In the world of lending, growth and prudence rarely walk hand in hand. Yet, SK Finance Limited seems determined to prove otherwise. The Jaipur-based NBFC, known for its strong presence in vehicle and MSME lending, has clocked an impressive first half in FY 2026 — a period marked by both opportunity and margin pressure.

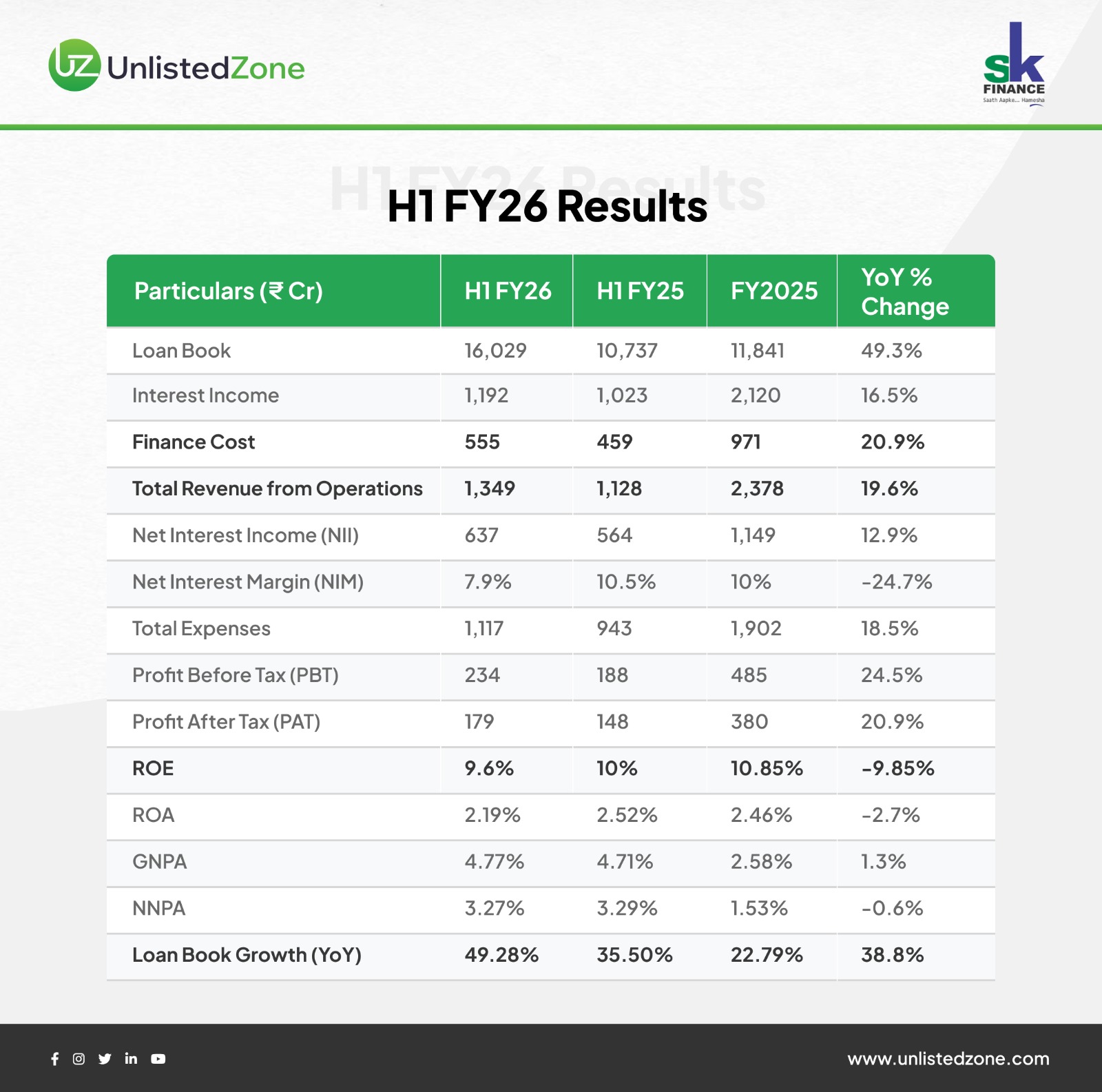

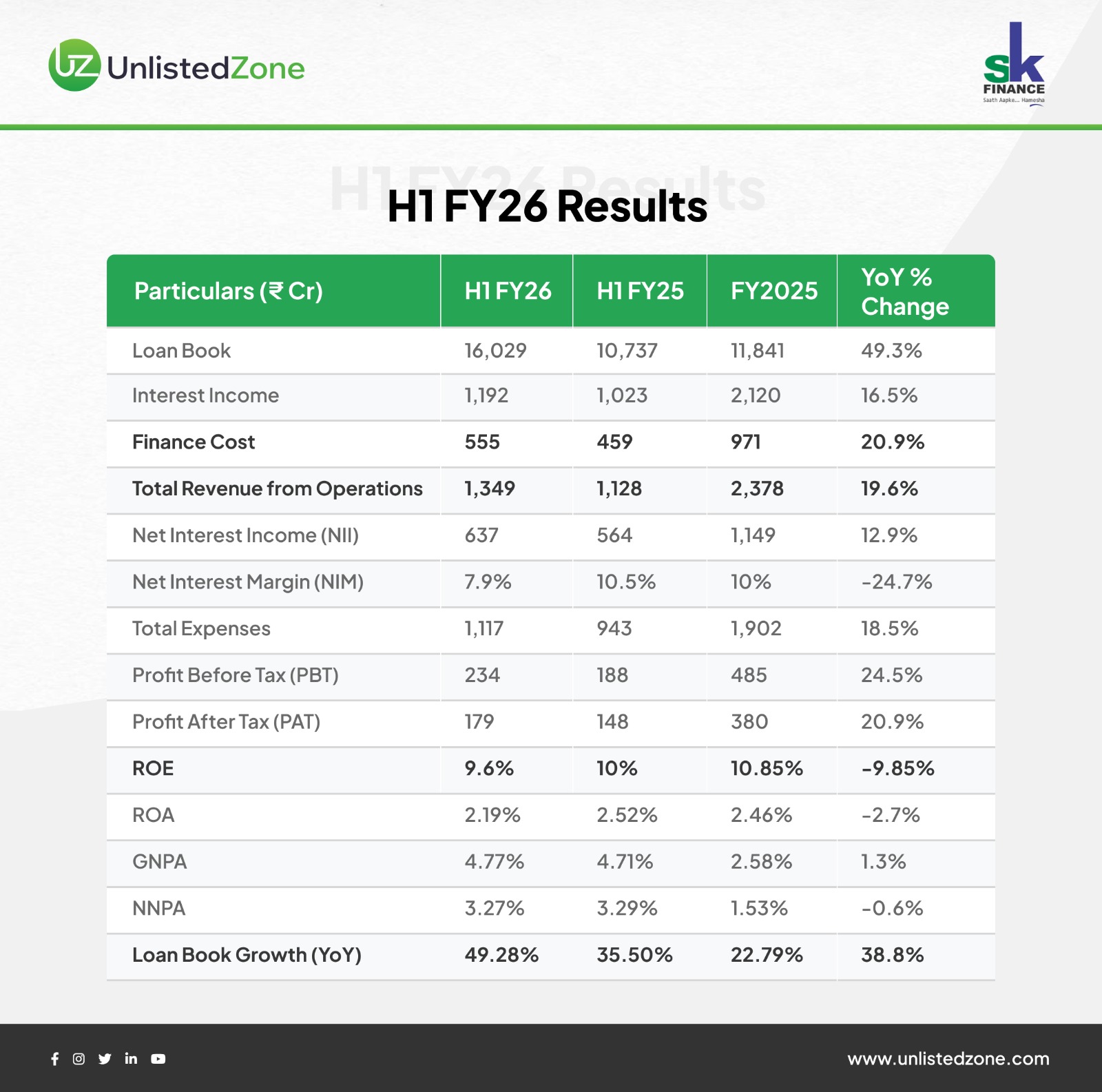

Financial Performance H1 FY26 Vs H1 FY25

Riding the Credit Boom

Riding the Credit Boom

SK Finance’s loan book has ballooned 49% YoY, touching ₹ 16,029 crore. This isn’t a one-off spurt. The company has built its strength where others hesitate — semi-urban and rural India.

Its bread and butter?

Used-vehicle financing and MSME loans — segments still underserved by traditional banks but booming with credit demand.

Such rapid expansion shows how deep-rooted distribution and localized underwriting can deliver growth even in tightening liquidity conditions.

Topline Up, Margins Squeezed

Revenue from operations jumped 19.6% YoY to ₹ 1,349 crore, thanks to higher disbursements.

But here’s the flip side — finance costs rose 21%, eating into spreads.

Net Interest Income grew 13%, but the Net Interest Margin fell sharply from 10.5% to 7.9%.

Higher borrowing costs, a competitive lending environment, and limited ability to hike lending rates have all conspired to compress margins — a theme playing out across the NBFC sector.

Still Managing to Deliver Profits

Despite cost pressure, SK Finance’s Profit After Tax grew 21% YoY to ₹ 179 crore.

How?

Operational discipline.

The company’s cost control, digitisation of collections, and strong recovery mechanism cushioned the hit.

The ROE slipped slightly to 9.8%, but profitability in absolute terms improved.

In other words — even if margins are thinning, the pie itself has gotten much bigger.

Asset Quality: Stable Under Stress

Rapid growth often hides bad loans — but not here.

GNPA stands at 4.77% (almost flat YoY) and NNPA at 3.27%.

For an NBFC expanding its loan book by nearly 50%, that stability is noteworthy.

Collateral-backed lending and early delinquency tracking have helped, though asset quality remains higher than that of larger, more diversified peers.

Returns — Moderate, Yet Consistent

ROA of 2.2% and ROE near 10% position SK Finance among well-managed mid-tier NBFCs.

As its asset base compounds, margins may stabilise and lift these ratios further.

But investors should note — growth can’t indefinitely outrun cost of funds. Future profitability hinges on lowering borrowing costs through securitisation, co-lending, and institutional debt diversification.

Challenges Ahead

-

Rising Cost of Funds: The biggest headwind; rate hikes continue to pressure NIMs.

-

Competitive Intensity: NBFCs and fintechs are crowding rural lending.

-

Regulatory Scrutiny: RBI’s tighter norms on provisioning and leverage could weigh on earnings.

Opportunity Landscape

-

Tier-III & Tier-IV Expansion: Credit penetration in smaller towns is still low.

-

Digital Underwriting: AI-driven scoring and predictive recovery models can cut NPAs.

-

MSME Lending: SK’s regional presence positions it perfectly for cluster-based growth.

UnlistedZone View — Growth with Caution

SK Finance’s H1 FY 2026 report is a mix of strong momentum and prudent execution.

It’s expanding faster than peers, keeping credit quality in check, and digitising its backbone.

However, margin compression due to high borrowing costs is a near-term concern.

For investors in the unlisted space, SK Finance remains a structurally strong growth story — but not a risk-free one. Sustained discipline in underwriting and liability management will be key to long-term value creation.

Bottom Line:

SK Finance is doing what every NBFC dreams of — growing aggressively without losing control.

If it can keep that balance, it’s not just scaling a loan book — it’s compounding trust.

Riding the Credit Boom

Riding the Credit Boom