When you hear Schneider Electric, you usually think of a global powerhouse in energy management and automation. But one of its Indian subsidiaries, Schneider Electric President Systems Limited (SEPSL), has had a quieter — and more nuanced — six months.

The company’s revenue slipped, but it also pulled off something few manufacturers manage in a slowdown: profit margins actually improved. Let’s unpack what happened.

A Slowdown on the Top Line

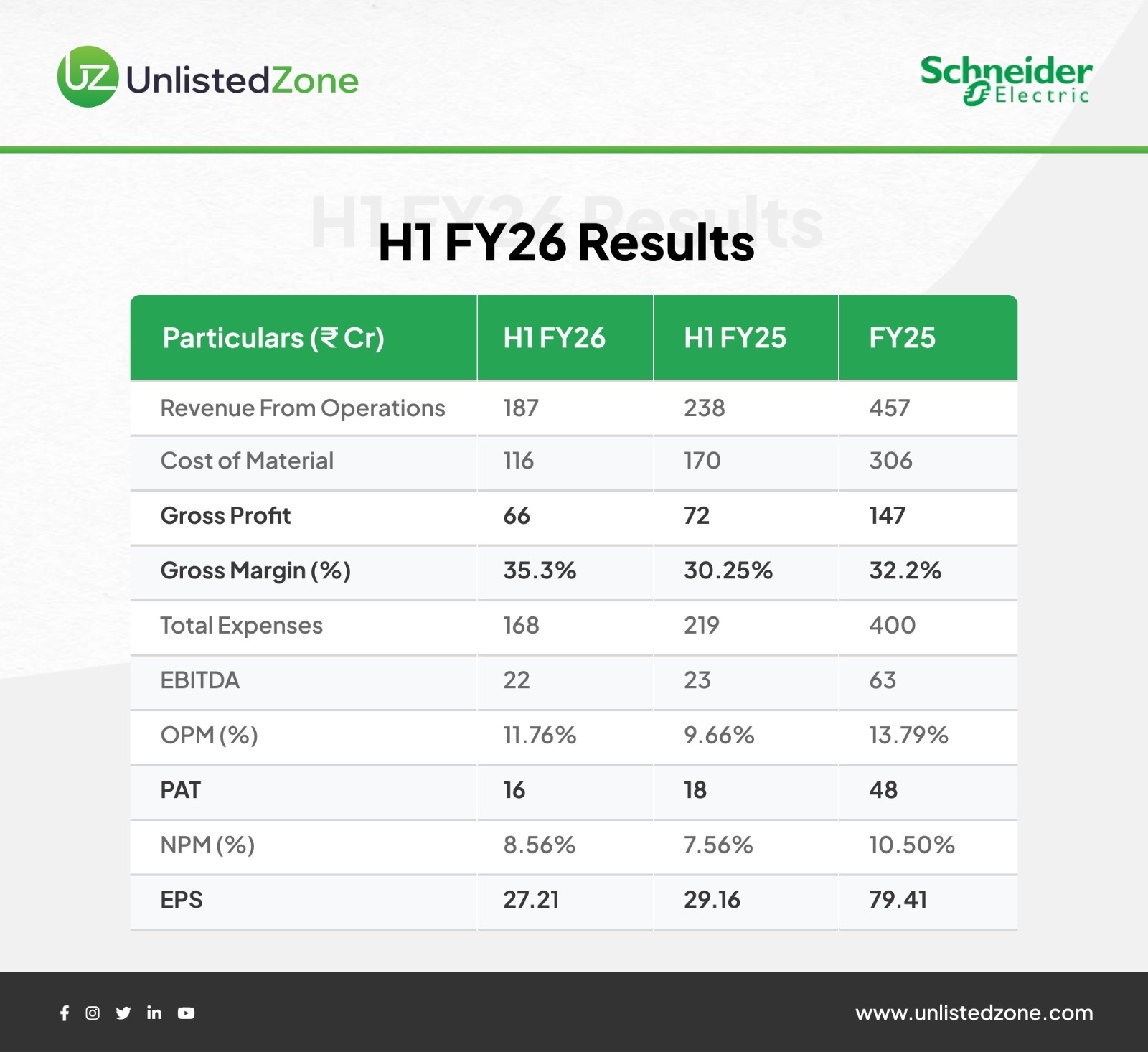

In the first half of FY26, SEPSL’s revenue from operations dropped from ₹238 crore to ₹187 crore — a 21% fall.

It’s not entirely surprising. The company supplies precision enclosures, integrated infrastructure solutions, and customized cabinets for IT and industrial clients — segments that have seen a bit of post-COVID normalization. Orders have taken longer to close, and demand from certain export markets has softened.

But while sales shrank, profits didn’t collapse — they got more efficient.

The Profitability Puzzle

How do you make less revenue but higher margins?

Simple — you cut smarter.

-

Cost of materials fell sharply to ₹116 crore (from ₹170 crore).

-

Gross margins expanded from 30.25% → 35.3%.

-

Operating margins (EBITDA) improved from 9.7% → 11.8%.

In other words, SEPSL managed to squeeze more profit out of every rupee of sales by controlling input costs and streamlining operations.

Even at the bottom line, PAT fell only slightly — ₹16 crore vs ₹18 crore last year — but net margin improved to 8.6%. For a manufacturing company, that’s a solid show of resilience.

Cash: The Real Winner

Here’s where things get interesting.

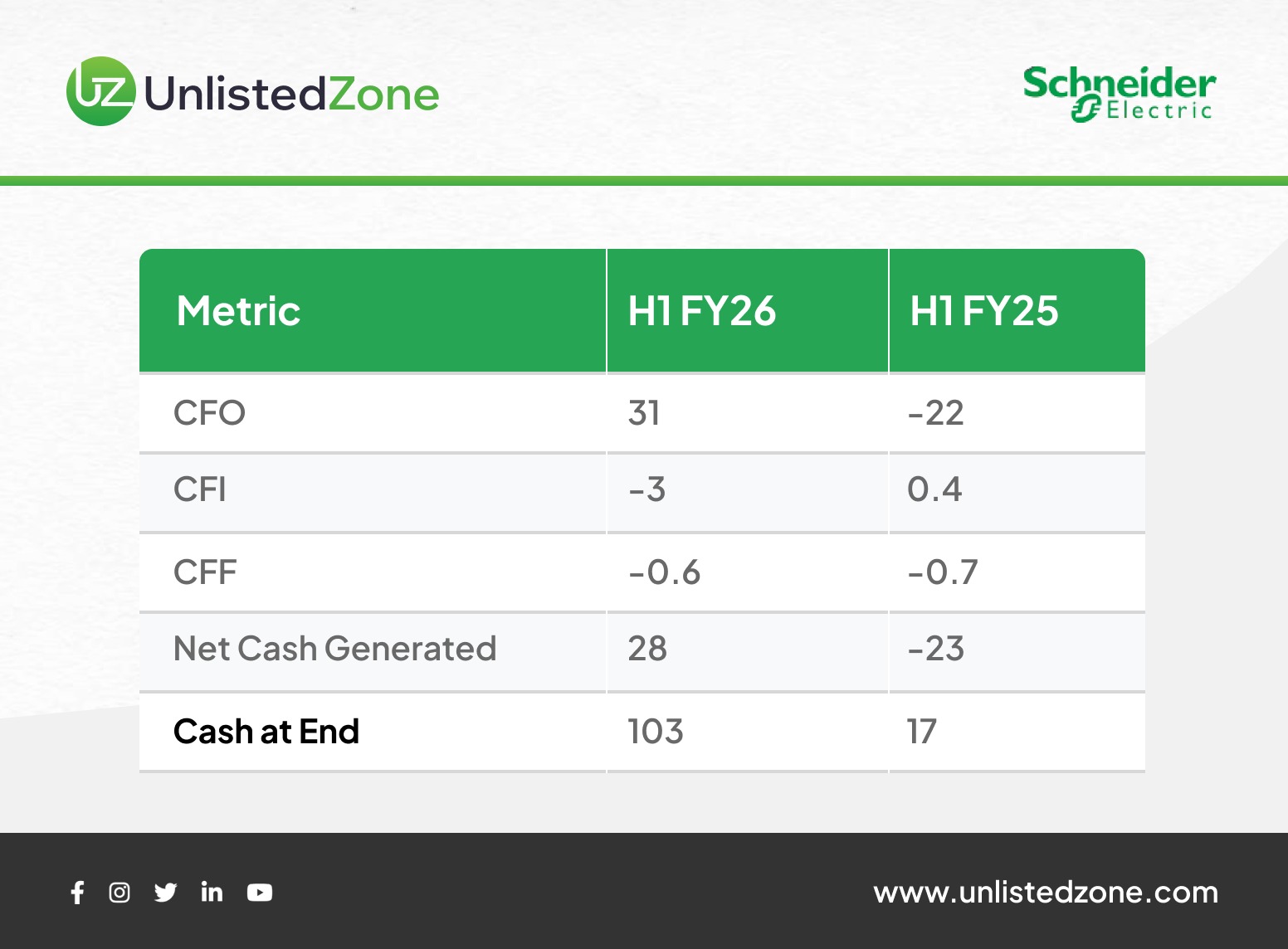

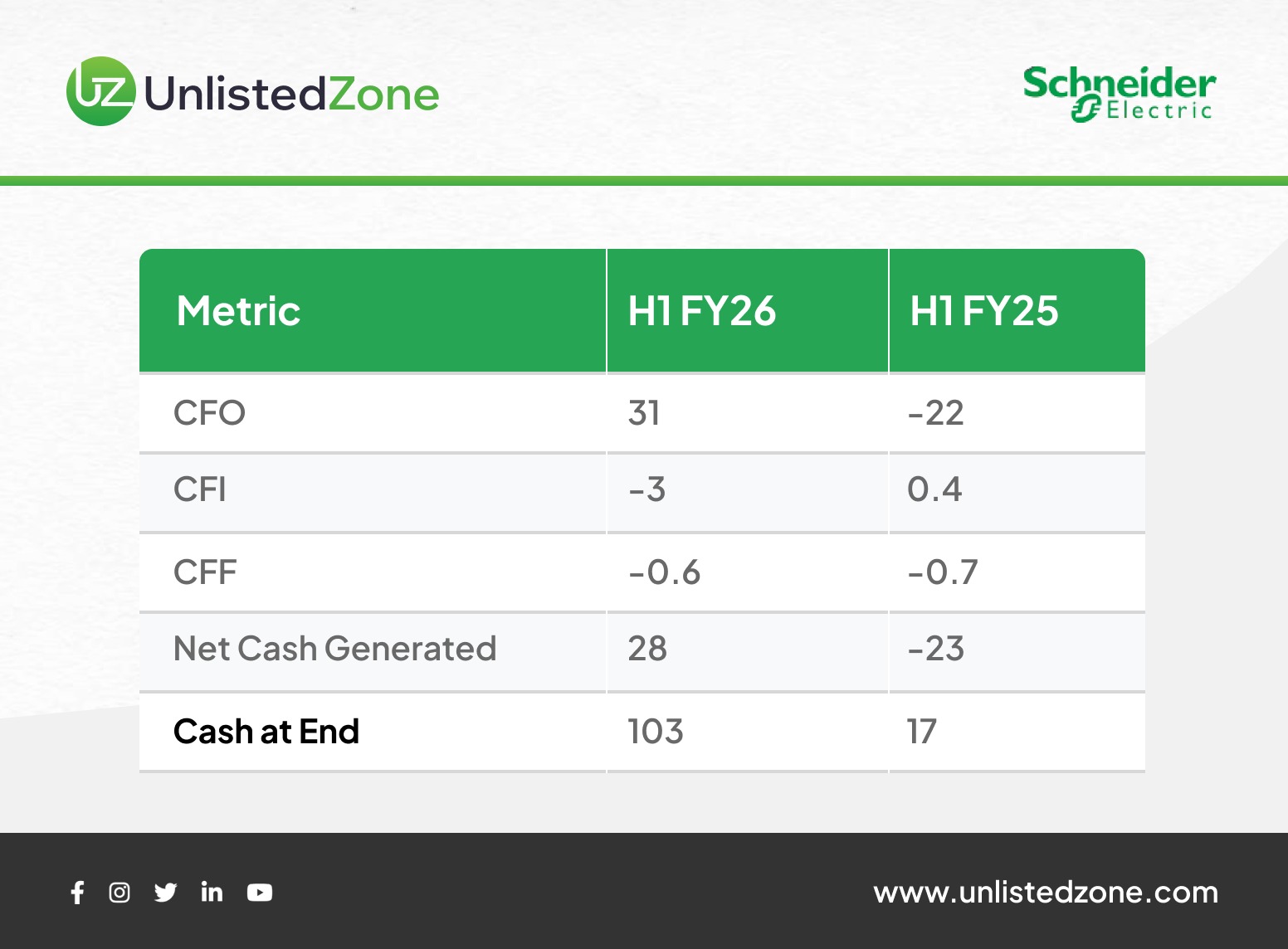

In the same period last year, SEPSL was burning cash — operating cash flow was -₹22 crore.

This year? It flipped to +₹31 crore.

That’s a ₹53 crore turnaround.

Better working-capital control, faster receivable collections, and leaner inventories helped the business turn its operations into a cash machine.

As a result, cash reserves soared from ₹17 crore to ₹102 crore — a 6x jump. For a company with a ₹187 crore half-year revenue, that’s an enviable liquidity cushion.

A Stronger Balance Sheet

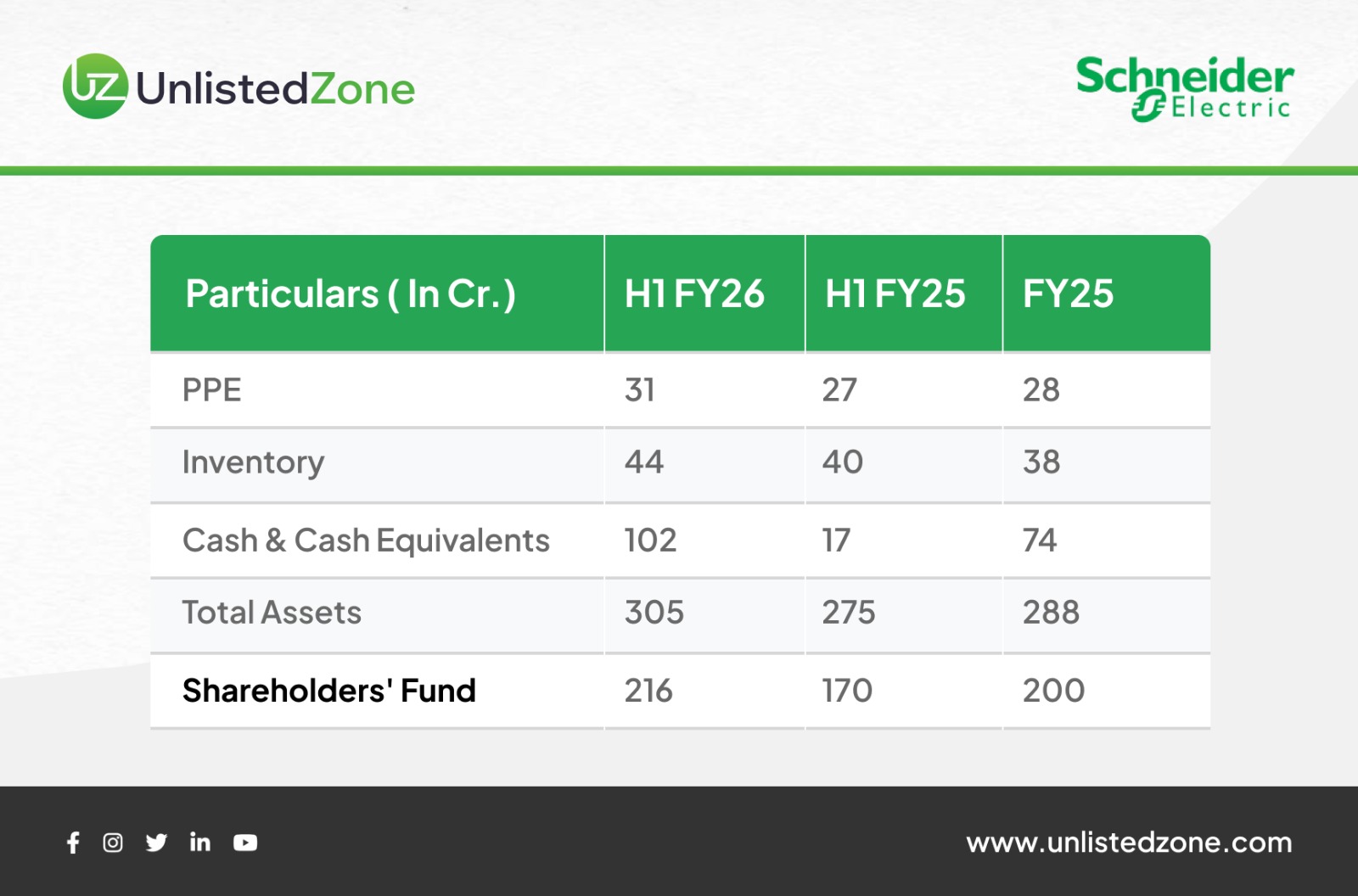

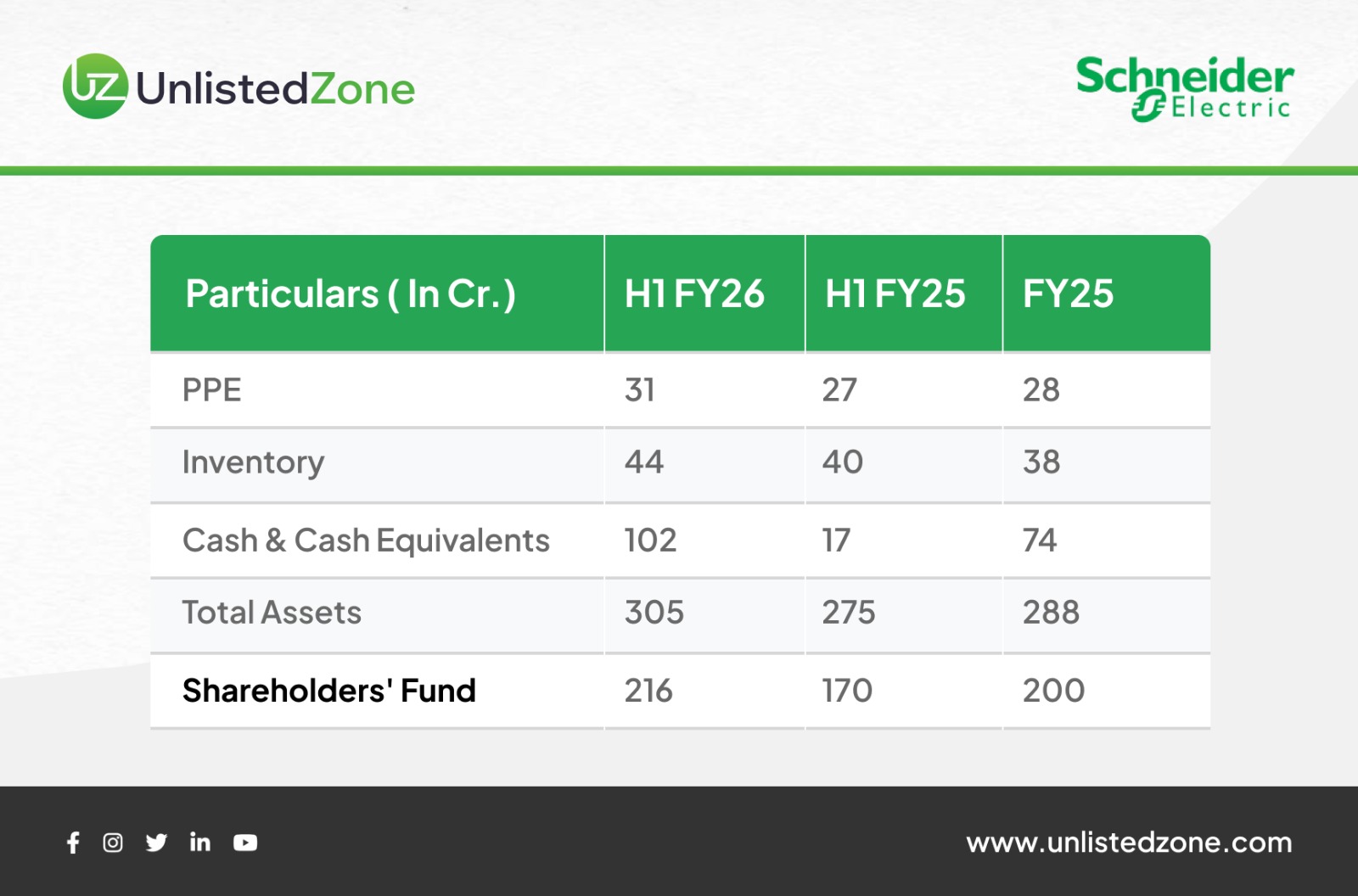

Even with slower sales, SEPSL’s net worth jumped from ₹170 crore to ₹216 crore, thanks to strong internal accruals.

Total assets rose modestly to ₹305 crore, and inventory ticked up to ₹44 crore — possibly to support upcoming orders.

In short, the company grew cautiously, avoided debt bloat, and fortified its balance sheet.

So, What’s the Catch?

Growth — or the lack of it.

While efficiency metrics are great, SEPSL’s ability to expand topline again will determine its next phase. The industrial automation and infrastructure segments are cyclical; eventually, margin optimization runs out of road if volumes don’t bounce back.

But for now, Schneider Electric’s Indian arm looks like a case study in discipline over expansion — protecting profitability even when the market slows.

Finshots Take

-

Revenue fell, but margins rose — a classic example of good cost control.

-

Cash flows turned positive, giving the company stronger footing for FY27.

-

The next test? Reviving demand while keeping this new-found efficiency intact.

If SEPSL can pull that off, it’ll prove that even in manufacturing, less can sometimes be more.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.