Sunday Proptech (OYO Assets): A Deep Dive into India's Emerging Hospitality Investment Platform

Understanding the Asset Ownership Strategy Behind OYO's Latest Venture

1. What is Sunday Proptech?

Sunday Proptech Limited, operating as OYO Assets, represents a strategic pivot in the hospitality investment landscape. Launched in September 2025, it is positioned as India's most ambitious hotel ownership and asset management platform, designed to acquire, upgrade, and operate high-potential hotel properties both in India and globally.

Unlike traditional OYO operations which follow an asset-light model (providing technology and management services without owning properties), Sunday Proptech is an asset-heavy ownership platform. The company acquires undervalued or high-growth potential hotels, upgrades them to premium mid-stay brands (like Sunday Hotels and Studio 6/Motel 6), and generates sustainable cash flows through ownership.

a) Key Characteristics:

- Current Portfolio: 8 operational hotels (primarily in the USA)

- Expansion Pipeline: 8 additional properties under acquisition

- Geographic Presence: United States and India

- Brand Portfolio: Sunday Hotels (India), Studio 6/Motel 6 (USA)

- Revenue Model: Direct hotel ownership generating rental income and operational profits

- Competitive Edge: Market-leading RevPAR (Revenue Per Available Room) driven by OYO's distribution network and technology stack

b) The Properties:

US Portfolio (8 Hotels - 691 Keys Total):

- Greenville Haywood Mall (72 keys, ₹11.6 Cr annual revenue)

- Cincinnati Fairfield (72 keys, ₹11.6 Cr revenue)

- Shreveport Bossier City (124 keys, ₹13.3 Cr revenue)

- St. Louis Westport Craig Road (71 keys, ₹9.1 Cr revenue)

- Charlotte Tyvola Road (72 keys, ₹11.6 Cr revenue)

- Cincinnati Florence Meijer Dr. (72 keys, ₹8.3 Cr revenue)

- Indianapolis North Carmel (72 keys, ₹10 Cr revenue)

- Huntsville US Space & Rocket Center (108 keys, ₹15.8 Cr revenue)

c) Average EBITDA margins across US properties: 38-46%

d) India Portfolio (4 Hotels - 418 Keys):

- Sunday Hotel Ahmedabad (66 keys, ₹5.3 Cr annual revenue)

- Sunday Hotel Vadodara (96 keys, ₹7.4 Cr revenue)

- Sunday Hotel Jaipur (90 keys, ₹13.8 Cr revenue)

- Sunday Hotel Chandigarh Zirakpur (166 keys, ₹16.6 Cr revenue)

2. Who Are the Shareholders in Sunday Proptech?

Sunday Proptech operates as a Joint Venture (JV) structure with a carefully curated shareholder base that brings both strategic and financial strength:

a) Primary Shareholders:

1. Oravel Stays Limited (OYO) - The Parent Company

- World's leading digital hotel company

- Operates in 35+ countries

- 23,000+ hotels and 224,000+ vacation homes

- FY25 metrics: ₹16250 Cr GBV, ₹6,253 Cr Revenue, ₹1036 Cr EBITDA

2. Key Existing OYO Shareholders The marquee investor base includes global institutional investors who have backed OYO's growth story.

3. InCred (May 2025 Private Placement)

- Invested at ₹1 per share

- Acquired 2 Crore equity shares

4. Tattva (Fund) (July 2025 Private Placement)

- Invested at ₹52.5 per share

- Acquired 62.86 Lakh equity shares

- Represents significant valuation markup within 2 months

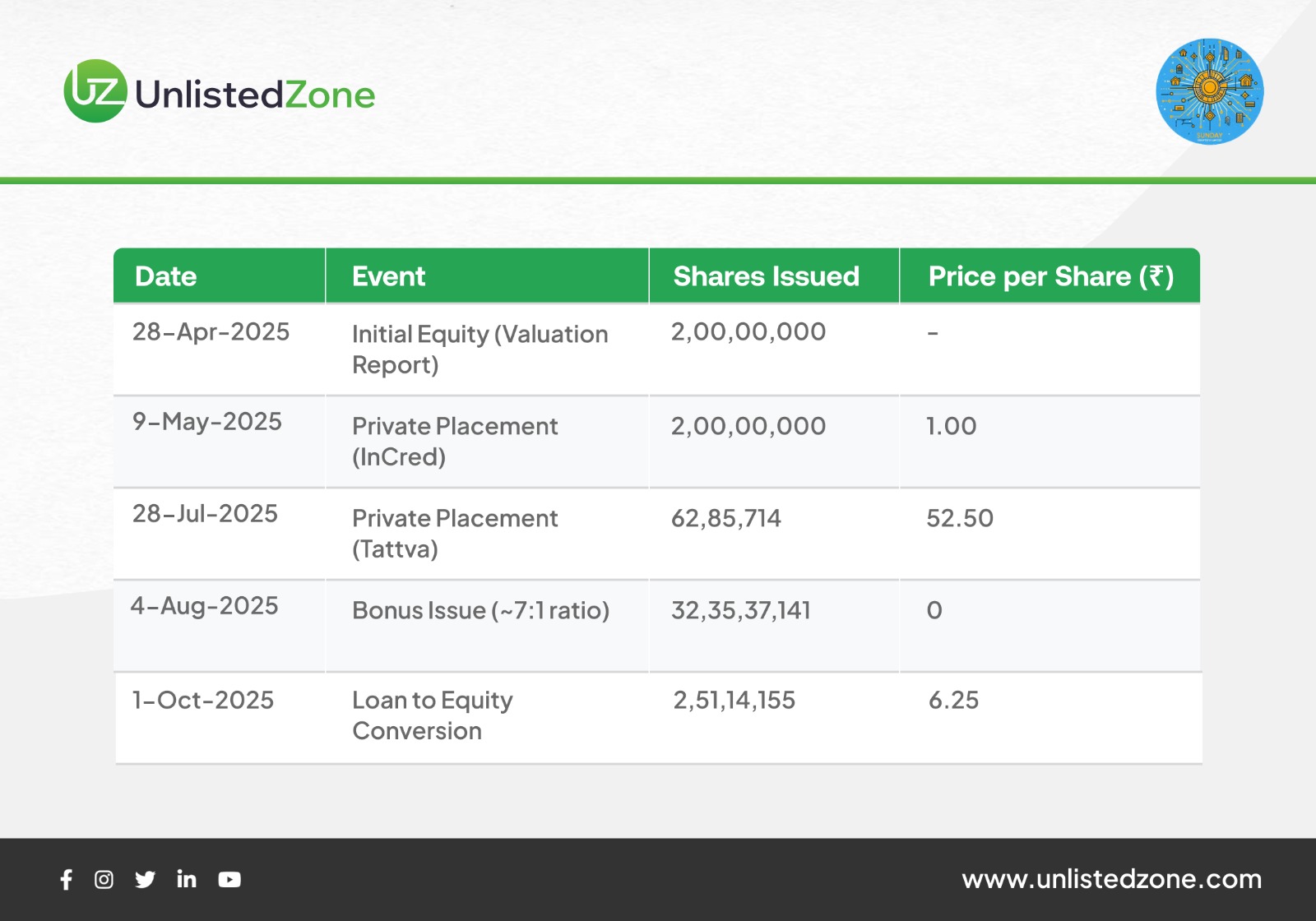

b) Share Structure Timeline:

Total Outstanding Shares (as of October 2025): 37.47 Crore shares (374,737,010)

The structure is deliberately kept separate from OYO's core operations to maintain the distinction between the asset-light technology platform (OYO) and the asset-heavy ownership business (Sunday Proptech).

3. Why is OYO Starting This Company?

The creation of Sunday Proptech represents a strategic evolution in OYO's business model, driven by multiple compelling rationales:

A. Replicating Global Best Practices

The world's leading hospitality brands have successfully deployed a dual-structure model:

Asset-Light Franchise/Brand Company + Asset-Heavy Ownership Platform

Global Examples:

- Marriott International (Brand) → Ventive Hospitality (Asset Owner in India)

- IHG Hotels & Resorts (Brand) → Samhi Hotels (Asset Owner in India)

- Indian Hotels Company (IHCL/Taj) (Brand) → TajGVK (Asset Owner in South India)

- Hilton Worldwide (Brand) → Multiple REITs and Ownership Platforms

This separation allows:

- The brand company to scale globally without capital intensity

- The asset company to capture real estate appreciation and operational yields

- Shareholders to choose their risk-return profile (growth vs. income)

B. Unlocking Dual Value Streams

OYO's Core Business (Asset-Light):

- High scalability, low capital requirements

- Technology and brand licensing fees

- Network effects from demand aggregation

Sunday Proptech (Asset-Heavy):

- Real asset backing with tangible value

- Predictable annuity income streams

- Protection during market volatility

- Upside from property appreciation

C. Competitive Advantages

Sunday Proptech leverages OYO's decade-long operational expertise:

- Distribution Strength: OYO's 132 million+ app downloads drive occupancy

- Technology Stack: Revenue management, dynamic pricing, operational automation

- Market-Leading RevPAR: Superior revenue per room vs. competitors

- Lowest Cost Structure: Technology-driven operational efficiency

- Brand Portfolio: Established brands (Sunday Hotels, Motel 6) accelerate turnaround

D. Capital Efficiency Strategy

Rather than building hotels from scratch (greenfield development), Sunday Proptech:

- Acquires undervalued or underperforming properties

- Applies OYO's branding and technology for rapid turnaround

- Generates cash flows faster than new construction

- Captures yield and valuation arbitrage

E. Market Opportunity

The Indian and US hospitality markets offer:

- Fragmented ownership landscape with acquisition opportunities

- Growing domestic and international travel demand

- Premium valuations for institutionally-owned hotel portfolios (as evidenced by listed peers)

- Investor appetite for real asset-backed income opportunities

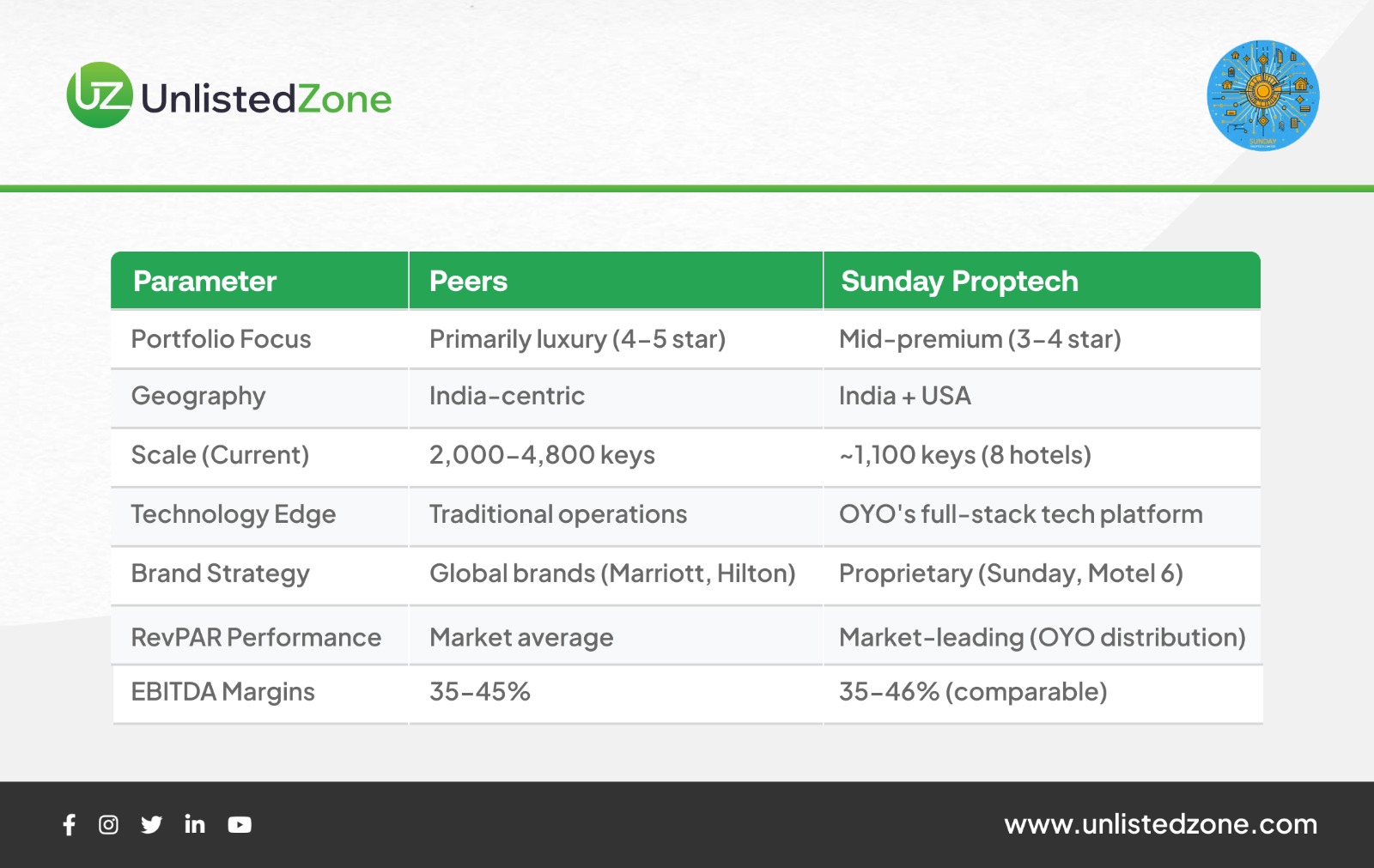

4. Who Are the Peers in This Business?

Sunday Proptech competes in the institutional hotel ownership and asset management space. Here's the competitive landscape:

1. Chalet Hotels Limited

- Market Cap: ₹21000 Cr (Oct 2025)

- Enterprise Value: ₹23,000 Cr

- Portfolio: 11 luxury properties, 3,314 rooms

- FY26E EBITDA: ₹953 Cr

- FY26E Profit: ₹285 Cr

- Valuation Multiples: 24x EV/EBITDA, 73x P/E

- Parent: K Raheja Corp

- Focus: High-end hotels and commercial properties in gateway cities

- Competitive Position: Premium luxury positioning

2. Ventive Hospitality Limited

- Market Cap: ₹17,800 Cr

- Enterprise Value: ₹19,410 Cr

- Portfolio: 11 luxury hotels, 2,036 keys (including 3 Maldives properties with 515 rooms)

- FY26E EBITDA: ₹885 Cr

- FY26E Profit: ₹177 Cr

- Valuation Multiples: 22x EV/EBITDA, 100x P/E

- Backed by: Blackstone

- Brands: Marriott, Hilton, Ritz-Carlton

- Geography: Pune, Bengaluru, Maldives

- Recent: Listed recently, showcasing strong investor appetite

3. Samhi Hotels Limited

- Market Cap: ₹4500 Cr

- Enterprise Value: ₹6600 Cr

- Portfolio: ~4,800 keys across 3-star to 5-star segments

- FY26E EBITDA: ₹439 Cr

- FY26E Profit: ₹ 188 Cr

- Valuation Multiples: 15x EV/EBITDA, 32x P/E

- Backed by: Brookfield

- Strategy: Operational turnaround and yield enhancement

- Positioning: Institutional ownership platform

4. Brigade Hotel Ventures Limited

- Market Cap: ₹3,100 Cr

- Enterprise Value: ₹3,200 Cr

- FY25 EBITDA: ₹ 165 Cr

- FY25 Profit: ₹24 Cr

- Valuation Multiples: 20x EV/EBITDA, 129x P/E

- Parent: Brigade Group

- Regional Focus: South India

Peer Average Valuation Range: 15-24x EV/EBITDA

Key Differentiators:

5. How Are Shares Allotted by the Company?

Sunday Proptech has followed a structured capital raise strategy with multiple tranches to fund its acquisition pipeline:

Phase 1: Capital (April-May 2025)

April 28, 2025 - Initial Equity Structure

- 2 Crore shares issued as per initial valuation report

- Foundation shareholder base established

May 9, 2025 - InCred Private Placement

- Shares Issued: 2 Crore

- Price: ₹1 per share

- Amount Raised: ₹2 Crore

- Rationale: Early-stage institutional validation

Phase 2: Valuation Markup (July 2025)

July 28, 2025 - Tattva Fund Placement

- Shares Issued: 62.86 Lakh

- Price: ₹52.50 per share

- Amount Raised: ₹33 Crore (approx)

- Significance: 52.5x price increase in 2.5 months - validates business model and asset quality

Phase 3: Capital Structure Optimization (August 2025)

August 4, 2025 - Bonus Issue

- Ratio: Approximately 7:1

- Shares Issued: 32.35 Crore

- Price: ₹0 (bonus to existing shareholders)

- Purpose:

- Improved liquidity

- Broader shareholder base

- Lower per-share price for future raises

- Reward early investors

Phase 4: Debt-to-Equity Conversion (October 2025)

October 1, 2025 - Loan Conversion

- Shares Issued: 2.51 Crore

- Price: ₹6.25 per share

- Debt Converted: ₹16.5 Crore

- Purpose:

- Strengthen balance sheet

- Reduce interest burden

- Align lender interests with equity upside

Total Capital Raised (Estimated):

- InCred Round: ₹2 Cr

- Tattva Round: ₹33 Cr

- Debt Conversion: ₹16.5 Cr

- Total: ~₹51.5 Crore

Current Share Structure:

- Total Outstanding Shares: 37.47 Crore (374,737,010)

- Major Events: 4 capital raises + 1 bonus issue in 6 months

- Valuation Trajectory: ₹1 → ₹52.5 → ₹6.25 (post-bonus adjusted)

Allotment Strategy Insights:

- Selective Investor Base: Chose institutional investors with hospitality/real estate expertise

- Milestone-Based Pricing: Each round tied to operational achievements (property acquisitions)

- Liquidity Creation: Bonus issue prepared company for potential listing

- Balance Sheet Management: Debt-to-equity swap reduced leverage before scale-up

6. Is It Worth Investing at Different Valuations (₹7, ₹10, ₹15)?

This is the critical investment decision - let's analyze Sunday Proptech's value proposition at three price points against listed peers:

In FY26, Sunday Proptech is expecting a Revenue of INR 38 cr, EBITDA of 25 Cr with 8 Hotels and in FY27, it is expecting a Revenue of INR 177 cr , EBITDA of INR 93 cr and PAT of INR 27 Cr.

Investment Framework: FY26 EBITDA = ₹25 Crore (Expected)

Scenario A: Investment at ₹7 per Share

Valuation: ₹262 Crore Market Cap | 10.5x EBITDA (FY26)

✅ Investment Thesis:

1. Deep Value Entry

- Trading at a 35-55% discount to listed peers (Samhi: 15x, Ventive: 22x, Chalet: 24x)

- Samhi Hotels (most comparable) trades at 15x - Sunday would be 30% cheaper

2. Risk-Adjusted Returns

- Pre-operational risk largely mitigated (8 hotels already operational)

- Asset backing provides downside protection

- US properties delivering 35-46% EBITDA margins

3. Growth Upside

- FY27E EBITDA projected at ₹93 Cr (3.7x growth from FY26)

- If company maintains 10.5x multiple: Market cap = ₹977 Cr

- Potential Return: 370% in 18 months

4. Re-Rating Catalyst

- As operational track record strengthens, multiple could expand to 12-14x (peer average)

- At 12x FY27 EBITDA: Market cap = ₹1,116 Cr → Share price ₹29.8.

Risk Assessment at ₹7:

- ⚠️ Limited liquidity (unlisted)

- ⚠️ Execution risk on 8 pending acquisitions

- ✅ Strong margin of safety

- ✅ Tangible asset backing

Scenario B: Investment at ₹10 per Share

Valuation: ₹375 Crore Market Cap | 15.0x EBITDA (FY26)

✅ Investment Thesis:

1. Fair Value Positioning

- Midpoint between Samhi (15x) and Ventive (22x), below Chalet (24x)

- Reflects growth potential while offering reasonable entry

2. FY27 Upside

- At 15x multiple on FY27E EBITDA (₹93 Cr): Market cap = ₹1,395 Cr

- Share Price: ₹37.2 → 272% return

- Even at conservative 12x FY27: ₹29.8/share → 198% return

3. Comparable to Quality Peers

- Similar margin profile to Samhi (institutional, PE-backed)

- Technology advantage vs. traditional players

- Dual-geography diversification (India + USA)

Risk Assessment at ₹10:

- ⚠️ Less margin of safety than ₹7 entry

- ⚠️ Needs to execute on growth plan to justify valuation

- ✅ Fair risk-reward for growth investors

- ✅ Better liquidity if lists soon

Scenario C: Investment at ₹15 per Share

Valuation: ₹562 Crore Market Cap | 22.5x EBITDA (FY26)

⚠️ Investment Thesis:

1. Premium Valuation

- Trading around Chalet (24x) and Ventive (22x)

- Only justified if Sunday achieves:

- Superior growth vs. peers

- Market-leading RevPAR sustainably

- Faster scale-up (16 hotels by FY27 vs. current 8)

2. FY27 Upside Limited

- At 22.5x FY27E EBITDA (₹93 Cr): Market cap = ₹2,093 Cr

- Share Price: ₹55.8 → 272% return (same as ₹10 scenario)

- BUT: Multiple compression risk - peers trade at 12-20x

- If market re-rates to 15x (fair value): ₹37.2/share → 148% return

3. Execution Dependency

- Must deliver ₹93 Cr FY27 EBITDA (no room for shortfall)

- Asset acquisition delays directly impact returns

- Competition from larger players for premium assets

Risk Assessment at ₹15:

- ⚠️ HIGH - Premium valuation with limited margin of safety

- ⚠️ Multiple compression risk if growth disappoints

- ⚠️ Illiquidity premium not justified at 22.5x

- ⚠️ Better alternatives exist at this price point (buy Samhi in listed market)

Peer Comparison Summary Table Based on FY26E Numbers:

*P/E based on FY26E PAT of ₹10 Cr

Key Investment Considerations:

Bullish Factors:

✅ Asset Backing: Real estate provides tangible value floor

✅ Operational Proof: 8 US properties delivering 35-46% EBITDA

✅ Technology Moat: OYO's distribution and revenue management systems

✅ Market Tailwinds: Travel recovery, premium mid-stay segment growth

✅ Peer Valuations: Listed comps trading at 12-21x EBITDA

✅ Growth Trajectory: 3.7x EBITDA growth projected (₹25 Cr → ₹93 Cr)

✅ Dual Geography: US + India diversification

Risk Factors:

⚠️ Illiquidity: Unlisted shares, limited exit options pre-IPO

⚠️ Execution Risk: 8 pending acquisitions must close on time

⚠️ Capital Requirements: May need further dilution for expansion

⚠️ Market Risk: Hospitality cycles, economic downturns

⚠️ Competition: Larger players (Brookfield, Blackstone) competing for assets

⚠️ OYO Brand Risk: Reputational challenges from parent company

⚠️ Currency Risk: 50% revenue from US operations

⚠️ Regulatory Risk: Real estate and hospitality regulations in multiple countries

Final Verdict:

Sunday Proptech is NOT for everyone - but for investors who:

- Can tolerate illiquidity for 18-36 months

- Believe in OYO's operational capabilities

- Want exposure to institutionalized hotel ownership

- Enter at reasonable valuations (₹7-10)

Disclaimer: This analysis is based solely on the documents provided and publicly available peer company data. This is not investment advice. Investors should conduct their own due diligence, consult financial advisors, and assess their risk tolerance before making investment decisions in unlisted securities.

Data Sources: OYO Assets Presentation (September 2025), Sunday Proptech Share Capital Analysis (October 2025), Secondary research on listed peers by UnlistedZone