Business Model Overview Hero FinCorp Limited is a leading Non-Banking Financial Company (NBFC) in India, offering a wide array of retail, corporate, and SME lending products. Its portfolio includes two-wheeler financing, personal loans, loans against property, used car financing, SME loans, and corporate loans. A significant revenue driver comes from financing Hero MotoCorp customers, ensuring a strong retail foothold. Additional income streams include insurance commissions, investment income, and fees from value-added services, making it a well-diversified NBFC.

Key Revenue Streams

-

Interest Income – Generated from retail, SME, and corporate lending.

-

Insurance Commission – From cross-selling insurance products.

-

Profit on Sale of Investments – Gains from investment disposals.

-

Other Charges – Processing fees, penalties, and service charges.

-

Gains on Derecognition of Financial Instruments – From loan portfolio restructuring or sale.

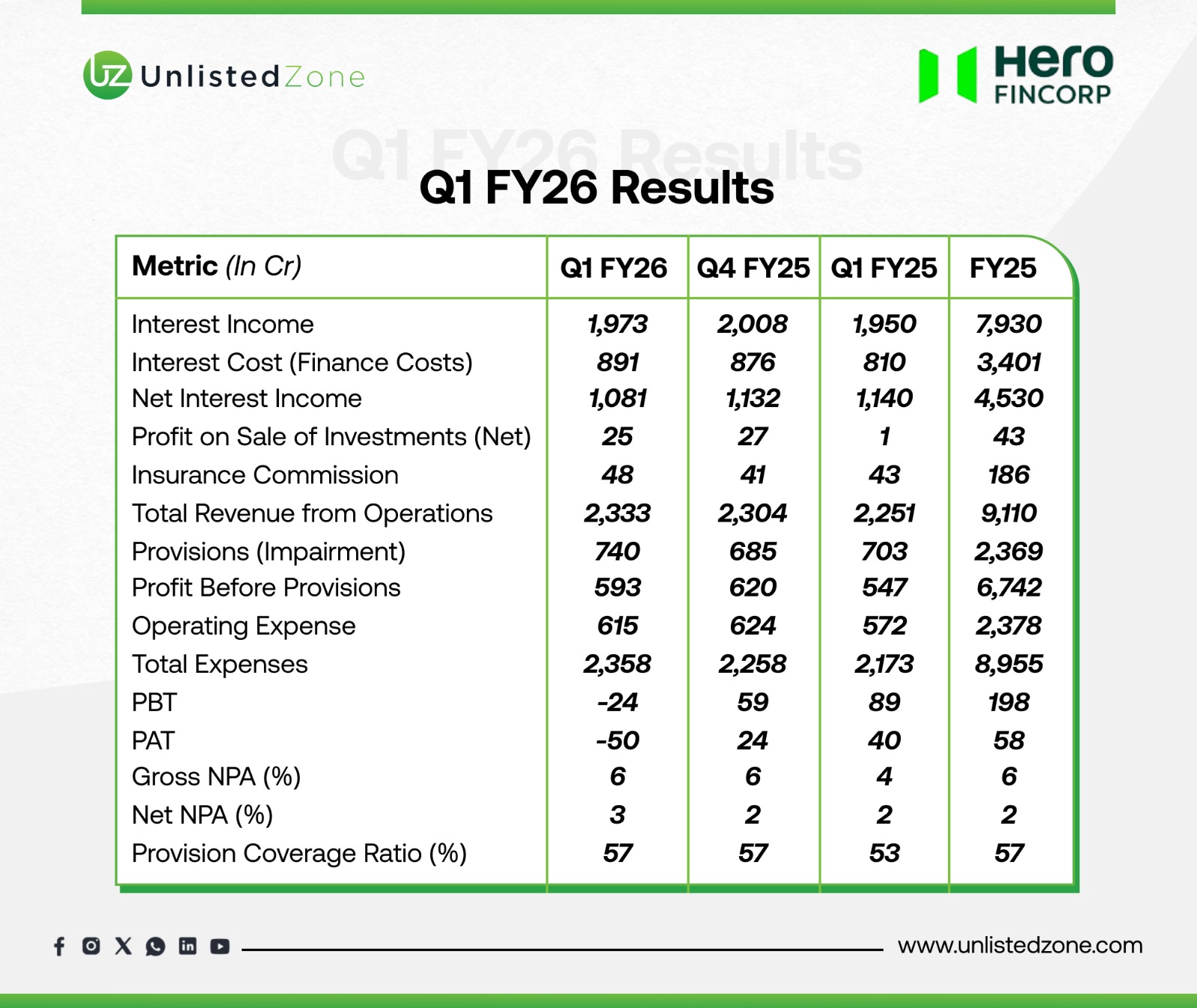

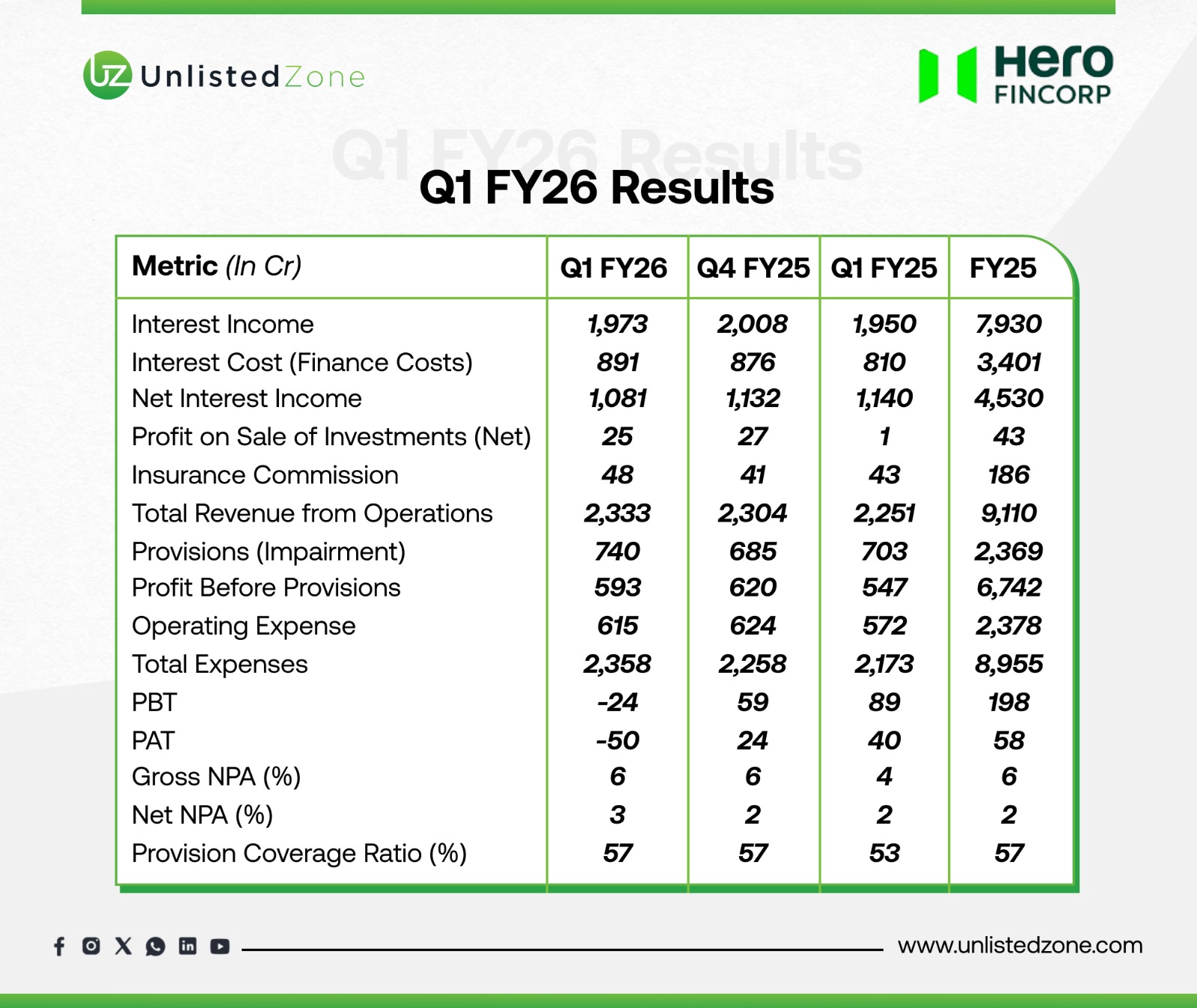

Financial Performance Snapshot: Q1 FY26 vs Previous Quarters

Quarterly Highlights & Insights

-

Steady Revenue Growth – Revenue from operations rose to ₹2,333.22 crore, up 3.7% YoY, driven by interest income and insurance commission.

-

Sharp Decline in Profitability – PBT fell to ₹-23.73 crore from ₹88.82 crore in Q1 FY25 due to higher impairment provisions and rising finance costs.

-

Increased Credit Costs – Provisions for impairment jumped to ₹740.29 crore, reflecting asset quality pressures.

-

NPA Levels – Gross NPAs stood at 5.65%, up from 4.44% last year, while Net NPAs rose slightly to 2.50%.

-

Margin Impact – PAT margin turned negative at -2.13% from 1.76% a year earlier.

Valuation Snapshot (As of March 31, 2025)

-

Book Value per Share (₹): 452.07

-

Price-to-Book (P/B): 2.98

-

Net Worth (₹ Cr): 5,759.40

-

Market Capitalisation (₹ Cr): 17,517.5

This valuation indicates that the company trades at nearly 3x its book value, reflecting market confidence despite near-term profitability pressures.

Conclusion

Hero FinCorp’s Q1 FY26 results indicate resilient revenue growth but significant profitability headwinds due to elevated credit provisions and slightly deteriorating asset quality. While its diversified lending base provides stability, the focus ahead will be on controlling credit costs and improving recoveries to restore margins.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided is for educational purposes only and not investment advice. Investors should do their own research or consult a SEBI-registered advisor before making investment decisions. Investments in unlisted shares involve risks, including liquidity risk and price volatility.