A) Company Overview

Founded in August 2021, Deepak Houseware and Toys Pvt. Ltd, operating under the brand name Urban Tots, is one of the fastest-growing players in India’s toy manufacturing sector. Based in Rajasthan, the company has quickly established itself as a pioneer in the domestic toy market by building a state-of-the-art manufacturing plant and developing the capacity to produce its own molds — a capability few Indian toy makers possess.

Urban Tots offers a diverse portfolio of plastic, electronic, wooden, and metallic toys, catering to multiple customer segments and age groups. With strategic collaborations, government incentives, and strong retail and online partnerships, the company is positioning itself as a dominant homegrown brand in India’s rapidly expanding toy industry.

B) Product & Market Strategy

-

Product Range: Wide assortment of toys across multiple materials (plastic, metal, wood, electronic).

-

Innovation Edge: Among the first Indian toy manufacturers to design and produce proprietary molds, reducing dependence on imports and improving quality control.

-

Retail Presence: Exclusive partnerships with FirstCry, DMart, Walmart, Hamleys, and Reliance Retail, with 18 exclusive distribution agreements.

-

Online Presence: Strong sales traction across major e-commerce platforms like Amazon and Flipkart.

-

Strategic Collaboration: Partnership with Indian Oil Corporation (IOC) to enhance market visibility and distribution.

C) Government Support & Incentives

Urban Tots has been selected under multiple government schemes that support domestic manufacturing and employment:

-

Rajasthan State DIC Scheme: Eligible for a 5% interest subsidy to promote local job creation.

-

PLI Scheme (Govt. of India): Recognized as a beneficiary of the Production Linked Incentive scheme aimed at boosting local toy production and reducing import dependency.

D) Financial Performance Snapshot (FY2023–FY2025)

Balance Sheet (in ₹ Crore)

Key Takeaway:

As of March 31, 2025:

-

Total Assets: ₹113 crore, up from ₹85 crore (FY24) and ₹56 crore (FY23).

-

PPE Investment: Heavy investment in Property, Plant & Equipment (PPE), which rose to ₹45 crore.

-

Shareholders' Funds: Increased to ₹46 crore, driven by growth in reserves and surplus (₹41 crore).

-

Borrowings: Grew to ₹35 crore, indicating a leveraged expansion strategy.

-

Trade Payables: Doubled to ₹26 crore, suggesting stronger supplier relationships.

-

Current Assets: Ballooned to ₹68 crore.

-

Trade Receivables: Surged to ₹36 crore, showing robust sales but also a higher need for efficient collections.

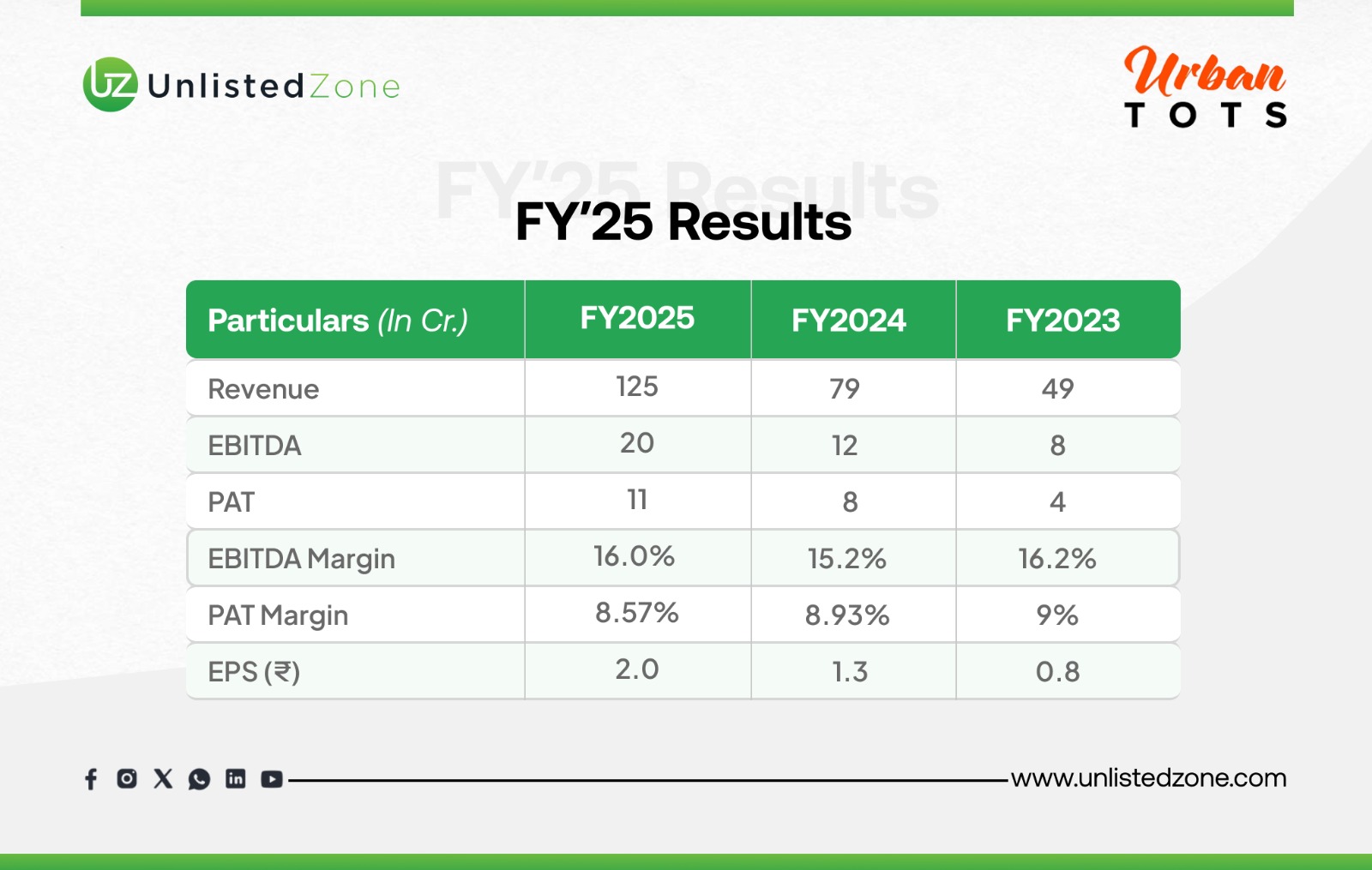

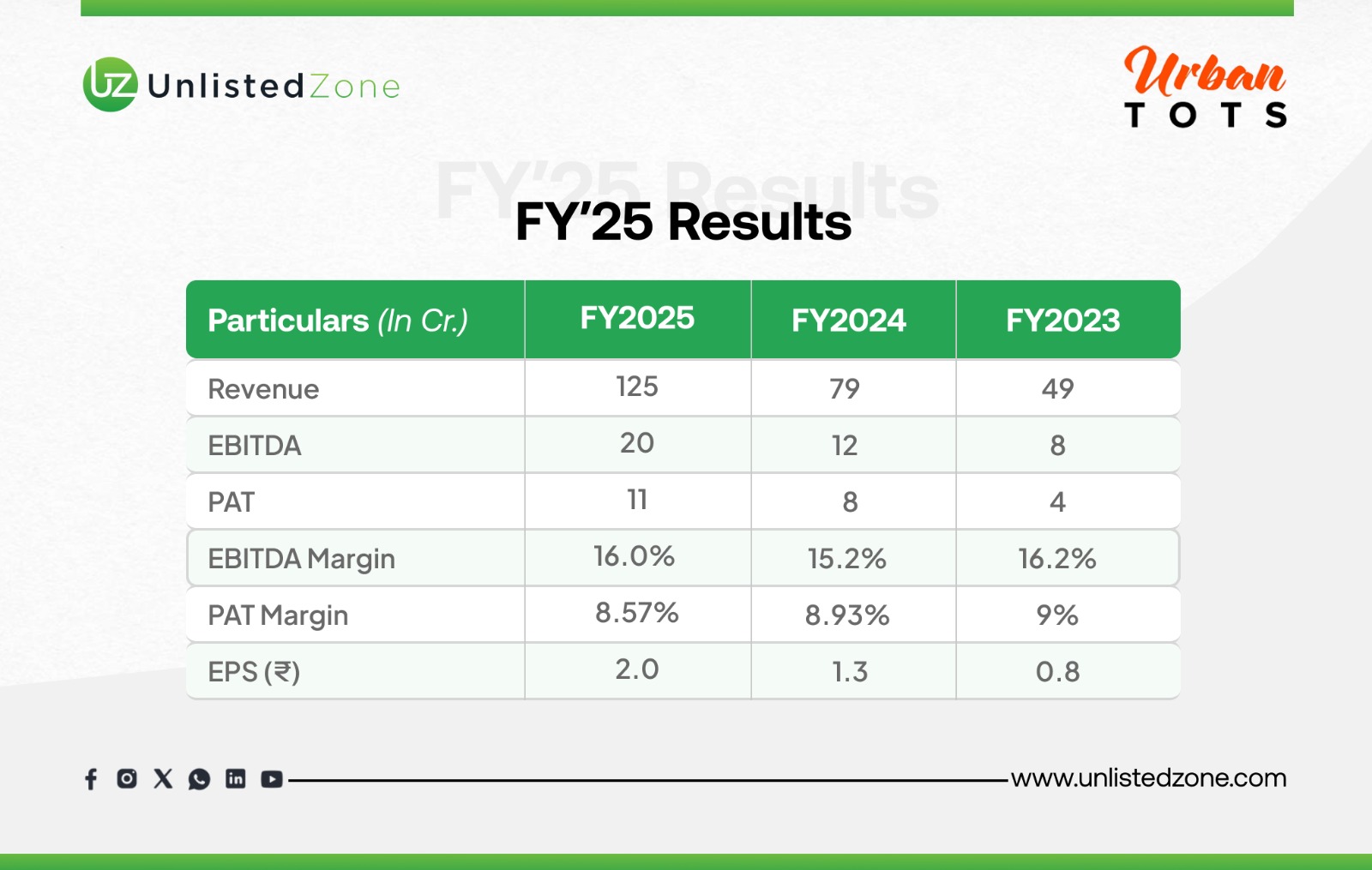

Profit & Loss Statement (in ₹ Crore)

Analysis:

-

Revenue: ₹125 crore, up 58% from FY24.

-

EBITDA: ₹20 crore, with a margin of 16%.

-

PAT: ₹11 crore, achieving a margin of 8.57%.

-

EPS: ₹2.0, showing strong per-share earnings growth.

-

Finance Cost: ₹3 crore, reflecting increased borrowing for expansion.

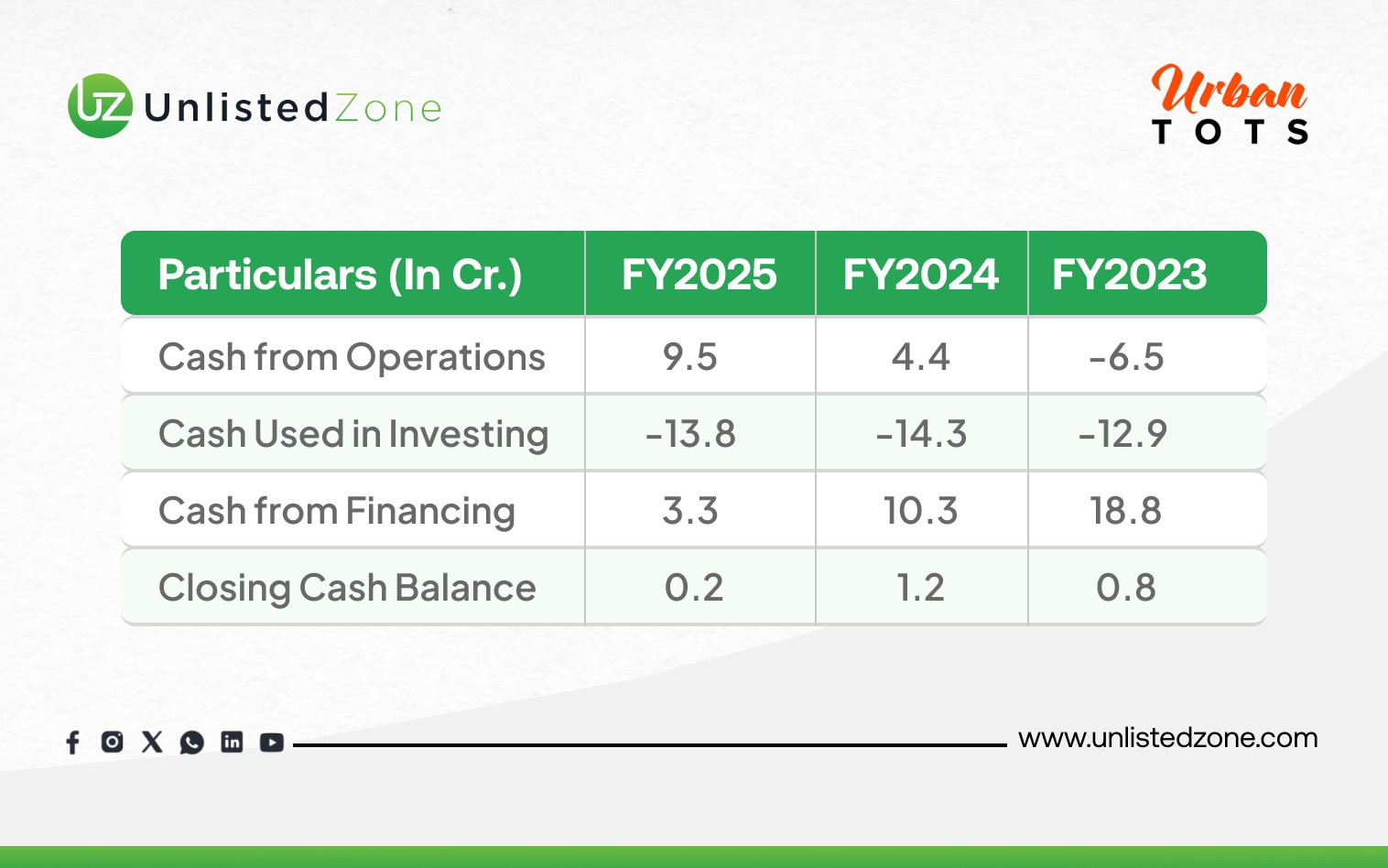

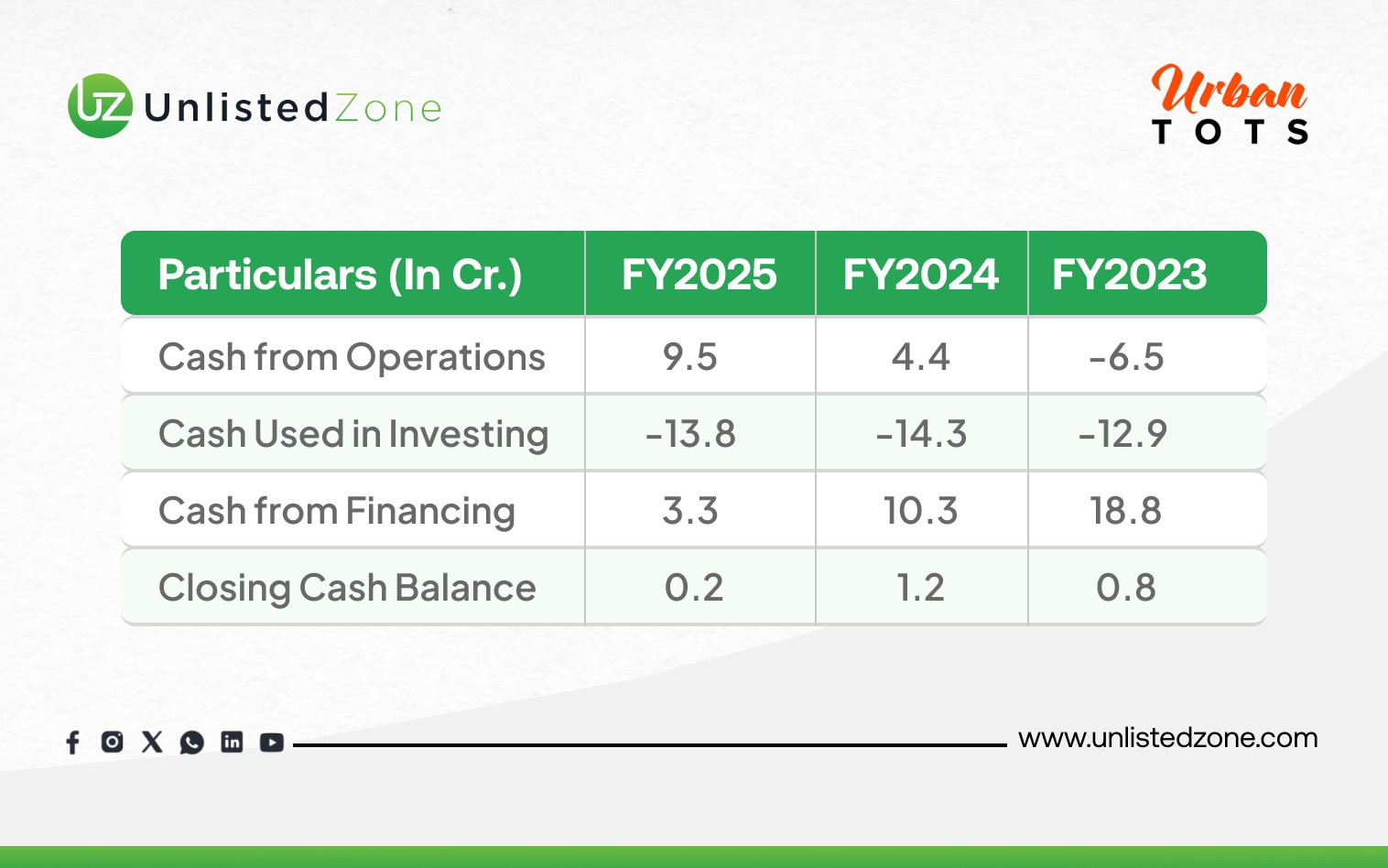

Cash Flow Summary (in ₹ Crore)

Interpretation: High investing cash outflow reflects continued investment in production facilities and capacity enhancement.

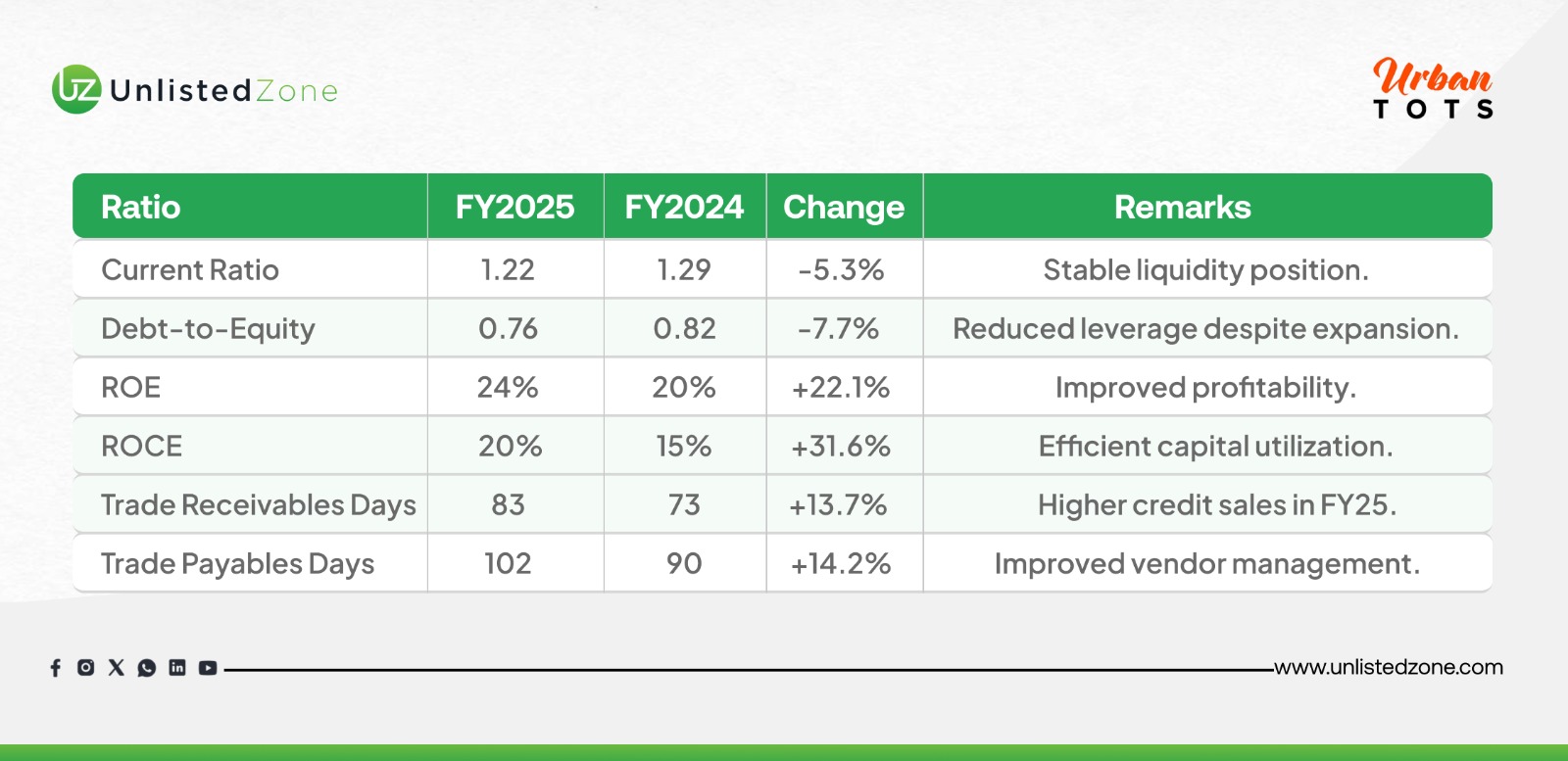

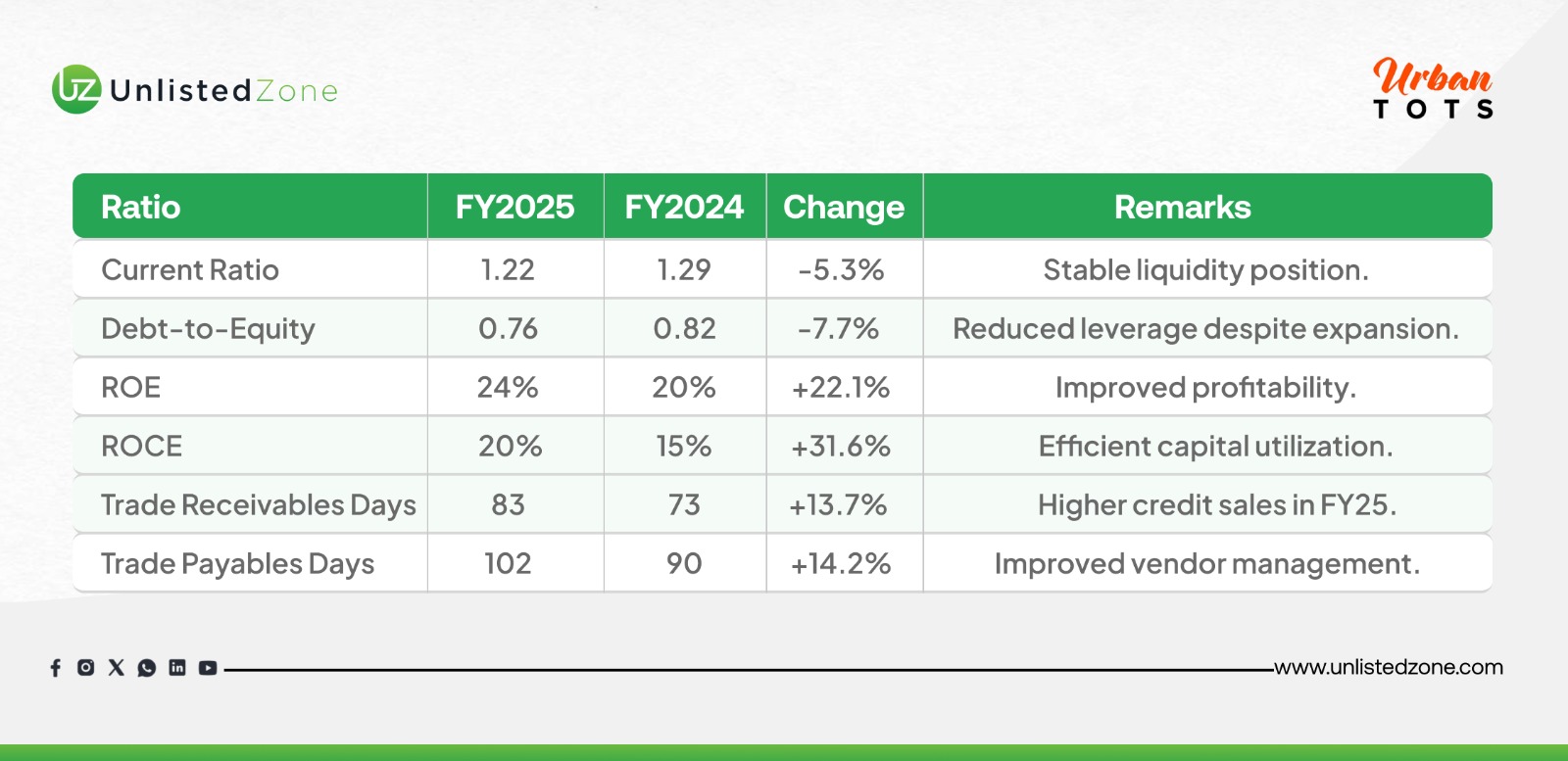

E) Ratio Analysis (FY2024 vs FY2025)

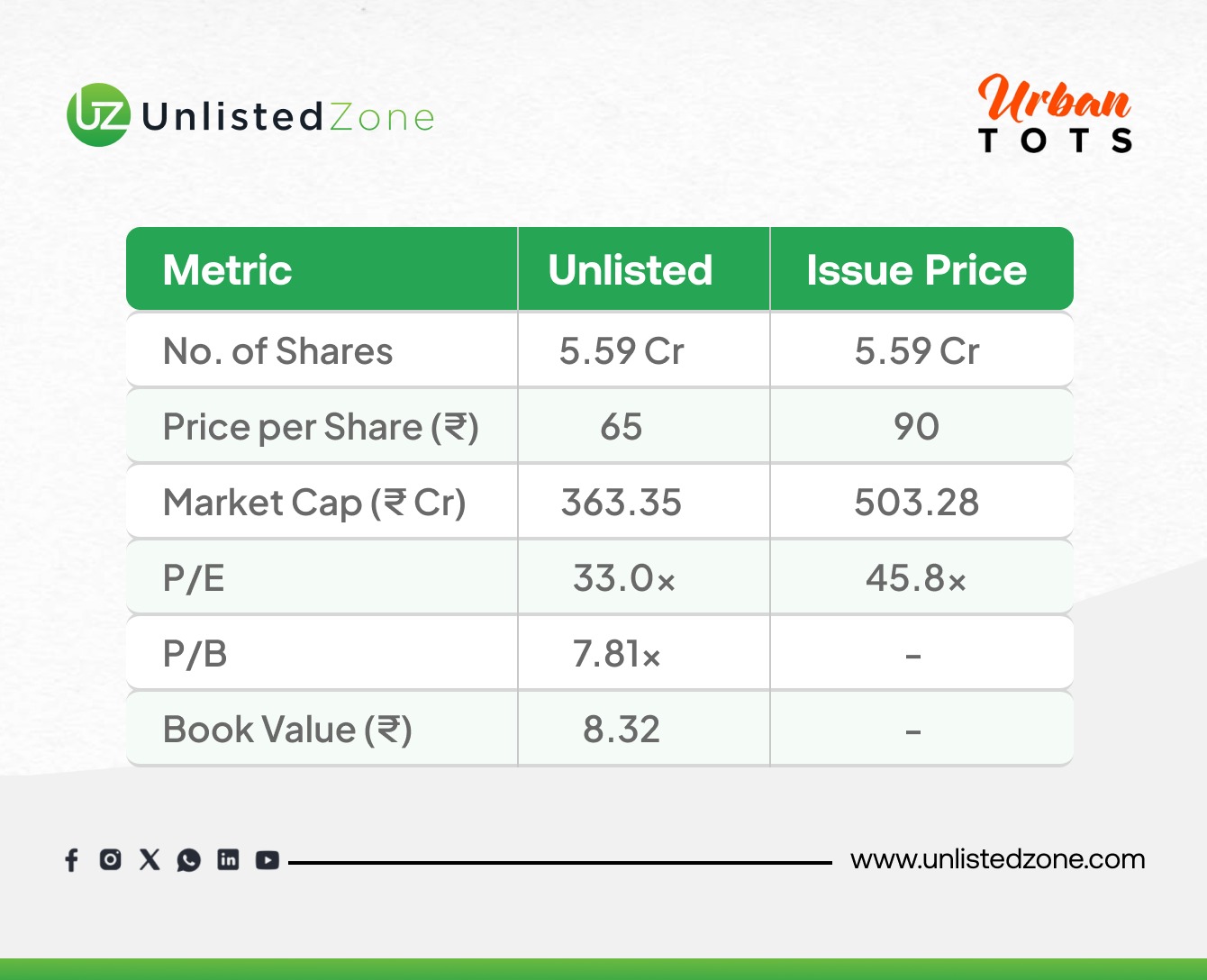

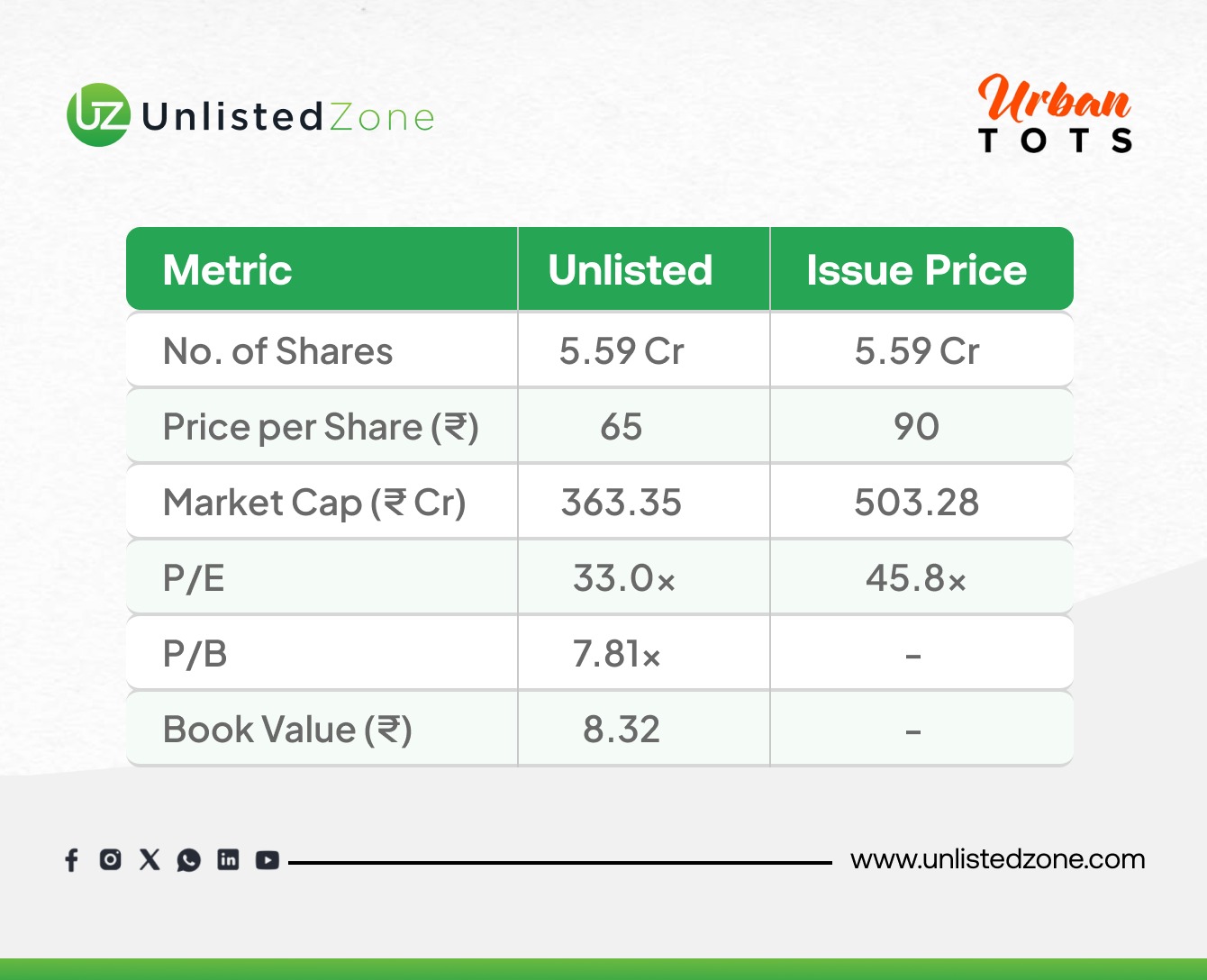

F) Valuation Insights (FY2025)

Commentary: The company’s rising valuation multiple mirrors investor confidence in its growth trajectory and the booming domestic toy market. Urban Tots issued only 2 lakh shares out of a planned 6 lakh in FY25, with the remainder issued post-year-end, indicating high investor demand and limited dilution.

G) India’s Toy Industry: Market Context & Growth Outlook

-

Market Size: Valued at USD 1.2-2.6 billion in 2023-2024, having grown from ~USD 0.86 billion in 2018.

-

Historical Growth: Achieved a CAGR of ~5% from 2018 to 2024.

-

Future Projection: Expected to grow at a CAGR of 6-12% through 2030-2035.

-

Target Market Size: Projected to reach USD 4.8-7.8 billion by 2034-2035.

Key Market Drivers

-

Socioeconomic Factors:

-

Government Initiatives:

-

PLI Scheme, Quality Control Orders, and import duty hikes.

-

Domestic Manufacturing Boost: The PLI and toy cluster schemes under Atmanirbhar Bharat have encouraged over 1,000 new toy units to emerge in India.

-

Import Decline: Toy imports dropped by ~70% since 2019, reflecting growing self-reliance.

-

Export Growth: India’s toy exports surged 239% from 2014 to 2024, reaching over ₹3,000 crore.

-

These policies have successfully reduced imports and boosted local manufacturing.

-

Product Trends:

-

Surging demand for educational and STEM toys.

-

Growth fueled by edtech integrations and a focus on play-based learning.

-

Rising consumer interest in sustainable and eco-friendly toy materials.

Challenges & Competition

Urban Tots' Position in the Market

-

Perfectly positioned to leverage government support (like the PLI scheme) and the dominant e-commerce sales channel.

-

Effectively carving out a niche by focusing on innovative, locally made toys.

Competitive Landscape: While legacy brands like Funskool and Mirada dominate premium segments, emerging players such as Urban Tots and Playgro are capturing mid-range and mass-market consumers through affordability and innovation.

H) Future Plans & IPO Outlook

Urban Tots is preparing for retail expansion, enhanced marketing initiatives, and deeper distribution network integration. The company has expressed intent to launch an IPO within five years, signaling ambitions to scale nationally and globally.

With robust government backing, consistent profitability, and a growing market base, Urban Tots represents a strong investment proposition for early-stage investors seeking exposure to India’s booming toy manufacturing sector.

Conclusion: Building India’s Next Toy Giant

Urban Tots embodies the new wave of Indian manufacturing—innovative, efficient, and globally competitive. With strong fundamentals, supportive policy frameworks, and ambitious expansion plans, the company is well-positioned to become a flagbearer of India’s toy industry revival. As India moves toward self-reliance in toy production, Urban Tots’ trajectory from a start-up to a potential IPO candidate within a decade underscores its immense growth potential and investor appeal.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.