Ramaraju Cotton Mills Limited, a part of the Ramco Group, operates in textiles, surgical products, and renewable energy through windmills. The company’s H1 FY2026 results show a significant operational turnaround, marked by improved margins, strong cash flows, and better cost efficiency despite continued losses at the bottom line. Below is a comprehensive breakdown of performance across segments and financial parameters.

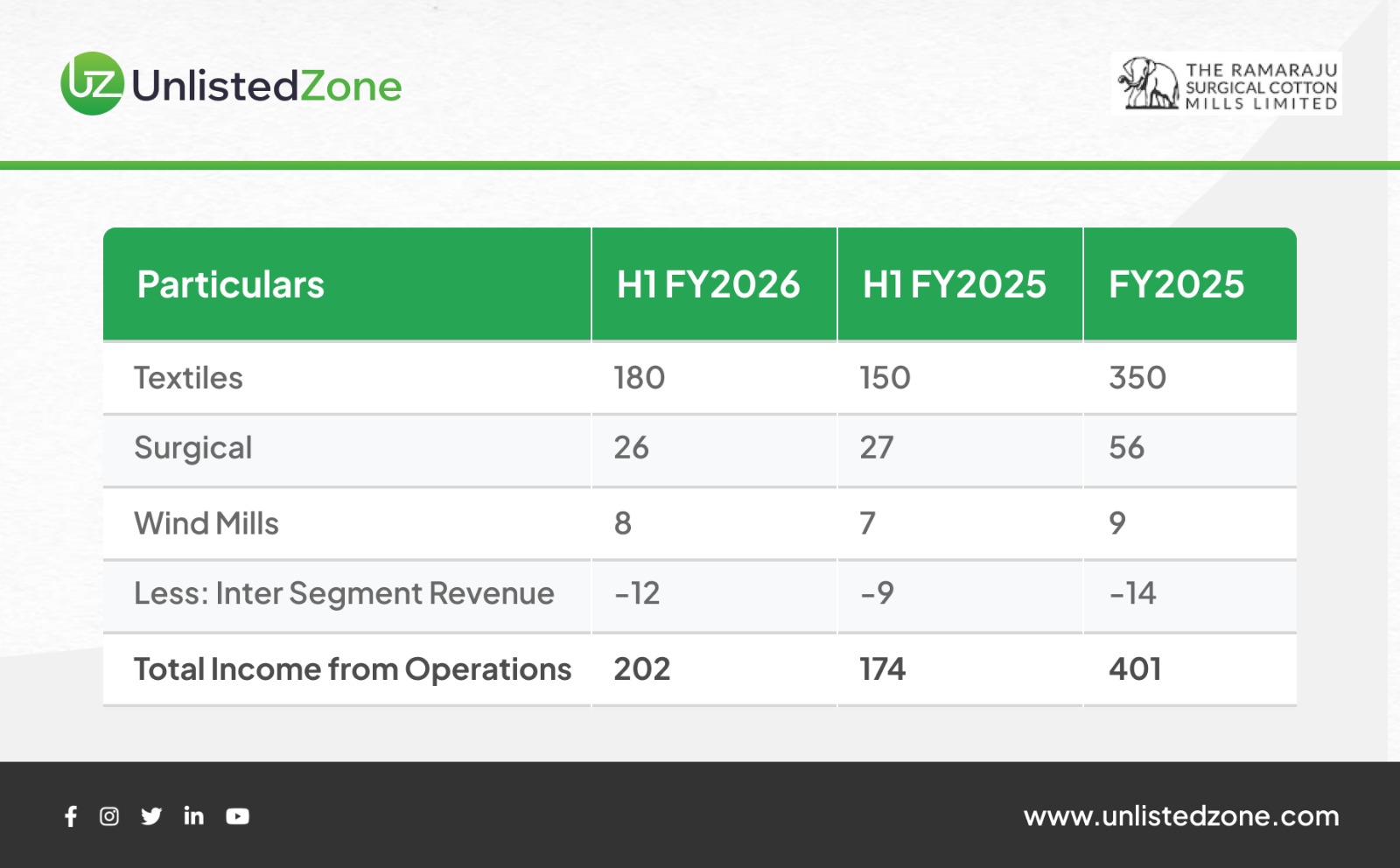

1. Revenue Performance

Detailed Analysis:

-

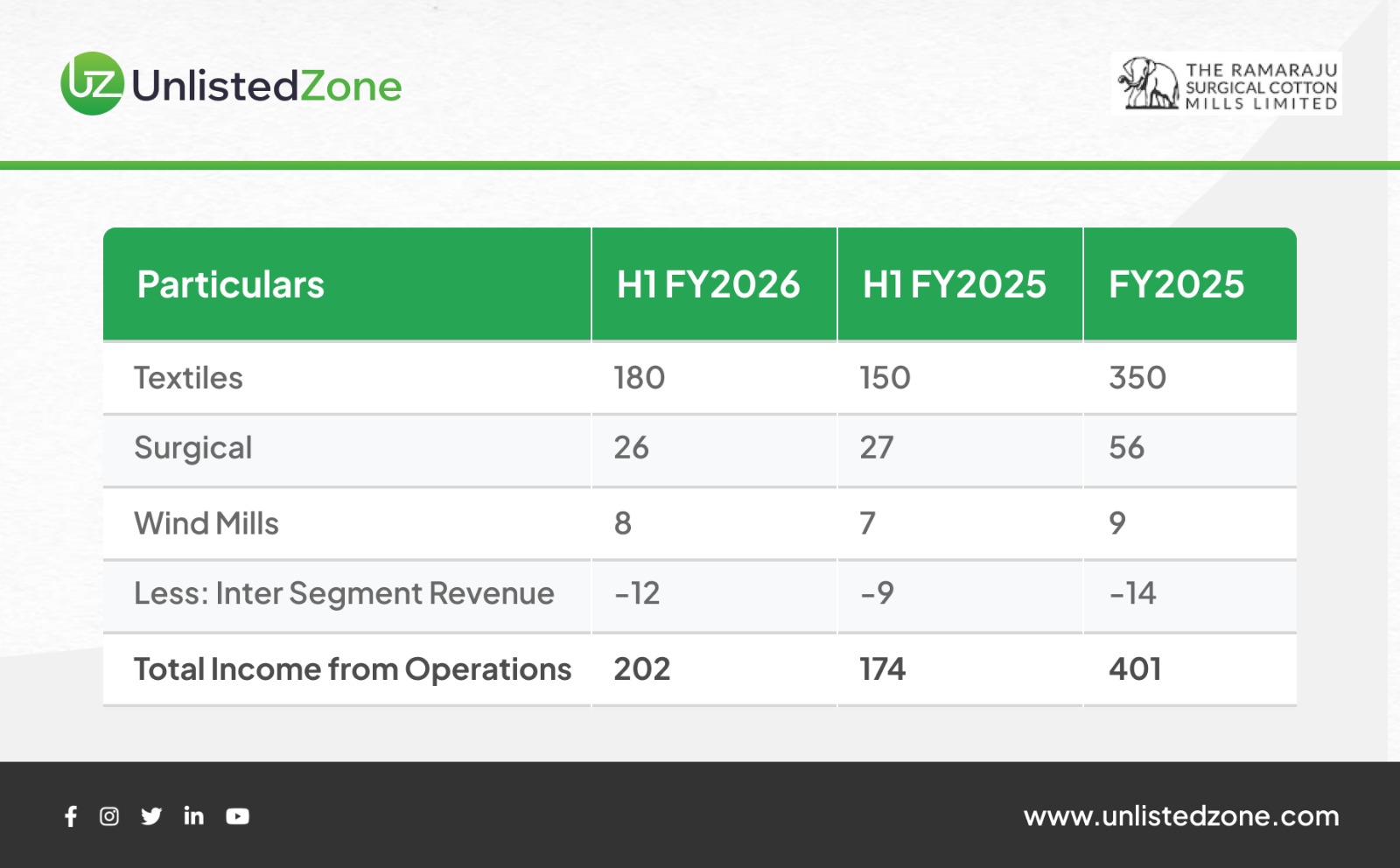

Topline Growth: The company’s total income from operations grew 16% YoY, from ₹174 crore in H1 FY2025 to ₹202 crore in H1 FY2026. The increase is primarily driven by higher realizations and demand recovery in the textile segment, which contributes about 89% of total revenue.

-

Textile Segment: Revenue rose by 20% YoY, reflecting higher export orders and stable yarn demand. Better product mix and pricing helped margins.

-

Surgical Segment: Marginal dip in surgical revenue (₹26 crore vs ₹27 crore) indicates stagnation in this division. However, it remains a stable contributor with consistent margins.

-

Wind Energy Segment: Revenue improved slightly to ₹8 crore from ₹7 crore last year, aided by improved power generation efficiency.

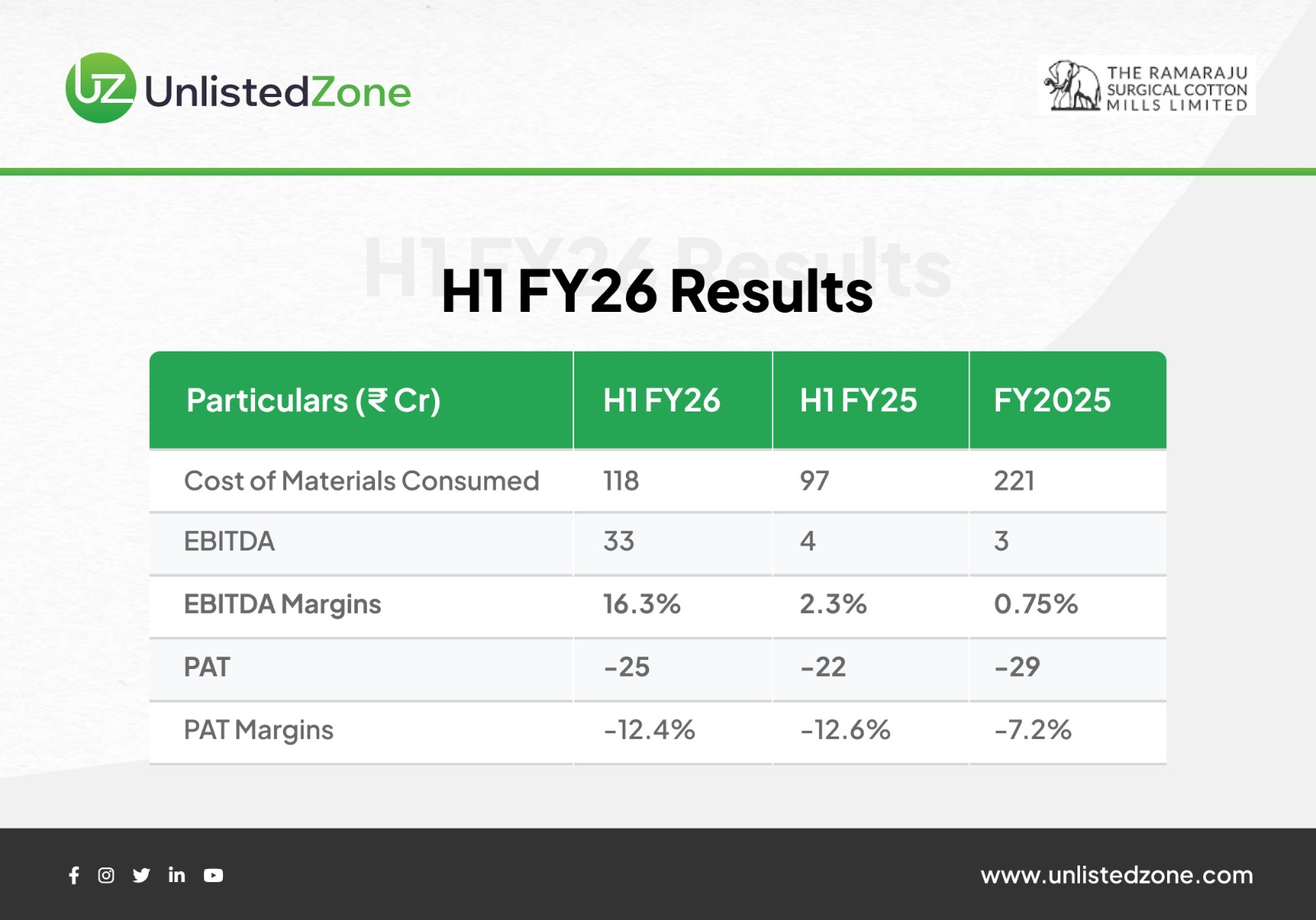

2. Profitability Analysis

Detailed Analysis:

-

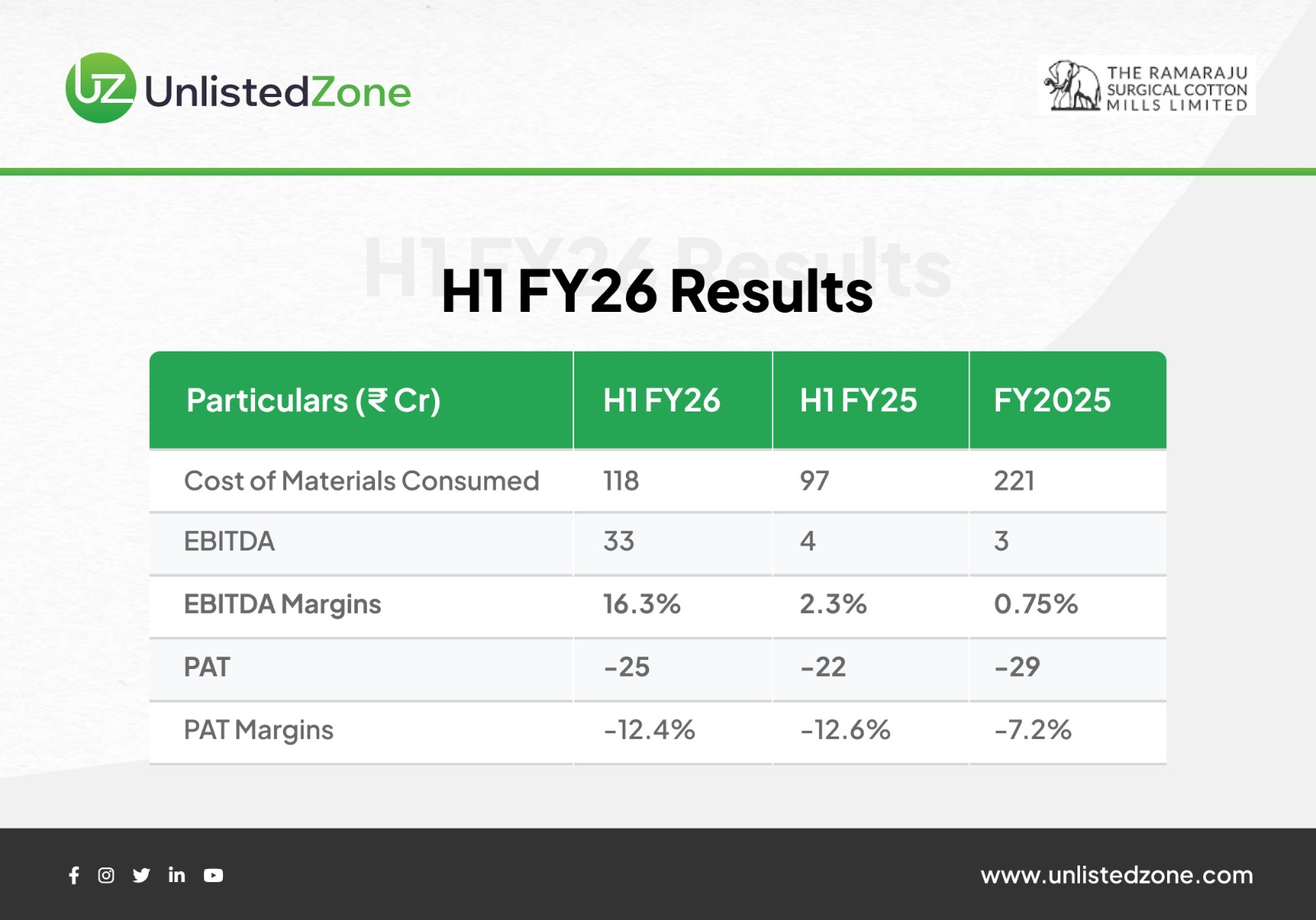

EBITDA Improvement: The company achieved a massive improvement in EBITDA, increasing more than 8x YoY to ₹33 crore. This surge reflects strict cost discipline, optimized raw material procurement, and better realization in the textile segment.

-

Margin Expansion: EBITDA margins jumped to 16.3% from 2.3% a year earlier, signaling a turnaround in core operations.

-

Net Losses: Despite better operating results, the company recorded a net loss of ₹25 crore, mainly due to high interest expenses and depreciation. However, the loss margin narrowed slightly compared to H1 FY2025.

-

Cost Structure: Raw material cost to sales ratio declined, showing improved efficiency. Power costs from in-house windmills also provided cost savings.

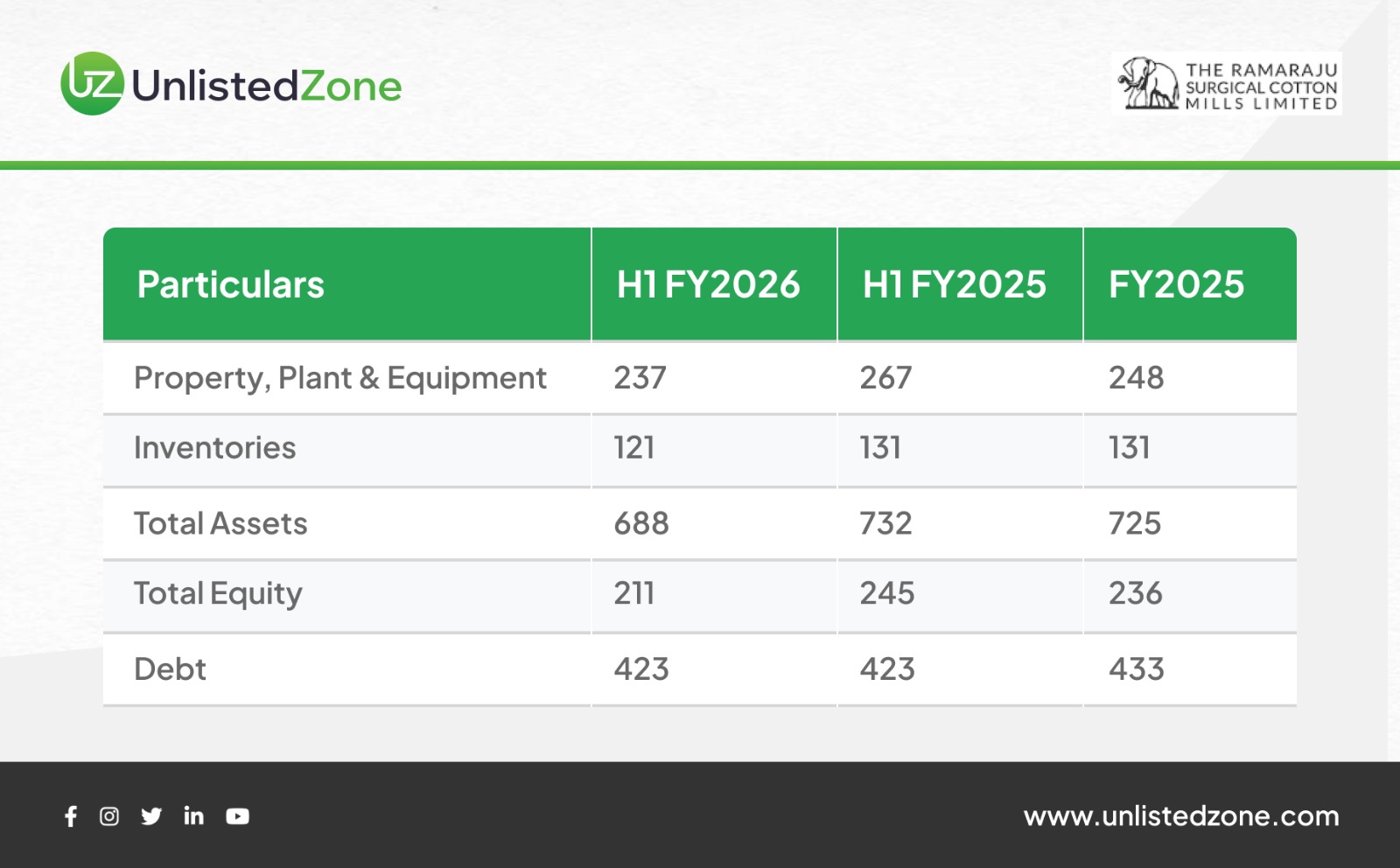

3. Balance Sheet Position

Detailed Analysis:

-

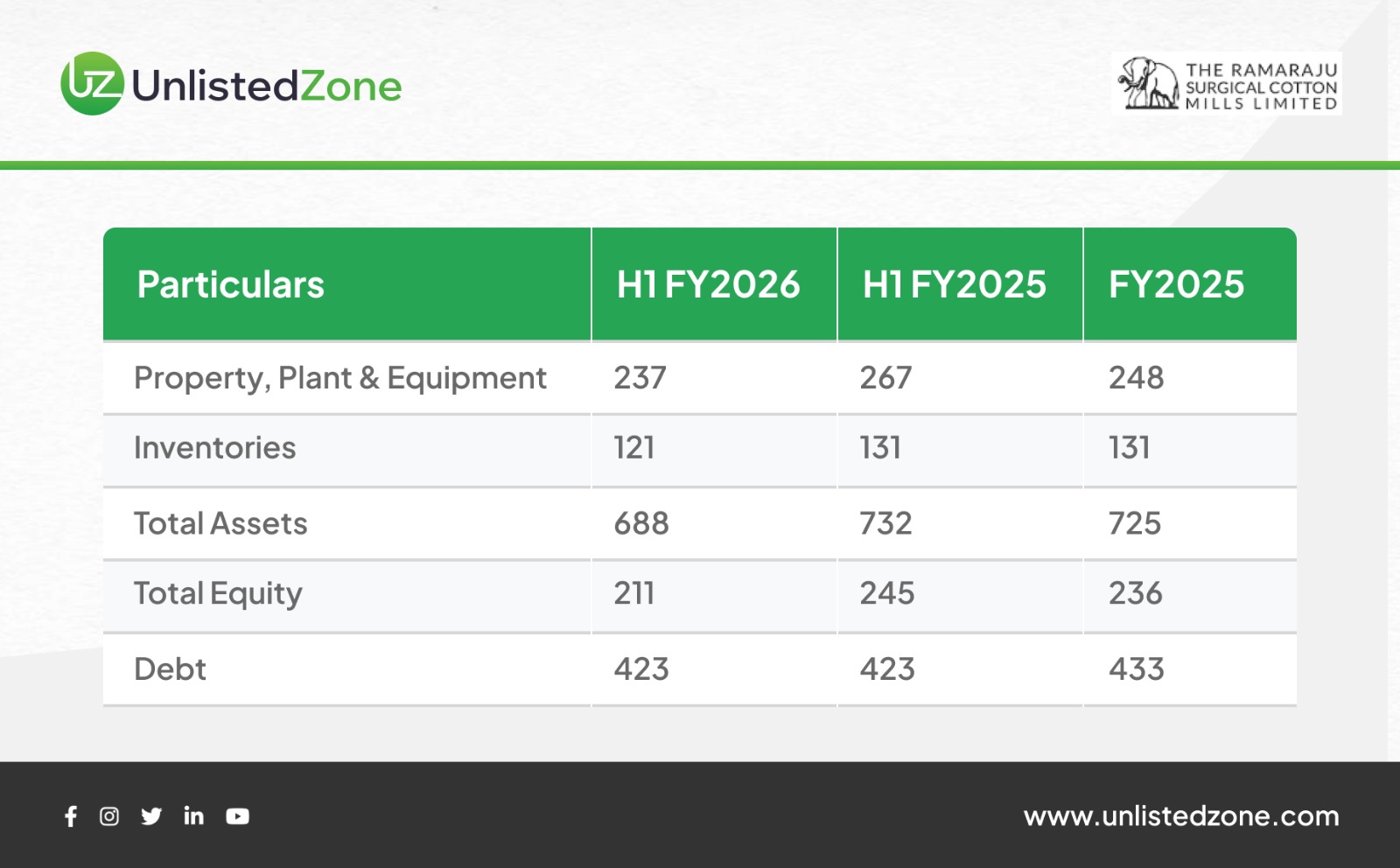

Asset Base: Fixed assets declined marginally, indicating limited capital expenditure. The company continues to operate efficiently with its existing manufacturing base.

-

Debt and Leverage: Debt levels remain high at ₹423 crore. With equity down to ₹211 crore, the debt-to-equity ratio is around 2.0x, indicating financial leverage pressure.

-

Working Capital: Inventory levels have stabilized at ₹121 crore, suggesting better inventory management and supply chain control.

-

Equity Decline: The fall in equity reflects cumulative losses, but improved operations can help gradual recovery.

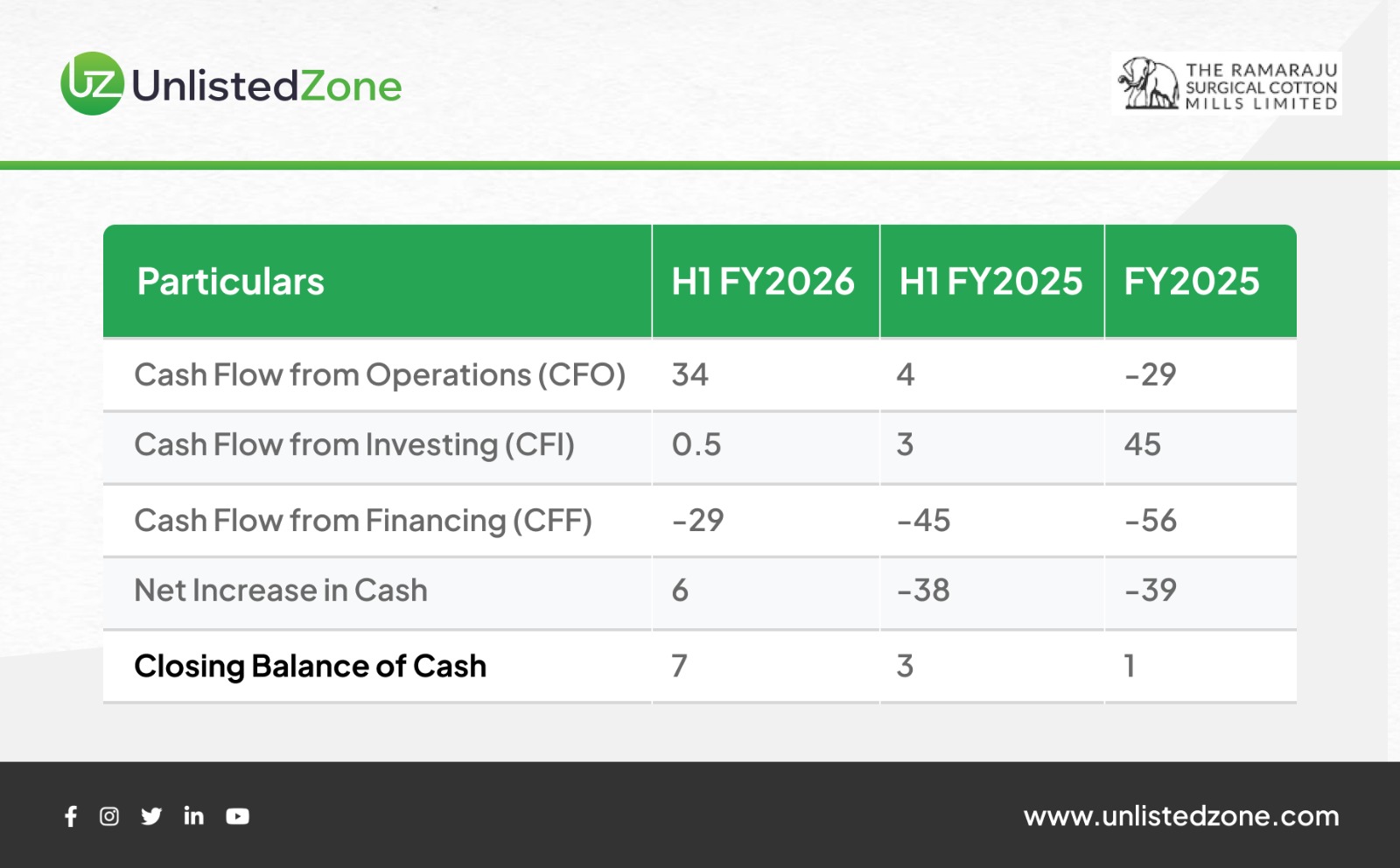

4. Cash Flow Analysis

Detailed Analysis:

-

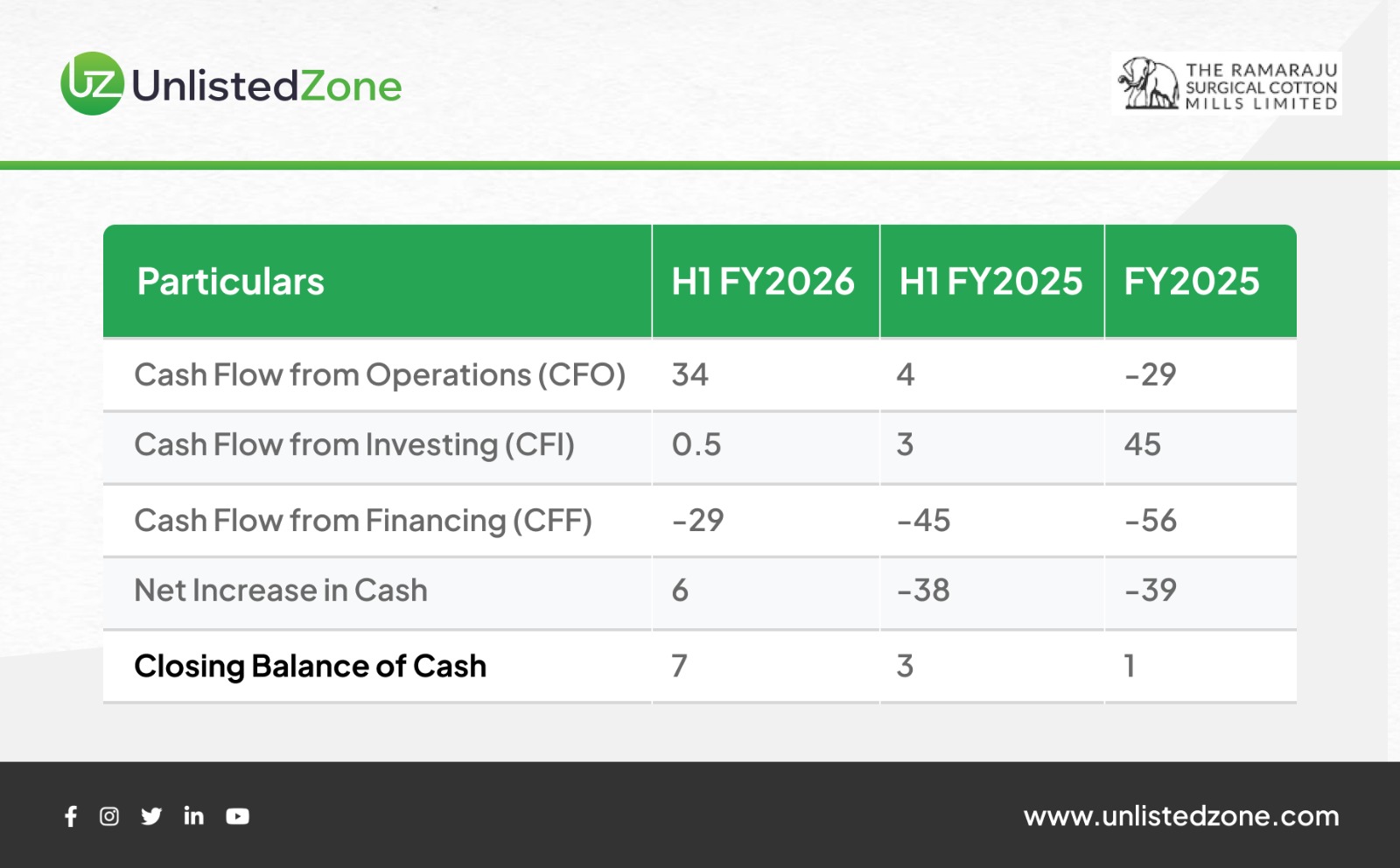

Operational Cash Flow Surge: CFO rose sharply to ₹34 crore, reflecting better operating efficiency, strong working capital control, and improved collection cycles.

-

Investing Activity: Minimal capital investment in H1 FY2026 indicates cautious capex strategy amid recovery.

-

Financing Activity: Outflow of ₹29 crore primarily relates to repayment of borrowings and interest payments.

-

Liquidity Position: Closing cash balance improved to ₹7 crore, compared to ₹1 crore at the end of FY2025 — signaling improved liquidity.

5. Segment Outlook and Future Prospects

-

Textile Division: Expected to benefit from steady demand in both domestic and export markets, though global cotton price volatility may impact short-term profitability.

-

Surgical Segment: Stable, low-risk business expected to maintain consistent contribution. Potential to expand margins through higher value-added products.

-

Windmill Operations: Renewable energy continues to support the company’s cost structure by reducing dependence on external power sources.

6. Key Ratios and Highlights

-

EBITDA Margin: 16.3% (vs 2.3% YoY)

-

PAT Margin: -12.4% (vs -12.6% YoY)

-

Debt-to-Equity Ratio: ~2.0x

-

Operating Cash Flow Growth: 750% YoY

-

Revenue Growth: 16% YoY

7. Investment Perspective for UnlistedZone Readers

-

Operational Recovery in Progress: The company’s sharp margin improvement and strong CFO indicate a turnaround at the operational level.

-

Leverage Concerns Remain: High debt and interest costs continue to affect net profitability. Debt reduction remains a key focus area.

-

Improving Efficiency: Better cost control, stable inventory, and improved power efficiency through windmills enhance competitiveness.

-

Positive Liquidity Trend: Rising cash reserves and strong CFO improve short-term financial stability.

Conclusion

Ramaraju Cotton Mills has demonstrated a strong operating turnaround in H1 FY2026, with significant improvement in margins and cash flows. Although profitability remains negative due to financial leverage, the company’s fundamentals have strengthened. If margin momentum sustains and debt reduction follows, Ramaraju could enter a phase of consistent profitability in the coming quarters.

For investors in the unlisted market, this performance highlights an improving business trajectory. Continued focus on efficiency, deleveraging, and export recovery will be the key drivers for long-term value creation.

Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.