About the Company

President Systems, established in 1984, is a leading designer, manufacturer, and supplier of enclosure systems for IT, Telecom, and Industrial sectors. It became part of Schneider Electric in 2011, gaining global expertise and brand strength. The company operates from a fully integrated ISO 9000/14000 certified manufacturing facility in Attibele, Bangalore, spread across 200,000 sq. ft. Its offerings include standard and customized 19-inch racks, cabinets, card frames, and micro data center solutions. Over decades, it has built a strong presence in India while serving both domestic and international markets.

A) Business Model & Segments

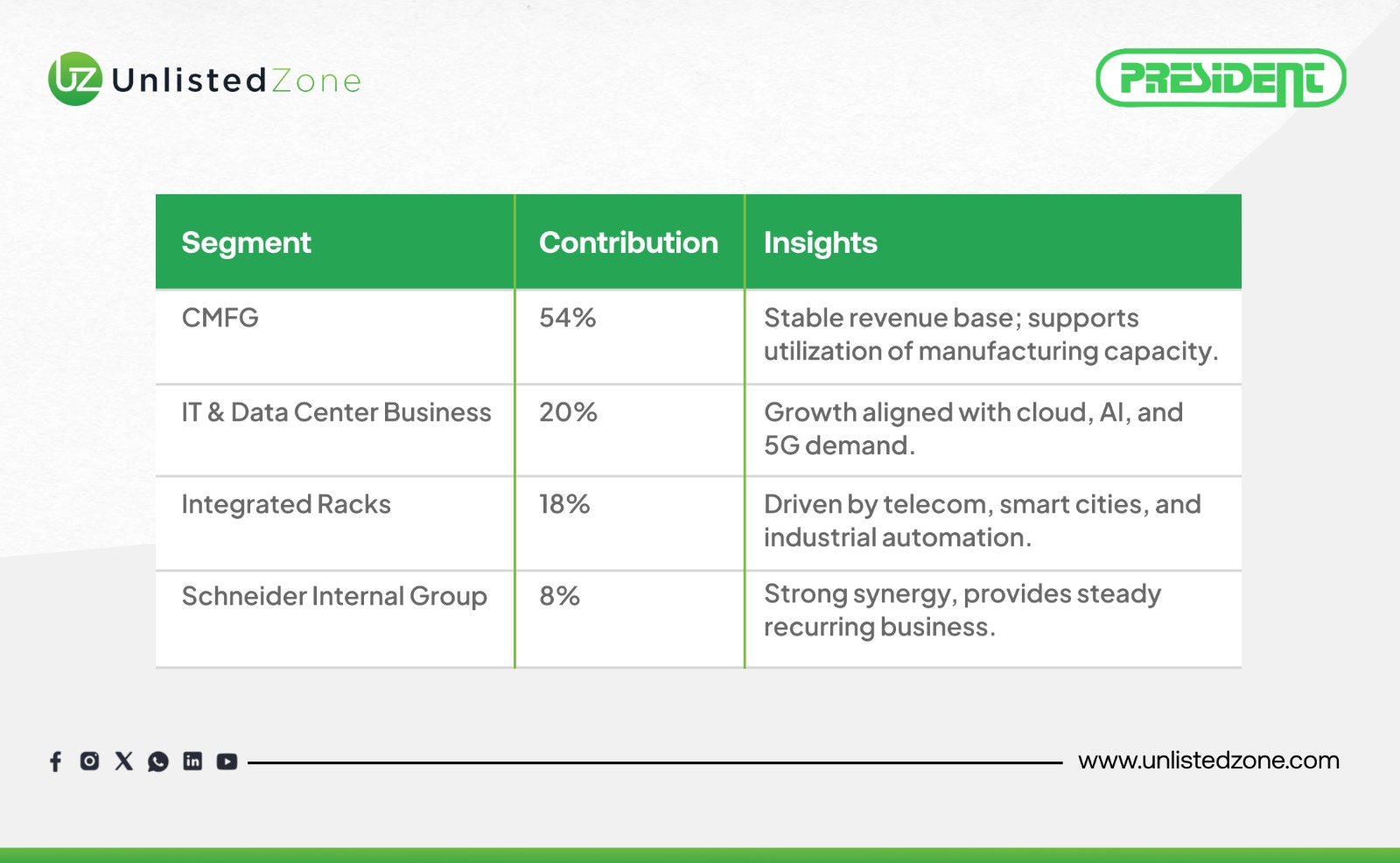

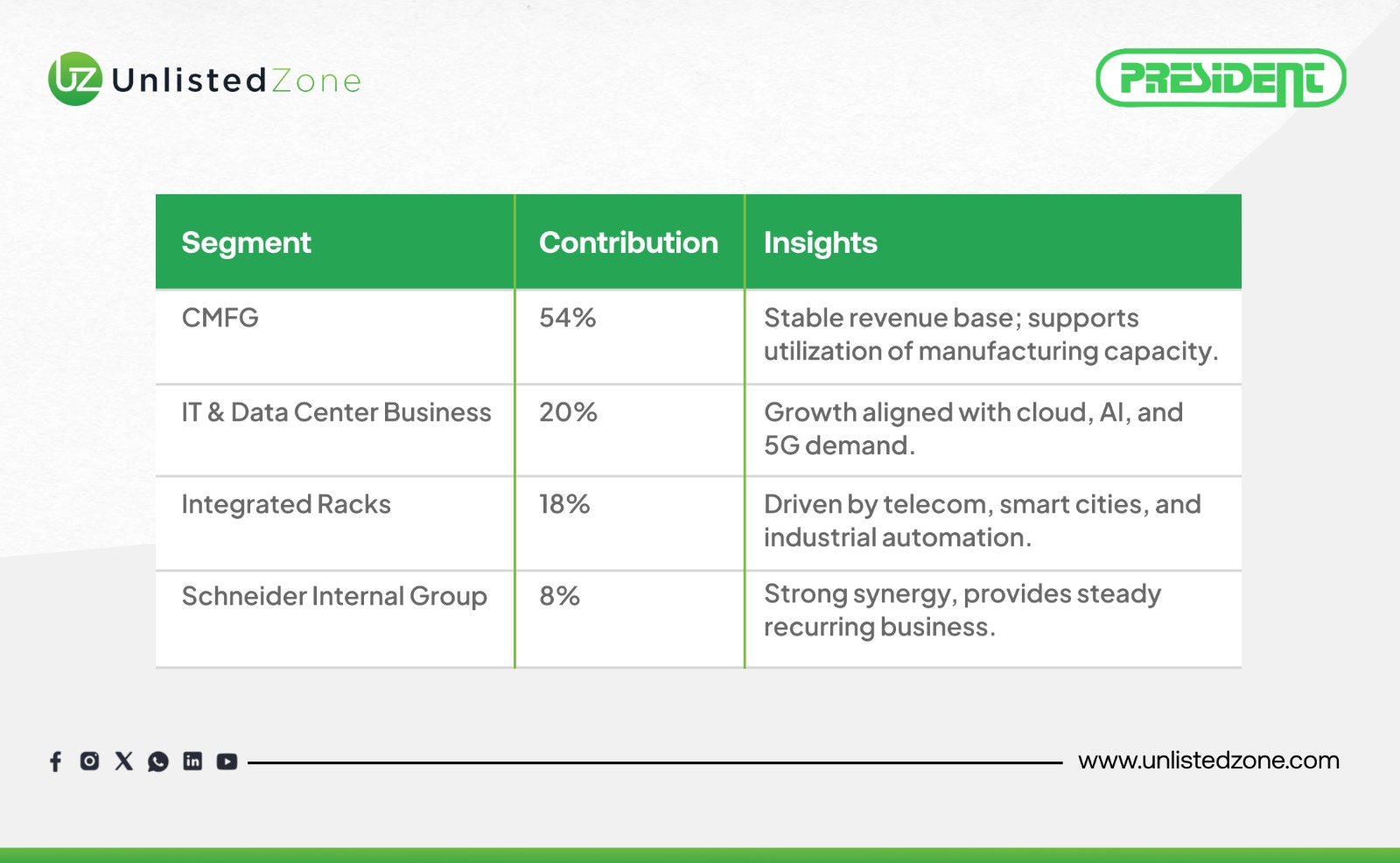

President Systems follows a diversified yet focused portfolio approach:

-

Contract Manufacturing (CMFG) – 54% of revenue. Offers build-to-print solutions for global telecom OEMs and ATM manufacturers.

-

IT & Data Center Business – 20%. Provides racks and micro data centers for IT/ITES enterprises, BFSI, government, and defense.

-

Integrated Racks – 18%. Solutions for telecom, industrial automation, and smart city deployments.

-

Schneider Internal Group (IG) – 8%. Supplies to Schneider Electric’s global operations across multiple geographies.

This mix ensures revenue stability (volume-driven CMFG), profitability (IT/Integrated Racks), and guaranteed synergy (IG segment).

B) Industry Positioning

President Systems operates in the rapidly expanding data center infrastructure industry, aligned with key growth drivers:

-

Cloud services market in India growing at 25.8% CAGR, projected to reach USD 232.78 billion by 2033.

-

Edge data center capacity expected to triple by 2027 (200-210 MW from current 60-70 MW).

-

Rising data consumption (27.5 GB/user per month) fueled by 5G adoption.

-

India’s internet penetration at 55.3%, with 806 million users as of 2024.

The company’s integration with Schneider Electric positions it as a premium solutions provider, competing on value and innovation rather than price.

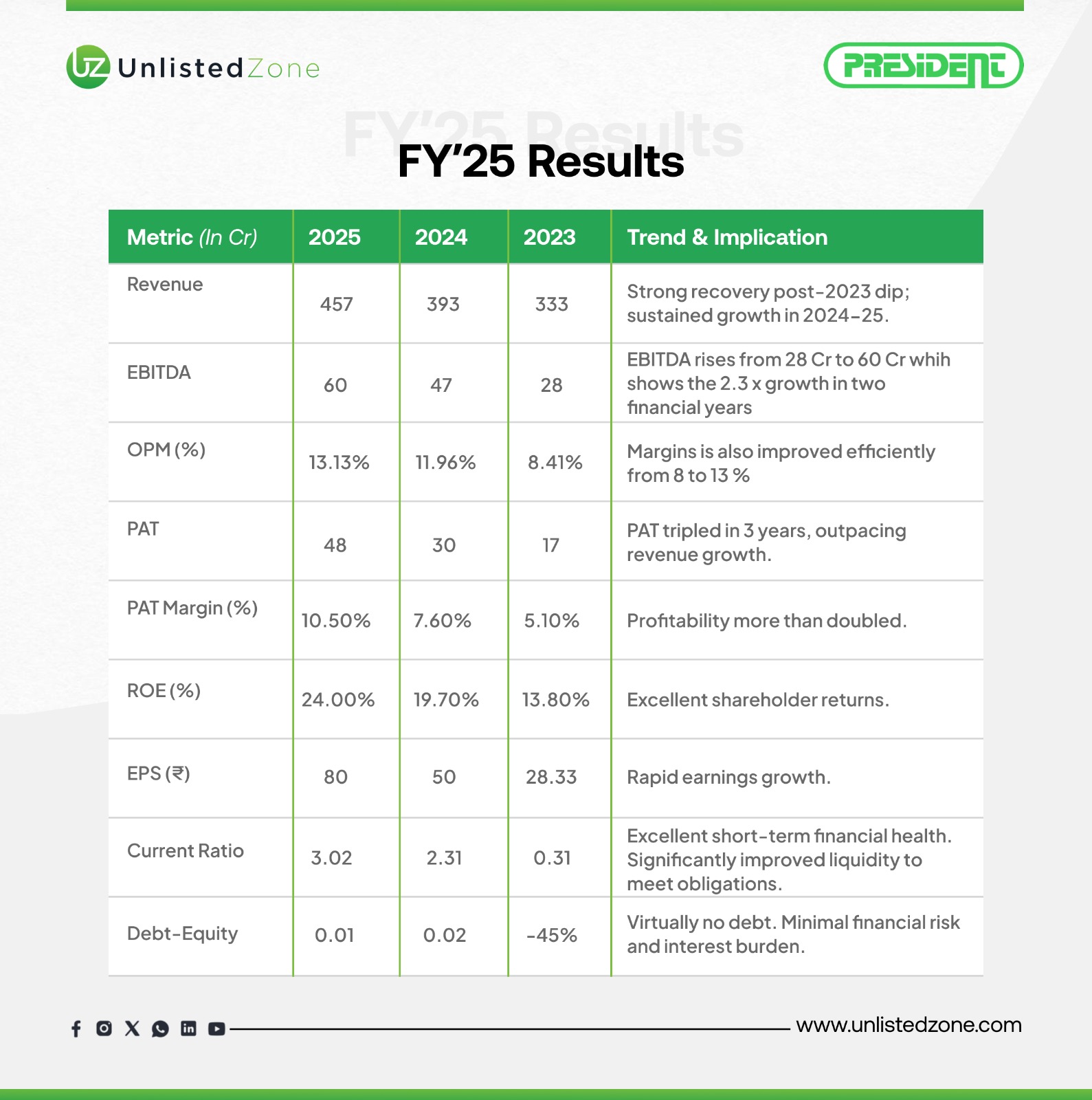

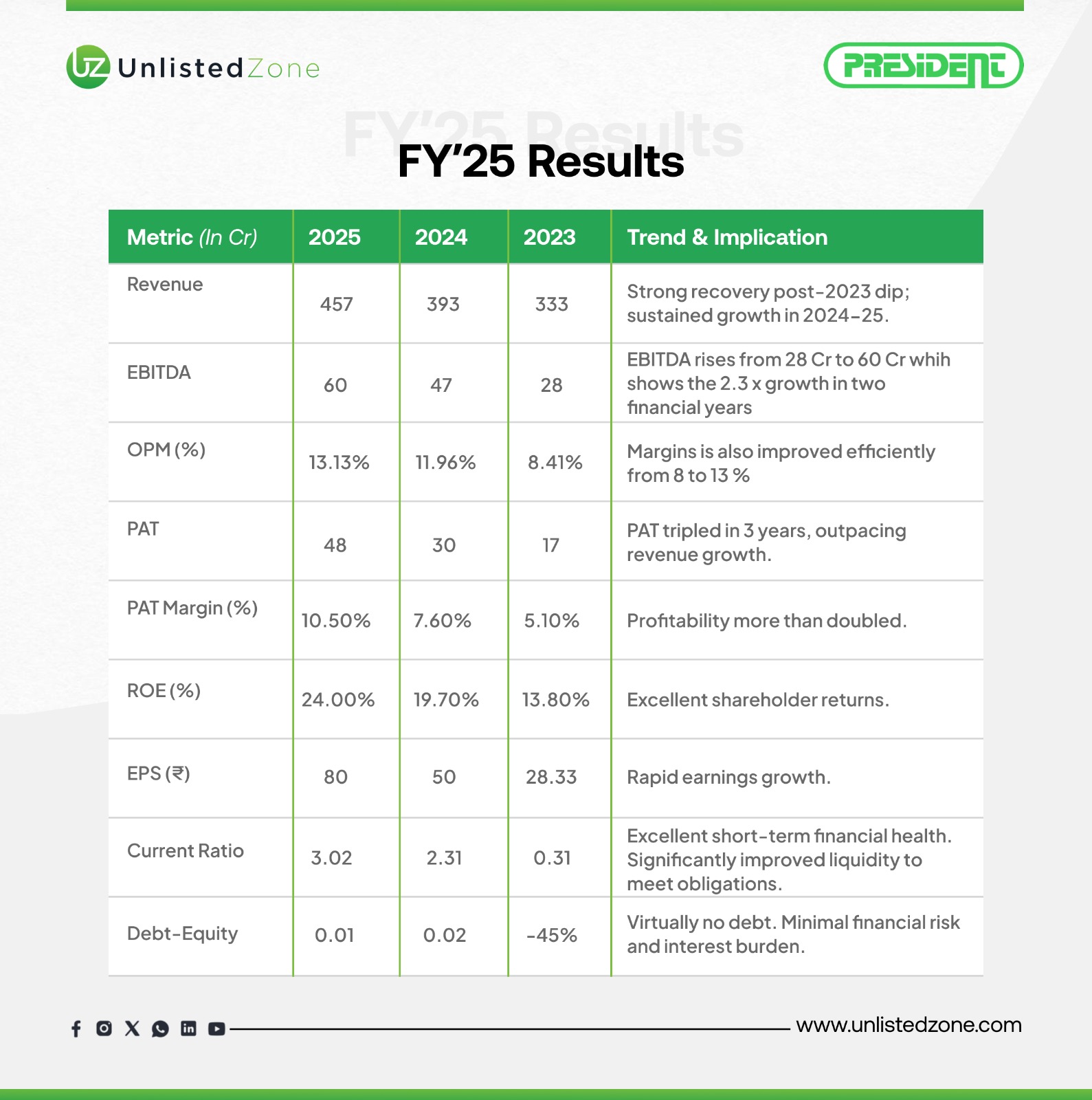

C) Key Highlights of FY 2025

-

Revenue: ₹4,569.9 Mn (₹457 Cr), up 16.3% YoY.

-

EBIT Margin: 12.5%, expanding by 285 bps.

-

PAT: ₹48 Cr, up from ₹30 Cr in FY24.

-

Free Cash Flow: ₹336.2 Mn (₹33.62 Cr), confirming strong cash conversion.

-

ROCE: 28.3% (up 570 bps), reflecting world-class efficiency.

-

Debt: Virtually nil (Debt-Equity: 0.01).

-

Cash Balance: ₹74 Cr in 2025, up from ₹1.3 Cr in 2022.

D) Financial Performance (2022–2025)

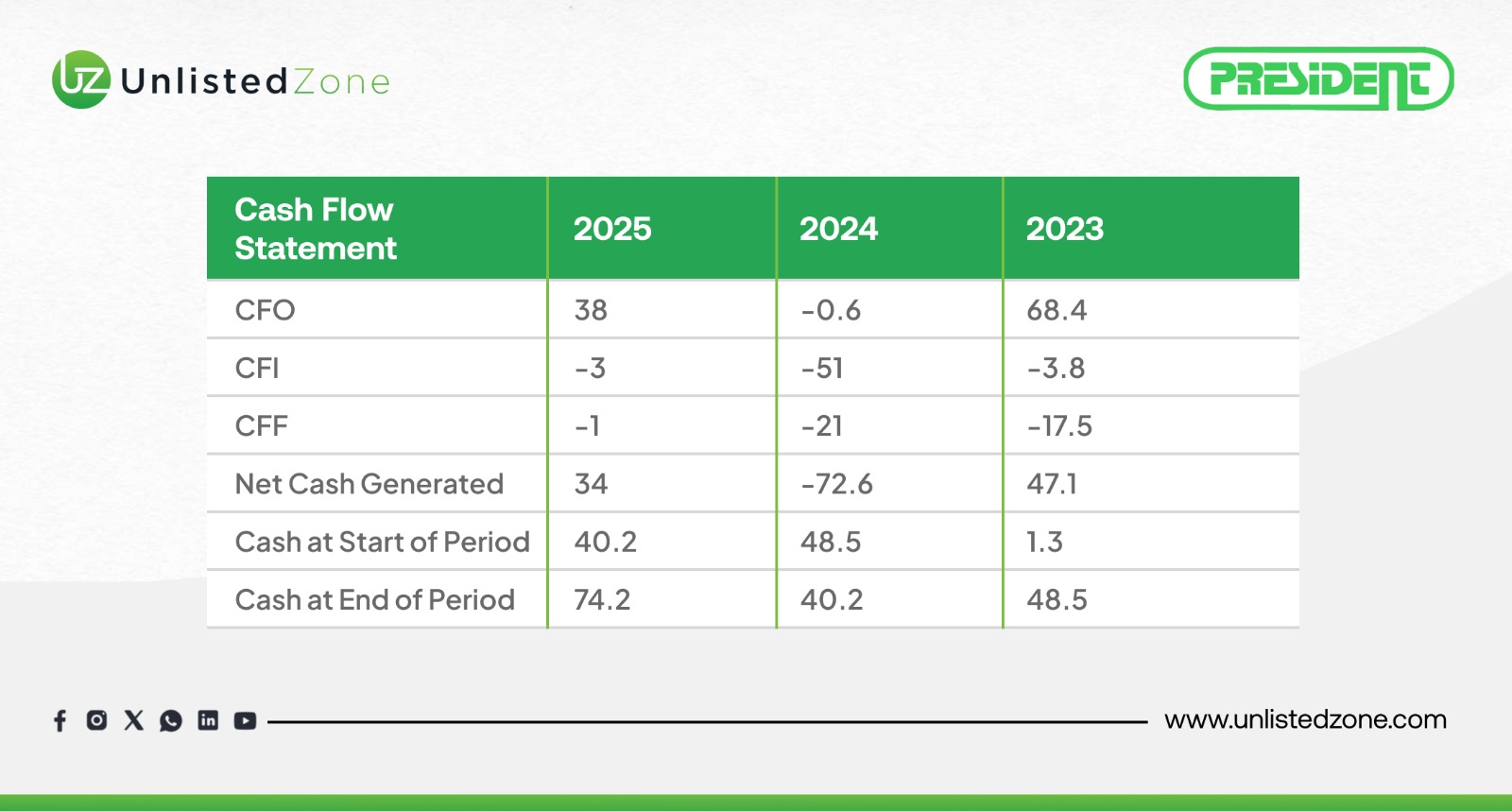

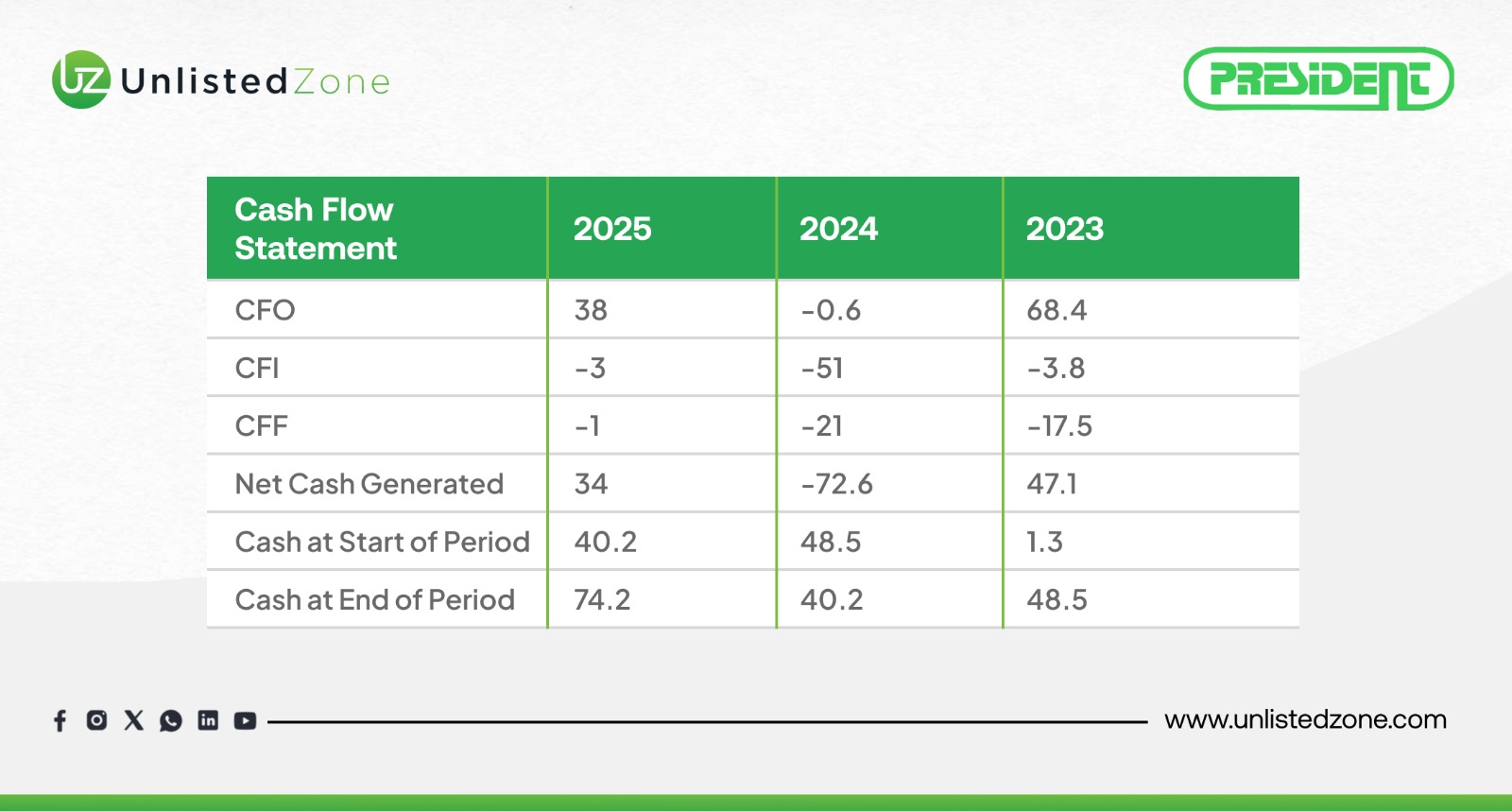

E) Cash Flow Analysis (2022–2025)

Cash Flow: CFO was volatile (₹6.4 Cr, ₹68.4 Cr, -₹0.6 Cr, ₹38 Cr) due to working capital swings, but underlying cash generation remains strong.

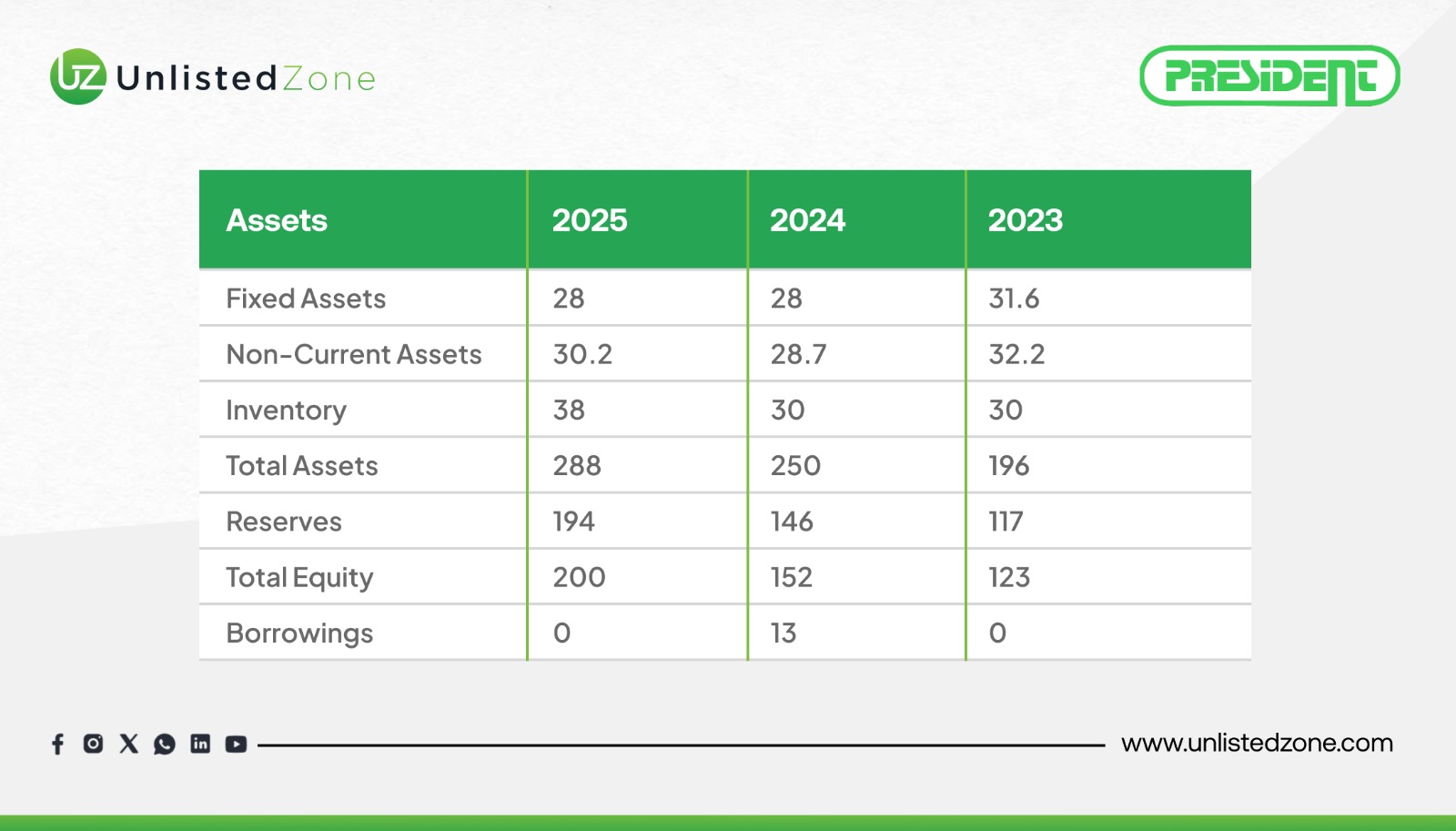

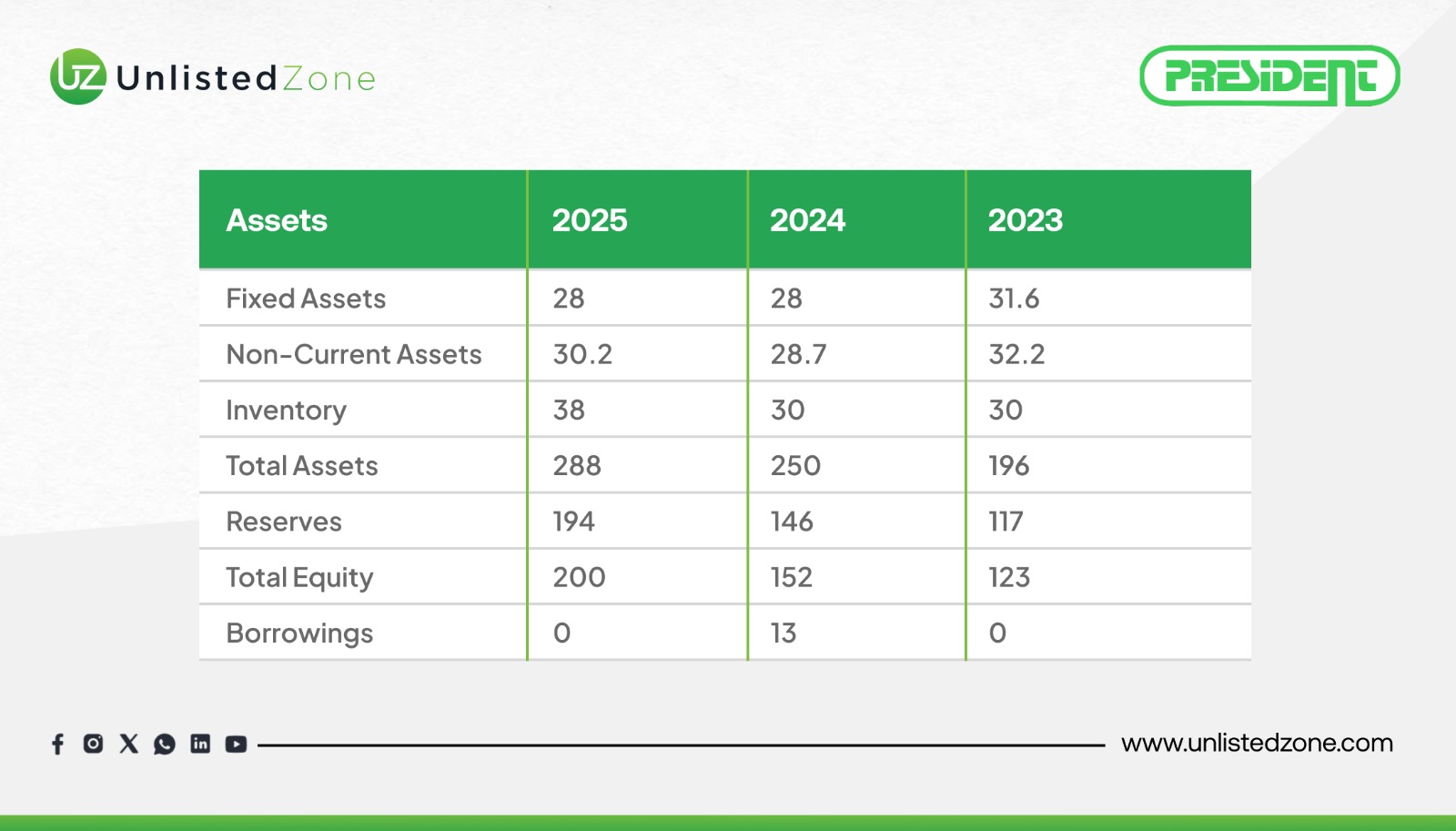

F) Balance Sheet Strength

-

Debt-Free: Borrowings reduced to zero in FY23 and FY25.

-

Equity Growth: Shareholders’ equity increased from ₹107 Cr to ₹200 Cr via retained earnings.

-

Liquidity: Current ratio improved to 3.02, indicating excellent short-term financial health.

-

Inventory Turnover: 13.49, highlighting highly efficient operations.

G) Segment-Wise Analysis (FY 2025)

H) Management Discussion & Analysis

Strengths: Market leadership, Schneider Electric backing, strong profitability (NPM >10%), robust balance sheet.

Weaknesses: Customer concentration in IT/Telecom, working capital volatility, susceptibility to import competition.

Opportunities: Cloud/AI adoption, Edge data center boom, IndiaAI initiatives, rising 5G/data consumption.

Threats: High competition, price pressure, commodity price fluctuations, cyclical IT spending.

Strategic Roadmap: Management is focusing on pricing discipline, cost optimization, and strategic capital allocation. The sharp decline in low-margin trading revenue confirms focus on high-value finished goods.

Shareholding Pattern (FY 2025)

I) Valuation Insights (Unlisted Market)

J) Future Outlook

President Systems is set to benefit disproportionately from India’s digital revolution:

-

Rising demand from cloud/AI adoption.

-

Expansion of edge data centers and decentralized IT infrastructure.

-

Increasing telecom, BFSI, and government investments in secure infrastructure.

-

Backing of Schneider Electric ensures global competitiveness.

K) UnlistedZone View

President Systems (Schneider Electric) is a hidden gem in India’s unlisted market. It combines market leadership, strong financial health, world-class efficiency, and alignment with long-term digital infrastructure trends. With high ROCE (28.3%), rapid EPS growth (₹80 in FY25), and a debt-free balance sheet, it is a strong candidate for investors seeking exposure to India’s data economy.

Our Take: Suitable for HNIs and long-term investors. While competition and margin pressure are risks, the Schneider Electric synergy and sectoral tailwinds outweigh these challenges. We expect sustained profitability and potential value unlocking if the company pursues a listing in the coming years.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.