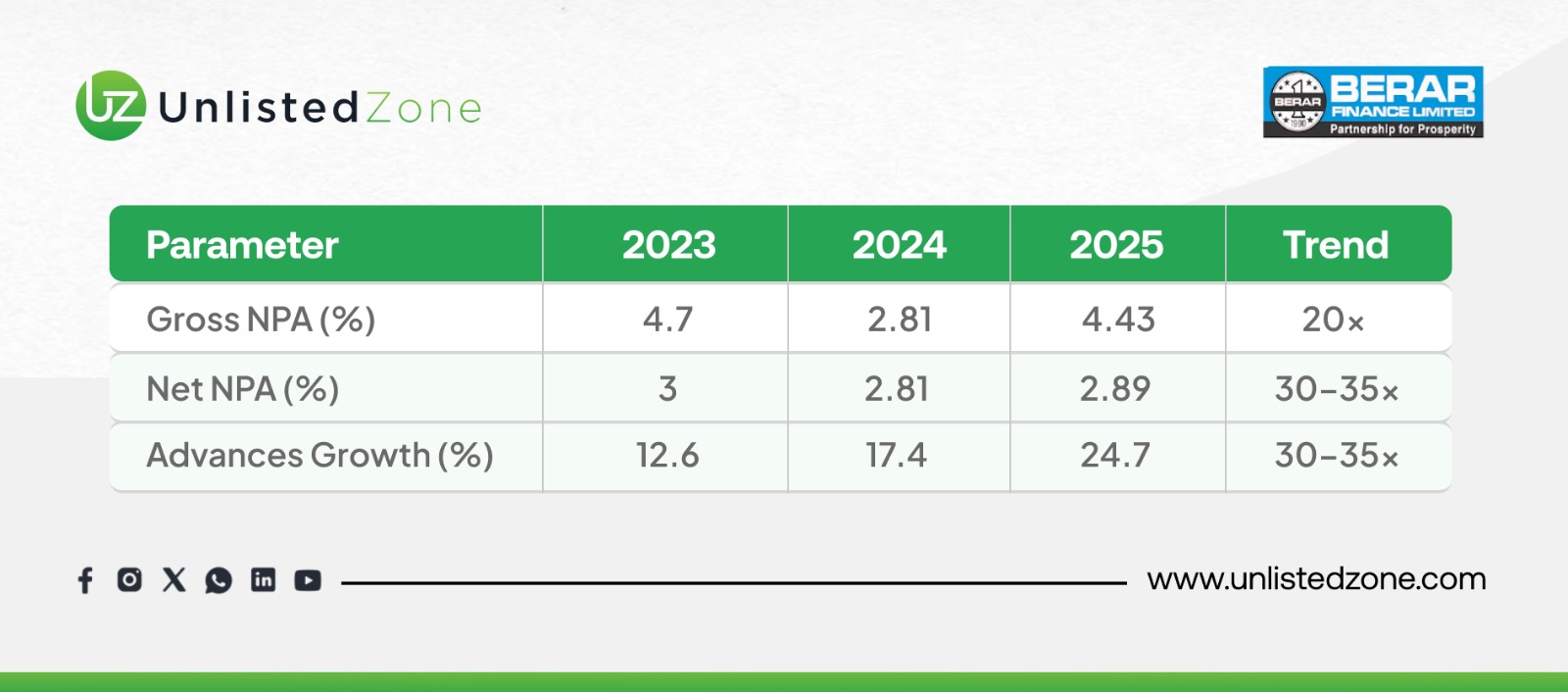

Asset Quality

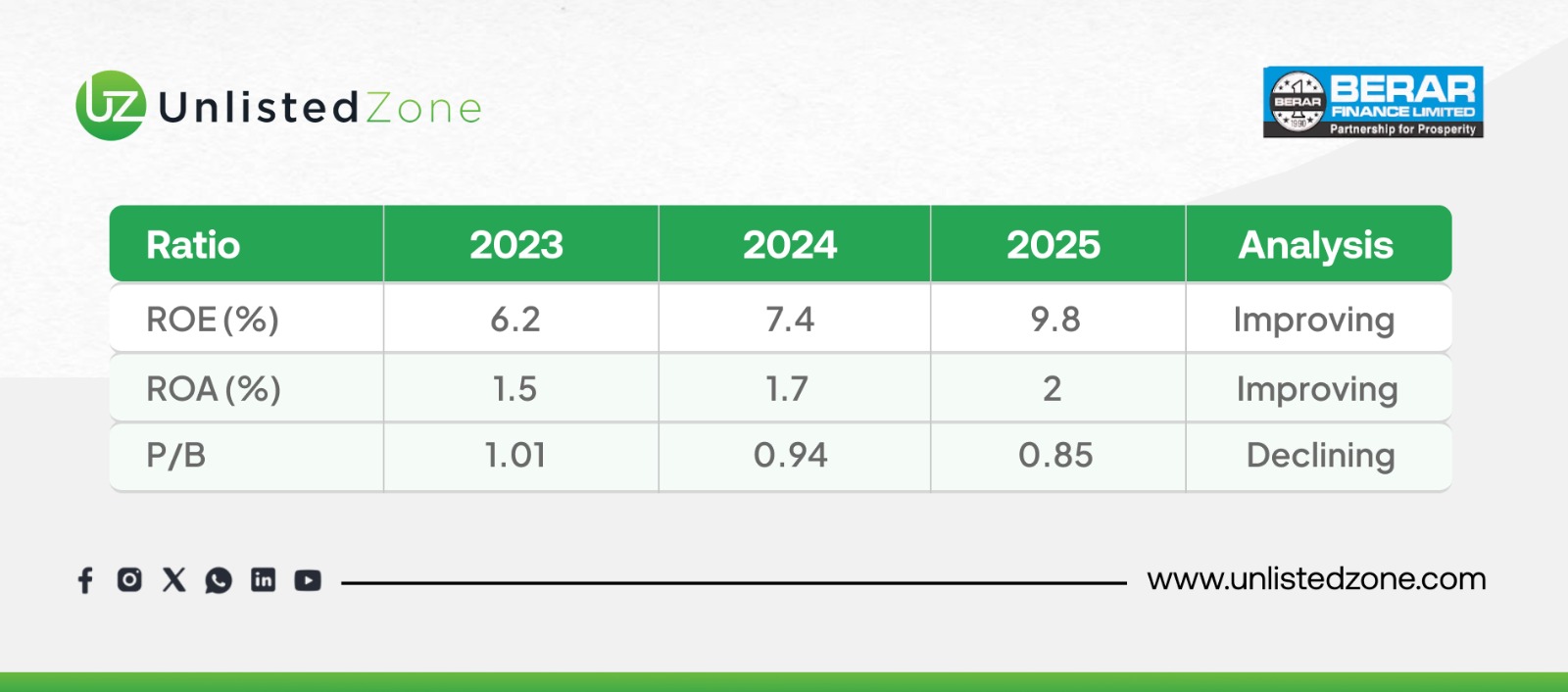

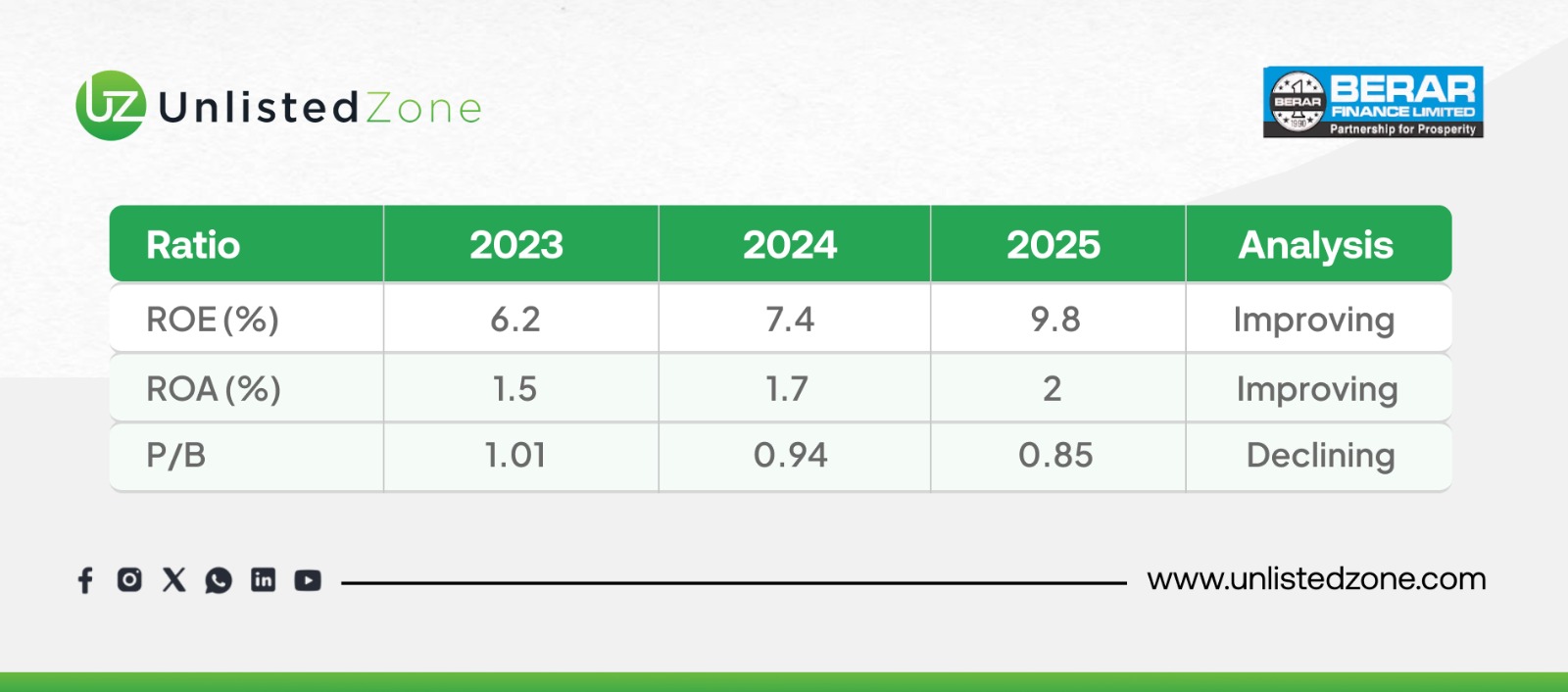

Profitability & Returns

Capital Adequacy & Liquidity

-

CAR (2025): 24.95% (vs RBI requirement: 15%) ✅

-

LCR (2025): 104.5% (requirement: 100%) ✅

-

Debt/Equity (2025): 3.1x ⚠️

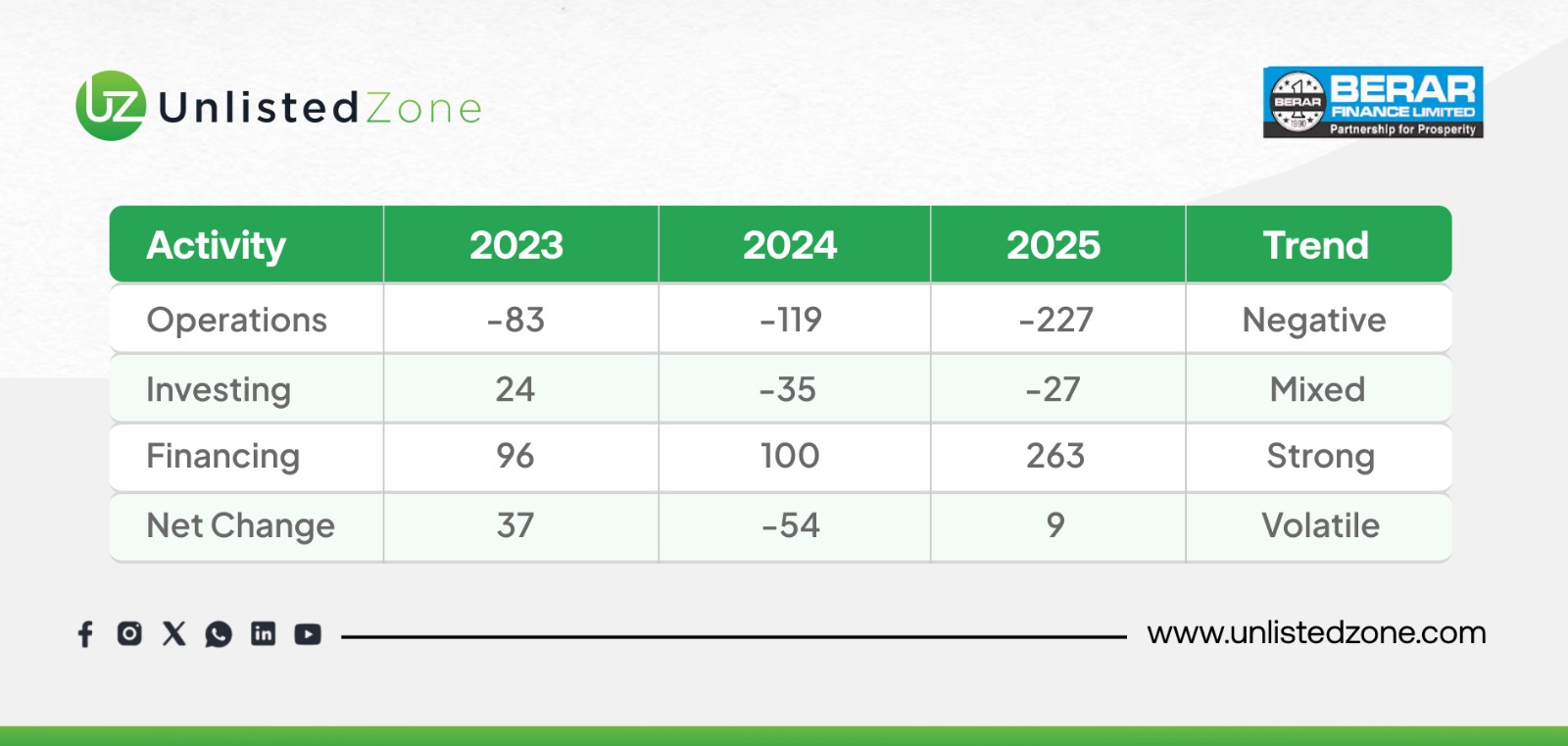

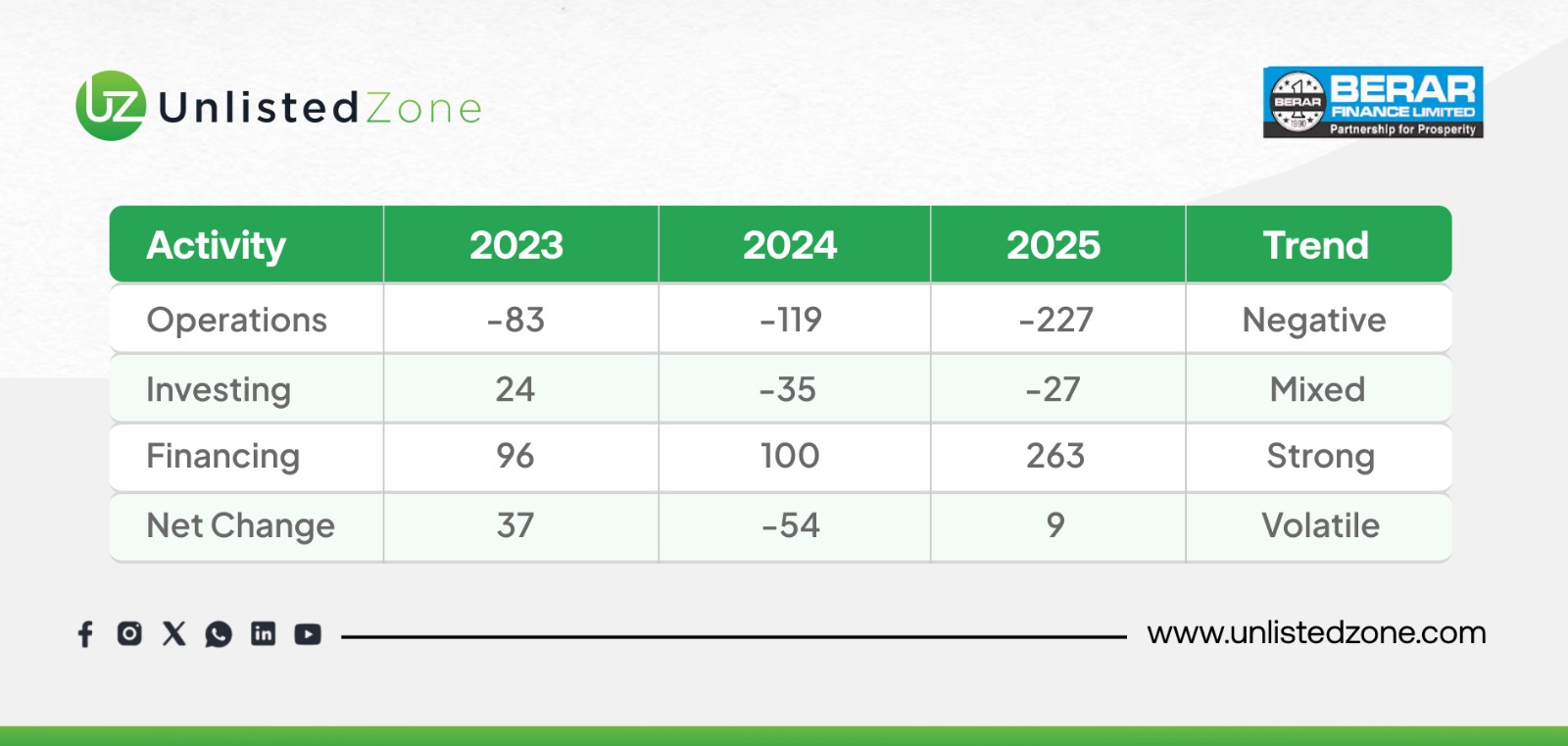

E) Cash Flow Analysis (₹ Cr)

Observation: Persistent negative operating cash flow → reflects high working capital needs due to aggressive advances growth.

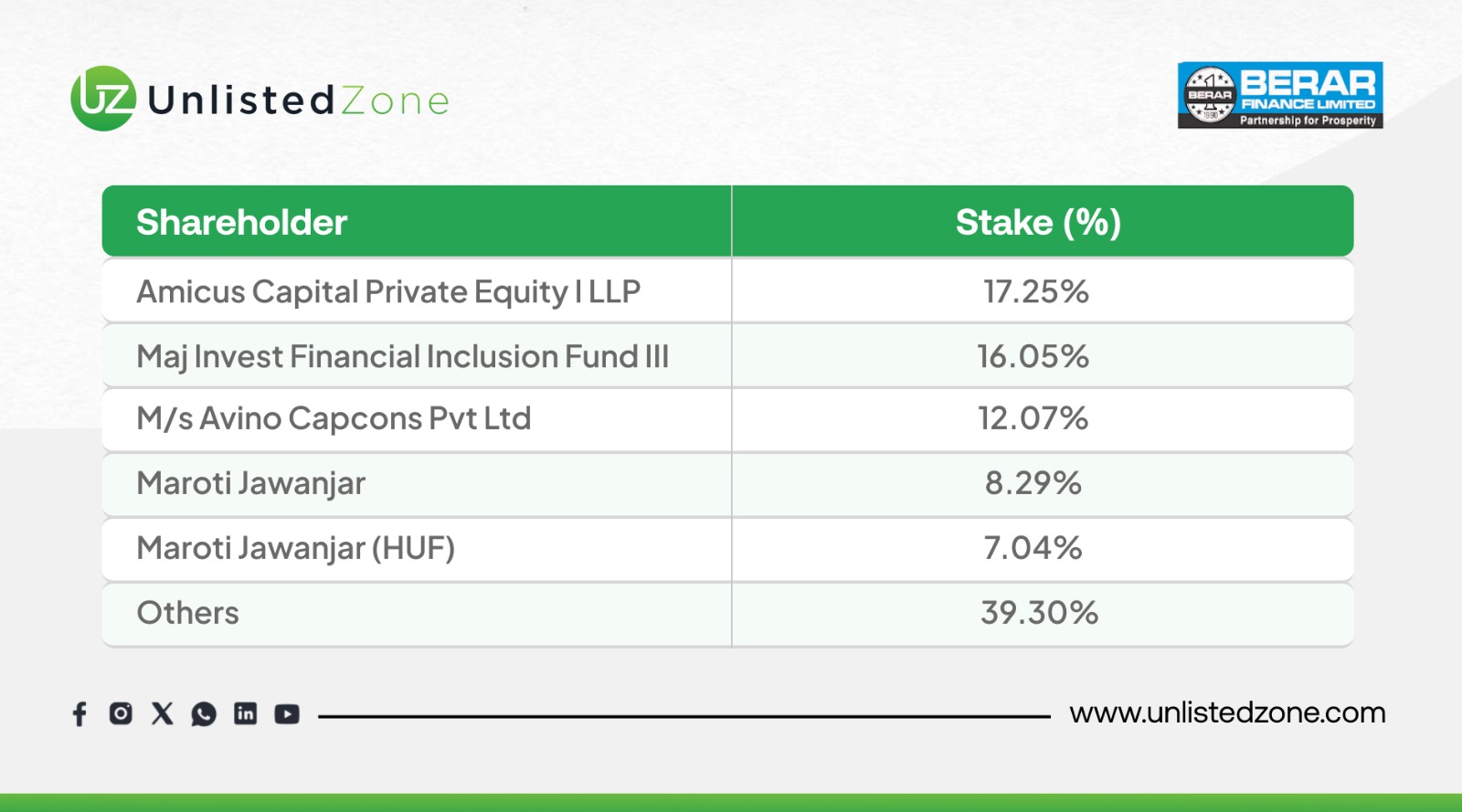

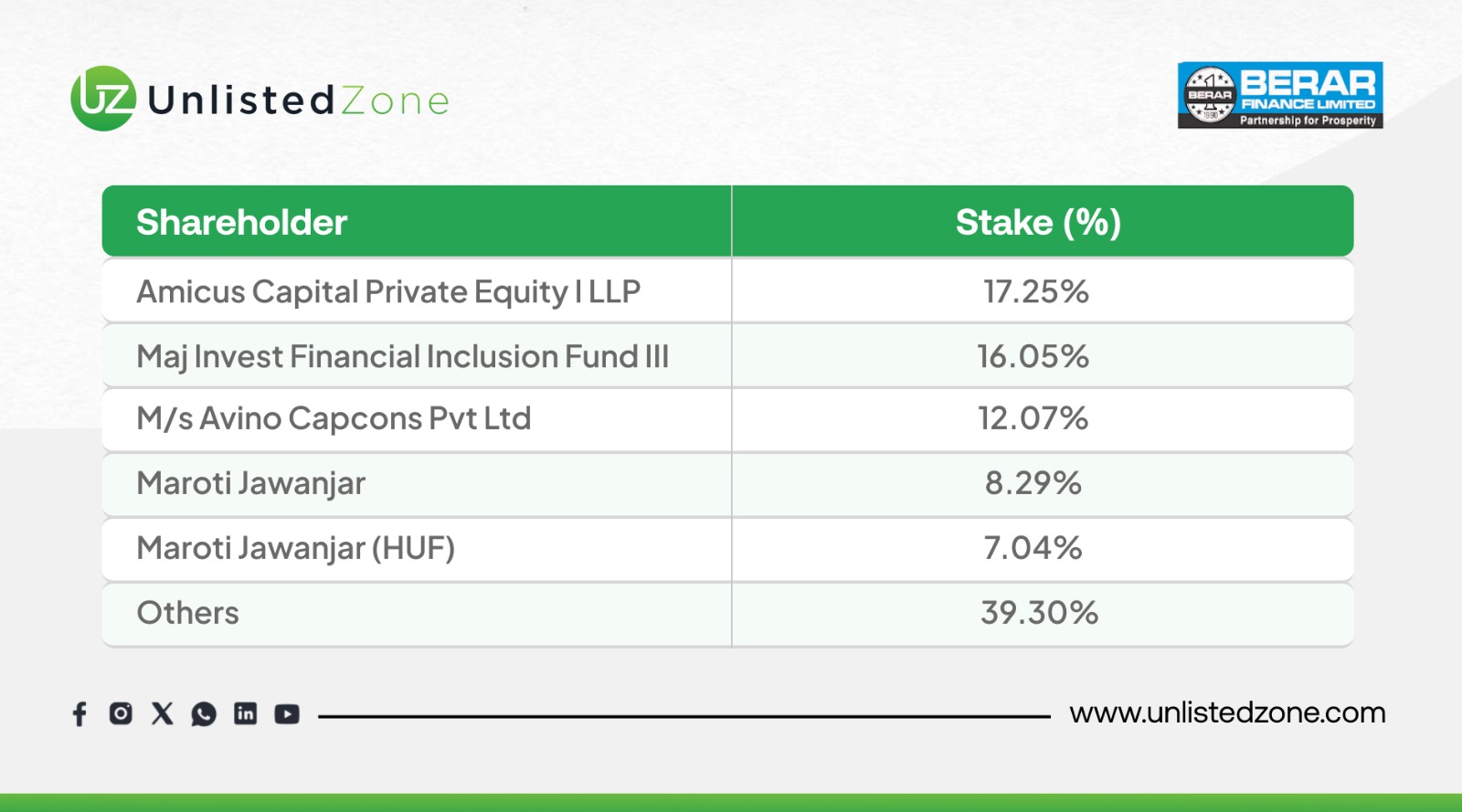

F) Shareholding Pattern (2025)

👉 Institutional Holding: 45.37% → Strong investor confidence

G) Market Valuation & Metrics (Unlisted)

-

Market Cap: ₹278 Cr

-

Price per Share: ₹225

-

P/E Ratio: 8.67 (sector avg: 15–20x)

-

P/B Ratio: 0.82 (<1 → undervalued)

-

Book Value per Share: ₹273.43

-

Debt/Equity: 3.1x

H) Management Discussion & Analysis (MD&A)

-

Market Outlook:

Management is optimistic about rural credit demand, supported by improving rural sentiment, easing inflation, and government focus on financial inclusion.

-

Risks & Challenges:

-

Strategic Roadmap:

-

Continue branch expansion in untapped regions.

-

Enhance digital capabilities for better customer acquisition and service.

-

Diversify product mix to reduce reliance on two-wheeler loans.

I) Risk Assessment

✅ Strengths

-

Strong CAR (24.95%) & liquidity

-

Rural/semi-urban stronghold

-

Diversified loan book

-

Institutional investor backing

⚠️ Concerns

🚀 Opportunities

-

Rural credit under-penetrated

-

Strong vehicle financing demand

-

Geographic expansion & digital lending

J) Growth Outlook & Strategy

-

Positive Indicators:

-

Strategic Focus Areas:

-

Branch expansion (162 by 2025)

-

Product diversification

-

Asset quality stabilization

-

Digital adoption & cost optimization

K) Investment Rationale

Bull Case:

-

Low P/E (8.7) vs sector (15–20x)

-

P/B < 1 (undervalued)

-

Strong AUM growth trajectory

-

Rural-focused growth aligned with govt policies

Bear Case:

L) Conclusion

Berar Finance is showing strong growth fundamentals with accelerating loan book, improving ROE, and a clear rural-focused strategy. However, asset quality volatility and negative operating cash flows remain red flags.

Valuation looks attractive (P/E 8.7, P/B 0.82) and institutional backing provides comfort. If asset quality stabilizes, stock re-rating potential is high.

L) Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.