Company Overview

Indian Potash Limited (IPL) is a premier fertilizer company and a pivotal player in India's agricultural ecosystem, with a core purpose of ensuring the availability and balanced use of plant nutrients nationwide. Originally focused on potash, IPL has strategically diversified into a multi-nutrient fertilizer player and is aggressively expanding into adjacent agri-businesses like sugar, distilleries, and dairy to de-risk its core operations and enhance profitability. With a vast distribution network, the company is committed to promoting the ideal NPK use ratio of 4:2:1 for soil health, supporting India's food security by enhancing agricultural productivity across even the most remote areas at affordable costs.

A) Outlook & Prospects for FY 2025-26

- Favorable Monsoon: The India Meteorological Department (IMD) forecast of above-normal rainfall (105% of LPA) is expected to boost agricultural output and rural demand, directly benefiting fertilizer consumption.

- Government Support: Continued Minimum Support Price (MSP) announcements are likely to sustain farmer incomes and fertilizer demand.

- Sugar Division Upside: Firm domestic sugar prices and the removal of the cap on sugar diversion for ethanol are expected to enhance profitability.

- New Revenue Streams: The newly commissioned distillery in Odisha and the acquired sugar mills in Gujarat are poised to contribute a full year of revenue in FY26, enhancing overall profitability.

- Subsidy Dependency: Timely payment of subsidies from the government remains critical for the company's liquidity and credit profile.

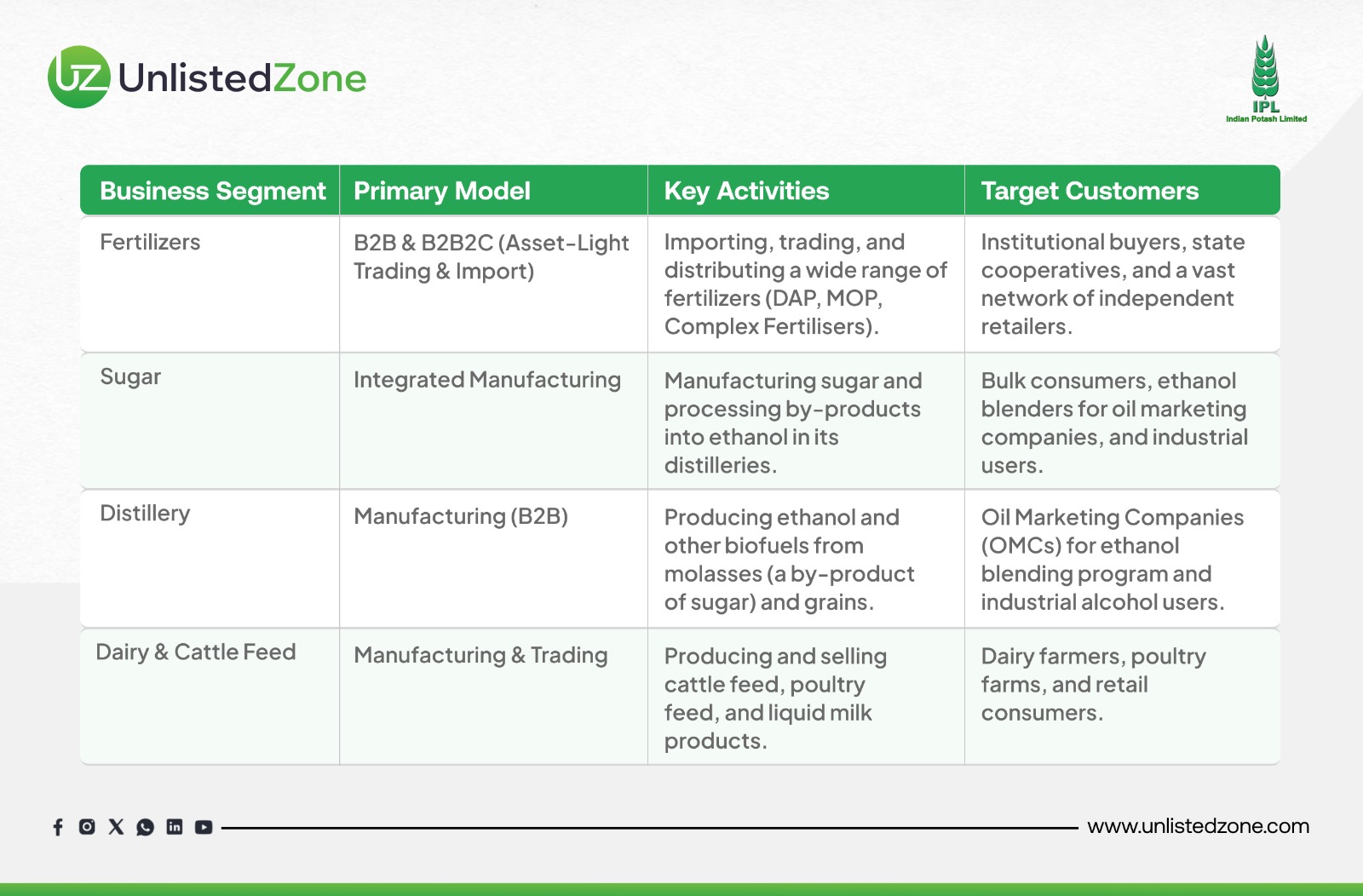

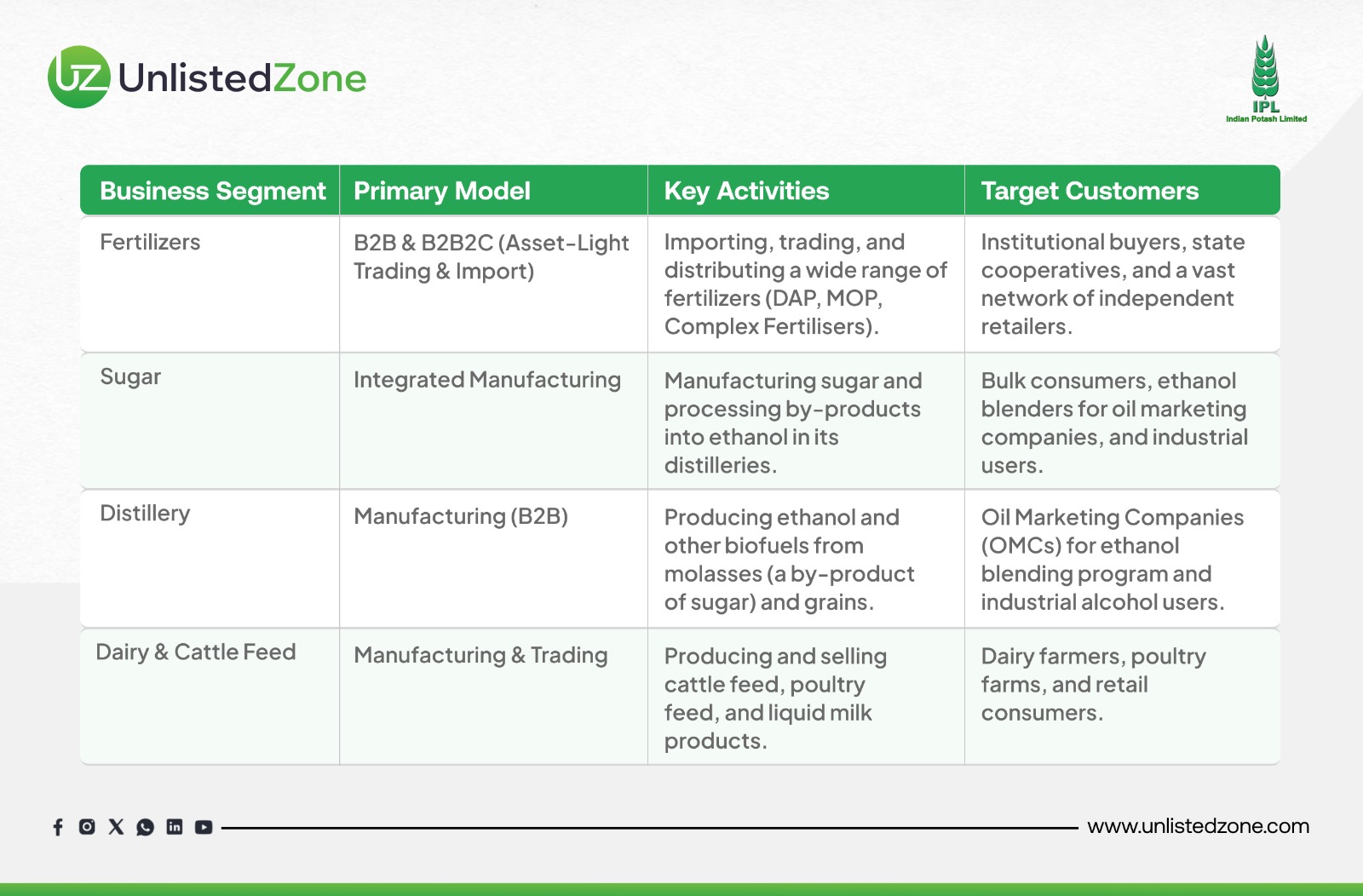

B) Detailed Business Model

IPL operates through multiple, interconnected business segments, employing a hybrid model that combines trading, manufacturing, and service provision.

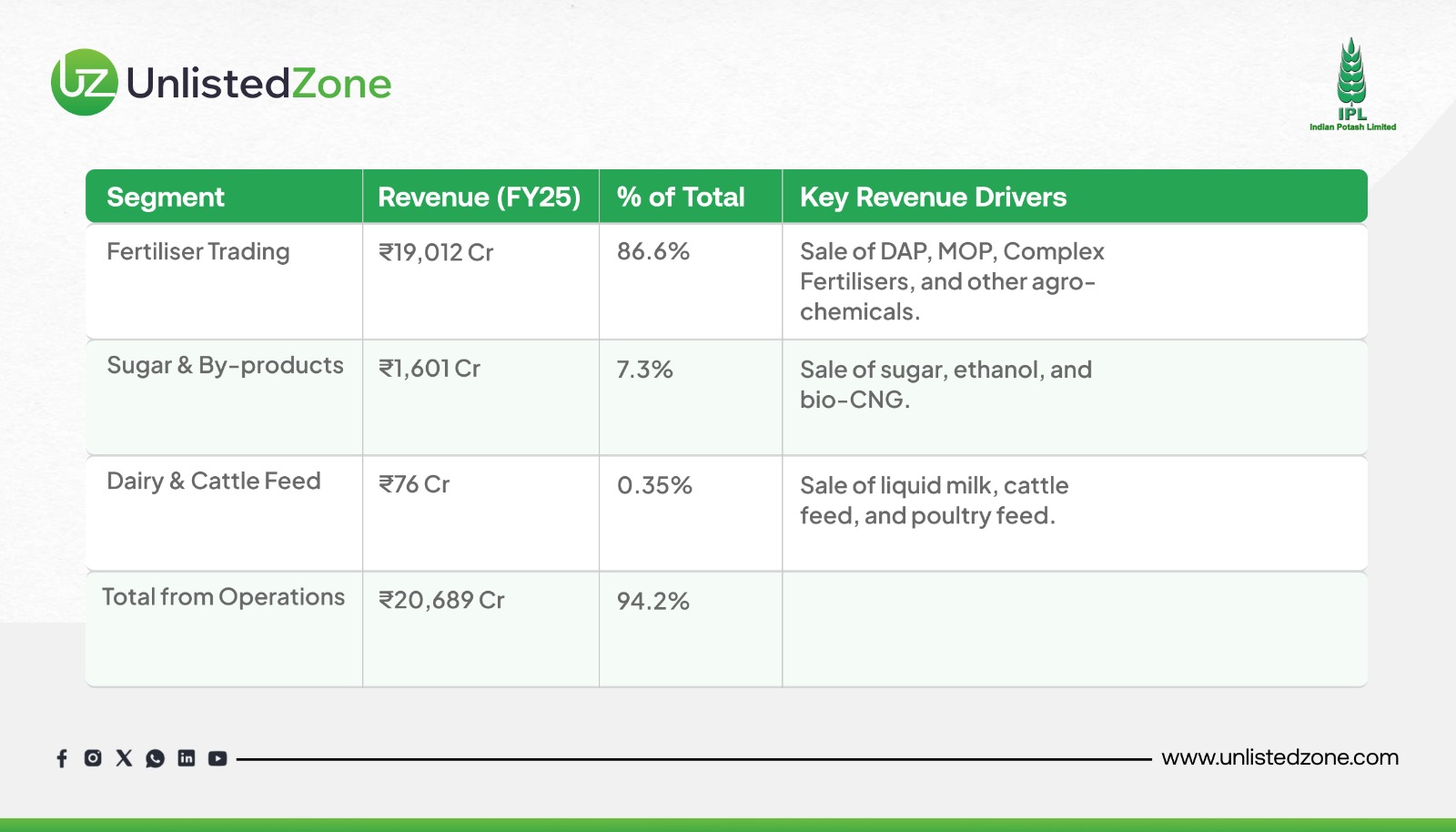

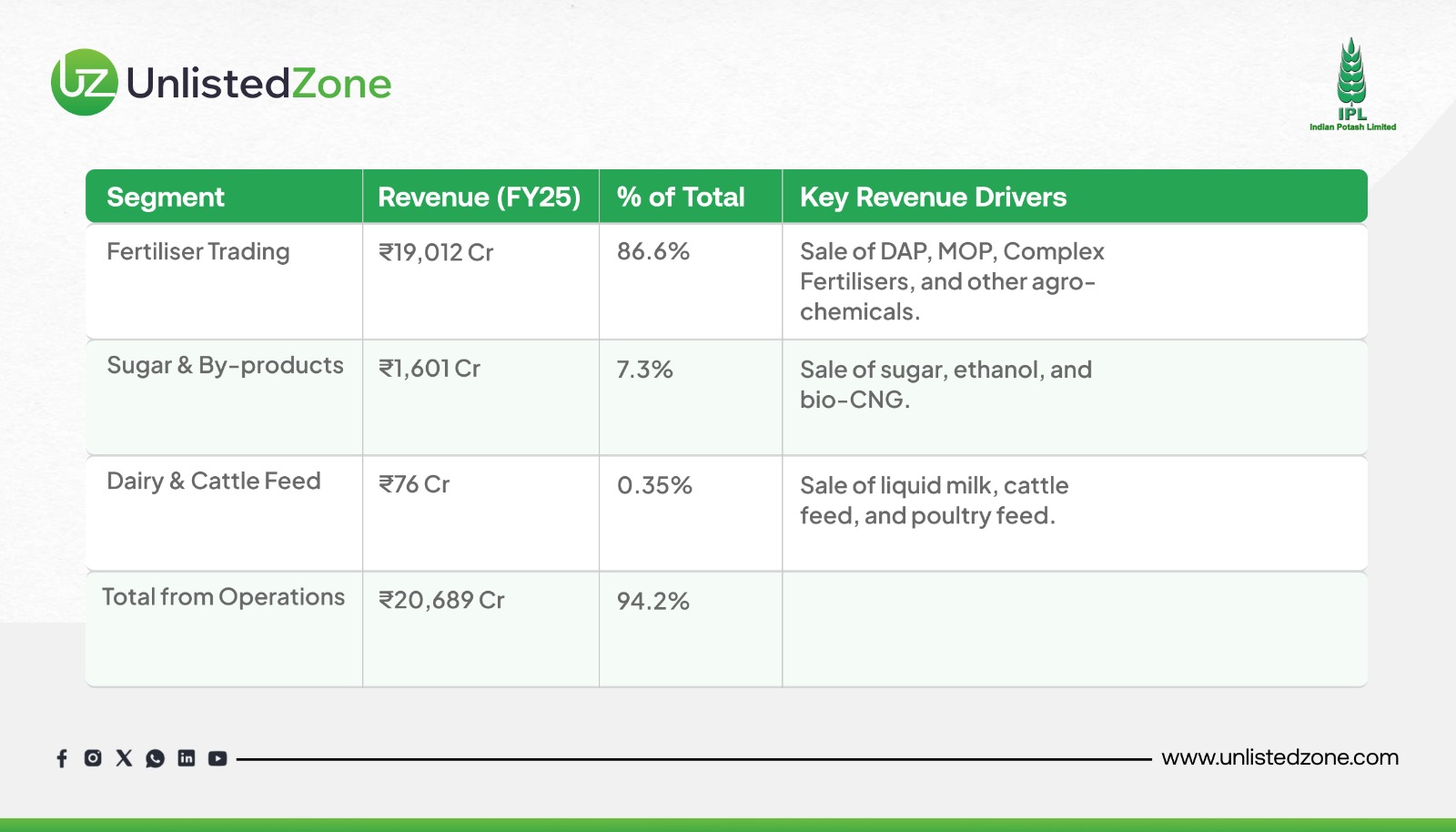

C) Detailed Revenue Streams

IPL's revenue is diversified across its business segments, with the core fertiliser business contributing the bulk of the turnover, while other segments and non-operational income drive profitability.

3.1. Primary Revenue Stream: Product Sales

- Note on Urea: The company also handles canalized Urea imports on behalf of the Department of Fertilizers (DOF). While the gross value of these sales (₹5,222 Cr in FY25) is high, only the net margin is reported in revenue, keeping the reported turnover lower than the actual scale of operations.

3.2. Margin Structure within Fertiliser Sales

A critical aspect of IPL's revenue quality is the margin difference between product types:

- Private Label / In-House Products: IPL earns significantly higher margins on products where it has control over the brand and supply chain.

- Traded Third-Party Products: Lower margins on products that are purely distributed.

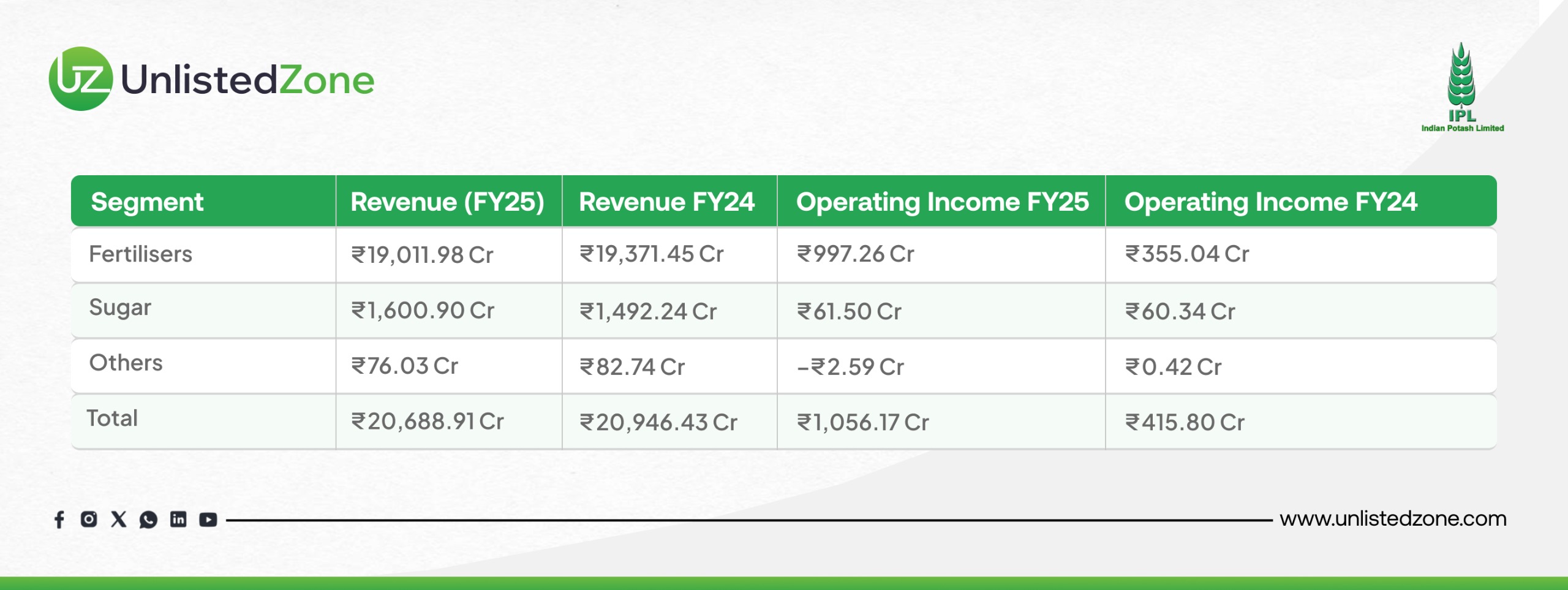

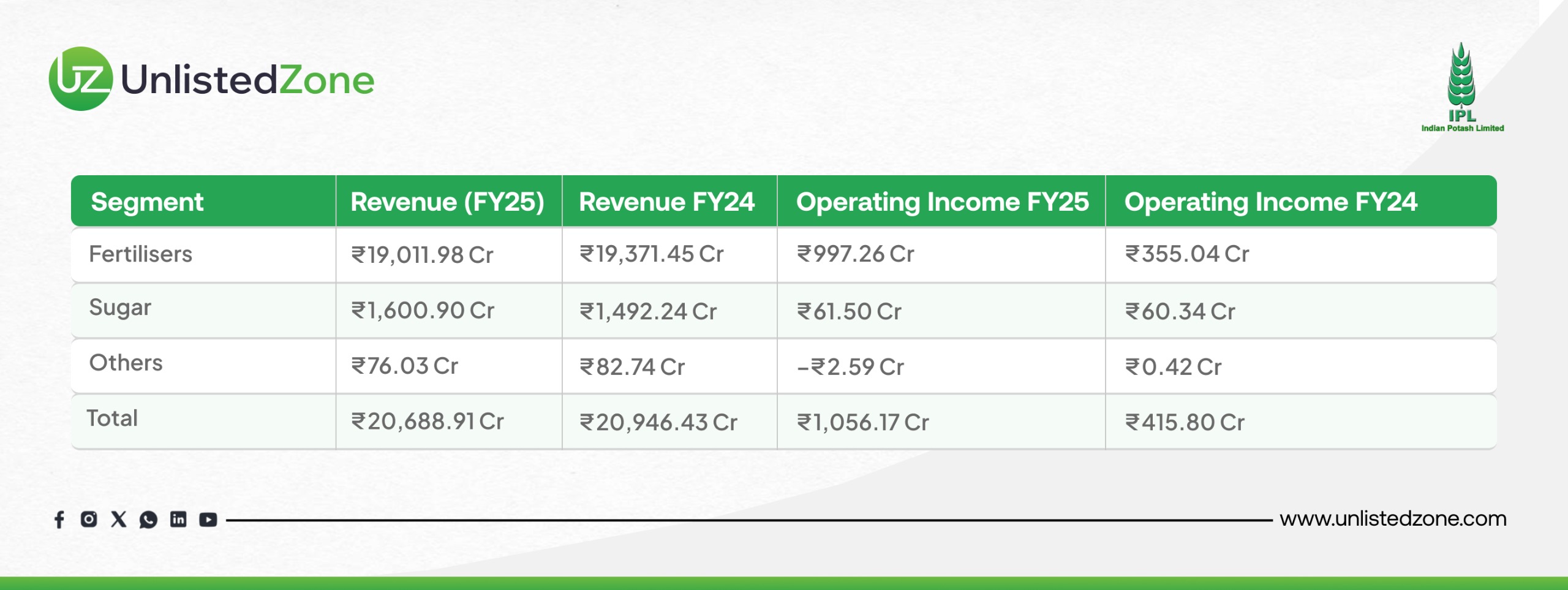

- FY25 Strategy Success: The conscious shift towards Complex Fertilisers (which likely have a higher proportion of in-house blends) was a key reason the Fertiliser segment's operating income jumped to ₹997 Cr in FY25 from ₹355 Cr in FY24, despite a slight drop in revenue.

3.3. Secondary Revenue Streams

- Subsidy Income: Government reimbursements under NBS policy; critical for product viability

- Dividend Income: ₹1,040 Cr from associate companies (mainly JPMC, Jordan) - largest profit driver

- Other Income: ₹205 Cr from treasury operations and bank interest

3.4. Future Revenue Streams (Commissioned in FY25)

- Grain-Based Distillery (Odisha): Commissioned in March 2025, this 190 KLPD plant will contribute a full 12 months of revenue from ethanol sales in FY26.

- Acquired Sugar Mills (Gujarat): The three mills acquired on a long-term lease will add significantly to the sugar division's revenue and profit in FY26.

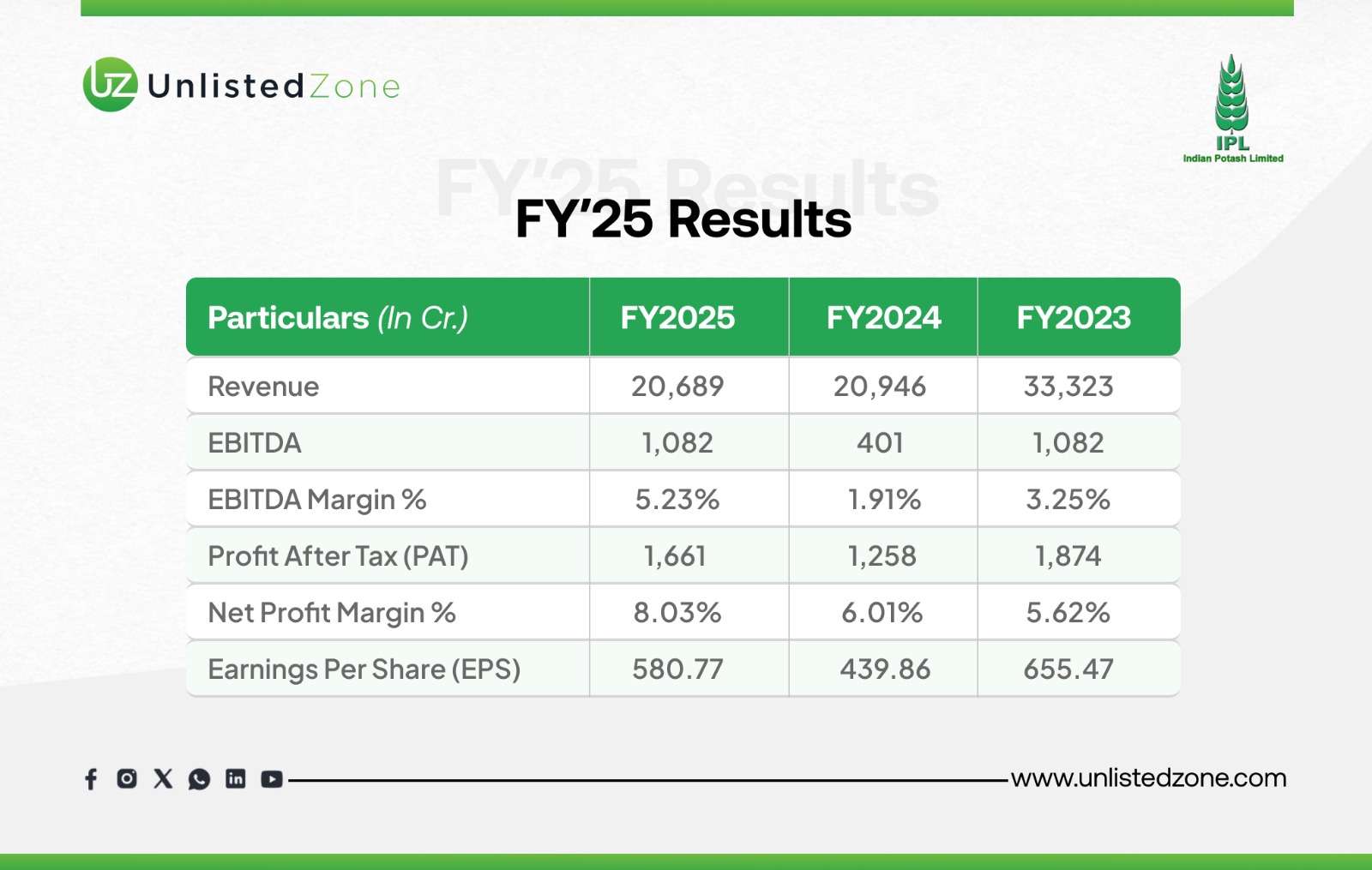

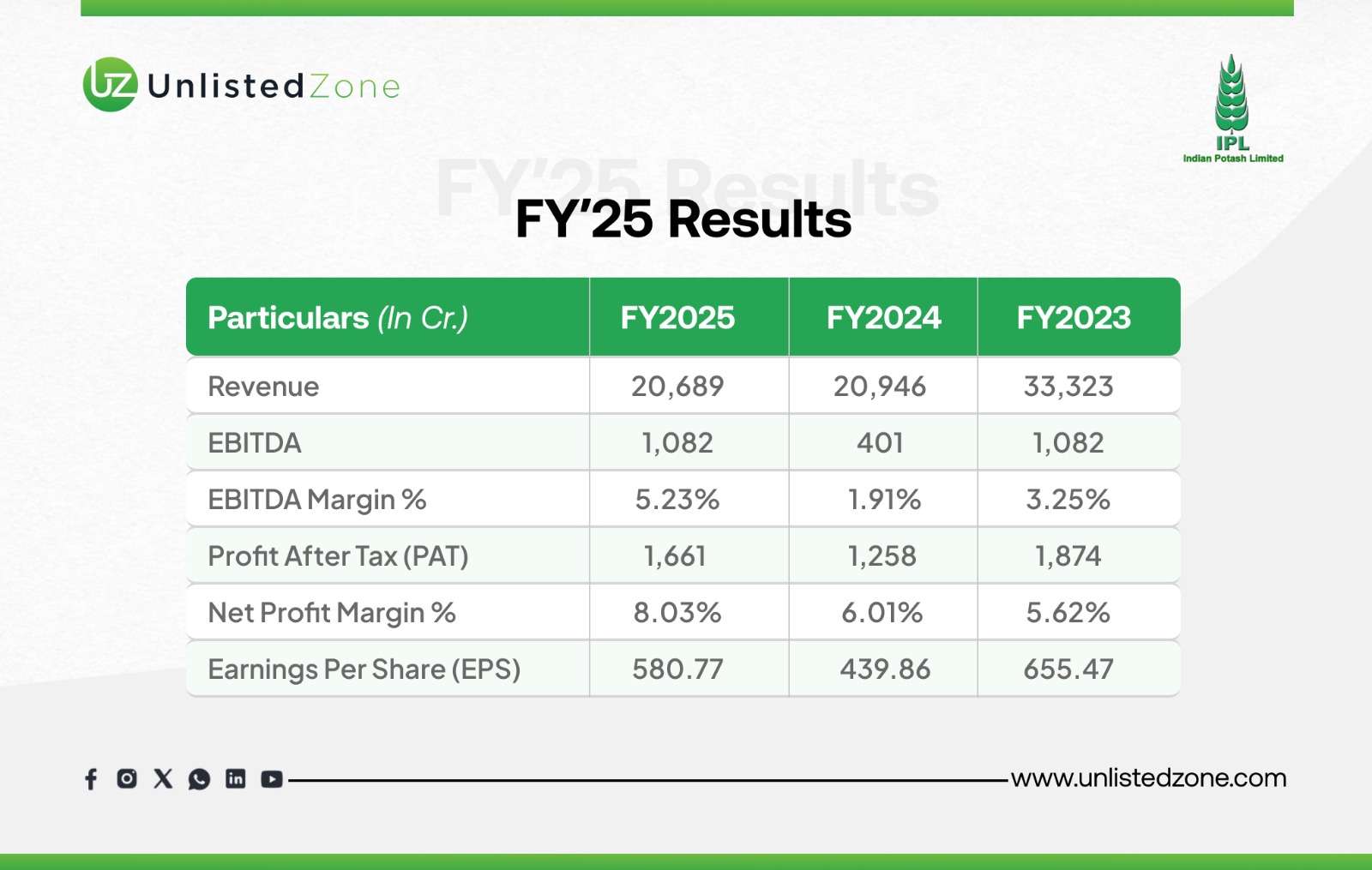

E) Financial Performance Summary (2022-2025)

-

Profit & Loss Statement (Values in ₹ Crores, unless specified)

Key Observations:

- Volatile Revenue: Revenue peaked in 2023 and then normalized in 2024-25.

- Margin Recovery: After a dip in 2023-24, EBITDA Margin and Net Profit Margin recovered strongly in 2025, reaching their highest levels in the period.

- High Other Income: A significant portion of PBT comes from "Other Income" (e.g., ₹2,172 Cr in 2025), which is substantially higher than the operating profit (EBIT), indicating major income from investments or other non-operational sources.

Segment-Wise Performance

3. Balance Sheet Highlights

Key Observations:

- Strong Equity Base: Reserves have grown consistently, indicating retained profits.

- High Investments: A large part of the asset base is in "Investments," which aligns with the high other income noted in the P&L.

- Working Capital Management: Significant fluctuations in Trade Receivables and Inventory suggest varying sales cycles and inventory management strategies year-on-year.

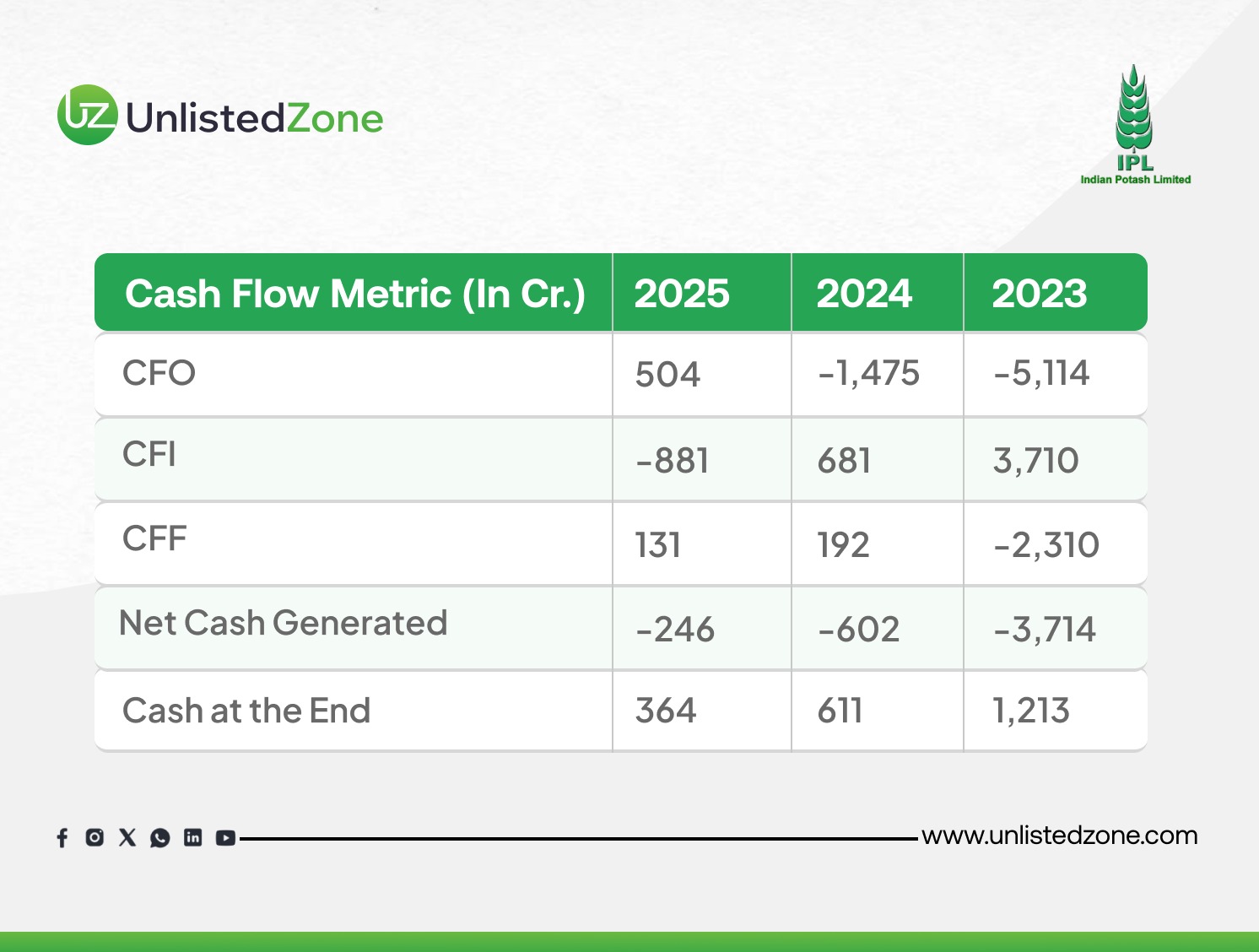

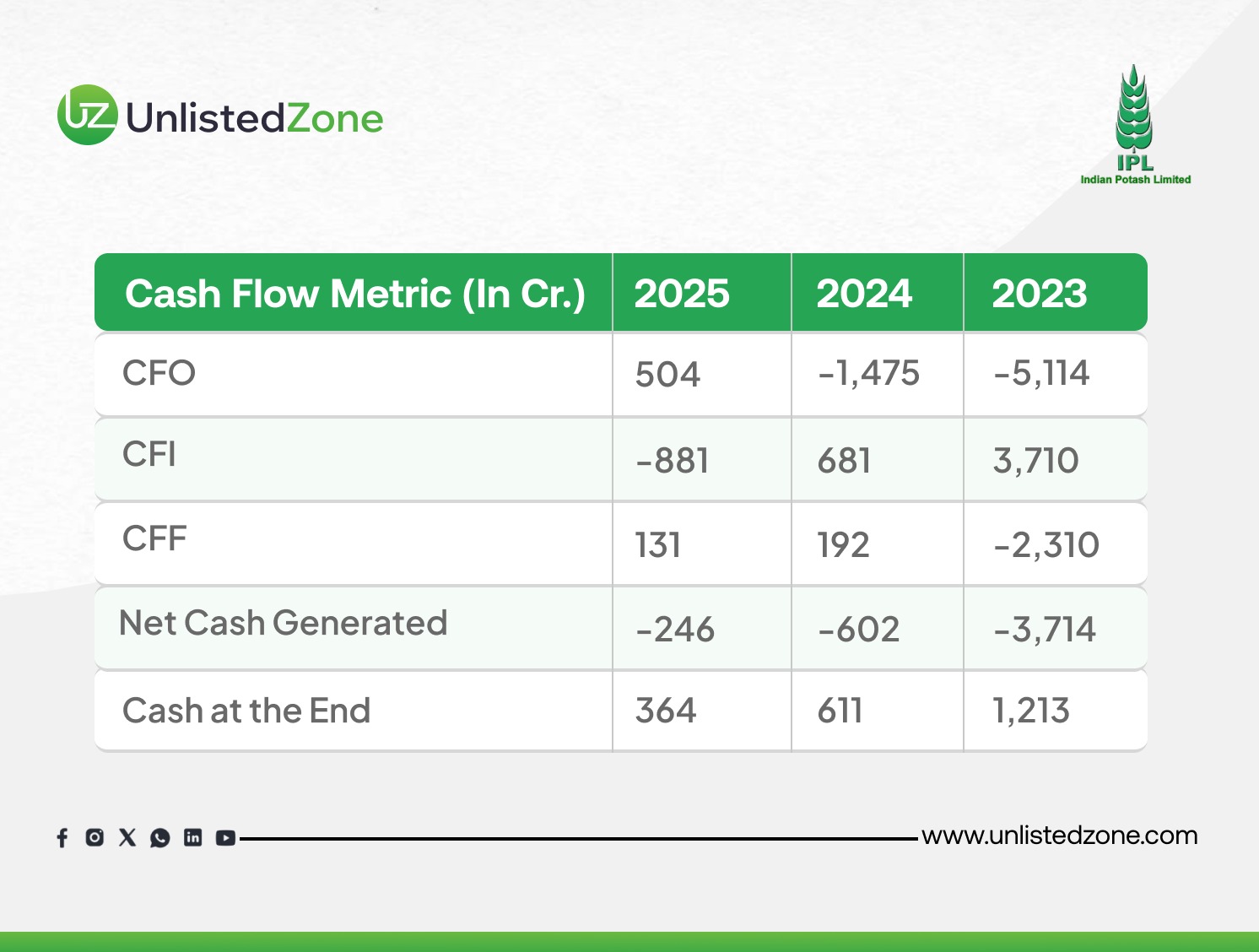

4. Cash Flow Statement (Values in ₹ Crores)

Key Observations:

- Operational Turnaround: CFO turned positive in FY25 after a significant outflow in FY24, reflecting improved working capital management and profitability.

- Investment Mode: Negative CFI in FY25 reflects capital expenditure in new projects (distillery, acquisitions).

F) Valuation and Unlisted Market Insights

Market Cap: ₹3,250 crores

- Unlisted Share Price: ₹3,250 per equity share

- P/E Ratio: 5.6 , P/B Ratio: 0.82 , Debt to Equity: 0.46

G) Strength , Growth & Risk Factors :

Strengths

- Strong ROE of 14.67%

- Low P/E ratio of 5.6

- Healthy Debt-to-Equity of 0.46

- Attractive P/B ratio of 0.82

- Market leader in fertilizer sector

- Successful diversification into sugar & distillery

Growth Drivers

- Above-normal monsoon forecast (105% LPA)

- Government MSP support for crops

- New distillery & sugar mills becoming operational

- Shift to high-margin complex fertilizers

- Strong dividend income from associates (₹1,040 Cr)

RisKS factors

- Dependence on government subsidy policies

- Global fertilizer price volatility

- Forex fluctuation risk (₹54 Cr loss in FY25)

- Strong competition in fertilizer sector

- Sugar division yield fluctuations

- Integration risks of new acquisitions

Conclusion

Indian Potash Limited has evolved from a traditional fertilizer importer into a sophisticated, diversified agri-business conglomerate. Its business model is a blend of core commodity trading, strategic market development, and vertical integration. While the fertilizer business provides the scale, its calibrated approach and diversification into sugar, distillery, and dairy are building a more resilient and profitable enterprise. The company's future growth is firmly tied to its ability to navigate government policies, leverage its new distillery and sugar assets, and continue its advocacy for balanced fertilization, which sustains long-term demand for its products.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.