Company Overview & Market Position of Fractal Analytics Unlisted Shares

Fractal.ai, co-founded by Srikanth Velamakanni and Pranay Agrawal over 25 years ago, is a client-centric powerhouse in the AI space. Operating under two segments—Fractal.ai (core AI services and products) and Fractal Alpha (independent AI businesses)—the company integrates AI, engineering, and design (AED) to deliver outsized value. Its strategic intent? To become the most respected enterprise AI company globally.

Identity: India's leading pure-play enterprise data, analytics, and AI (DAAI) company.

Global Reach: 91.6% of FY2025 revenue came from clients outside India.

Market Leadership: Recognized as a 'Leader' by Everest Group (2025) and Forrester (multiple times from 2017 to 2025).

TAM: The DAAI market stood at US$143 billion (₹12 trillion) in FY2025 and is projected to grow to US$310 billion (₹23 trillion) by FY2030 (CAGR 16.7%).

Growth vs Market: Fractal’s revenue CAGR of 18.0% (FY2023–FY2025) outperformed the global DAAI market CAGR of 11.0%.

Fractal.ai operates as a leading global pure-play provider of data, analytics, and artificial intelligence (DAAI) solutions. Its business model is centered on delivering end-to-end AI transformation for large enterprises, leveraging deep industry expertise and a robust portfolio of proprietary AI products and services.

1. Core Business Model & Strategy of Fractal Analytics Unlisted Shares

Fractal.ai's model is built on a dual-segment strategy that balances established service delivery with strategic innovation.

a) Fractal.ai Segment (Core Business):

This is the profitable, revenue-generating core of the company. It provides comprehensive AI solutions through a hybrid approach:

-

AI Services: High-value consulting and custom implementation across the AI lifecycle, from strategy to deployment.

-

AI Products: A suite of proprietary, agentic AI platforms under the Cogentiq brand, designed for specific enterprise functions (e.g., Cogentiq Business Insights for decision intelligence, Cogentiq CX for contact center optimization).

b) Fractal Alpha Segment (Strategic Incubator):

This segment functions as an R&D and innovation engine focused on developing next-generation AI products and foundational models (e.g., Kalaido.ai, Vaidya.ai). It is strategically designed to operate at a loss, funding long-term growth and market expansion.

Key Strategic Pillars:

-

Client-Centricity: Focus on long-term partnerships with "Must-Win Clients" (MWCs)—large enterprises with significant revenue or market capitalization.

-

Integrated Capabilities: Combines AI, Engineering, and Design (AED) to deliver solutions with high adoption and business impact.

-

Innovation-Led Growth: Sustained investment in R&D (~5% of revenue) and strategic acquisitions to expand capabilities and market reach.

-

Global Delivery: A predominantly international revenue base (91.6% from outside India) supported by partnerships with leading technology providers (e.g., Google Cloud, OpenAI).

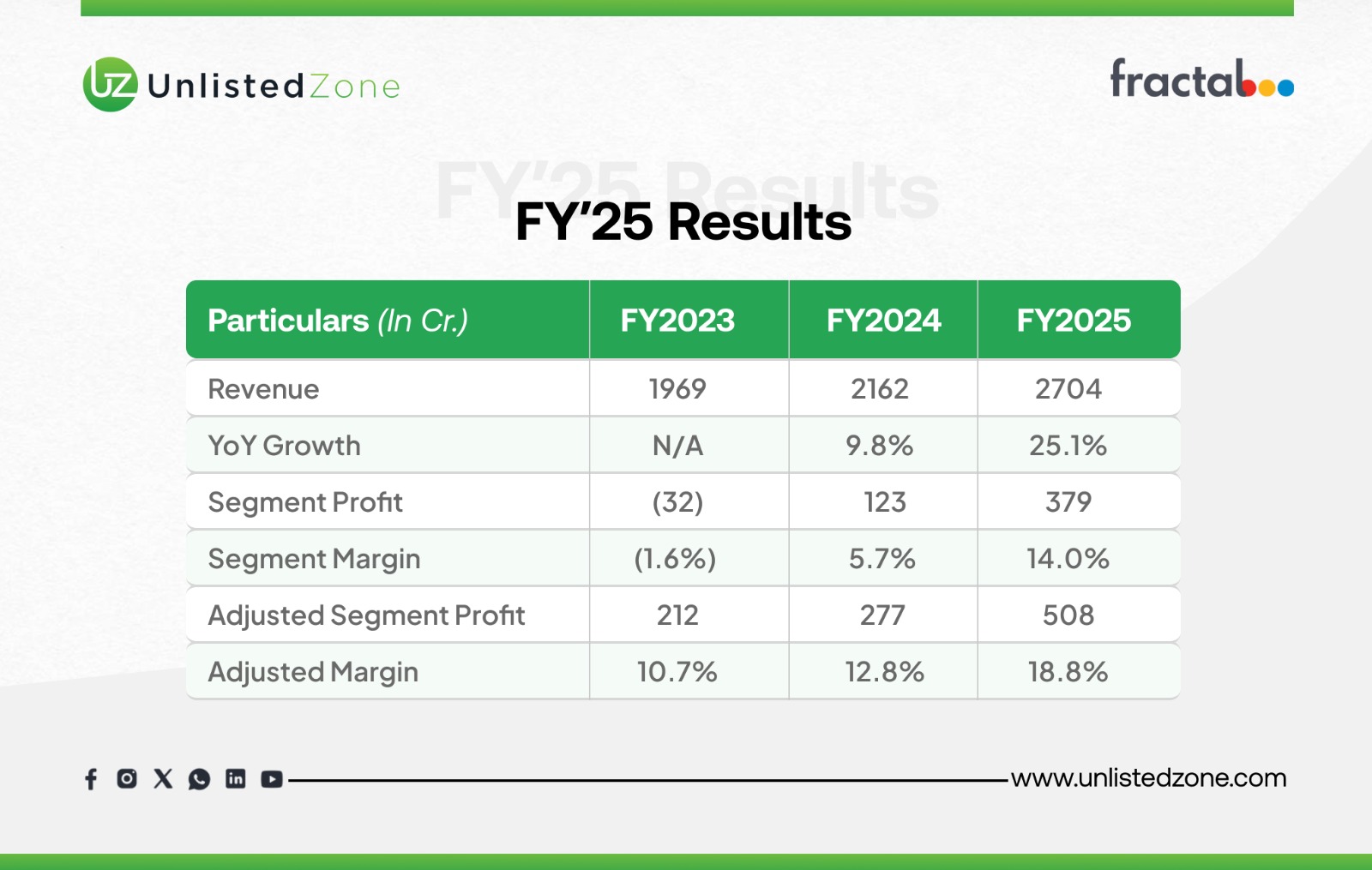

2. Financial Performance (Fractal.ai Segment - Core Business)

Core Segment: Main revenue driver and profitable business unit.

Revenue by Industry (Cr) oF Fractal .ai in FY 2025

-

CPG: 1062 (39.3%)

-

TMT: 809 (29.9%)

-

HLS: 375 (13.8%)

-

BFSI: 298(11.0%)

-

Others: 161 (6.0%)

Revenue by Geography (Cr) oF Fractal .ai in FY 2025

Americas: 1799 (66.5%)

3. Financial Performance (Fractal Alpha Segment)

R&D and incubation arm, currently loss-making but improving.

4. Client Base & Relationships of Fractal Analytics Unlisted Shares

Marquee Clients: Citi, Costco, Franklin Templeton, Mars, Mondelez, Nationwide, Nestle, Philips.

Industry Penetration: Serves top-tier clients across industries (10 of top 20 CPG, 8 of top 20 TMT, 10 of top 20 HLS, etc.).

Client Retention: Net Revenue Retention: 121.3% (FY25), 110.2% (FY24), 151.0% (FY23).

Top 10 Clients: Contributed 53.8% of FY25 revenue; average relationship length 8+ years.

NPS: 77 (consistently high satisfaction).

5. Key Products & Platforms (Cogentiq Suite) of Fractal Analytics Unlisted Shares

-

Cogentiq: Core agentic AI platform.

-

Business Insights: Conversational data query platform.

-

CX Suite: Virtual assistants and live call assist tools.

-

Campaign Assist: AI-driven marketing personalization.

-

Sales Assist: Sales intelligence for BFSI.

-

Digital Commerce: Tools for e-commerce and digital marketing.

6. Innovation & Intellectual Property of Fractal Analytics Unlisted Shares

R&D Investment: ₹144 Cr in FY25 (5.2% of revenue).

Patents: 24 granted, 41 pending (as of Aug 2025).

Key Innovations:

-

Kalaido.ai (diffusion model for text-to-image)

-

Vaidya.ai (medical multimodal foundation model)

-

Project Ramanujan (reasoning models; Meta HackerCup winner)

-

Fathom-R1-14B (open-source large reasoning model)

7. Human Resources & Culture of Fractal Analytics Unlisted Shares

Headcount: 5,254 (March 2025).

Selectivity: 1,514 hires from 195,707 applications (0.8% acceptance rate).

Attrition: 16.3% (FY25).

Culture: Certified "Great Place to Work" (India, 2018-2025; 6 other countries).

Ratings: Glassdoor 4.2/5 (overall), 4.4/5 (culture & values).

8. Growth Strategy of Fractal Analytics Unlisted Shares

-

Expand and deepen "Must-Win Clients" (113 accounts).

-

Strengthen AI research and innovation.

-

Foster a top-tier work culture.

-

Build partnerships (Google Cloud, OpenAI, C3 AI).

-

Strategic acquisitions (₹5,581 million invested FY22–FY25 in Senseforth.ai, Neal Analytics, etc.).

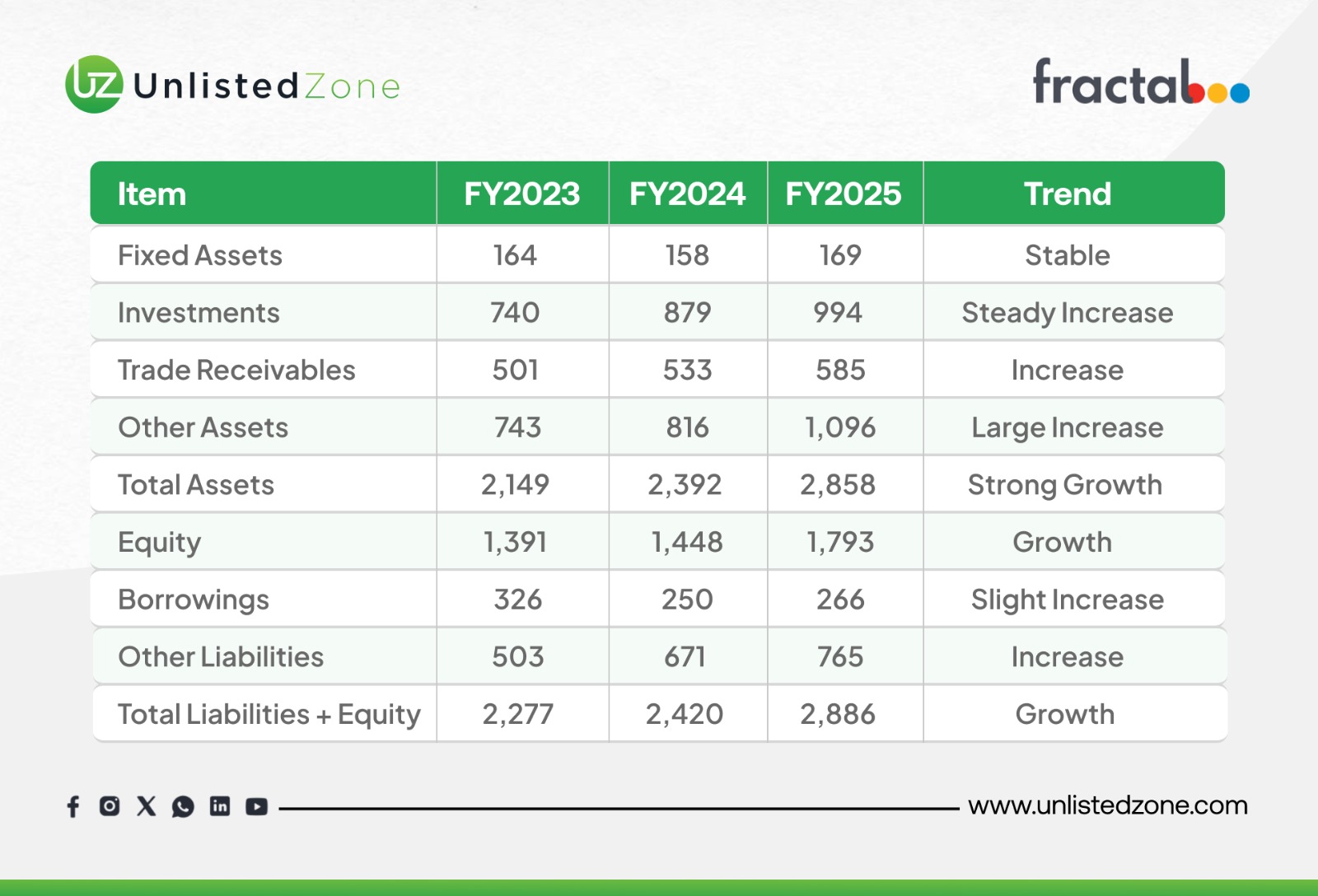

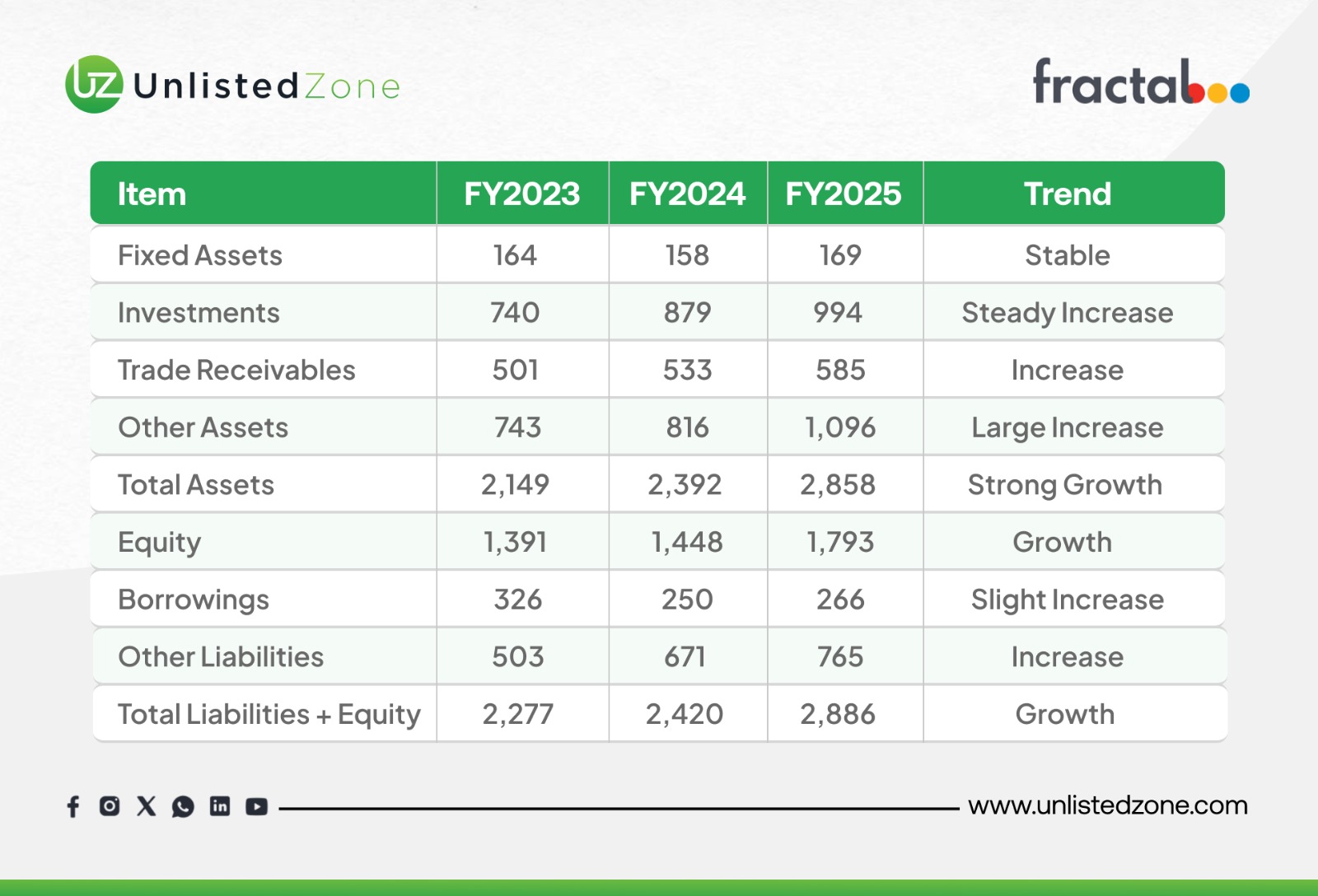

9. Balance Sheet Analysis (in ₹ Cr) of Fractal Analytics Unlisted Shares

Key Takeaways:

-

The company is growing its asset base significantly, with a 33% increase from 2023 to 2025.

-

Growth is driven by increases in Investments, Other Assets, and Trade Receivables.

-

CWIP increased 20x from 2023 to 2025, indicating major ongoing capital projects.

-

The company is strengthening its equity base, with Reserves growing significantly.

-

Borrowings were reduced in 2024 but saw a slight uptick in 2025.

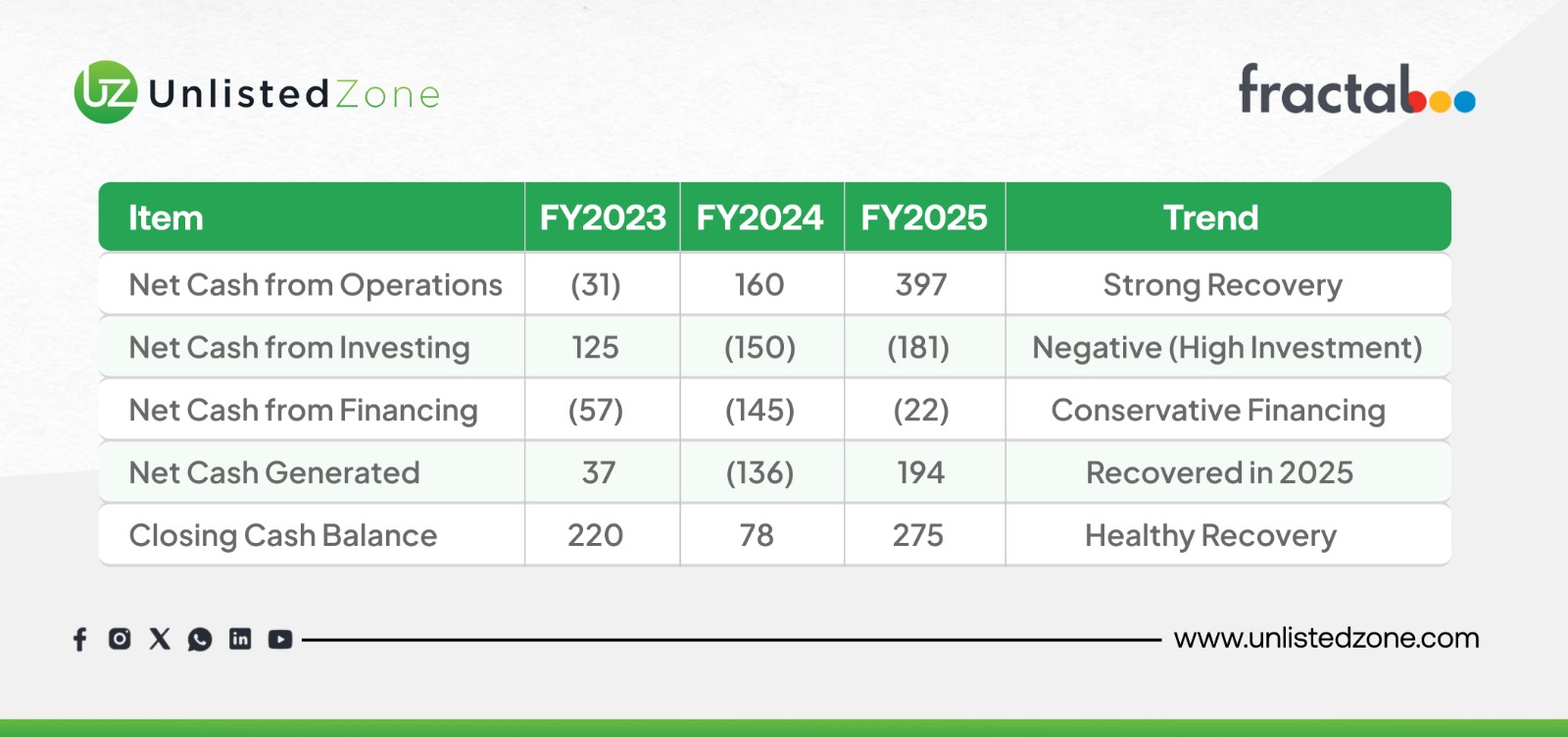

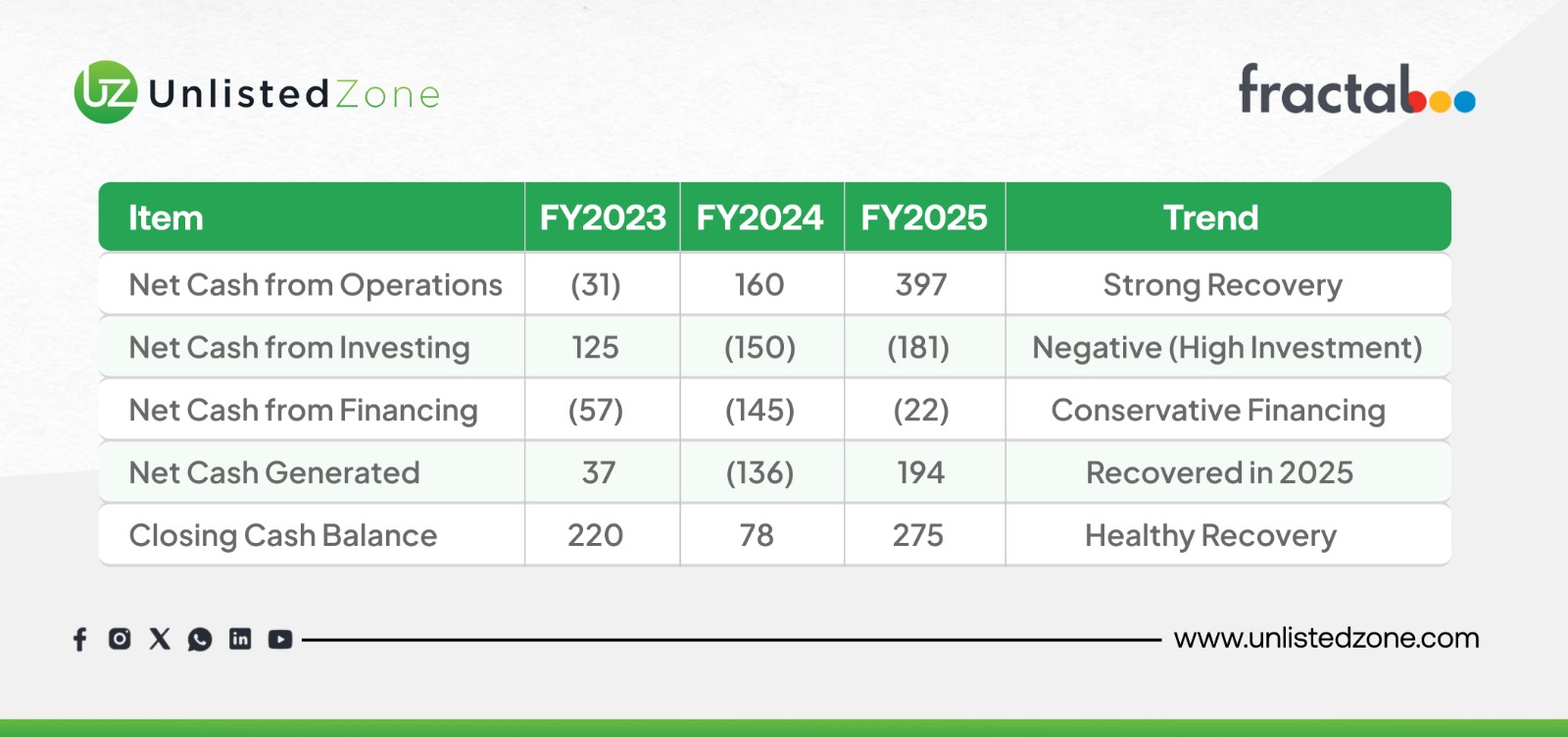

10. Cash Flow Summary (in ₹ Cr) of Fractal Analytics Unlisted Shares

Highlights:

-

2025 was a standout year: The company generated strong positive cash flow from operations (₹397 Cr).

-

Investment is high: The company is consistently investing heavily in its future (negative investing cash flow), which aligns with the rising CWIP on the balance sheet.

-

Financing is conservative: The company is a net repayer of debt and relies on its own operations and minor equity issuance for funding.

-

Cash Balance: After a dip in 2024, the cash balance recovered to a healthy ₹275 Cr in 2025.

Conclusion

Fractal.ai has established a resilient and scalable business model. Its core Fractal.ai segment is a high-growth, profitable engine, while the Fractal Alpha segment represents a strategic bet on future technology leadership. The company's focus on deep client relationships, integrated technical capabilities, and sustained innovation positions it to continue capitalizing on the expanding global DAAI market.

Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.