Introduction

The National Commodity & Derivatives Exchange Limited (NCDEX) has experienced substantial changes in its shareholding structure from March 31, 2024, to March 31, 2025. The surge in retail investors, the exit of venture capital funds, and several notable shifts in corporate and individual shareholder bases are key highlights. Additionally, a strategic investment from Share India Securities demonstrates growing confidence in NCDEX Unlisted Shares.

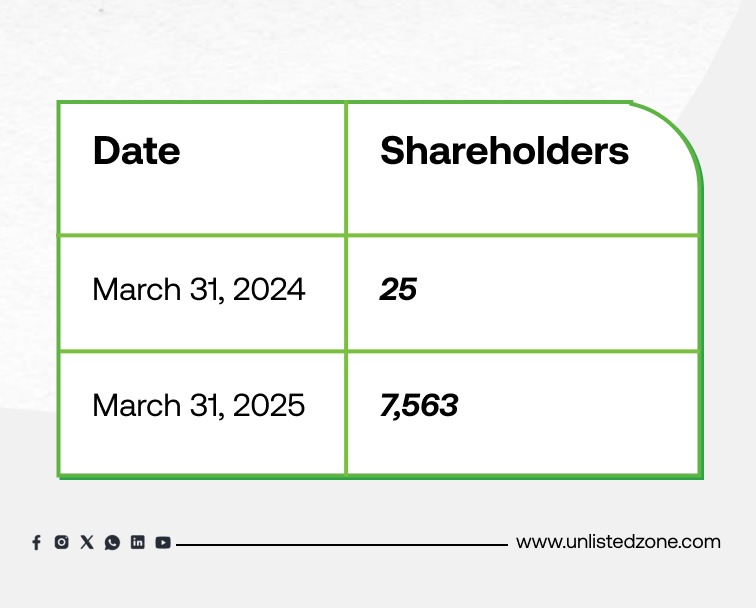

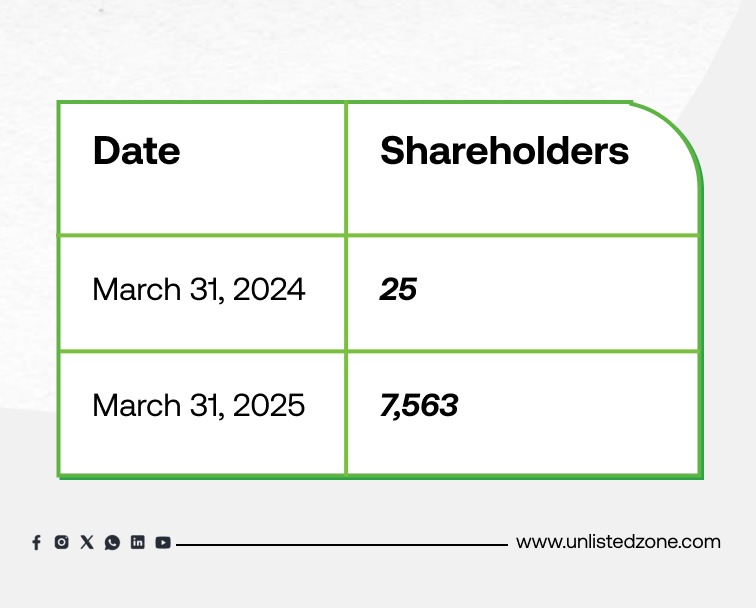

1. A Surge in Shareholders: From 25 to 7,563

The number of shareholders in NCDEX Unlisted Shares has seen a dramatic increase, reflecting growing interest in commodity trading.

This rise is largely driven by retail investors becoming more active in the market.

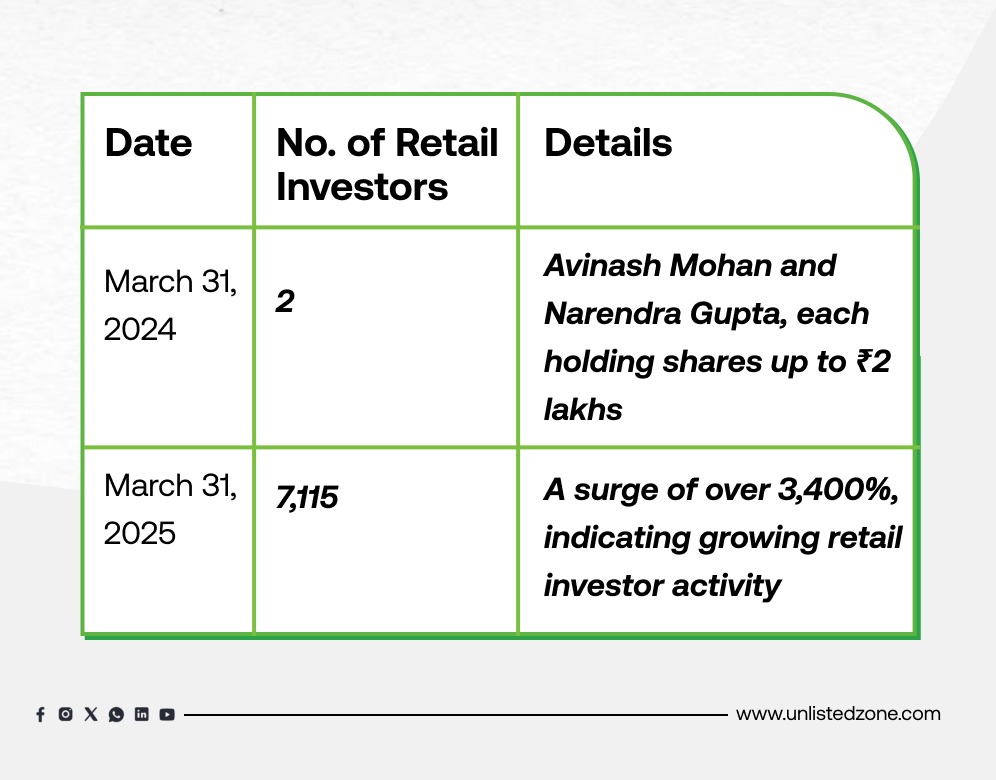

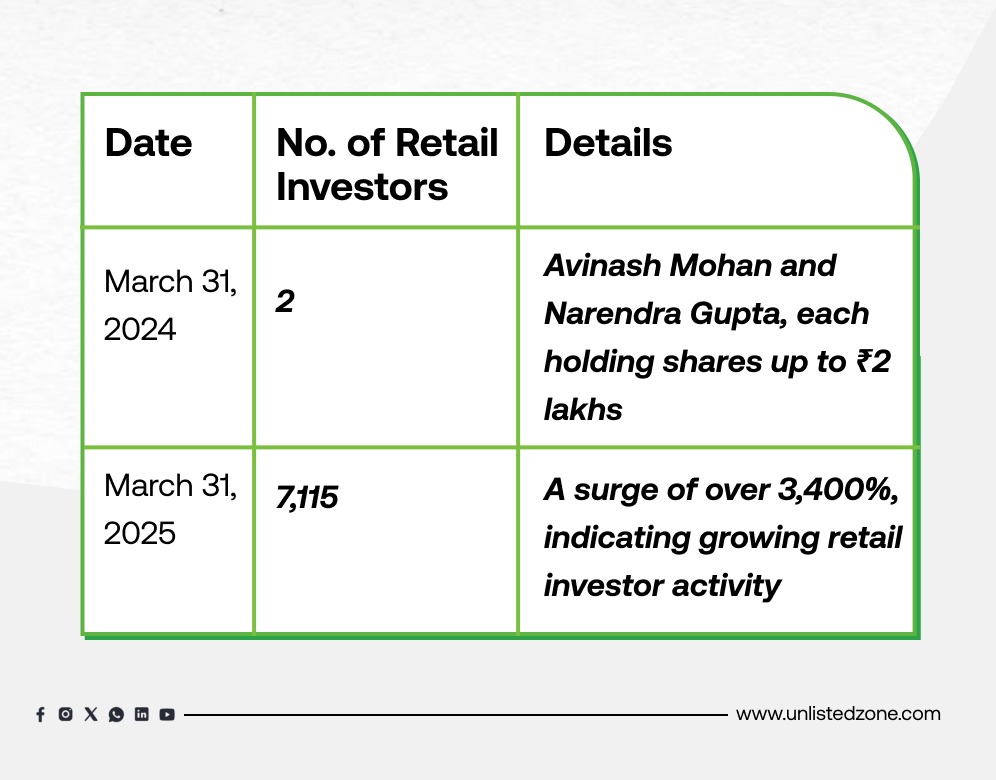

2. Retail Investors: A Massive Influx

Retail investor participation has surged significantly, with thousands of small investors joining the market.

This dramatic rise highlights the increasing appeal of NCDEX Unlisted Shares to smaller investors seeking to diversify their portfolios.

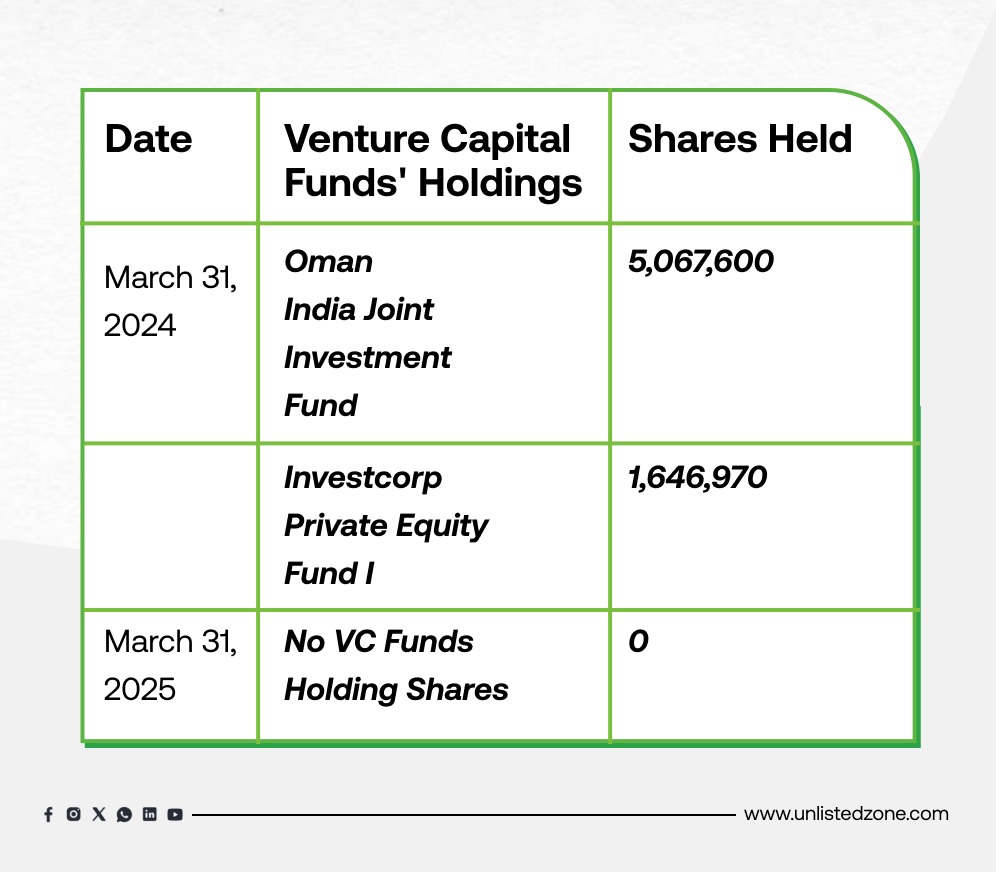

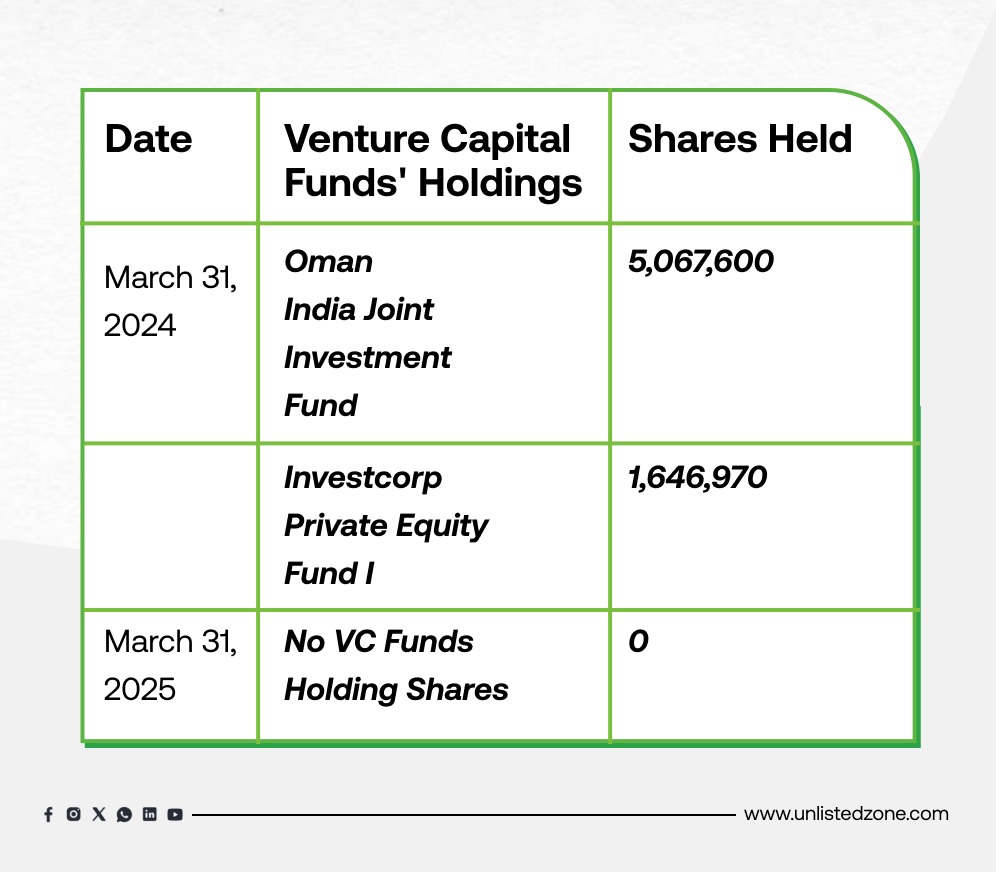

3. Exit of Venture Capital Funds

Venture capital funds have completely exited their holdings in NCDEX, marking a shift in the investor base.

The exit likely reflects a shift in institutional focus, with retail investors stepping in to fill the void.

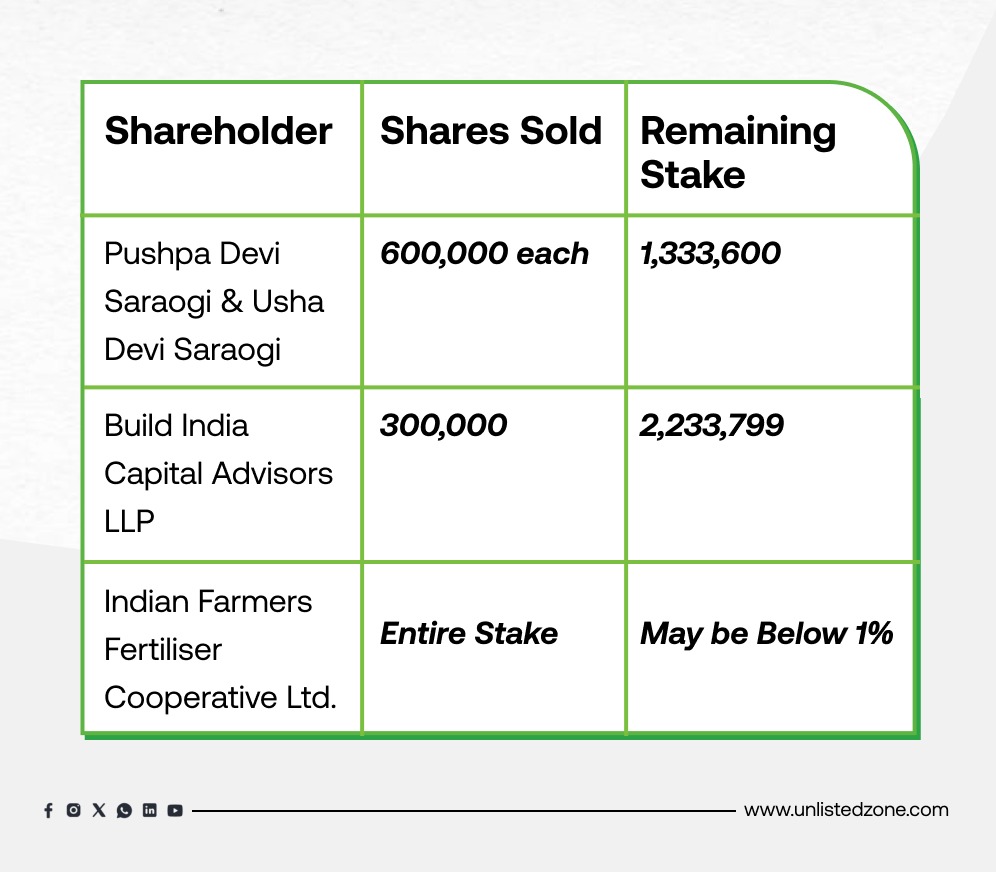

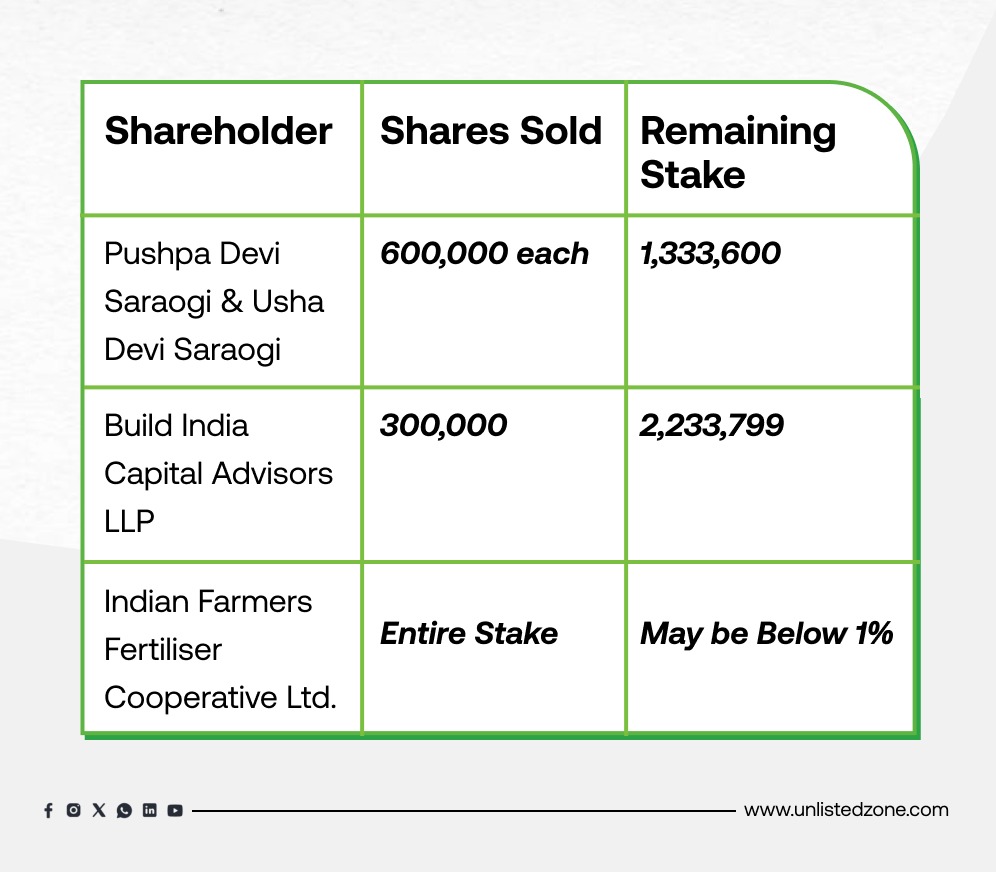

4. Significant Sales by Individual and Corporate Shareholders

Several large shareholders have reduced or sold portions of their holdings:

These sales could indicate concerns about the exchange's future growth prospects or may be part of strategic exits.

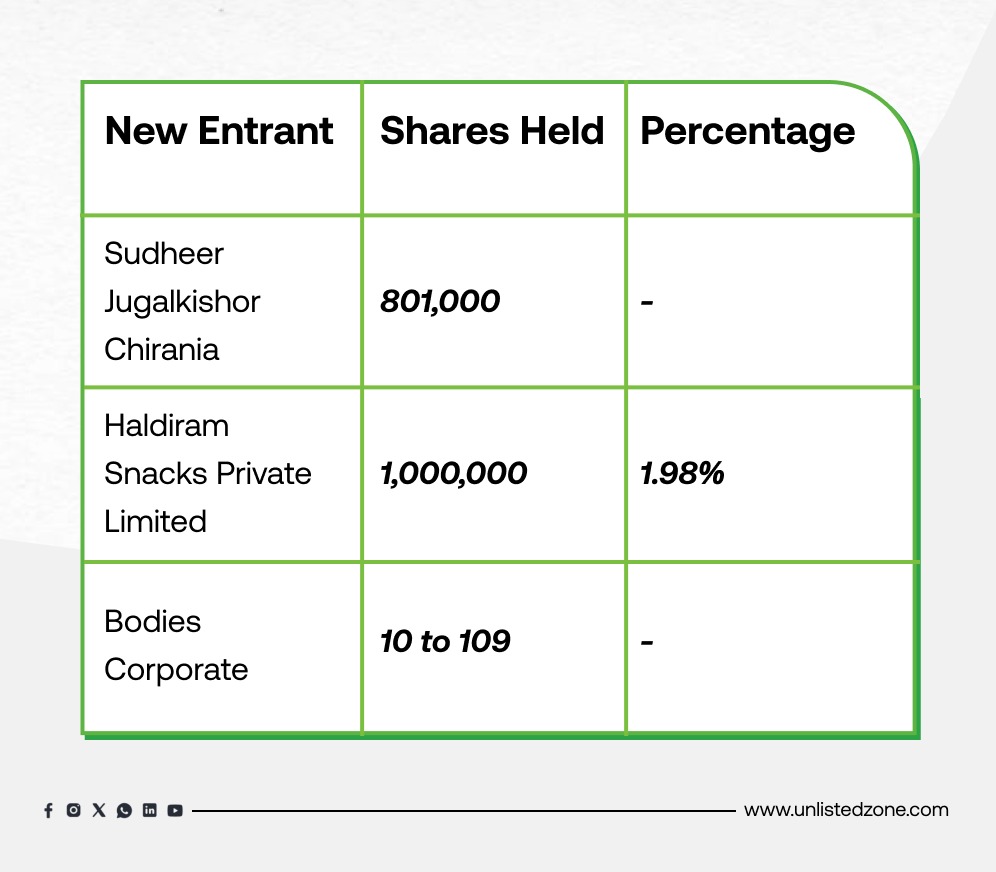

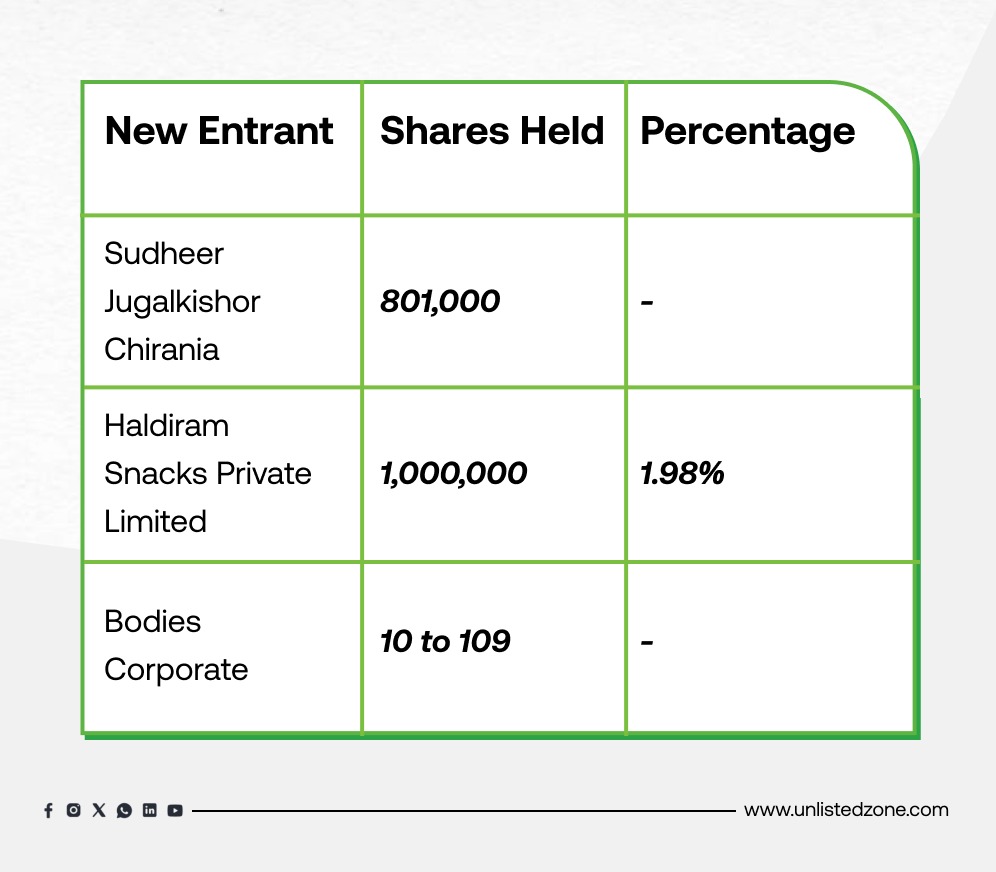

5. New Entrants and Corporate Expansion

The shareholding pattern reveals significant interest from corporate investors and new individuals:

These new entrants suggest that corporate players are increasingly eyeing NCDEX Unlisted Shares.

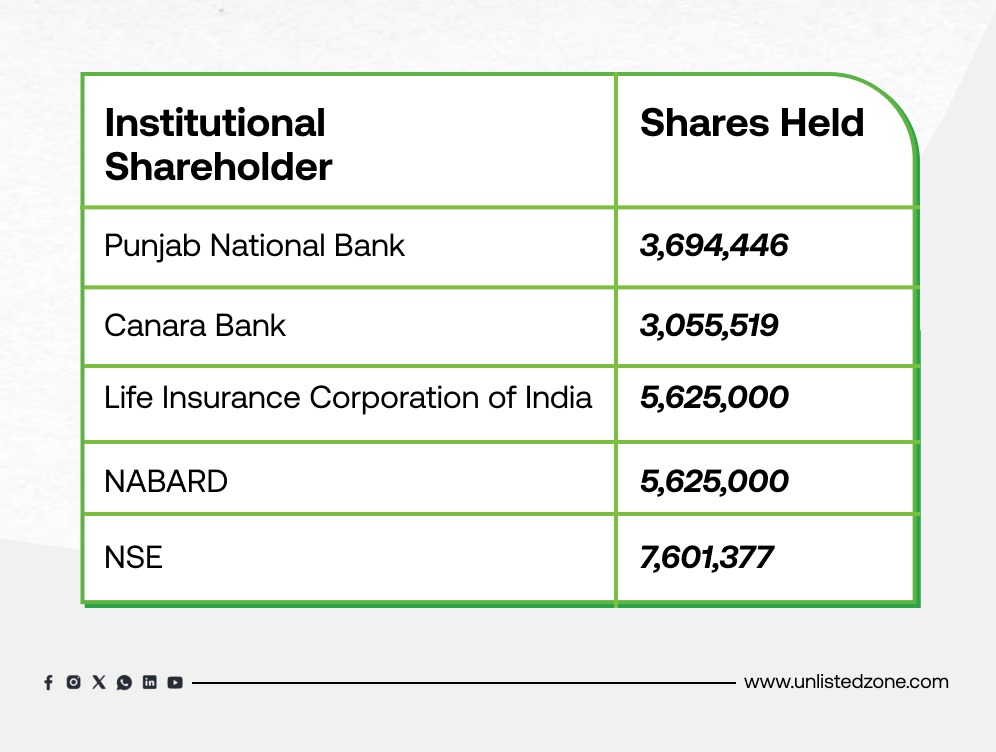

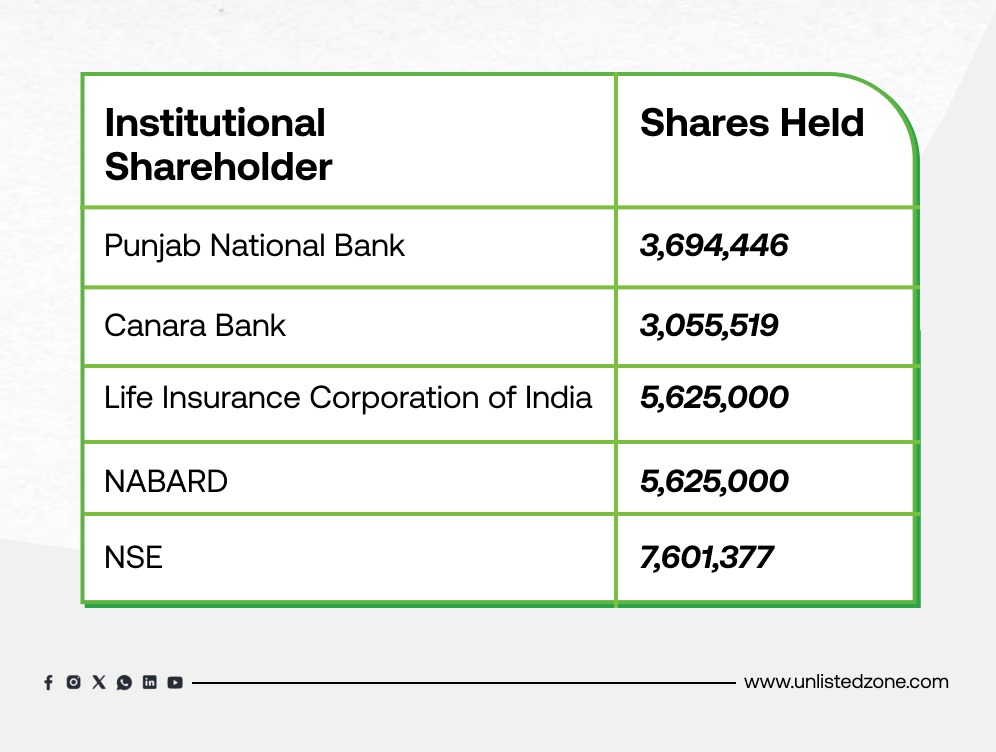

6. Stability Among Institutional Shareholders

Institutional investors have maintained their stakes, signaling continued confidence in NCDEX:

The stability among institutional investors underscores a positive outlook for NCDEX’s future growth.

7. Strategic Investment by Share India Securities

Share India Securities has made a significant investment of ₹280 million (approximately ₹28 Cr) in NCDEX Unlisted Shares at ₹197 per share. This strategic move by a reputable financial entity is expected to drive increased interest from both retail and institutional investors.

Conclusion: NCDEX’s Evolving Shareholding Landscape

The changes in NCDEX's shareholder base reflect a transformation in ownership. While venture capital funds and large individual investors have reduced their stakes, the rise in retail investors and strategic backing from Share India Securities indicate a positive future for the exchange. Corporate investors such as Haldiram, along with stable institutional support, reinforce confidence in NCDEX’s long-term potential. With rising retail participation, NCDEX Unlisted Shares remain an attractive investment opportunity, indicating promising growth ahead.