Mohindra Fasteners Limited (MFL), a manufacturer of high-tensile fasteners, faced a challenging FY 2024–25, with revenues declining by ~6.9% and profits dropping ~7.6% YoY, primarily due to weakening export markets. Despite global headwinds, the company maintained resilient profitability, underpinned by cost control, stable raw material prices, and operational efficiencies.

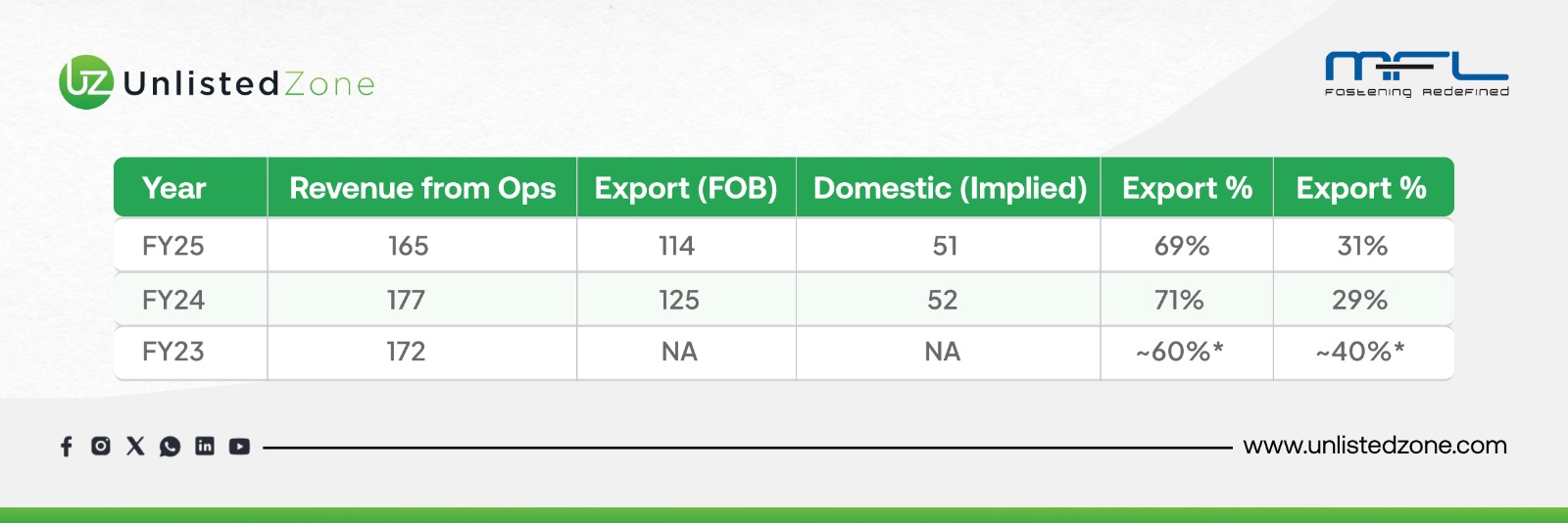

Exports contribute ~70% of revenues, but dependency on international markets has exposed MFL to risks from inflation, tariffs, geopolitical tensions, and logistics disruptions. Management is actively rebalancing toward domestic sales, leveraging its BIS certification and foraying into the industrial after-market segment.

A) Company Overview of Mohindra Fasteners Unlisted Shares

-

Business: Manufacturer of High Tensile Fasteners used in automotive and engineering sectors.

-

Established: 1997

-

Employees: ~400

-

Listing: Metropolitan Stock Exchange of India (MSEI) – Unlisted in public markets.

-

Clients:

-

Manufacturing Base: 3 plants located on Delhi–Rohtak Road, Haryana.

B) Key Highlights FY 2025 Of Mohindra Fasteners Unlisted Shares

1. Financial Performance (FY 2024-25)

-

Revenue from Operations: ₹165 Crores (Previous Year: ₹177 Crores) - a decrease of ~6.9%.

-

Net Profit Before Tax: ₹20 Crores (Previous Year: ₹2 Crores) - a decrease of ~7.6%.

-

Reason for Decline: Primarily due to a substantial drop in export sales

2. Strategic Initiatives & Future Outlook

-

Domestic Market Growth: Actively taking steps to increase domestic sales to create a healthier balance with exports.

-

BIS Certification: A key achievement that helps compete against cheap, low-quality imports.

-

New Business Segment: Started selling in the industrial after-market segment on an all-India basis.

-

Internal Improvements:

-

New ERP system implementation.

-

Replacing old equipment and building a new warehouse.

-

Standardizing processes for future operational efficiency.

-

Joint Venture (JV): KK Mohindra Fastenings Pvt. Ltd. (Pune-based JV with Germany's Keller & Kalmbach) is progressing, with efforts to add new customers and leverage BIS requirements.

-

Quality & Compliance

-

Certifications: Holds BIS, ISO 9001:2015, IATF 16949:2016, ISO 14001:2015 (Environment), and ISO 45001:2018 (Safety).

C) Financial Performance Analysis (₹ Crores) of Mohindra Fasteners Unlisted Shares

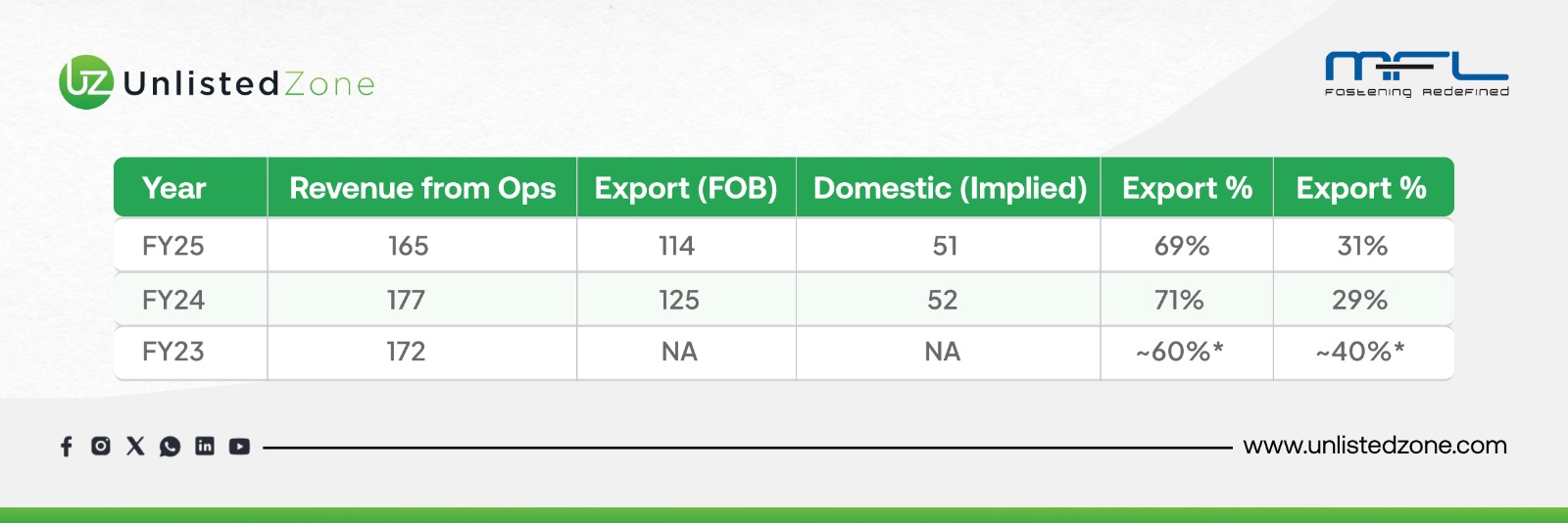

3.1 Revenue Trend

📉 Insight:

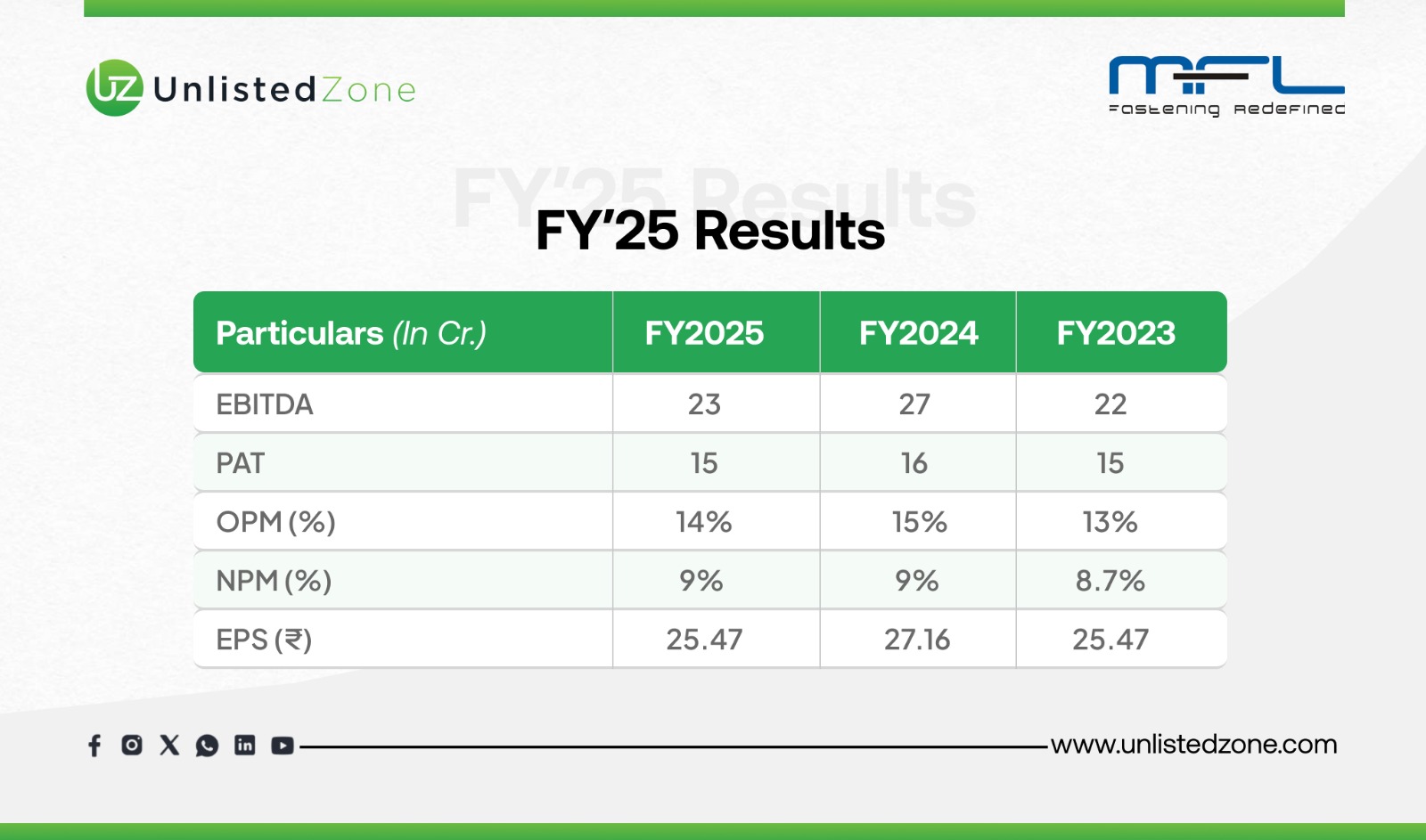

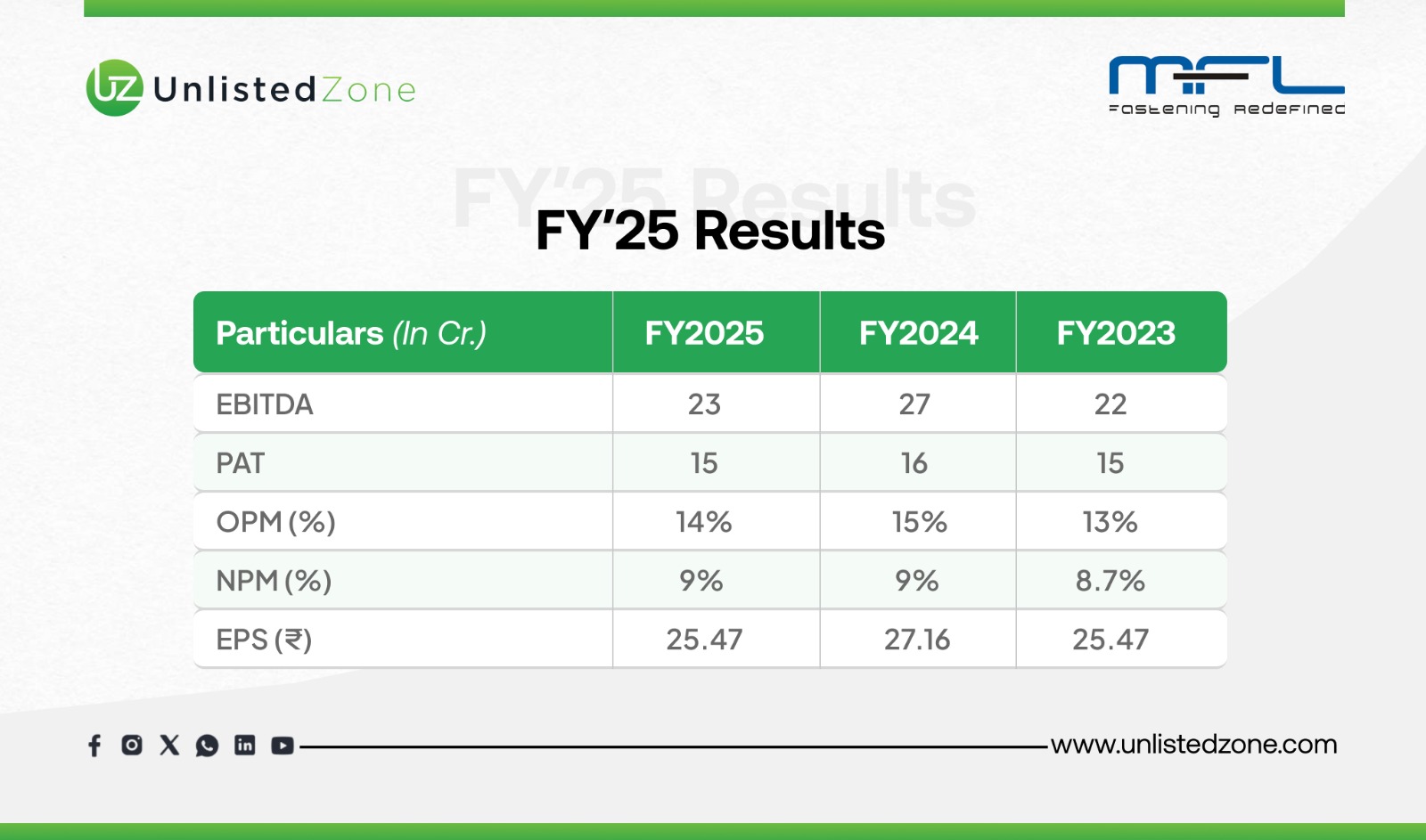

3.2 Profitability Insights of Mohindra Fasteners Unlisted Shares

Overall Profitability: Stable but Stagnant

Flat Bottom Line: PAT has been stuck at ₹15-16 Crores for three years.

Peak & Decline: FY24 was the best year (₹27 Cr EBITDA, ₹16 Cr PAT), but FY25 saw a drop in operational profit (EBITDA down to ₹23 Cr).

Resilient Margins: Margins (OPM ~14%, NPM ~9%) were defended in FY25, showing good cost control.

✅ Margins remain robust despite revenue decline → strong cost control & lower raw material prices.

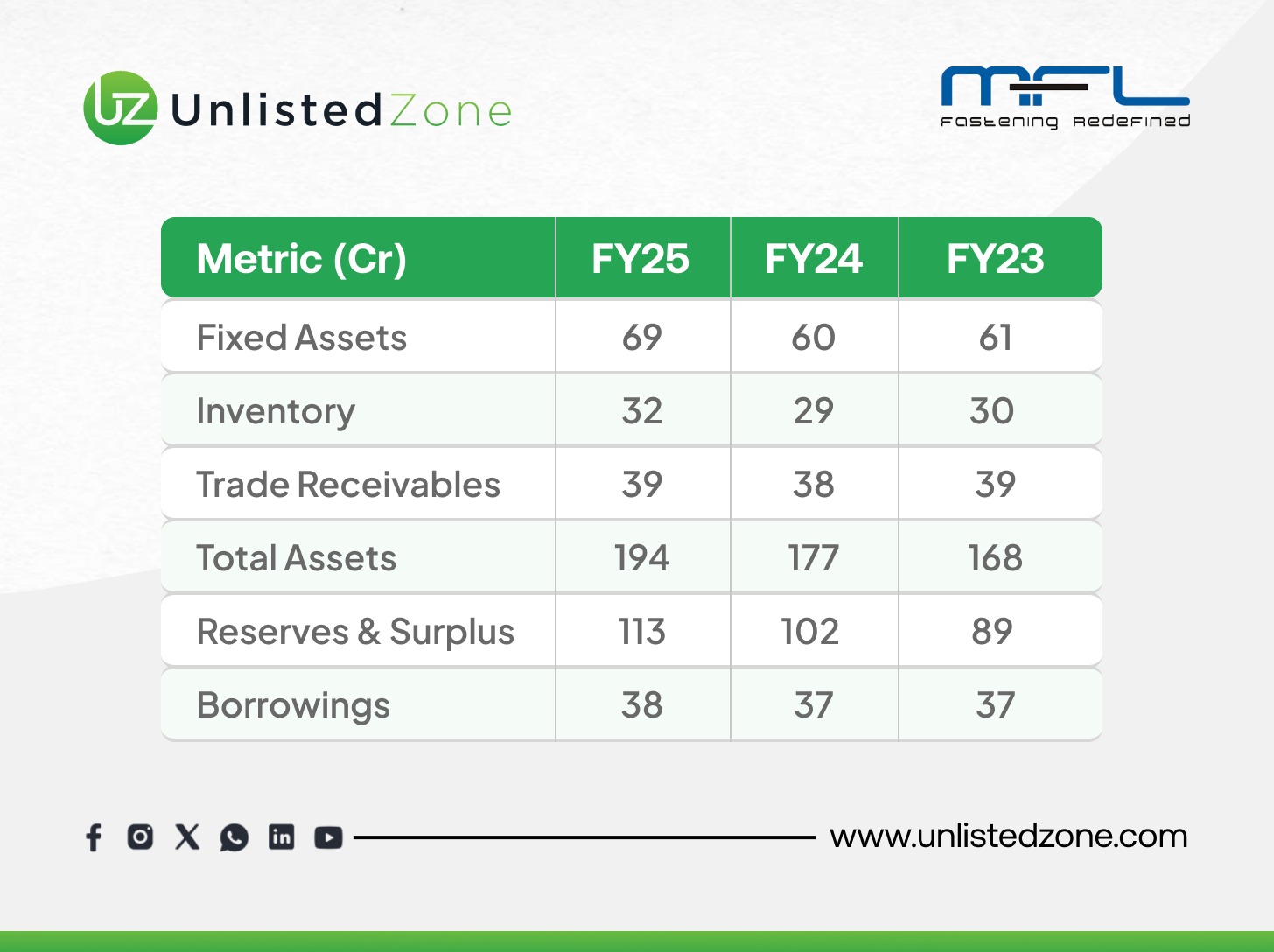

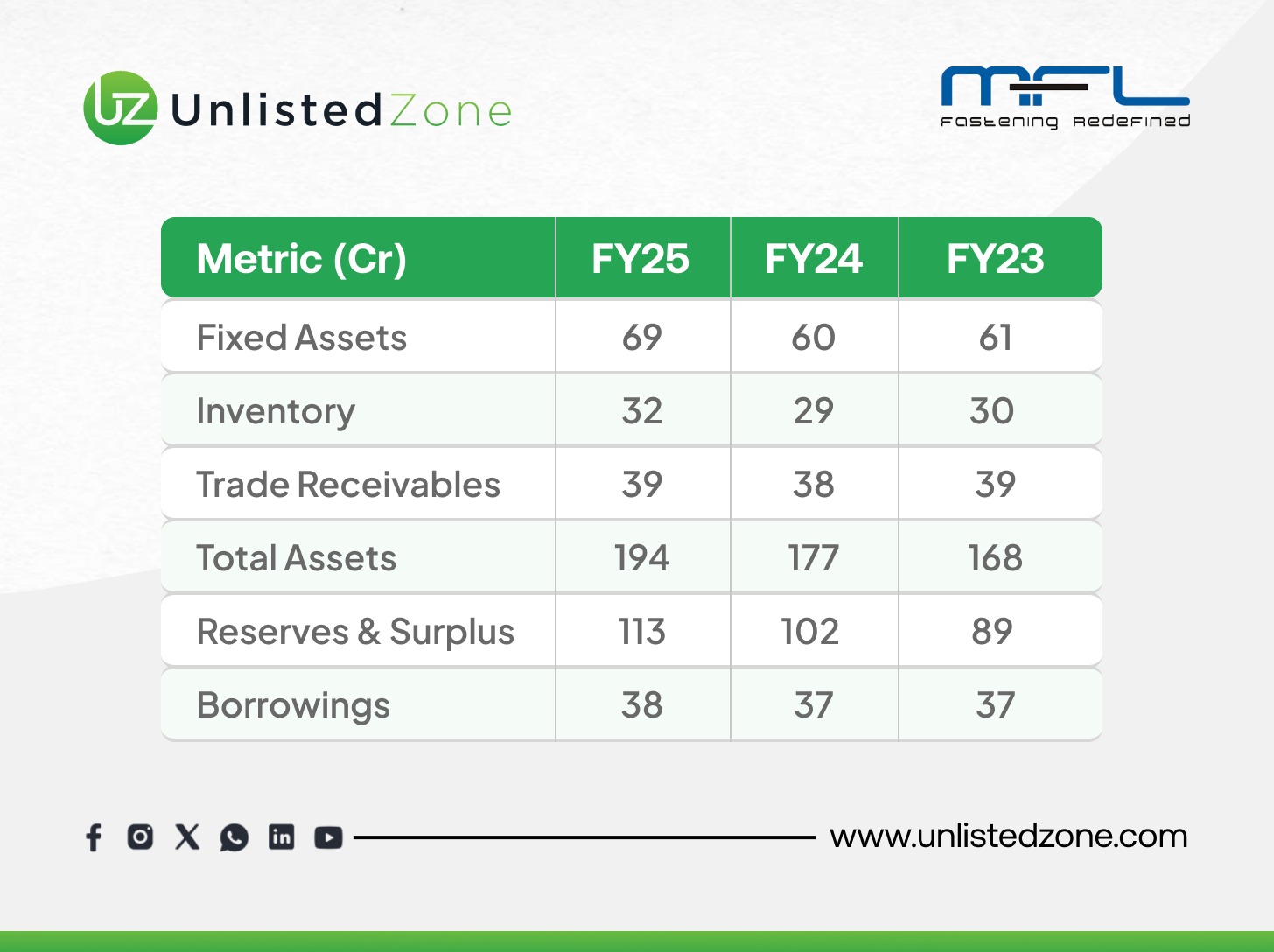

3.3 Balance Sheet Snapshot of Mohindra Fasteners Unlisted Shares

Aggressive Growth & Investment: Significant ₹9 Crore increase in Fixed Assets in FY25. This represents Capex in new machinery & plant to expand capacity.

Strong Internal Finances: This expansion is being healthily funded primarily from internal profits, not debt. This is evidenced by a steady ₹24 Crore growth in Reserves & Surplus over three years (from ₹89 Cr to ₹113 Cr), while Borrowings remained flat at ₹37-38 Cr.

Potential Working Capital Pressure: A note of caution is the increase in Inventory to ₹32 Cr in FY25. This build-up could indicate preparation for future sales growth, but it also warrants monitoring for any signs of slowing inventory turnover.

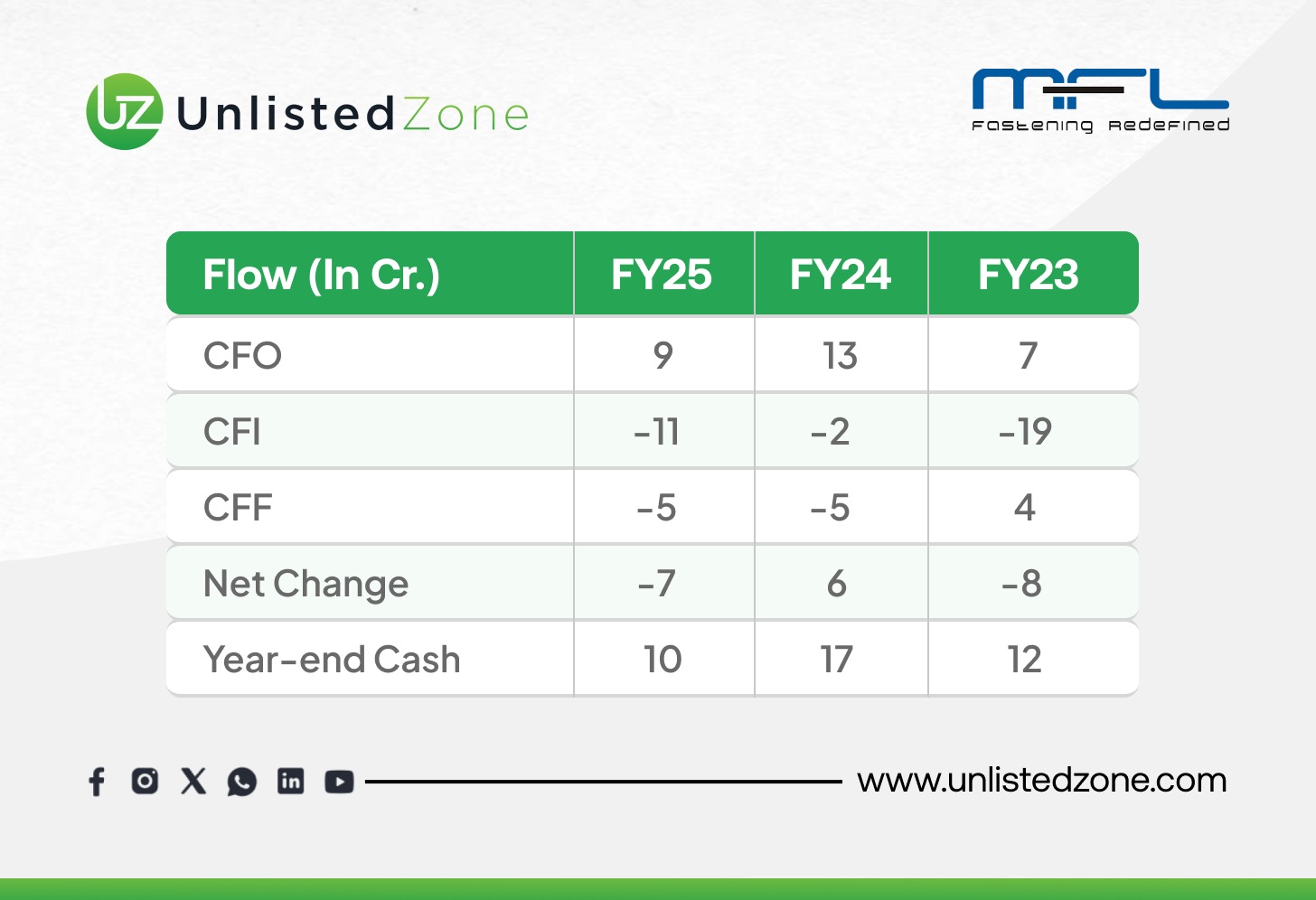

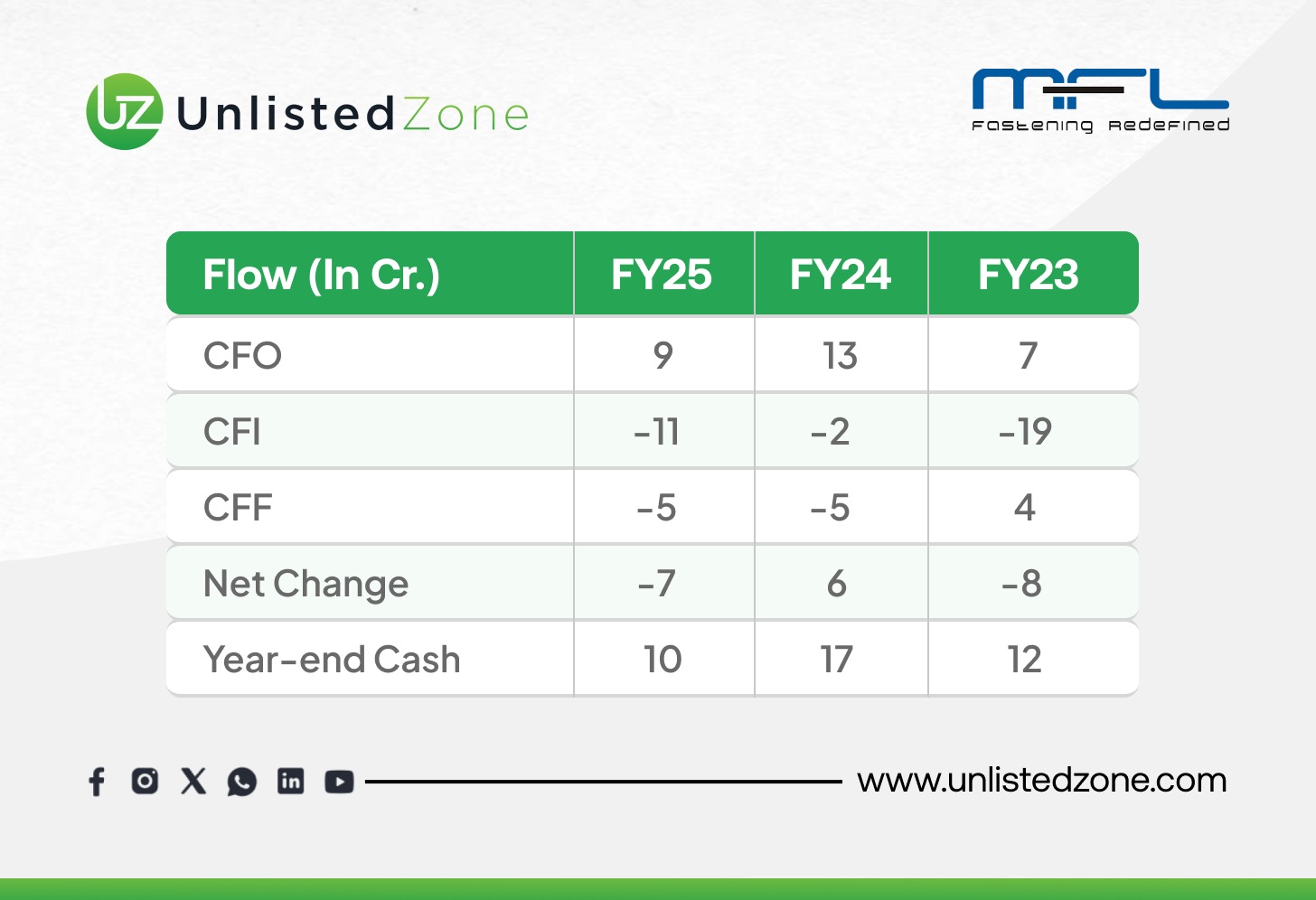

3.4 Cash Flow Analysis FY23- FY25 in Cr

Negative investing CF → heavy capex (new warehouse, equipment).

💡 Operations still generating positive cash to partly fund investments.

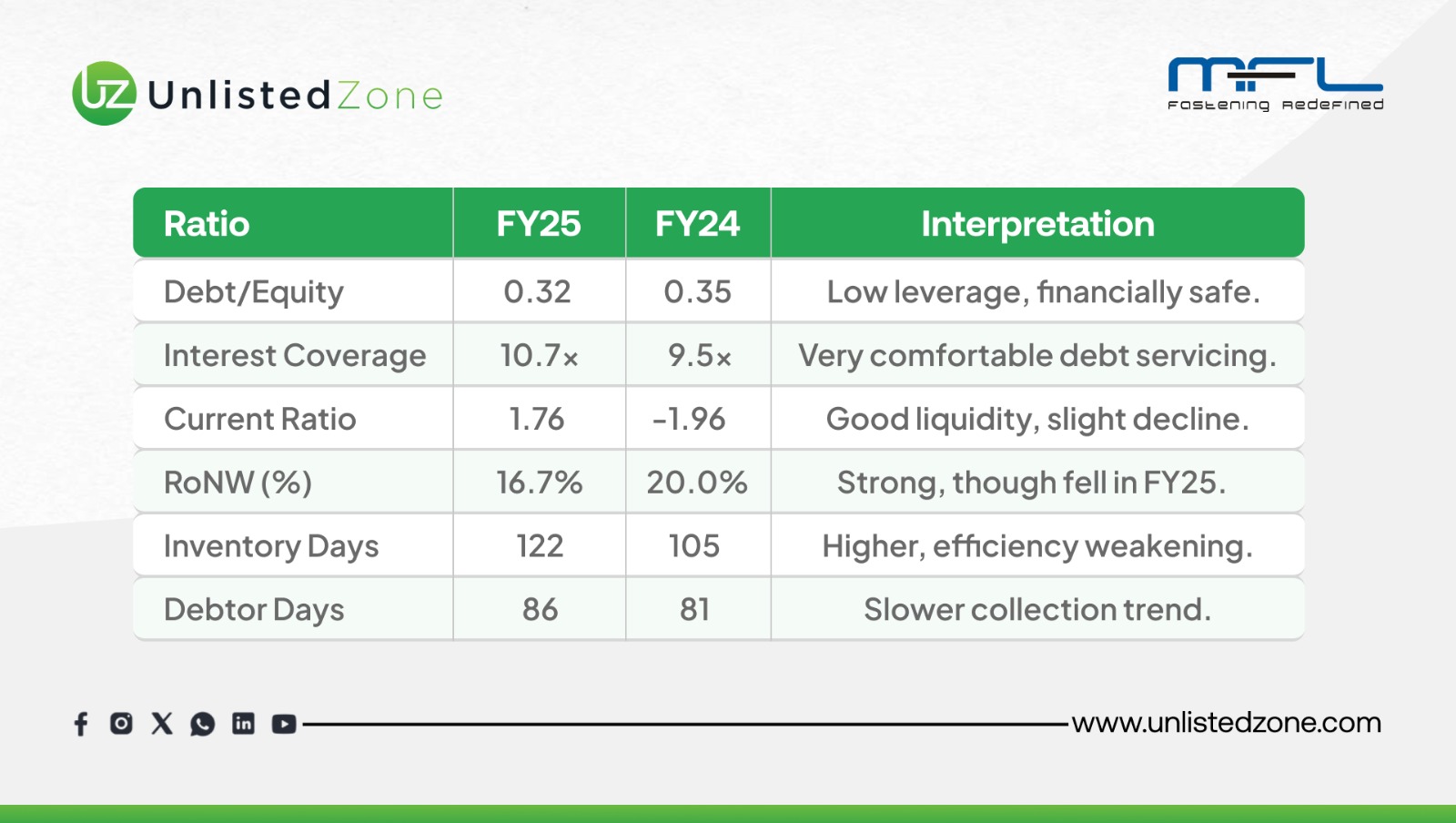

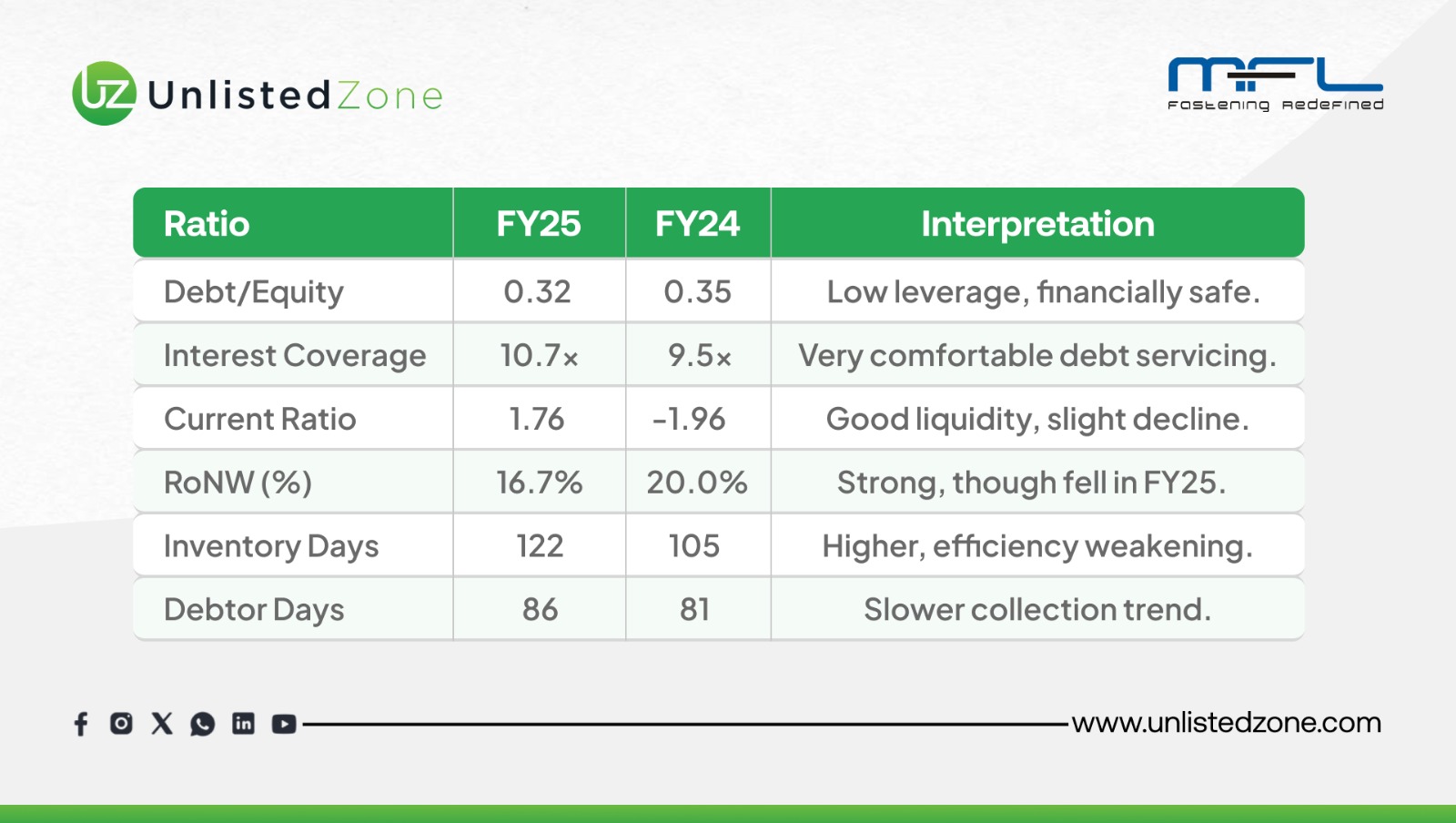

3.5 Key Ratios

D) Dividend & Valuation Insights of Mohindra Fasteners Unlisted Shares

-

FY24 Dividend Paid: ₹5/share (50%)

-

FY25 Recommended: ₹4.5/share (45%) → reduced due to weaker results.

-

Share Capital: No change; no DVRs or sweat equity.

-

Market Data (Unlisted):

E) Governance & Management

F) Industry Analysis – Fasteners Sector

India

-

Market Size (2025E): ₹7,706 billion

-

CAGR: 6.5–7%

-

Growth Drivers:

-

Automotive & construction boom

-

Government’s Make in India push

-

Infrastructure investments, urbanization

-

Challenges:

-

Price volatility in raw materials

-

Lack of product differentiation

-

Digital adoption gaps & supply chain inefficiencies

-

Key Players: Deepak Fasteners, TorqBolt, Jyoti Engineering, Big Bolt Nut, Kova Fasteners, Kaloti Group, Singhania International, etc.

Global

-

Market Size: $85.8 Bn (2023) → projected $125.9 Bn (2032).

-

CAGR: 4.3–4.6% (2024–32).

-

Regional Split: Asia-Pacific holds ~36% share (2023), expected to reach 45.5% by 2025.

-

Drivers:

-

Infrastructure & industrialization

-

EVs & aerospace demand for lightweight fasteners

-

Smart fasteners & additive manufacturing

-

Challenges:

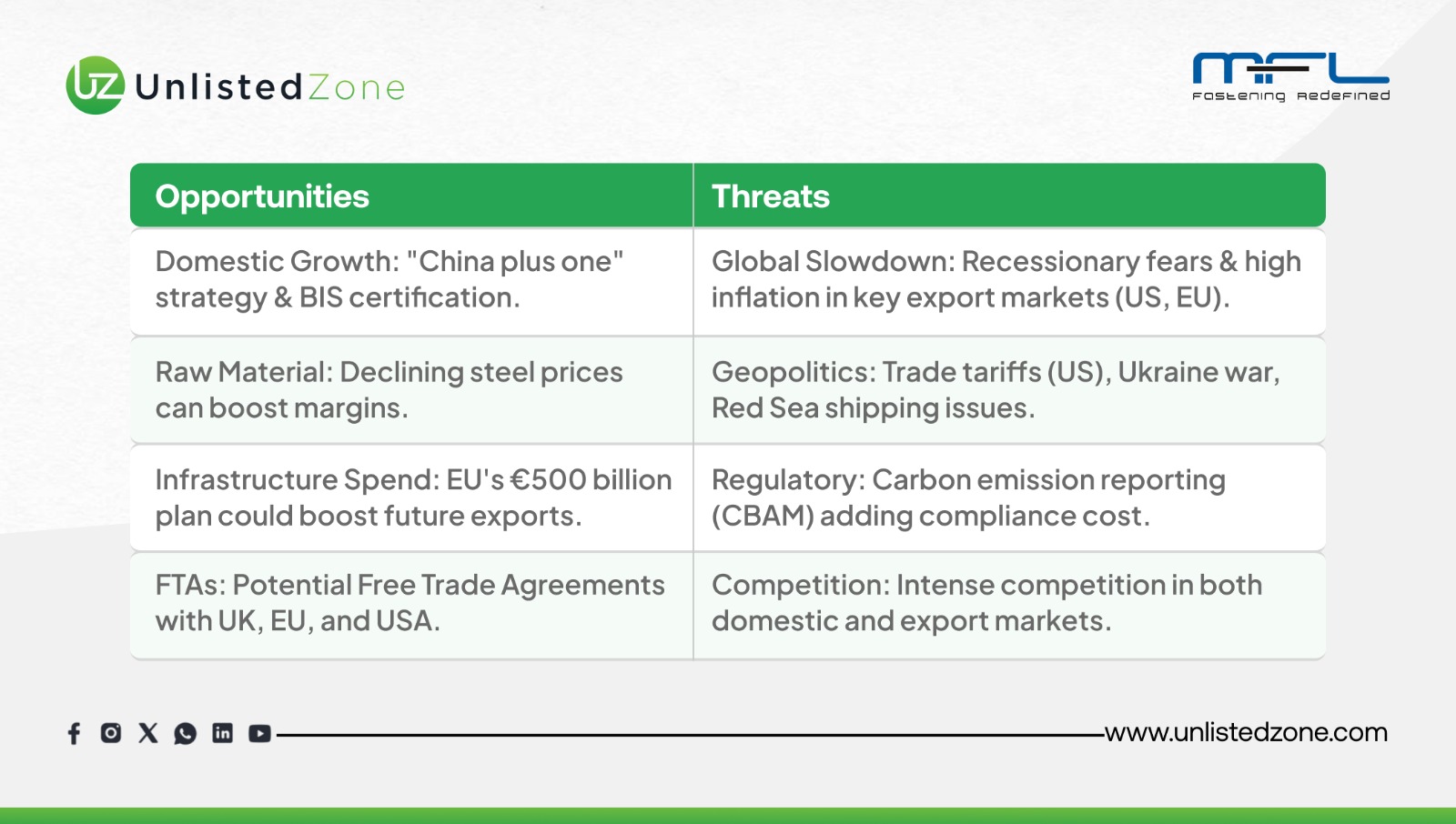

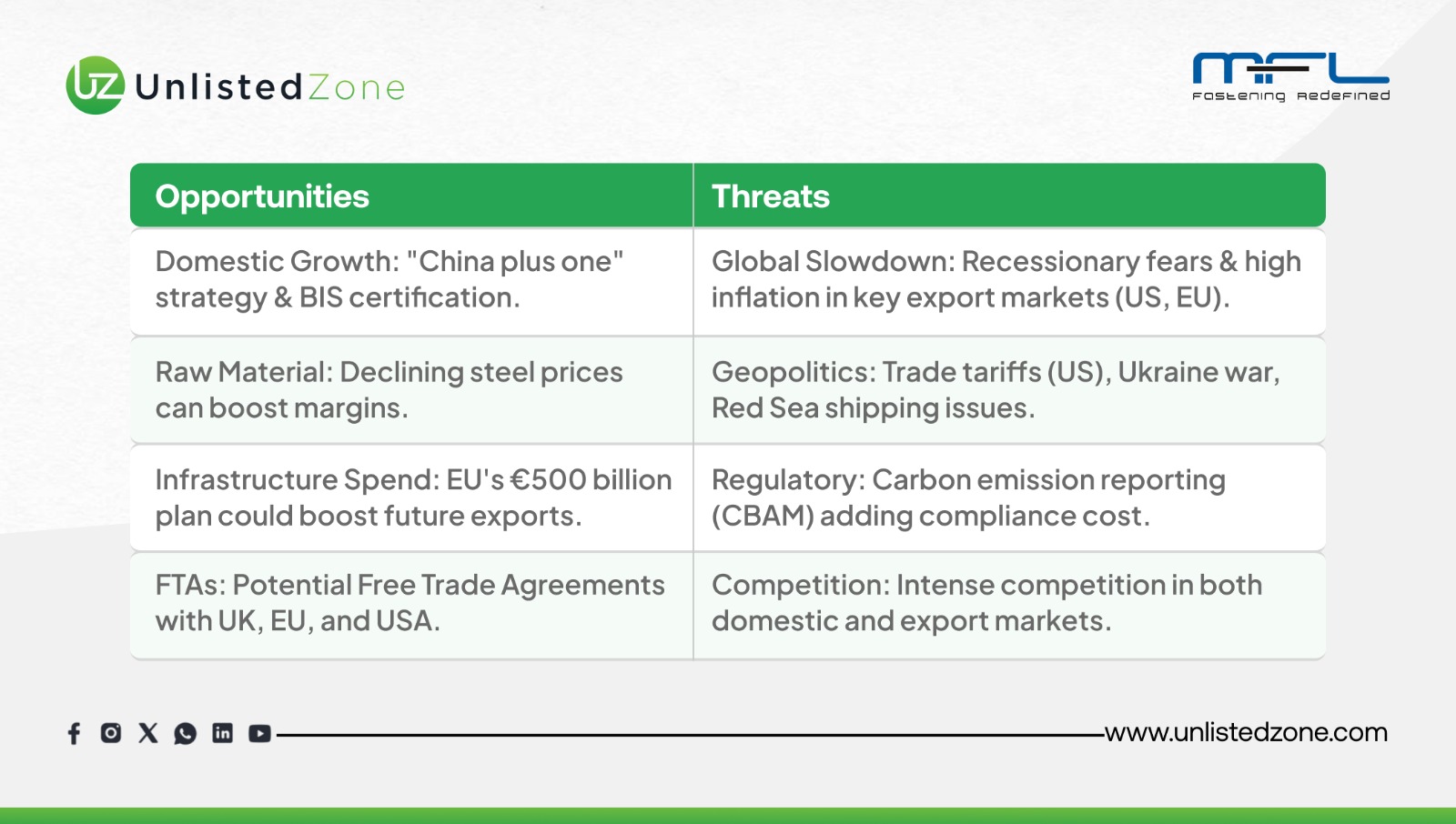

Key Opportunities & Threats of Mohindra Fastners Unlisted Shares

G) Final Conclusion

Mohindra Fasteners Limited is a financially stable, moderately growing, and strategically agile company in the high-tensile fastener industry. Despite FY25 revenue and profit pressures, MFL has maintained healthy profitability, low debt, and consistent shareholder returns.

The near-term challenge remains export dependency, but management’s push towards domestic expansion, operational improvements, and diversification (after-market, JV) provides strong growth levers. With supportive industry tailwinds in India and globally, MFL is well-positioned for long-term, sustainable growth.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.