1. What has OYO announced?

OYO (Oravel Stays Ltd.) is issuing Bonus Compulsorily Convertible Preference Shares (CCPS) to all its equity shareholders.

If you held OYO shares as on 24 October 2025, you’ll get

👉 1 Bonus CCPS for every 6,000 equity shares you own.

So, for every 6,000 shares, you’ll receive one CCPS — free of cost.

2. What if I hold less than 6,000 shares?

If you hold less than 6,000 equity shares, you will not get any Bonus CCPS.

There will be no fractional entitlement — which means if your holding is, say, 5,999 shares, you’ll get zero CCPS.

3. What is a Bonus CCPS?

A CCPS (Compulsorily Convertible Preference Share) is not a normal share.

It’s a type of share that will automatically convert into equity shares later under specific conditions.

In short — you get the CCPS now, and it will turn into equity shares later, depending on which option you choose.

4. What are the two conversion options available?

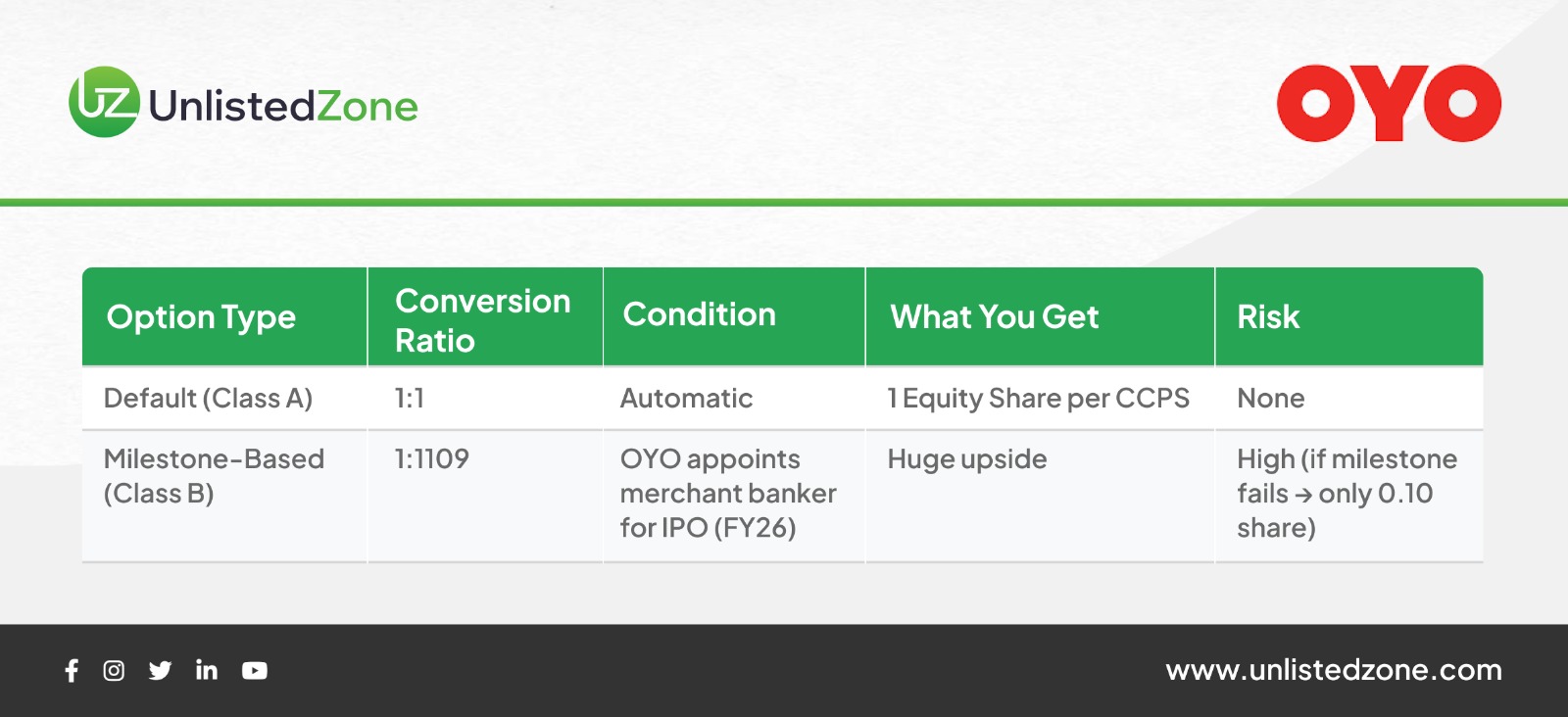

OYO is offering two ways (options) to convert your Bonus CCPS into equity:

Option 1 – Default Conversion (Class A)

If you do nothing, you’ll automatically fall under the Default Option.

Each Bonus CCPS will convert into 1 Equity Share.

👉 1 CCPS = 1 Equity Share

You don’t have to inform the company for this; it’s automatic.

Option 2 – Milestone-Based Conversion (Class B)

If you want to take a higher-risk, higher-reward route, you can opt for the “Milestone-Based Option.”

Here’s how it works:

-

If OYO appoints a merchant banker for its IPO during FY 2025–26 (the “Milestone”),

👉 1 CCPS = 1,109 Equity Shares

-

If OYO fails to achieve this milestone,

👉 1 CCPS = 0.10 Equity Shares

So, it’s a conditional reward — massive upside if IPO preparations move forward, minimal conversion if not.

5. What do Class A and Class B mean?

-

Class A Bonus CCPS Holders → Those who do not opt for the Milestone-Based Option. Their CCPS will convert 1:1 (default).

-

Class B Bonus CCPS Holders → Those who opt for the Milestone-Based Option. Their CCPS will convert 1:1109 or 1:0.10, depending on IPO progress.

6. What do I need to do if I want to choose the Milestone-Based Option?

You must inform OYO in writing within 3 working days from the date the postal ballot notice was sent.

You’ll need to fill out and submit the election letter (Annexure B) provided by the company.

If you don’t send the election letter within that time, you’ll automatically fall into Class A (the default 1:1 conversion).

7. What is the “Milestone” that decides the conversion ratio?

The Milestone is clearly defined as:

“Appointment of the bankers during FY 2025–26 in connection with any proposed initial public offering (IPO) of the Company.”

So, if OYO formally appoints a merchant banker during FY26, the milestone is considered achieved.

8. Why is OYO issuing these Bonus CCPS?

OYO is doing this for three main reasons:

-

To reward existing shareholders without immediately increasing equity capital.

-

To keep flexibility before IPO approval — CCPS don’t immediately dilute equity.

-

To align investor benefit with IPO success — shareholders gain only if the IPO actually progresses.

This structure ties investor benefit directly to IPO readiness.

9. How will this affect my shareholding?

There’s no change for now — CCPS are not counted as equity until they convert.

However, if the milestone is achieved (IPO banker appointment), and CCPS convert at 1:1109, the equity base will expand significantly, affecting overall percentage holdings.

10. Why two conversions — 1:1 and milestone-based?

OYO is giving flexibility to investors:

It’s like choosing between a fixed return and a performance-linked bonus.

11. Will I get any dividend on CCPS?

The Bonus CCPS carries a nominal dividend rate of 0.01% per annum (non-cumulative).

Dividends are payable only when declared by the board.

12. In short – summary for investors

13. Why is this unique?

This is a rare and creative corporate structure — combining:

It allows OYO to reward loyalty, signal IPO readiness, and manage capital prudently — all at once.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.