About the Company

Brief History and Overview

Nayara Energy, formerly Essar Oil, is an integrated downstream oil company operating across the hydrocarbon value chain. Acquired in 2016 by a consortium led by Rosneft, Trafigura, and UCP Investment Group, the company has since rebranded and expanded its refining, trading, retail, and petrochemical operations. It prioritizes health, safety, environment, and community well-being, embedding HSE across all activities.

Business Model of Nayara Energy

-

Core Operations: Refining crude into gasoline, diesel, jet fuel, polypropylene, and petrochemicals. FY25 crude processing: 20.49 MMT with 102.3% capacity utilization.

-

Trading: Procured 146.4 MM BL of crude across 129 grades, engaging in both supply and global trading.

-

Retail: ~6,683 outlets (~7% of India’s network), average throughput of 8.3 KL per outlet.

-

Subsidiaries:

-

Nayara Energy Singapore Pte Ltd (NESPL): Trading, sourcing, export placements.

-

Coviva Energy Terminals Ltd: Developing SBM-2 at Deendayal Port.

-

Segments: Refining, trading, retail, institutional business, petrochemicals, sustainability (biofuels, renewables).

Industry Positioning of Nayara Energy Limited

-

Contributes 8% of India’s refining capacity and 8% of polypropylene capacity.

-

Specializes in processing ultra-heavy crudes (96.1% of input).

-

Workforce: 55,000+ direct and indirect employees.

-

Safety record: 25.12 million safe man-hours, TRIR of 0.058, outperforming industry averages.

Key Highlights of FY24-25 Nayara Energy Unlisted Shares

-

HSE: Launched Nayara Energy HSE Management System; improved contractor safety and road risk management.

-

Sustainability: 12.7% ethanol blending; solar at 1,000+ outlets; desalination, rainwater harvesting, waste management.

-

IT: Cloud migration, cybersecurity upgrades, CTRM modernization, AI/analytics in HR and operations.

-

Expansion: Commissioned polypropylene plant, progressing ethanol projects, SBM-2 setup.

Financial Performance Of Nayara Energy Unlisted Shares

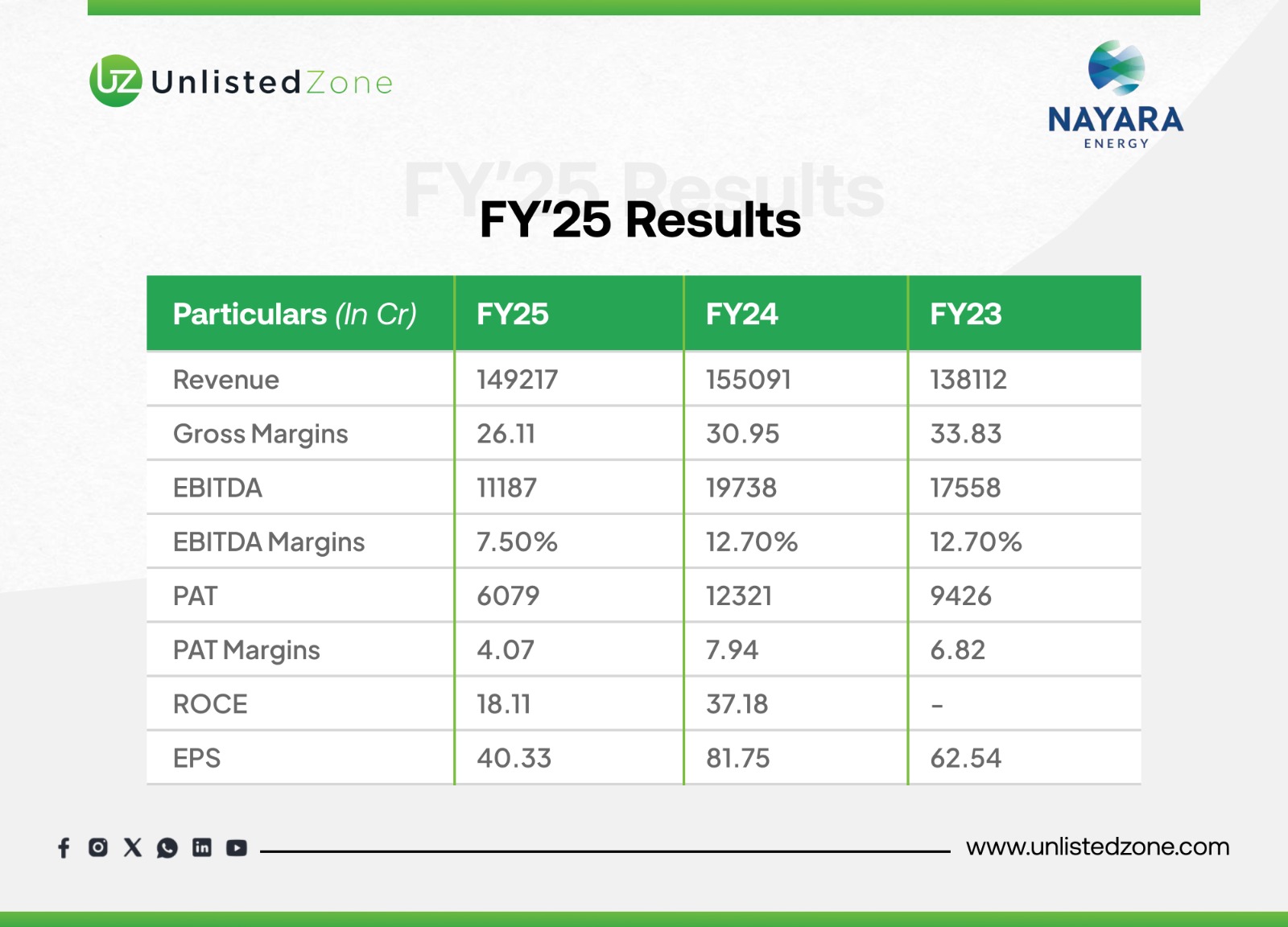

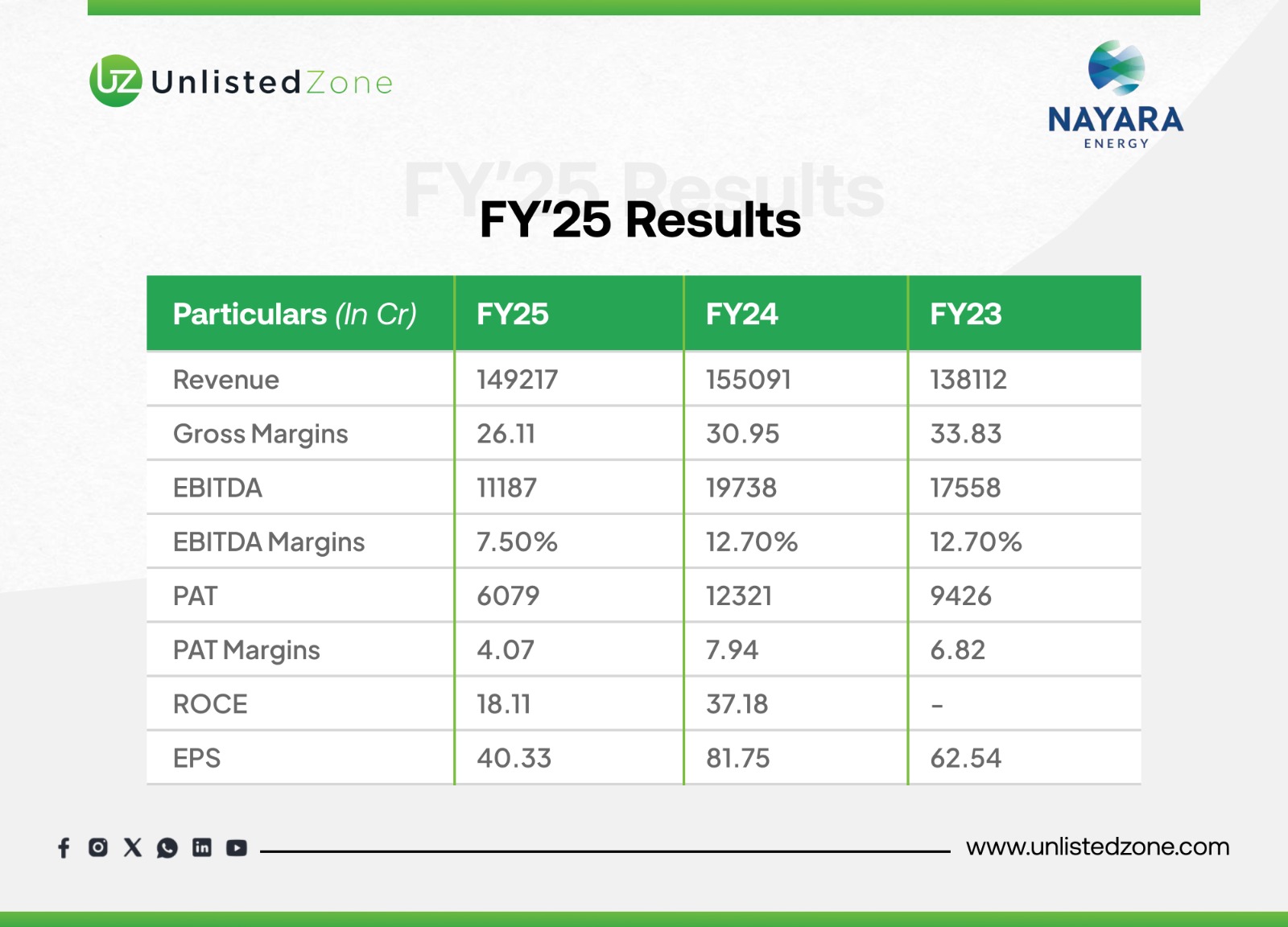

P&L Snapshot (₹ Cr):

-

Revenue Growth (YoY % Change): FY25 revenue declined 3.8% YoY from FY24 (₹155,091 Cr to ₹149,217 Cr), but grew 8.0% from FY23 (₹138,112 Cr).

-

EBITDA, PAT, Margins: EBITDA fell 43.3% YoY to ₹11,187 Cr, with margins compressing to 7.50% due to lower gross margins (26.11% vs. 30.95%). PAT dropped 50.7% YoY to ₹6,079 Cr, with margins at 4.07%, reflecting higher costs or market pressures.

-

EPS and Book Value: EPS halved to ₹40.33 from ₹81.75; book value implied from reserves and share capital growth (reserves up to ₹48,503 Cr from ₹41,984 Cr).

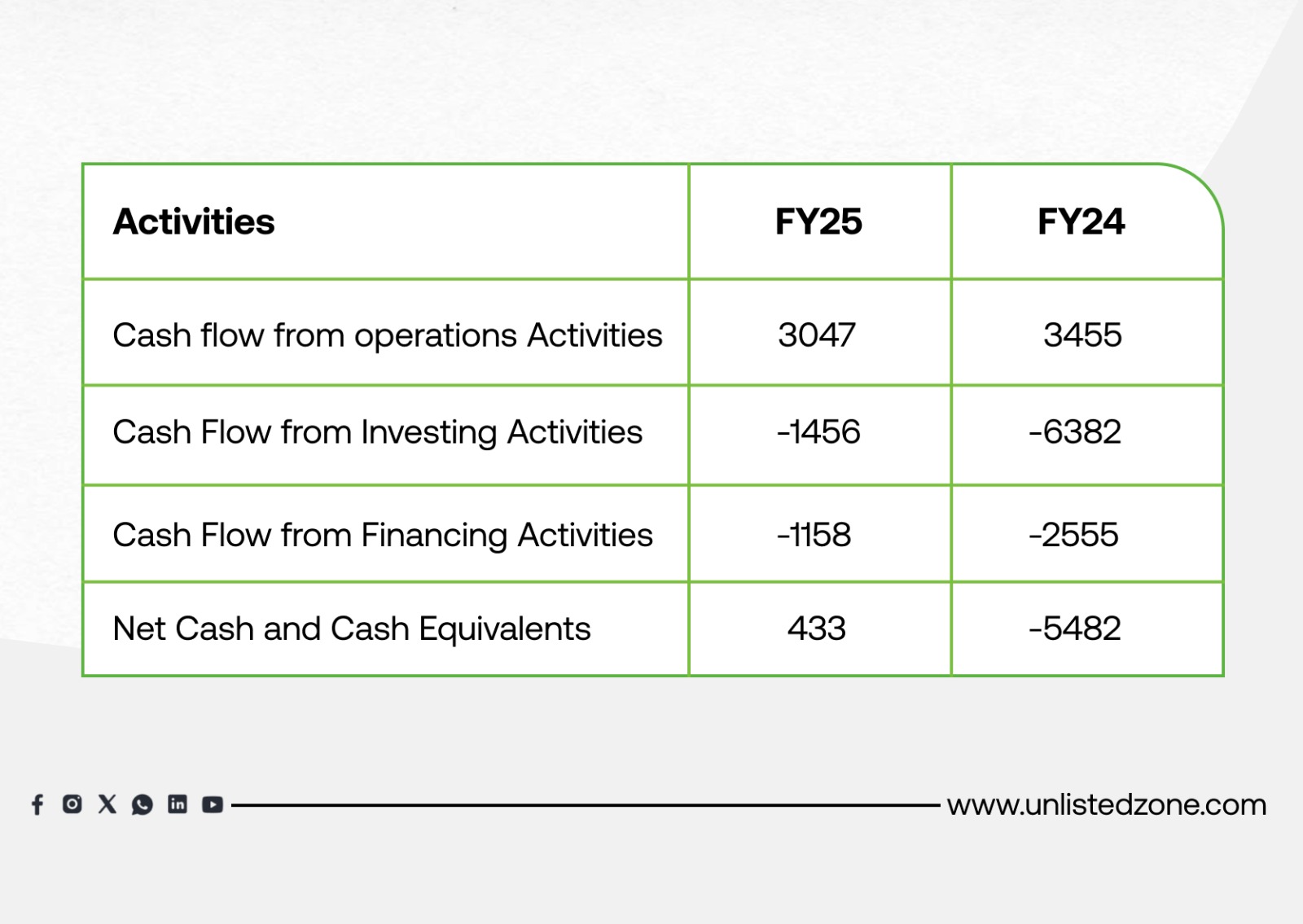

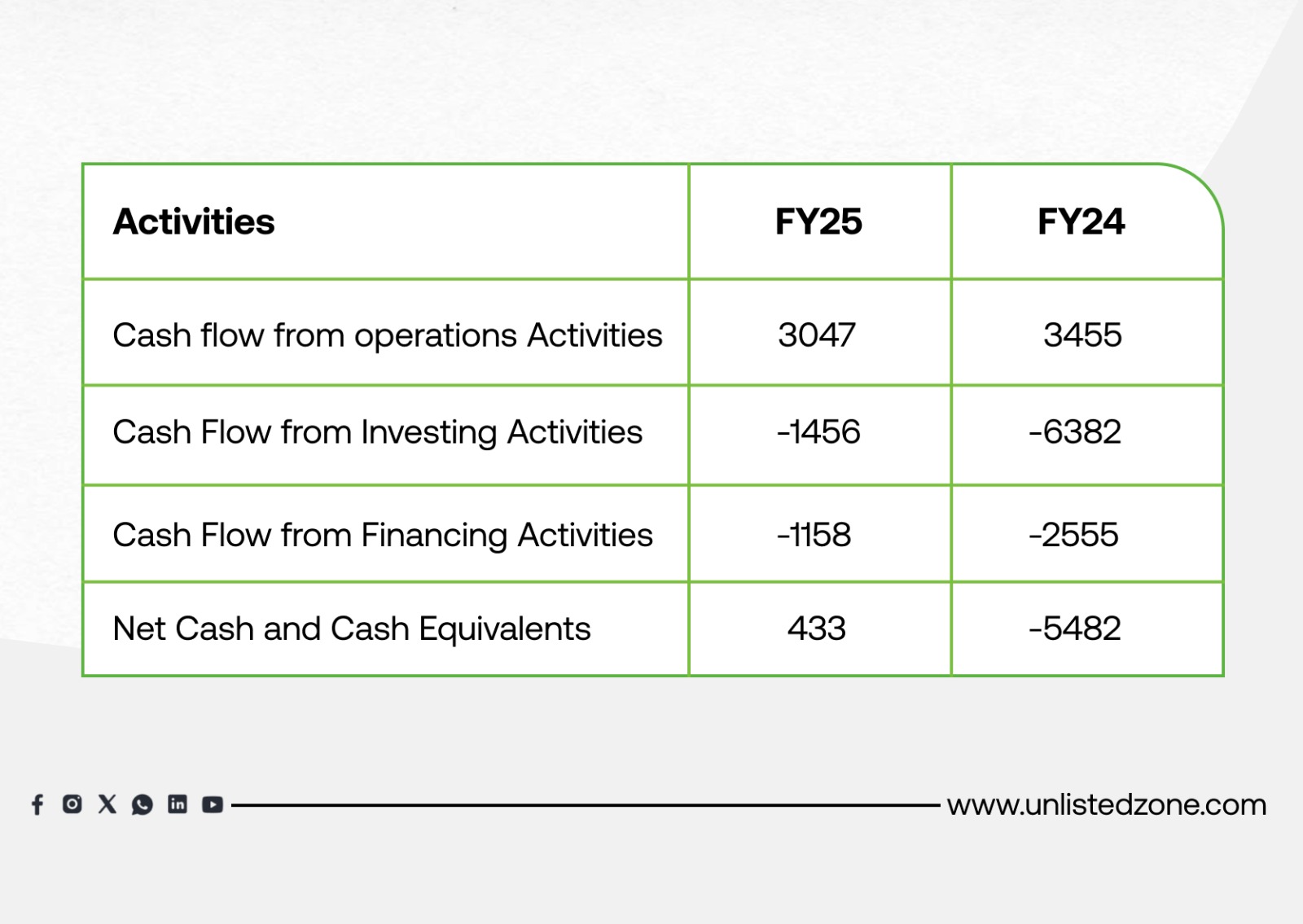

Cash Flow (₹ Cr):

Positive operational cash flow declined slightly YoY, indicating stable but pressured core operations. Investing outflows reduced (less capex), while financing outflows eased. Net positive in FY25 vs. negative in FY24, showing improved liquidity.

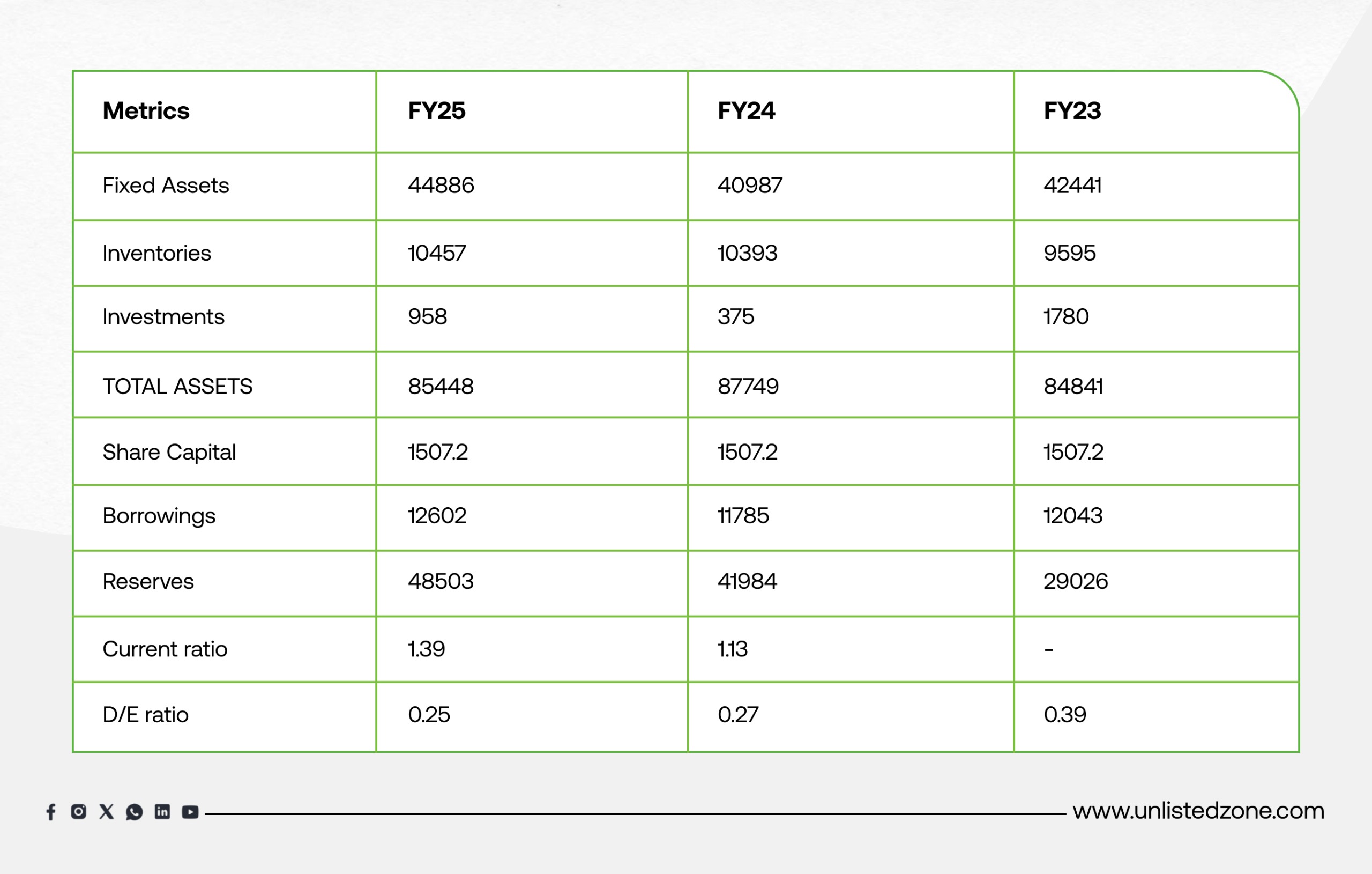

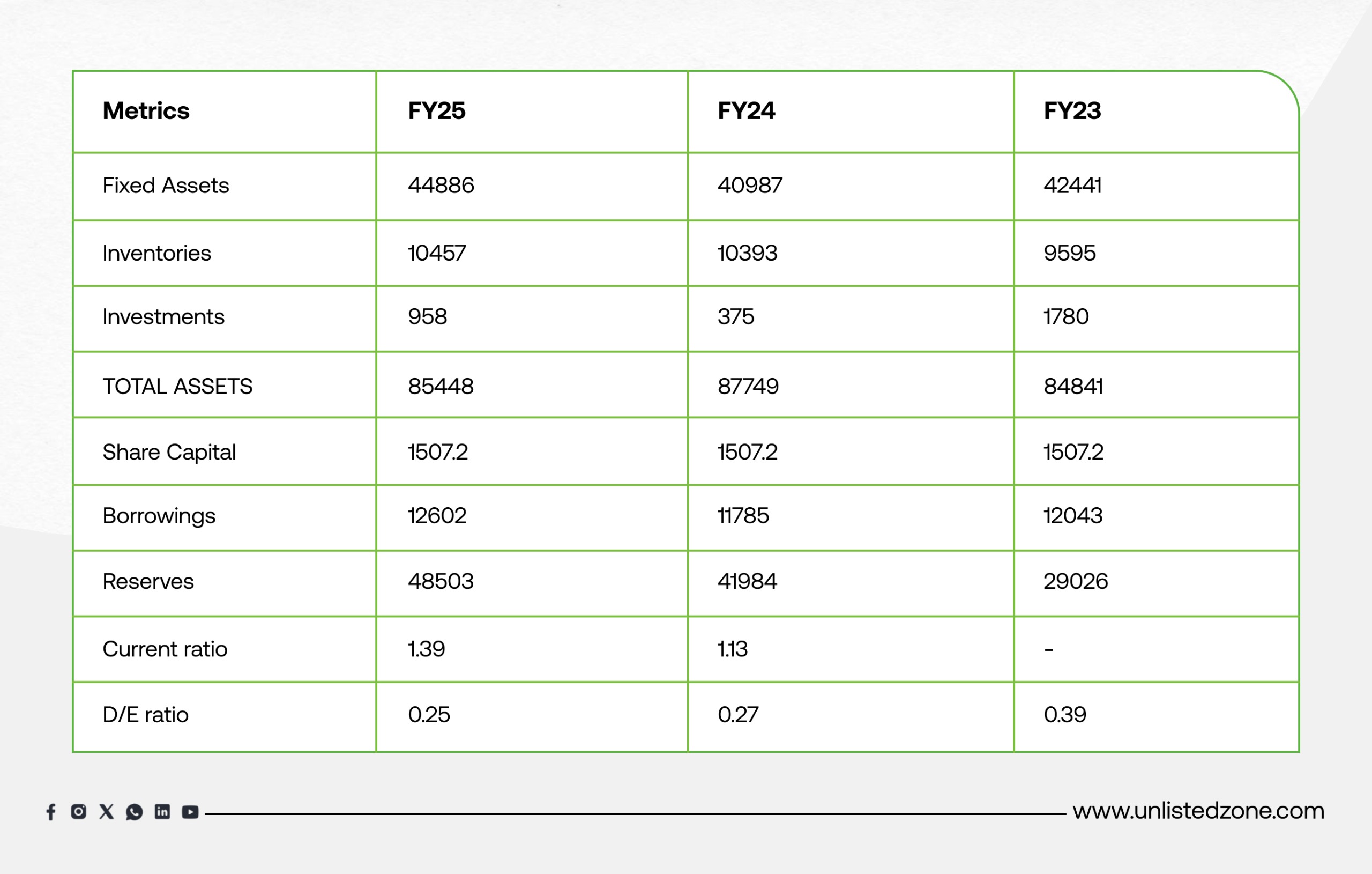

Balance Sheet (₹ Cr):

-

Assets, Liabilities, and Equity Changes: Total assets dipped 2.6% YoY to ₹85,448 Cr, driven by lower investments; fixed assets rose 9.5% due to expansions. Borrowings increased 7.0%, but reserves grew 15.5%, boosting net worth.

-

Debt/Equity Ratio, Net Worth, Reserves: D/E improved to 0.25 (low leverage); net worth strengthened with reserves at ₹48,503 Cr.

-

Liquidity Position: Current ratio improved to 1.39 from 1.13, indicating better short-term solvency.

Post-buyback (after March 31, 2025), paid-up capital reduced to 148,83,90,808 shares of ₹10 each (₹1488 Cr total), following buyback of 21,70,347 shares (8.38% of offer) at ₹731/share for ₹158 Cr.

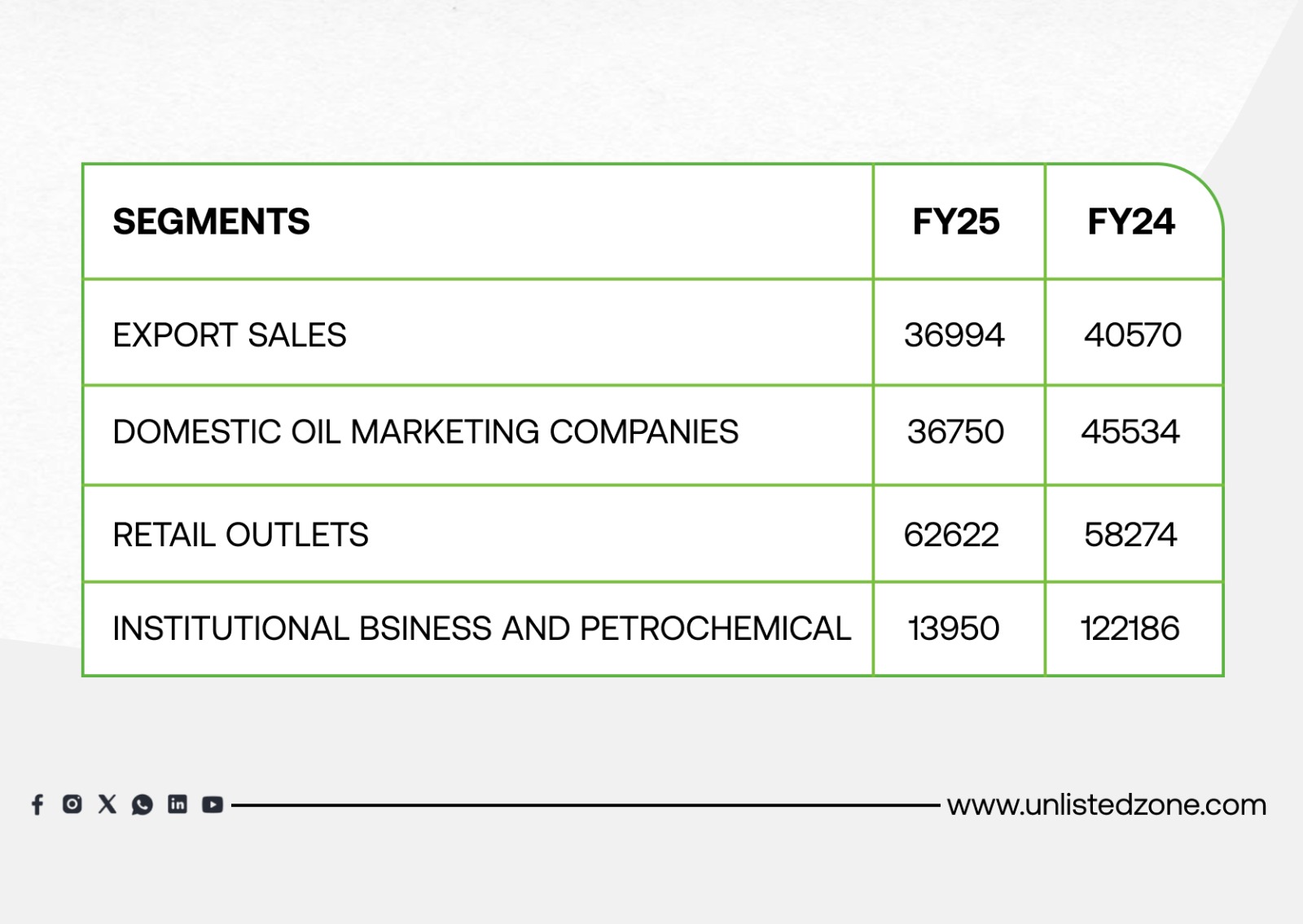

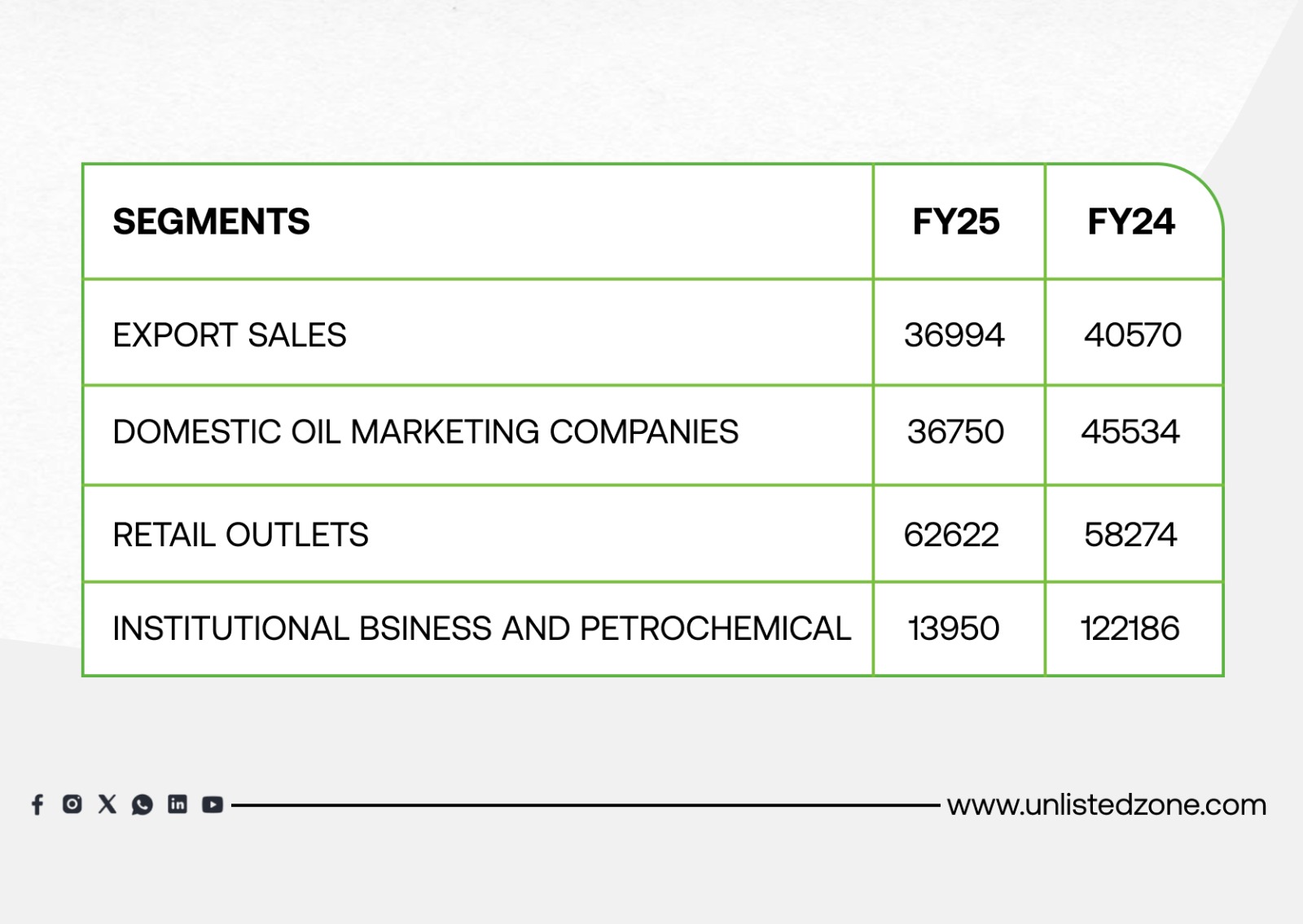

Segment Sales (₹ Cr):

-

Contribution of Different Business Segments: Manufactured goods dominate (90.6% of revenue in FY25), down 3.9% YoY. Traded goods (9.2%) fell 2.5%. Retail outlets grew 7.4% YoY, contributing 42% of sales, showing strong domestic consumer demand. Exports declined 8.8%, while institutional/petrochemical rose 14.1%.

-

Regional or Product-Level Performance: Domestic segments (retail + oil companies + institutional) total ~74% of sales, up from FY24 mix. Retail strength aligns with 6,683 outlets; petrochemicals leverage 8% national capacity.

Management Discussion & Analysis on Nayara Energy Unlisted Shares

-

Outlook: Growth in decarbonization, renewables, and efficiency amid evolving regulations (CCTS, 20% ethanol blending by 2025).

-

Risks: Crude price volatility, evolving regulations, CSR execution delays.

-

Roadmap: 7-pronged decarbonization (biofuels, hydrogen, CCU, renewables); strengthen HR, CSR, IT resilience, and governance.

Shareholding Pattern of Nayara Energy Unlisted Shares

-

Rosneft Singapore Pte. Limited is the largest shareholder with a 49.13% stake.

-

Kesani Enterprises Company Limited holds shares in two forms:

-

The combined holding of Kesani Enterprises Company Limited is 49.13% (31.92% + 17.21%).

-

Other shareholders hold a 1.73% stake in the company.

-

Post-buyback equity: 148.83 Cr shares.

-

Buyback at ₹731/share (~₹1,586 Cr) reduced minority holding.

Valuation Insights of Nayara Energy Unlisted Shares

-

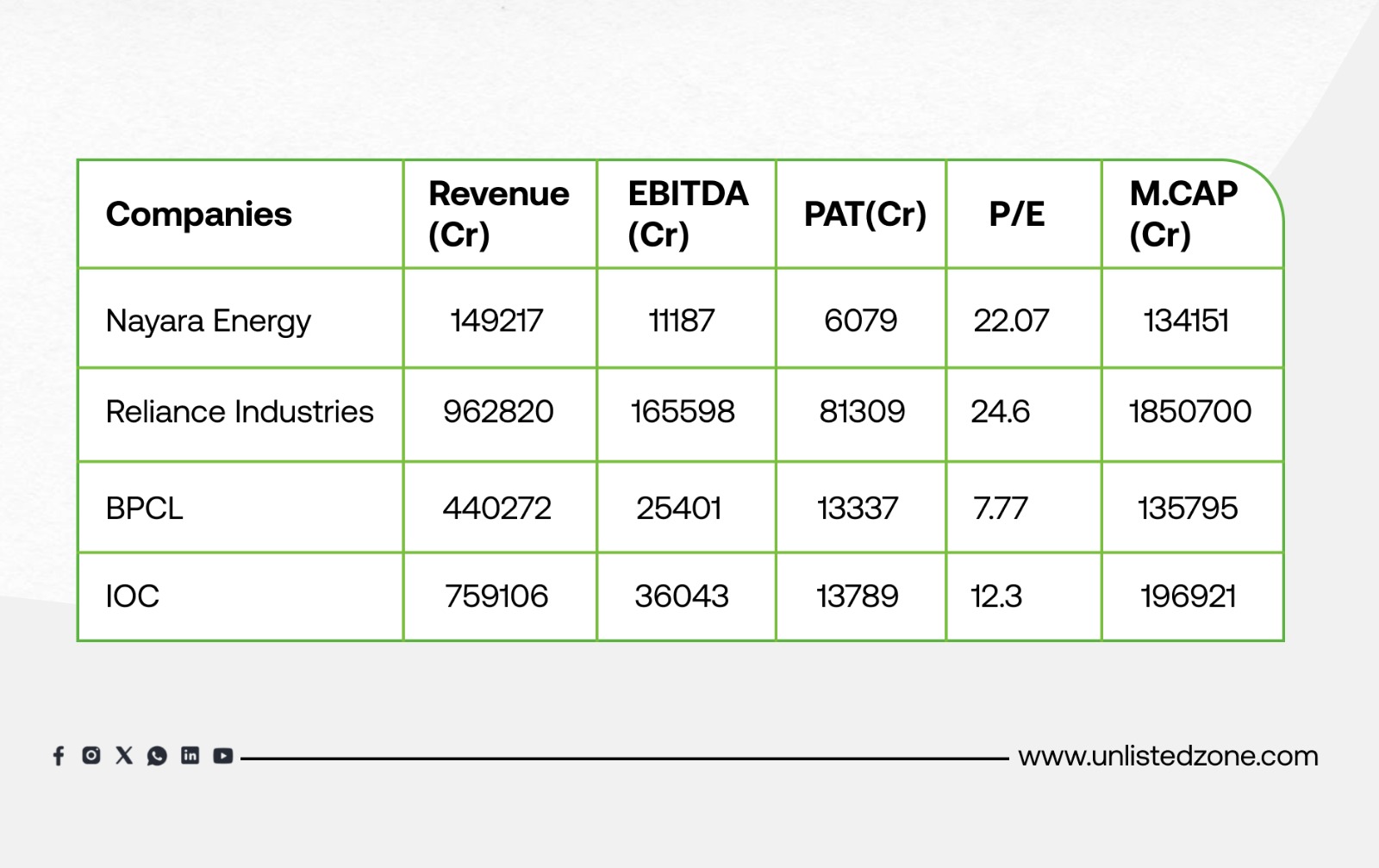

Implied Market Cap: ~₹134151 Cr (post-buyback @ ₹731/share).

-

Valuation ratios: P/E 22.07x, P/B ~2.68, EV/EBITDA ~ 11.87

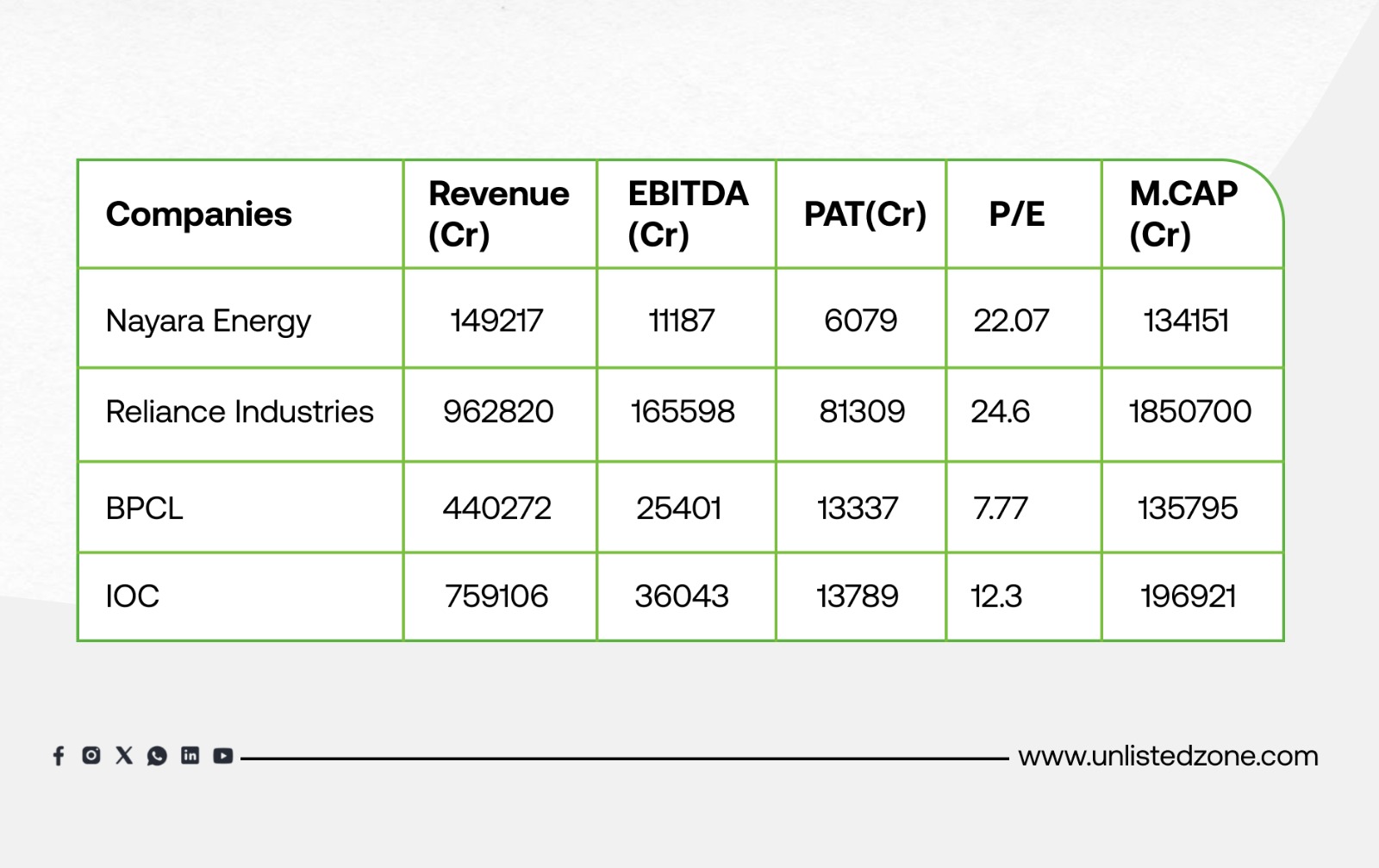

Peers Comparison

Future Outlook of Nayara Energy Unlisted Shares

-

Opportunities: Ethanol expansion, petrochemicals, SBM-2, renewables, digitalization.

-

Risks: Margin pressure, global crude volatility, regulatory shifts.

-

Suitability: Attractive for HNIs/long-term investors seeking downstream oil + ESG exposure.

UnlistedZone View on Nayara Energy Unlisted Shares

Thesis: Strong integrated model, ESG leadership, retail and petrochemical growth, Rosneft-backed stability.

Risks: Earnings volatility, CSR execution gaps, heavy crude reliance.

Call: Compelling long-term hold; undervalued vs peers; ideal for patient investors in India’s energy transition.

For More Information Visit : UnlistedZone

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.