1. Company Overview

Meesho Limited (formerly Meesho Private Limited / Fashnear Technologies Private Limited) is one of India’s fastest-growing e-commerce companies — and as per the Redseer Report (June 2025), it is India’s largest e-commerce marketplace by Placed Orders and Annual Transacting Users.

Founded in 2015 by Vidit Aatrey and Sanjeev Kumar (both IIT Delhi alumni), Meesho operates as a multi-sided technology platform, connecting four key stakeholders — consumers, sellers, logistics partners, and content creators.

Its mission is clear: “Enable every Indian to shop and sell online at the lowest possible price.”

2. Business Model: A Logistics-Led E-Commerce Platform

Unlike typical commission-based e-commerce models, Meesho runs on a zero-commission, logistics-driven marketplace model.

This means Meesho does not charge sellers any commission for listing or selling products — instead, it earns through logistics and advertising services.

Let’s break this down:

Core Revenue Streams

-

Seller Services:

-

Meesho provides order fulfillment, advertising, and data analytics tools for sellers.

-

Revenue is generated through logistics fees and promotional placements on the platform.

-

Logistics Network (Valmo):

-

Meesho has built a deep logistics ecosystem, including its in-house arm Valmo, which handled 76.3 crore shipments in FY25 (up from 22.4 crore in FY24).

-

This backbone allows Meesho to control cost efficiency and delivery timelines, especially for low-AOV (Average Order Value) products.

-

Advertising and Data Monetization:

-

Sellers pay for targeted visibility via Meesho’s ad tools.

-

Additionally, AI/ML insights enable dynamic product recommendations and price optimization.

-

New Ventures:

Why It Resembles a Logistics Business

-

75–80% of orders are Cash-on-Delivery (CoD) — similar to logistics players who manage cash flows and delivery risk.

-

Primary monetization depends on order fulfillment efficiency, not on product commissions.

-

Unit economics improve through better delivery routing, packaging optimization, and AI-led logistics planning — mirroring logistics company KPIs like per-order cost, delivery TAT, and success rate.

Thus, Meesho’s model is not purely retail or marketplace-led — it’s a hybrid e-commerce + logistics platform, where scale efficiency in delivery and returns drives profitability.

Therefore, in valuation terms, it should be benchmarked closer to logistics companies (e.g., Delhivery, Ecom Express, Blue Dart) rather than only consumer-tech marketplaces (like Flipkart or Nykaa).

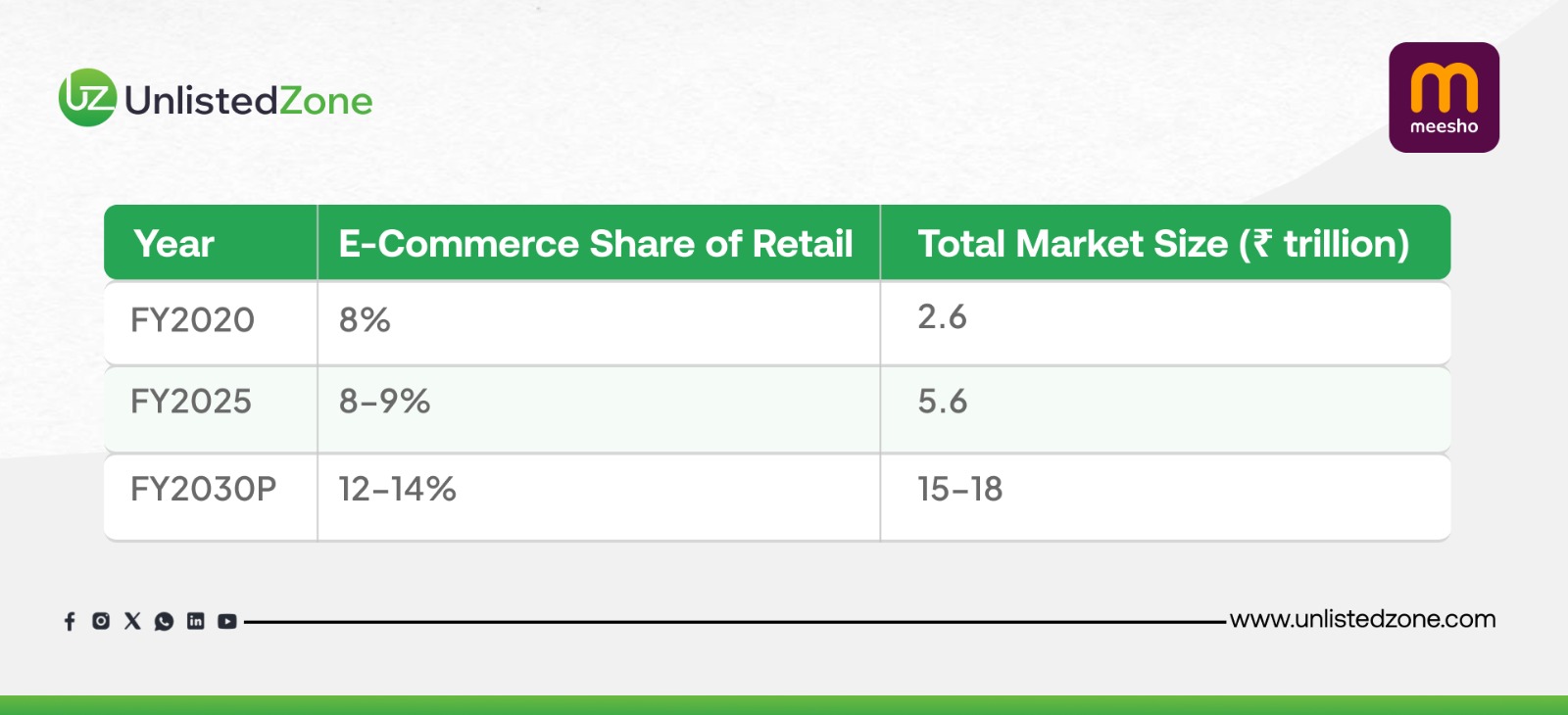

3. Market Context: India’s Retail and E-Commerce Landscape

India’s retail sector is undergoing a massive digital transition.

CAGR (FY25–30P):

Meesho has captured a dominant position in Fashion (21–23%), Home & Kitchen (23–25%), and Beauty & Personal Care (8–10%) — all high-frequency, low-AOV categories where logistics cost control is key.

4. Operational Performance

Consumers

-

Annual Transacting Users: 21.3 Cr (LTM Jun-2025) vs 15.5 Cr in FY24 (+37%).

-

Placed Orders: 183.4 Cr in FY25 (+37% YoY).

-

AOV: ₹274 in FY25 vs ₹298 in FY24.

-

Order Frequency: 9.5x per year — rising sharply with user stickiness.

Over 54% of users are women, and nearly 90% belong to Tier-II/III cities, reinforcing Meesho’s Bharat-centric positioning.

Sellers

-

Active Sellers: 5.75 lakh (LTM Jun-2025), up 36% YoY.

-

Orders per Seller: 3,570 (FY25) vs 3,166 (FY24).

-

Sellers benefit from zero commission and pan-India reach.

Logistics

-

Shipped Orders: 158.7 Cr (FY25), up 38% YoY.

-

Valmo share: 48% of total shipments — a major shift from 20% in FY24.

-

Active delivery agents: 13,678 (LTM Jun-2025).

Payments

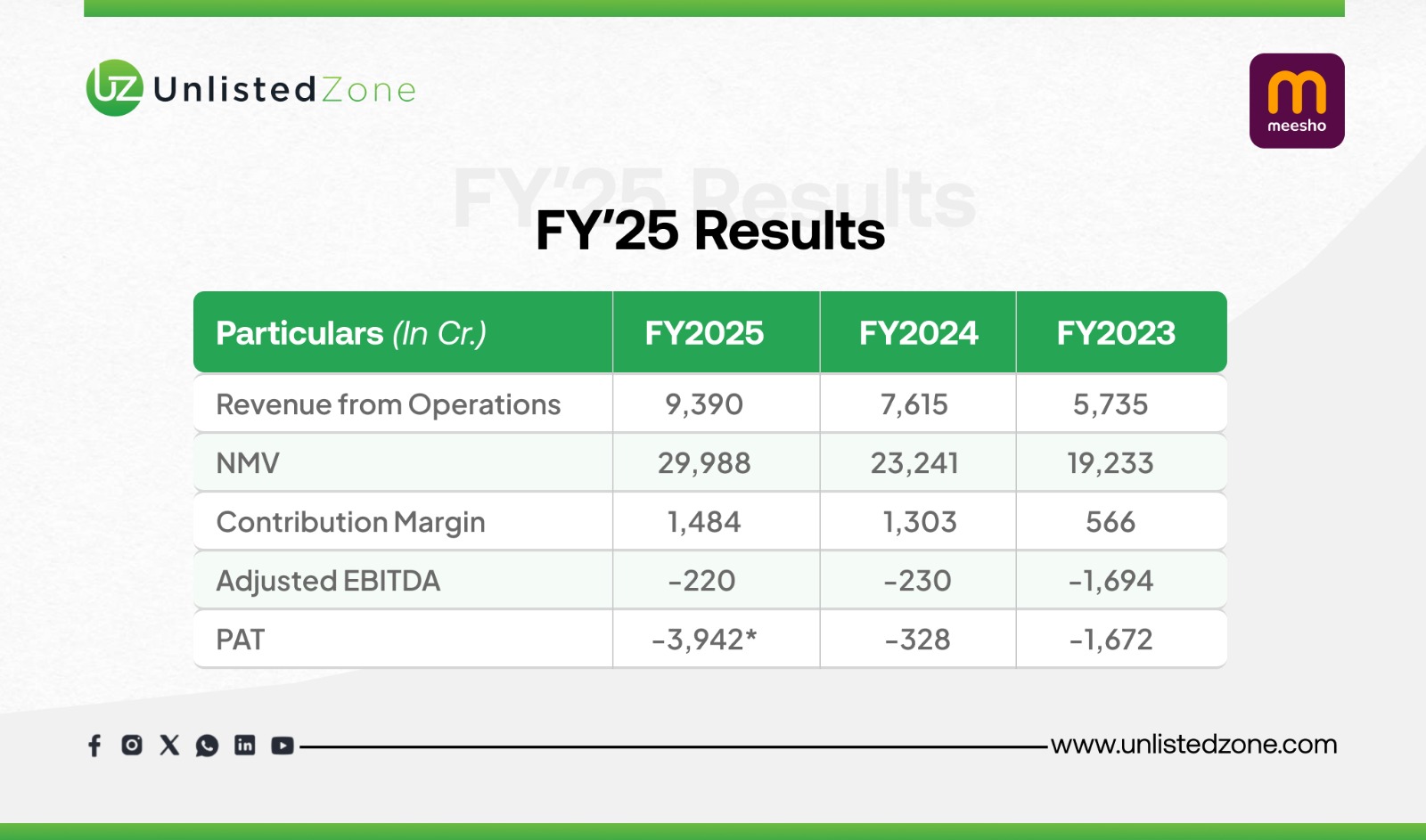

5. Financial Performance

*Includes one-time ESOP and tax restructuring expenses.

Key Insights:

-

Revenue CAGR (FY23–FY25): 28%.

-

Core operations profitable at contribution level (5% of NMV).

-

Free Cash Flow: Positive ₹591 Cr in FY25 vs -₹2,336 Cr in FY23 — a remarkable turnaround.

-

FY25 net loss widened due to non-recurring accounting adjustments, not business weakness.

6. Leadership and Governance

Strong governance and independent oversight enhance credibility ahead of IPO listing.

7. IPO Details

-

Total Issue Size: Fresh Issue of up to ₹4,250 Cr + Offer for Sale of 17.57 Cr shares.

-

Pre-IPO Placement: Up to ₹850 Cr (reduces Fresh Issue if exercised).

-

Allocation:

-

QIBs – 75%

-

NIIs – 15%

-

RIIs – 10%

Use of Proceeds:

-

Strengthening AI/ML technology stack

-

Expanding logistics infrastructure (Valmo)

-

Working capital and marketing

8. Risks and Challenges

-

Sustained Accounting Losses: Profitability yet to stabilize; dependent on cost discipline.

-

CoD Risk: Still forms ~77% of shipments; cash collection inefficiencies may persist.

-

Seller Churn: FY24 restructuring led to temporary seller decline.

-

Technology Reliability: Platform outages (Nov 2024, Apr 2025) highlighted system dependencies.

-

Regulatory Disputes: ₹710 Cr contingent liabilities (tax and vendor issues).

-

Intense Competition: From Flipkart, Amazon, and emerging quick-commerce players.

9. Strategic Outlook

Strengths

-

Largest e-commerce platform by orders and users.

-

Zero-commission model ensures seller stickiness.

-

Scalable logistics engine (Valmo) improving delivery economics.

-

Positive cash flow generation in FY24–25.

Future Strategy

-

Drive prepaid order adoption (reducing cash risk).

-

Expand ad-tech monetization for sellers.

-

Strengthen local delivery capabilities through Valmo.

-

Increase automation and AI-based logistics routing.

Valuation Viewpoint

Given its fulfillment-driven business model and logistics-heavy unit economics, Meesho’s valuation should be benchmarked not just against consumer-tech marketplaces, but also against logistics and supply chain players.

A blended multiple approach (using EV/Revenue comparable to Delhivery and Price-to-GMV comparable to Nykaa or Flipkart) would provide a more realistic enterprise valuation.

This reflects Meesho’s hybrid nature — a tech-enabled logistics company powering value commerce at scale.

10. Conclusion

Meesho Limited has transformed India’s value e-commerce landscape by enabling millions of small sellers and regional brands to reach a national audience.

Its logistics-first, AI-driven marketplace model gives it a sustainable edge in Tier-II and Tier-III India, where affordability and fulfillment efficiency drive customer loyalty.

While profitability remains a near-term challenge, operational cash flows, user scale, and technology depth indicate that Meesho is no longer just an online marketplace — it’s a logistics-tech ecosystem redefining how India shops online.

In short:

Meesho is not just selling products; it’s moving India’s commerce forward — one delivery at a time. 🚚📦